6

chapter

Entering Foreign

Markets

Part II: Business-Level Strategies

Global Strategy

Mike W. Peng

Copyright © 2005 South-Western.

All rights reserved.

PowerPoint Presentation by David Ahlstrom, Chinese University of Hong Kong

and Charlie Cook, The University of West Alabama

Why Go Abroad?

• Answers typically include:

To reach larger economies of scale by selling to more

customers in other countries.

To reduce the risk of over dependence on one

country by spreading sales in multiple countries.

To replicate the success at home in new settings.

Copyright © 2005 South-Western. All rights reserved.

6–2

Why Go Abroad?

Overcoming the Liability of Foreignness

• The Liability of Foreignness

The inherent disadvantage foreign firms experience in

host countries because of their non-native status.

Liability is manifested in two dimensions:

The

numerous differences in formal and informal

institutions in different countries (e.g., regulatory,

language, and cultural differences). Failure to

recognize these rules may cost foreign firms dearly.

Customers

discriminate against foreign firms,

sometimes formally and other times informally.

Copyright © 2005 South-Western. All rights reserved.

6–3

Why Go Abroad?

Overcoming the Liability of Foreignness

• To offset the liability of foreignness, foreign firms

must employ overwhelming resources and

capabilities (in some aspects).

Superior knowledge about institutional intricacies in

various countries

Superior technologies

Superior organizational, marketing, and financial

capabilities

Copyright © 2005 South-Western. All rights reserved.

6–4

Why Go Abroad?

Understanding the Propensity to Internationalize

• Not every firm is ready for going abroad.

Prematurely venturing overseas may be detrimental

to overall firm performance, especially for smaller

firms whose margin for error is very small.

• Factors underlying the motivation to go abroad:

Size of the firm

Size of the domestic market

Copyright © 2005 South-Western. All rights reserved.

6–5

Firm Size, Domestic Market Size, and

Propensity to Internationalize

Figure 6.1

Copyright © 2005 South-Western. All rights reserved.

6–6

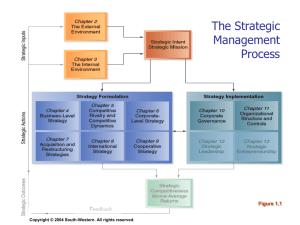

A Comprehensive Model of

Foreign Market Entries

Figure 6.2

Copyright © 2005 South-Western. All rights reserved.

6–7

A Comprehensive Model

of Foreign Market Entries

• Industry-Based Considerations

Rivalry among established competitors

Attack, counter-attack, or avoid

High entry barriers

More active foreign market entries

Bargaining power of suppliers

Entry through backward vertical integration

Bargaining power of buyers

Entry through forward vertical integration (e.g.

Sony acquiring Columbia pictures)

Threat of substitute products from abroad

Copyright © 2005 South-Western. All rights reserved.

6–8

A Comprehensive Model of

Foreign Market Entries (cont’d)

• Resource-Based Considerations

On firm-specific resources and capabilities:

Value:

The more valuable, the better overseas

Rarity:

The rarer, the better

Imitability:

The easier to be imitated, the more

dangerous overseas

Organization:

The more bundled as a system, the

better

Copyright © 2005 South-Western. All rights reserved.

6–9

A Comprehensive Model of

Foreign Market Entries (cont’d)

• Institution-Based Considerations

Regulatory risks: Obsolescing bargain – change of attitudes by

the host country governments toward the MNCs after their

entries

Trade barriers:

Tariff barriers

Nontariff barriers (safety inspections, local content

requirements, entry modes restrictions)

Currency risks: Speculation and hedging

Cultural distances

Institutional norms

Copyright © 2005 South-Western. All rights reserved.

6–10

A Comprehensive Model: A Synthesis

• How each of the three perspectives on

strategy—industry-, resource-, and institutionbased—sheds additional light on foreign entry

decisions.

• To make an optimal decision, given these

conflicting forces, strategists often have to make

a series of entry decisions along the 2W1H

dimensions (where, when, and how).

Copyright © 2005 South-Western. All rights reserved.

6–11

Where to Enter?

Location-Specific Advantages

• Location-Specific Advantages

Geographical features difficult to match by others.

Singapore, Austria, Turkey, Miami

Clustering of economic activities (agglomeration).

Knowledge spillover among closely located firms

that attempt to hire individuals from competitors.

A regional skilled labor force available to work for

different firms.

A

regional pool of specialized suppliers and

buyers.

Copyright © 2005 South-Western. All rights reserved.

6–12

Where to Enter?

