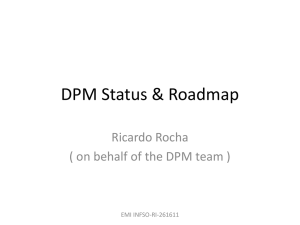

Dundee Precious Metals Highlights

advertisement

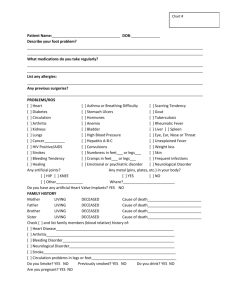

SEE Business Forum Istanbul, Turkey November 22 - 23, 2012 Dundee Precious Metals Highlights Canada Sabina 11% $1.3B gold producer 2 operating mines in Bulgaria & Armenia Avala 51% Strategic complex concentrate smelter in Namibia Chelopech Dunav 47% Krumovgrad Deno Gold 2012 gold production of 132,000 to 145,000 oz Low cash cost/ounce gold produced Growing pipeline of growth opportunities Experienced management team Namibia Custom Smelter Attractive value proposition TSX:DPM Operating assets Development assets Exploration assets 2 Portfolio of Assets Canada Sabina 10.7% Avala 51% Chelopech 100% Dunav 47% Krumovgrad 100% Kapan 100% Tsumeb Smelter 100% Operating assets Development assets Exploration assets TSX:DPM 3 Strong Balance Sheet Capital Structure @ October 10, 2012 $115M Cash on Hand @ June 30, 2012 (excluding AVZ & DNV) Share Price C$9.13 Shares Outstanding 125M Fully diluted shares Additional cash on dilution 147M C$66M 52 week high - low $10.72 - $5.82 $110M Significant Operating Cash Flow Annualized H1 2012 $83M Debt @ June 30, 2012 Total Debt:Total Capital = 10% TSX:DPM Gross Revenue by Metals Sold 2011A Gold Copper Silver Zinc 6% 5% 41% 48% 2012E 2016E 5% 4% 6% 6% 36% 24% 55% 64% 4 Corporate Strategy Build DPM into an intermediate, low-cost gold producer: Optimize value of existing operating assets Chelopech – production expansion and pyrite recovery project Smelter – complete Project 2012 upgrades & expansion Deno Gold Mine - open pit evaluation and underground extension Grow business beyond existing operating assets Develop Krumovgrad Gold Project Establish deep pipeline of greenfield exploration opportunities Complete acquisitions that offer accretive growth, diversity and gold exposure Sustain low quartile operating cost position Maintain a solid financial position TSX:DPM 5 Chelopech Mine • Low Cost, Long Life Producer Strategy DPM Ownership Complete expansion to 2 mtpy Q4 2012 100% Location Bulgaria Acquired Sept. 2003 Continue to replace depletion and increase Mineral Resources and Mineral Reserves through exploration Resources Measured & Indicated (at Oct. 31, 2011) Complete feasibility study on the pyrite gold recovery project Reserves (@ Jan. 1, 2012) Gold (oz) (4.09 g/t) Copper (lbs) (1.31% Cu) Gold (oz) (3.66 g/t) Copper (lbs) (1.15% Cu) Mine Type Deposit Type Estimated Mine Life @ expanded rate TSX:DPM 3,930,000 862,840,000 2,660,000 572,600,000 Underground High sulphidation epithermal deposit 10 + yrs 6 Namibia Custom Smelter • A Unique Strategic Asset Strategy Build a one of a kind asset to treat DPM and third party complex concentrate DPM Ownership Location 100% Namibia Upgrade operation to meet global standards Increase capacity and lower costs Acquisition March 2010 Contract other third party sources of complex Capital expenditures to date concentrate to optimize throughput Project 2012 Costs Smelter Capacity Technology Tonne (000s) Product $57M $75M Ausmelt Copper blister bars 2011 concentrate throughput 180,403 tonnes Expanding smelter capacity 240k – 310k tpy Sulphuric acid capture plant FS 2009 $50M Complete 2010 2011 H1 2012 2012E 2013E: +O2 Chelopech con Third party con TSX:DPM 7 Namibia Custom Smelter • Environmental & Production Upgrades Upgrade Initiatives Status Costs Fugitive