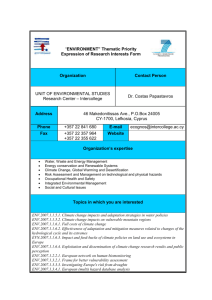

Presentation by Dr. Manfred Rosenstock, DG Environment

advertisement

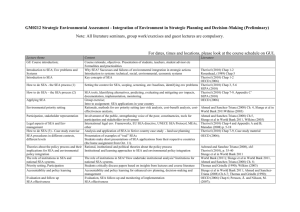

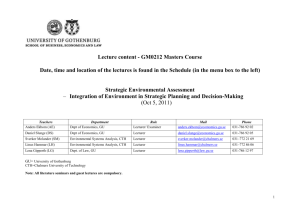

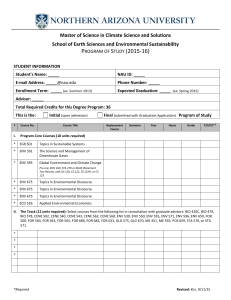

Environmental Taxation in the EU Challenges for economic growth, fiscal sustainability and environmental protection 6 June 2014, Nicosia Dr. Manfred Rosenstock DG ENV, European Commission The views expressed in this presentation are those of the author and may not in any circumstances be regarded as stating an official position of the European Commission DG ENV Political Context at EU level Energy and resource prices likely to increase over time on world market Thus need to adapt our economic structures („green growth“, „eco-efficient economy“). Key point in Europe 2020 strategy, Flagship Initiative: Resource-efficient Europe and Roadmap to a resource-efficient Europe Encourage through choice of efficient instruments => market-based instruments to promote energy efficiency, curb pollution, encourage innovation Roadmap calls for shift towards environmental taxes and removal of environmentally-harmful subsidies. Follow-up through European Semester: Annual Growth Survey; Country-specific recommendations DG ENV Potential for a tax shift Economic and environmental arguments in favour of environmental taxes. Environmental tax reform (ETR) defined as shift from taxing labour (and capital) to pollution and resource use. ETR plus reform of environmentally-harmful subsidies => Environmental fiscal reform. Context of economic crisis: Need for fiscal consolidation, environmental taxes as instrument. Number of MS did ETR since 1990s. Still no increase of environmental taxes in relative terms, rather decline in the EU for many years, stabilisation since 2009. DG ENV Share of environmental taxes in total taxes EU-15/EU-28 1995 2003 2012 Cyprus CY 2003 2012 Energy taxes 5,4 5,2 4,5 6,0 5,4 Transport taxes 1,4 1,3 1,3 5,7 2,2 Pollution taxes 0,2 0,2 0,3 n.a. n.a. Environmental taxes 7,0 6,7 6,1 11,8 7,6 Source: Eurostat, 2014 DG ENV Revenue from environmentally-related taxes, in % of total taxes, 2002 vs. 2012 Energy taxes Transport taxes Taxes on pollution/resources 12 Environmental taxes' contribution (percentage) 10 8 6 4 2 0 4 DG ENV Acceptability issues Reasons for limited progress? Possible explanation: Policy successful Also Other MBI – cap and trade, habitat banking, subsidies Perception of high tax burden in EU Concerns about competitiveness and distributive effects Thus further increases challenging. Approaches used by MS: o Revenue recycling: lump-sum transfers, ETR o Derogations: tax reductions/exemptions o Earmarking for „green“ purposes o Harmonisation at EU level DG ENV Directive on energy products taxation – general approach • Not a Community tax but framework of rules to restructure and harmonise national tax systems (Directive 2003/96/EC). • Includes mineral oil products plus other energy products (coal, lignite, natural gas), electricity; with minimum rates. • Not a CO2 tax but some incentives to reduce CO2 emissions through higher prices of energy products • Commission proposal for review of ETD (2011): Contribute better to climate and energy targets by splitting tax in two components: a CO2 tax on emissions outside ETS, an energy consumption tax Abolishing existing distortions between various energy products DG ENV Environmental taxation – transport, pollution, resources • Transport: Important and growing source of CO2 emissions and air pollution, noise and congestion. Most MS use annual circulation and/or registration taxes. In recent years, more MS introduced CO2 element in taxes. • Large variations in use of green taxes on pollution and resources between MS. Water Framework Directive: MS to ensure cost recovery in line with polluter-pays principle; Blueprint Waste management: Waste policy/targets review 2014. Some MS tax landfill or specific waste, e.g. plastic bags European Semester recommendations/ analysis Resource taxes, e.g. aggregates taxes, in some MS DG ENV Types of environmental taxes used by MS (Source: EEA, 2006) Austria Belgium Denmark Finland France Germany Greece Iceland Ireland Italy Lux'burg Holland Norw ay Portugal Spain Air/Energy CO2* SO2 NOx Fuels S in f uels Transport Car sales and use Dif f . annual car tax Water Water ef f luents Waste Waste-end Dangerous w aste Noise Aviation noise Products Tyres Beverage cont. Packaging Bags Pesticides CFCs Batteries Light bulbs PVC/phtalates Lubrication oil Fertilisers Paper, board Solvents Resources Raw materials in 1996 new in 2000 new in 2004 Sources, including: EEA (2000) Environmental taxes - Redent developments in tools for integration, Copenhagen OECD/EU database for environmental taxes (http://www1.oecd.org/env/policies/taxes/index.htm) DG ENV Sw eden UK Types of environmental taxes used by MS (Source: EEA, 2006) CY CZ EST H LV LT M PL SLO SK BG RO TR HR MK Air/Energy CO2* SO2 NOx Other air pollutants Fuels S in fuels Transport Car sales Annual circuation tax Water Water effluents Waste Waste taxes Noise Aviation noise Products Tyres Beverage cont. Packaging Bags Pesticides CFCs Batteries Light bulbs PVC/phtalates Lubrication oil Fertilisers Paper, board Solvents Resources Raw materials Source: OECD/EEA database for environmental taxes (http://www1.oecd.org/env/policies/taxes/index.htm) DG ENV CS BiH AL Further information • COM Studies on Environmental Taxation issues http://ec.europa.eu/environment/enveco/taxation/index.htm • Studies on potential for Environmental Fiscal Reform http://ec.europa.eu/environment/integration/green_semeste r/pdf/EFR-Final%20Report.pdf http://www.eea.europa.eu/highlights/fiscal-reform-cancreate-jobs OECD/EEA database on environmental policy instruments http://www2.oecd.org/ecoinst/queries/Default.aspx EEA reports on economic instruments in environmental policy http://www.eea.europa.eu/themes/policy/publications DG ENV