Cultural/Institutional Distances and

Foreign Entry Locations

• Cultural Distance

The difference between two cultures along some

identifiable dimensions (such as power distance).

• Institutional Distance

The extent of similarity or dissimilarity between the

regulatory, normative, and cognitive institutions of

two countries.

Firms from common-law countries are more likely to

be interested in other common-law countries

Colony-colonizer links boost trade by 900% (e.g.

Great Britain – Commonwealth countries and France

– West Africa)

Copyright © 2005 South-Western. All rights reserved.

6–13

Where to Enter?

Cultural/Institutional Distances and

Foreign Entry Locations (cont’d)

• Two schools of thought have emerged:

Stage models in which firms enter culturally similar

countries during the first stage of internationalization

and, as they gain confidence, enter culturally more

distant countries in later stages.

Critics of stage models argue that considerations of

strategic goals such as market and efficiency are

more important than cultural/institutional

considerations as suggested by stage models

Copyright © 2005 South-Western. All rights reserved.

6–14

When to Enter?

• First or Late Mover Advantages

While evidence supports first mover advantages,

there is also evidence supporting a late mover

strategy.

Although first movers may have an opportunity to

gain advantage, pioneering status is not a birthright

for success

• Entry timing, although important, is not the sole

determinant of success and failure of foreign

entries.

Copyright © 2005 South-Western. All rights reserved.

6–15

How to Enter?

Scale of Entry: Commitment and Experience

• Large-Scale Entries

Benefits

A demonstration of strategic commitment to certain

markets, which both assures local customers and

suppliers and deters potential entrants.

Drawbacks

Large-scale entry limits strategic flexibility

elsewhere.

Entrants must incur sizable losses if the large-scale

entry “bet” turns out to be wrong.

Copyright © 2005 South-Western. All rights reserved.

6–16

How to Enter? (cont’d)

Scale of Entry: Commitment and Experience

• Small-Scale Entries

Benefits

Less costly if entry is unsuccessful.

Organization learns through hands-on experience

in host countries.

Drawbacks

A lack of strong strategic commitment, which may

lead to difficulties in building market share and

capturing first mover advantages.

Copyright © 2005 South-Western. All rights reserved.

6–17

How To Enter?

Modes of Entry: The First Step

• Factors Affecting the Choice of Entry Mode:

Among numerous modes of entry, strategists are

unlikely to consider all of them at the same time.

Given the complexity, strategists must prioritize by

considering only a few manageable key variables first

and then consider other variables later.

A

hierarchical model shown in Figure 6.3 and

explained in Table 6.4 is helpful.

Copyright © 2005 South-Western. All rights reserved.

6–18

The Choice of Entry Modes: A Hierarchical Model

Source: Adapted from Y. Pan & D. Tse, 2000, The hierarchical model of market

entry modes (p. 538), Journal of International Business Studies, 31: 535–554.

Copyright © 2005 South-Western. All rights reserved.

Figure 6.3

6–19

How To Enter?

Modes of Entry: The First Step (cont’d)

• The crucial first step: equity or non-equity modes

• This is what defines a multinational enterprise

(MNE) and a non-MNE

Equity modes: Through foreign direct investment (FDI)

Direct control and management of value-adding

activities overseas—key word is direct, as opposed to

foreign portfolio investment (FPI)

If a firm does not have FDI, it can still engage in

international business (through non-equity modes), but

it is not an MNE.

Copyright © 2005 South-Western. All rights reserved.

6–20

How To Enter?

The MNE advantages: OLI

• Ownership (O): Better management and coordination

internationally

• Location (L): Location, location, location! (see “Where to

enter” section)

• Internalization (I): Replacing arm’s-length market

transactions, which usually have high transaction costs

internationally, with internal relationships among MNE

subsidiaries in different countries

• Relative to the non-MNE, the MNE has a powerful set of

OLI advantages

Copyright © 2005 South-Western. All rights reserved.

6–21

Modes of Entry: Advantages and Disadvantages

Table 6.4 (cont’d)

Copyright © 2005 South-Western. All rights reserved.

6–22

How to Enter?

Making Strategic Choices

• A company may have a variety of entry choices

for different countries and tasks.

Entry strategies may change over time.

Entry strategies, even when successful, do not

guarantee international success; post-entry strategies

are also crucial.

Copyright © 2005 South-Western. All rights reserved.

6–23

Entry Debate:

High Control vs. Low Control

• High control: Better?

• Low control: Not necessarily bad?

No evidence that WOS always perform better than

JVs.

Firms from some countries (e.g., Japan) usually

prefer to have high control, whereas those from other

countries may not have such a preference.

Copyright © 2005 South-Western. All rights reserved.

6–24