Department of International Finance Master Theses FSS 2013

advertisement

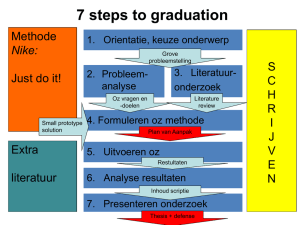

Department of International Finance Master Theses FSS 2013 Alexander Hillert / Lena Jaroszek (ZEW) / Stefan Ruenzi / Nic Schaub / Paris Tsotsonos / Florian Weigert University of Mannheim http://intfin.bwl.uni-mannheim.de lsruenzi@bwl.uni-mannheim.de Tel: +49 (621) 181-1646 Requirements to Write a Thesis You are a student either enrolled in a diploma degree or master program at the University of Mannheim You have successfully completed a seminar at one of the finance chairs (Prof. Albrecht, Prof. Bühler, Prof. Maug, Prof. Ruenzi, Prof. Theissen, Prof. Terberger, Prof. Weber) You are interested to write your thesis in the field of Empirical Finance (Asset Pricing, Mutual Funds & Portfolio Management, Corporate Finance,…) You are available in the time period from March 22 to July 22, 2013 The number of theses is limited (8 topics) © 2013 Stefan Ruenzi Department of International Finance – Master Theses 2 Schedule 06.03.2013 11.03. – 13.03.2013 18.03.2013 18.03. – 22.03.2013 22.03.2013 Mid May End June 22.07.2013 © 2013 Stefan Ruenzi Presentation of Topics Registration Period: Submit your Priority List (via https://formular.io/ls_cf/aaees/ Assignment of Topics Registration of Master Thesis Start of Thesis Processing Time First Colloquium Second Colloquium Submission Deadline of Thesis Department of International Finance – Master Theses 3 Colloquia There will be two block-seminars during the 7th and 13th week of the processing time First Colloquium: Presentation of thesis outline and discussion of first (empirical) results Second Colloquium: Presentation of (empirical) results and discussion of final thesis structure Colloquia serve as additional guidance to successfully structure your thesis and to stimulate further research investigations; Colloquia are not graded Participation on both block-seminars is mandatory for all students © 2013 Stefan Ruenzi Department of International Finance – Master Theses 4 Further Information Supervision of thesis by assigned advisor and Prof. Stefan Ruenzi Language: German or English Page Limit: approx. 50 pages (without appendix) Formal Requirements: Master Thesis is an independent academic research paper (follow the guide „Leitfaden zur Anfertigung von Diplom- und Seminararbeiten“ of Professor‘s Weber chair) We support empirical work and help to retrieve required data „No excuses policy“ for plagiarism © 2013 Stefan Ruenzi Department of International Finance – Master Theses 5 Topics: Master Theses FSS 2013 Topic R1: How to (robustly) measure financial literacy Advisor: Lena Jaroszek (ZEW, jaroszek@zew.de) Literature review and empirical topic Motivation: Private investors face financial decisions regarding their everyday life but also old age provision. Studies evaluate private investors’ financial literacy and analyze whether superior financial knowledge is associated with more favorable financial outcomes. For this purpose financial literacy is typically assessed via quiz questions in household surveys. The aim of the master thesis is: - To conduct a literature research on approaches to approximate financial literacy, including proxies like general schooling or numerical skills but also different measures constructed from quiz questions in consumer surveys. - To take measures from the literature to the SAVE 2009 household data and compare them with respect to the robustness of the results depending on the different measures employed. © 2013 Stefan Ruenzi Department of International Finance – Master Theses 7 Topic R2: An empirical evaluation of a textual analysis based investor sentiment index Advisor: Alexander Hillert (hillert@bwl.uni-mannheim.de) Empirical topic Idea: construct an investor sentiment index based on qualitative information and compare its explanatory power to the standard quantitative sentiment indices (e.g. Baker/Wurgler (2006)). Major tasks for the linguistic part: download press articles (LexisNexis, Factiva), adapt existing word lists (cf. Tetlock (2007), Loughran/McDonald (2011)) to the text corpus, process texts with software (LIWC or Antconc) to get the sentiment of each article, aggregate sentiment into an index. Major tasks for the empirical part: analyze correlation with other indices and macroeconomic factors; test whether news-based sentiment explains