America And The Great Crash

advertisement

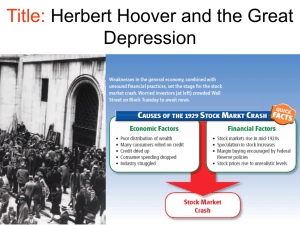

America and the Great Crash Mr. Phipps U.S. History California State Standards • 11.6.1. Describe the monetary issues of the late nineteenth and early twentieth centuries that gave rise to the establishment of the Federal Reserve and the weaknesses in key sectors of the economy in the late 1920s. • 11.6.2. Understand the explanations of the principal causes of the Great Depression and the steps taken by the Federal Reserve, Congress, and Presidents Herbert Hoover and Franklin Delano Roosevelt to combat the economic crisis. • 11.6.3. Discuss the human toll of the Depression, natural disasters, and unwise agricultural practices and their effects on the depopulation of rural regions and on political movements of the left and right, with particular attention to the Dust Bowl refugees and their social and economic impacts in California. The Era • Considered the worst economic catastrophe in the U.S. • The American depression was part of global economic crisis • The Stock Market crash did not cause the Depression, only made it happen faster • The American government radically changed to respond to widespread economic and social problems Part A: Economic Problems The Great Depression started as a series of related economic problems. I. The Sick Economy of the 1920s • The prosperity of the 1920s failed to cover up major economic problems • Wages dropped, Production dropped, Unemployment increased • Many important industries affected, including: – – – – – – – – – Agriculture and Farming Railroads Textiles Steel Mining Lumber Automobiles Housing Construction Consumer Goods At the time of the Great Crash, stock values dropped from $87 to $19 Billion. Steel production dropped 80%, and overall industrial output decreased by 50% II. Consumer Spending Consumer debt increased from $3 Billion in 1920 to over $7 Billion in 1929. • Advertising and culture of 1920s emphasized mass consumption • Excessive spending throughout the 1920s increased debt • By the end of the 1920s, consumers were purchasing less • Rising prices, declining wages, and higher interest payments resulted in greater debt III. Distribution of Wealth • The gap between the rich and the poor widened • The wealthiest 1% saw their income increase by 75%; the rest of the population increased less than 9% • 5% of Americans controlled 1/3 of all the wealth; 70% of Americans earned less than a subsistence wage IV. Speculation on Wall Street Stock Speculation -Investors buy risky or unstable stocks and bonds hoping for a quick profit Buying on Margin -Investors buy risky stocks on loan, hoping that the profit, when sold, would exceed the loan amount V. The Laissez-Faire President Herbert Hoover (19291933) • Political Experience – Graduate from Stanford – Brilliant Engineer – Director of Food Administration during WWI – Secretary of Commerce (19211928) • Campaign Promise – Continued economic prosperity Hoover’s campaign promise was to assure the American people that there would be “a chicken in every pot.” Hoover’s Conservatism • Believed that Americans were self-sufficient -rugged individualism • Argued that government intervention would ruin American democracy • Considered that the “economic down-turn” of 1929 was part of a regular business cycle VI. Foreign Loans • The Dawes Plan (1924) -- American loans to Germany (so that Germany could pay WWI war reparations to Britain and France) • Hawley-Smoot Tariff (1930) -- Raised import tariffs on all goods, resulting in higher expense for good and decreased demand • Reduction in foreign demand for American consumer goods -- world trade decreased by 40% Foreign Loans Default Part B: The Chain Reaction Economic problems throughout the 1920s resulted in dangerous economic instability, setting off a chain reaction in October 1929. I. The Pieces Causes • Decrease in consumer spending • Unequal distribution of wealth • Overproduction of goods • Huge farm surpluses • Unpaid war debts • Buying on margin Effects • Under-consumption of goods • Families had limited income to buy goods • Price of goods falls • Drop in farm prices • Banks didn’t get back money • Stock speculation, buying on credit, unstable market By mid-November, investors had lost over $30 billion. II. The Chain • Investors call brokers--they want their money • Brokers call investors/speculators to collect money (to pay back loans) • Investors sell stock at any price, flooding the market with stocks • Brokers go under -- stocks are worthless/Investors lose their savings • American public panics -- they go to their banks to withdraw their money • Banks run out of money and close down permanently The Bank Runs III. The Crash • September 1929 – Stock Market witnesses unusual ups/downs • October 24, 1929 – Stock Market takes major plunge • October 29, 1929 – “Black Tuesday” – Stock Market bottoms out – 16.4 million shares sold, causing stock prices to plummet – The Stock Market fails to rally through November, compounding the economic problems IV. The Failure • Total of 11,000 (of 25,000) banks failed by 1933 – Panicked, individuals went to banks to withdraw savings – Banks loaned out money and had no reserve savings – Banks closed permanently, leaving people stranded • Over 9 million people lost their savings • 25,355 Business fail • 1/3 of employees laid-off, unemployment increases to 25% Great Crash World Payments Investors Investors lose millions. Businesses lose profits. Businesses and Workers Consumer spending drops. Workers are laid off. Businesses cut investment and production Some fail. Overall U.S. production plummets. Banks Businesses and workers cannot repay bank loans. Savings accounts are wiped out. Banks run out of money and fail. Bank runs occur. U.S. investors have little or no money to invest. Allies