the Tax Clinic Presentation - Michigan State University College of Law

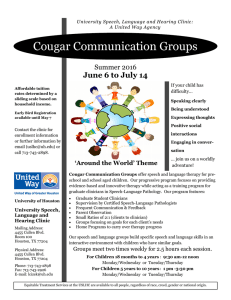

advertisement

Michigan State University College of Law Alvin L. Storrs Low-Income Taxpayer Clinic Introduction to the Tax Clinic Who We Serve • English as a Second Language Taxpayers • International Students & Scholars • Low-Income Taxpayers with an IRS controversy. Courts We Practice In • • • • Michigan Tax Tribunal Michigan Court of Appeals United States Tax Court U.S. District Court What Clinicians Will Learn • Analytical skills through careful reading of Internal Revenue Code, Treasury Regulations, and case law. • Interpersonal skills via daily interaction with clients, opposing counsel and governmental agencies. • Advocacy for clients through the written and oral communication word. • Writing skills that advocate for our clients How is Tax Clinic different from other law school courses. • Clinicians are working as attorneys, on behalf of real clients with real legal problems. The stakes are high! • Reading, research, and analysis is mostly directed towards the clinician’s cases. What should 1Ls Do • Speak with current and former clinicians. • Recognize how tax issues effect all areas of the law. • Visit the Tax Clinic. What Should 2Ls and 3Ls Do • Participate in at least one clinical program. • Recognize that public service is a responsibility that comes with the privilege of practicing law – why not start early? What do clinicians gain from the Tax Clinic experience? • Real practice experience. • Writing products. • Resume benefits. • Greater Responsibility. • Satisfaction of helping clients. Contact Information • Joshua M. Wease, Director wease@law.msu.edu • Christina M. Thompson, Public Interest Tax Fellow cthompson@law.msu.edu 610 Abbot Road, East Lansing, MI 48823 Phone: 517.336.8088 - Fax: 517.336.8089