Boston Matrix

advertisement

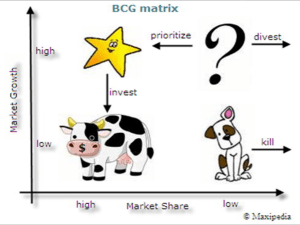

BOSTON MATRIX FRED LEE PERIOD 3 WHAT IS BOSTON MATRIX? • A tool of portfolio analysis developed by the Boston Consulting Group in the early 1970’s • Well-known management tool used in product life cycle theory • A tool that numerous companies utilize to enhance their products and help decide on their portfolio decisions FUNCTIONS • Categorizes products based on market growth and market share • It prioritizes which products of a firm should get more investment and attention, and vice versa • It focuses on a portfolio of products • It focuses on the products’ cash flow ITS ESSENCE • Products are categorized into: • Question Marks (a.k.a. problem child) : Products with high market growth but low market share • Stars: Products with high market growth and high market share • Cash Cows: Products with low market growth and high market share • Dogs: Products with low market growth and low market share DETAILS #1 • Question Mark: Low share, and low market growth -> negative cash flow > uncertain potential -> can potentially become a star or a dog • Star: High share and high market growth -> The product is relatively strong -> neutral or modest cash inflow DETAILS #2 • Cash Cow: High market share, but low market growth -> at mature state of the product cycle -> successful -> unlikely to grow more -> large positive cash flow • Dog: Low market share, and low market growth -> unattractive -> no potential -> failed products or in the decline phase STRATEGY #1 • Question Mark: • Invest for a high market share or divest • Promote the product • Produce selectively, meaning do not produce in excess • Star: • Invest for a sustained market growth • Increase sales and market share • Maintain leadership among the firm’s competitors • Counter challenges from the firm’s competitors STRATEGY #2 • Cash Cow: Harvest Defend its share Try for short term profits Do not need to invest much; in fact reduce investment to maximize short term profits • Use profits to supplement other products • • • • • Dog: • Phase out or divest • Do not invest • Its profits should invest in its own product EXAMPLES • Star: Walmart -> It has a high market share, and it is growing rapidly too; IPod -> high market share in a growing market, but needed a lot of investment • Question Mark: Panasonic smartphones -> small market share in a rapidly growing market -> customers are aware of Panasonic’s cash cow examples, but unaware of its smartphone market entrance. • Cash Cow: Pepsi -> high market share, but low market growth rate. Customers are already aware of its products, and fluctuate little • Dog: GM’s Hummer -> low market share, and it is not growing much either. ADVANTAGES • Very simple and useful for any companies • Highlights important factors of the firm’s portfolio products • Helps to generalize and make decisions with certain products • Can become an efficient planner tool for firms DISADVANTAGES • It only is a “snapshot” of a short-term condition and position • Assumptions on which the matrix is based have flaws • Does not look into environmental forces • The product of cycle is not fixed; it varies over time • Market share itself is sometimes enough to decide if the product is able to generate cash flow