emissions (arsenic) Completion Q4 2012 $75M Sulphur emissions (acid plant) Completion Q4 2014 $167M Emissions control (Project 2012) Further Production Facility Optimization Initiatives Additional oxygen for Ausmelt furnace All primary smelting in Ausmelt furnace 3 blocks of dust-capturing chambers installed in the new baghouse TSX:DPM New oxygen plant New vehicle designed to vacuum dust off the ground for disposal New dust disposal site 8 Deno Gold Mine • Potential to Increase Size and Life of Mine Strategy DPM Ownership 100% Location Armenia Acquired August 2006 Mine Type Underground Product Au/Cu & Zn concentrate Explore regional license to define additional Mineral Resources Deposit Type Polymetallic vein deposit (swarms) Open Pit Resource Q4 2012 Continue operational improvements & cost reductions Underground Resource Q2 2013 Define the potential open pit and underground resource for the Shahumyan deposit Complete open pit and underground studies based on the new resources TSX:DPM 9 Krumovgrad Gold Project • Low Cost, High Return Project Strategy Advance project to a 2014 production date – subject to appeals Achieve 74,000 ounces of annual gold production Seek opportunities to further increase recoveries Evaluate other exploration opportunities within existing licenses Location Bulgaria; 100% DPM ownership Proposed Mine Type Open Pit; low-sulphidation epithermal Au deposit Gold Recoveries & Grade 85%; 3.4 g/t Annual ore production 850,000 tpy Annual gold production 74,000 ounces Annual silver production 35,000 ounces Mine Life 9 years Capital Cost to complete US$127M* Total cash cost per oz AuEq $404* Waste Small integrated tailings and mine waste facility Recovery process Conventional crushing, grinding & flotation * As per NI 43-101 technical report filed on SEDAR January 13, 2012 Achievements 30 year mining concession Definitive Feasibility Study & NI 43-101 Final EIA approval granted Nov. 2011 Appeal decision pending Detailed engineering schedule Q2 2012 – Q4 2013 Estimated construction timeline 2013 - 2014 Estimated production timeline TSX:DPM Status 2014/2015 10 Gold Production (000 oz) Forecast Significant Growth Over Next Three Years • Growing Pipeline of Development Opportunities Pyrite Stream Krumovgrad Deno Chelopech Source: Cormark Securities, July 26, 2012 TSX:DPM 11 Partially Owned Exploration Investments • Source of Additional Value & Growth SECURITIES HOLDINGS % HELD Sabina Gold & Silver Corp. (TSX: SBB) 18.5M 10.7% VALUE @ Oct. 10, 2012 $54M Special Warrants 10M 29M Warrants (strike C$1.07) 5M 10M Total SBB $93M Avala Resources Ltd. (TSX-V: AVZ) Special Rights 110M 51.4% 50M $57M 26M Total AVZ* $83M Dunav Resources Ltd. (TSX-V: DNV) 56M Warrants (strike C$0.42) 27.5M Total DNV* 47.3% 14M 0 $14M Total shares and other securities ~$190M *AVZ and DNV are consolidated TSX:DPM 12 Compelling Investment Opportunity Solid operating assets with overall cost profile Growing pipeline of development/investment opportunities Significant cash flow and capital available to fund growth Strong balance sheet Proven Management and Board Attractive Value Proposition Underground at Chelopech Namibia Custom Smelter TSX:DPM Entrance to Deno Gold Mine Krumovgrad 13 Dundee Precious Metals Dundee Place 1 Adelaide St. East Suite 500 Toronto, ON, M5C 2V9 www.dundeeprecious.com The Toronto Stock Exchange DPM – Common Shares DPM.WT.A – 2015 Warrants 14