return differences between sentiment-prone and not sentiment-prone stocks; analyze whether news-based sentiment explains the profitability of return anomalies Remarks: knowledge about textual analysis is required for this topic © 2013 Stefan Ruenzi Department of International Finance – Master Theses 8 Topic R3: Predicting bankruptcy – A textual analysis approach Advisor: Alexander Hillert (hillert@bwl.uni-mannheim.de) Empirical topic Idea: use qualitative information to predict corporate bankruptcy Prior studies only use quantitative information (stock market and accounting data) to predict bankruptcy does qualitative information add value? Two data sources for qualitative information: press articles (LexisNexis, Factiva) and corporate reports (8-K, 10-K, and 10-Q filings) Major tasks for the linguistic part: download text corpora, adapt existing word lists (cf. Tetlock (2007), Loughran/McDonald (2011)), process texts with software (LIWC or Antconc) to compute a negativity/insolvency score. Major tasks for the empirical part: test whether the text-based measure predicts bankruptcy, replicate the model of Campbell et al. (2008), test whether the text-based measure improve the model. Remarks: knowledge about textual analysis is required for this topic © 2013 Stefan Ruenzi Department of International Finance – Master Theses 9 Topic R4: Does Public Opinion Affect Executive Pay? Advisor: Paris Tsotsonos (tsotsonos@bwl.uni-mannheim.de) Empirical topic Recent literature has shown that public opinion can be a disciplining device for various corporate decisions, e.g. in the context of corporate governance In the context of executive compensation, Bebchuk et al. (2002) and Bebchuk/Fried (2004) argue that public outrage may limit CEO pay Research idea: investigate whether public opinion affects the level and the structure of executive pay in the US Benchmark paper: Kuhnen, Niessen (Management Science, 2012) The empirical study involves a textual analysis of news articles (programs will be provided by the chair) © 2013 Stefan Ruenzi Department of International Finance – Master Theses 10 Topic R7: Linking Fund Flows, Market Liquidity and Asset Prices Advisor: Michael Ungeheuer (ungeheuer@bwl.uni-mannheim.de) Empirical and/or theoretical topic Motivation: Illiquidity tends to suddenly jump to high levels, simultaneously with price drops and across many securities (e.g. Black Monday 1987). This characteristic can be a large risk for investors (and economies). Research Question: What is the nature of the link between the behavior of funds and extreme liquidity crises? Tasks for this thesis: - Review and classify the existing theories about destabilizing mechanisms linking the behavior of funds and market liquidity during crises. - Conduct an empirical study: Test the relationship between fund flows (and/or other fund-related variables), stock liquidity and asset prices. © 2013 Stefan Ruenzi Department of International Finance – Master Theses 11 Topic R8: Downside Liquidity Risk Advisor: Michael Ungeheuer (ungeheuer@bwl.uni-mannheim.de) Empirical topic Motivation: There is evidence for a downside liquidity risk premium. It is however not clear how to optimally measure (downside) dependence between liquidity shocks and returns. Some alternative measures of dependence: - Pearson correlation - Spearman (‘rank’) correlation - Conditional versions of these correlation coefficients - Tail dependence Research Question: Considering a wide range of measures of (downside) dependence, what are good measures of dependence between liquidity and returns? How are they related to expected returns? Tasks for this thesis: - Analyze the structure of dependence between stock liquidity shocks / returns and market liquidity shocks / returns. - Link the structure of dependence to expected returns. © 2013 Stefan Ruenzi Department of International Finance – Master Theses 12 Final Remarks Please read the document for the assignment of diploma- and master theses on our webpage (http://intfin.bwl.uni-mannheim.de) and pay attention to all deadlines Assignment of topics is based on your grade obtained in the seminar Please only indicate the topics on the priority list, that you are really willing to work on We reward the willingness to work empirically in our grading Questions: weigert@bwl.uni-mannheim.de © 2013 Stefan Ruenzi Department of International Finance – Master Theses 13