cannot pay debts to United States. Europeans cannot afford American goods. U.S. investments in Germany decline. German war payments to Allies fall off. Part C: The Hoover Response Blamed for the Crash, Hoover adopted small-scale measures and indirect aid to deal with the Depression. Stage 1: Reassurance • “Any lack of confidence in the economic future…is foolish.” • Recommends business as usual • Contends that the Stock Market “crash” is a correction…just part of the regular business cycle Stage 2: Business as Usual • Hoover asks: – Industry to keep factories open and keep wages high (pledge lasts less than a year) – The Federal Reserve Board to pump more money in circulation (results in inflation) – Private industrialists to loan money to the banks and community Stage 3: Too Little, Too Late • Hoover establishes: – Reconstruction Finance Corporation (1932) in indirect aid to banks--lends $238 million to banks, $500 million to insurance corporations, farmer groups, railroads, and individual governments – Indirect Aid associations--intended to trickle down from the top (the rich buy stuff, creating jobs, etc) • Major Problems: – Hoover strongly opposed to federal intervention-thought it would ruin feelings of independence – Government was running out of money – Indirect aid was not helping those who most needed it Hoover’s Dam Construction Boulder Dam (now called Hoover Dam) – Was world’s tallest dam (726 ft.) – Was second largest (1,244 ft. long) • Intended to create jobs and money flow • $700 million project • Provided electricity, water, irrigation, and flood control to 7 western states Stage 4: The Bonus Army QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. Washington, D.C., Spring, 1932 • 17,000 World War I veterans march to the capital to demand that they get paid their bonus for service in the war • The bonus was scheduled to be paid in 1945, but rising unemployment and desperation forced the government to response Bonus Army encampment at Washington, D.C. The process to get one’s bonus required someone to find their file, bound in red tape and review it. Thus, to review the file required the government worker to “cut the red tape.” The Response Hoover’s Response • Called “Bonus Marchers” communists and criminals • Congress voted to deny veterans their bonus • Ordered the U.S. army to forcibly remove the protestors from Washington, D.C. The Clash August 1932 • 2,000 veterans and their families refused to leave • U.S. Army, under command of Douglas MacArthur and Dwight Eisenhower attack more than half with tanks and gas – One baby died, two vets shot, scores injured, and many burned by attack Hoover’s End • Americans shocked by treatment of veterans • People felt that Hoover had no compassion • Failure to deal with Depression and the Bonus Army ends Hoover’s hope for reelection Part D: The Social Impact of the Great Depression The Great Depression defined an entire generation: poverty, unemployment, migrations, hunger--affected all levels of society. I. Foreclosures • Job losses resulted in defaulted loans and mortgages • Banks would take property--thousands lost their homes including all personal property II. Hoovervilles • Foreclosures resulted in homelessness • Homelessness resulted in development of migrant towns • Usually outside large cities, made from scraps, junk • Considered crime-ridden slums III. Families Taken by famous photographer Dorothea Lange, this picture of a migrant mother and her children became the iconic photo of the Depression. The poverty of this family is evident, as is the mother’s endurance, strength, and pride. Many husbands left their families in search of jobs. Consequently, while many women were already jobless (and homeless), they were also abandoned by men who, sometimes, never returned. Tennessee pea picker family. The intense poverty of the Depression put an enormous stress on families. In most cases, poor families either had to farm out their children to relatives, go on welfare, have their kids work, or abandon them to an orphanage. IV. Migration Forced to move in search of a job and because they had lost their homes to foreclosure, many families lived out of their jalopies. Migrating westward, many of these families were seen as a threat to local workers, particularly in California. Okies, migrants from the Oklahoma dust bowl, and Arkies from Arkansas were particularly discriminated as dirty bums. V. Breadlines As a local source for aid, breadlines distributed foods within the community. Although some of these were funded by the federal government, most were subsidized by local charities. Most breadlines focused on working men, providing much needed nourishment before they found a job. Women, children, and minorities were typically barred from eating at breadlines and soupkitchens. This photo, taken in San Francisco, underscores the poverty and desperation these men felt. Feeling the Strain • Impact on Health – – – – Starvation and hunger Child malnutrition (rickets and other diseases) Suicide rate rises 30% Admission to mental health hospitals triple • Impact on Family – Living conditions deteriorate, living in smaller houses or on the road – Men feel the failure of providing for their family – Working women accused of job-stealing • Impact on Minorities – Competition for jobs increases, producing increased hostility between AfricanAmericans, Hispanics, and Asian-Americans – Lynching increased – Aid and relief programs discriminate against minorities – Mexican-Americans and Americans of Mexican descent deported The Dust Bowl Persistent dust storms and drought in the Midwest exacerbated the poverty of regional farmers. Years of Drought • Starting in 1930s, the Great Plains were gripped by severe drought and windstorms • Causes – – – – Over-farming Mechanized Farming Dry irrigation Single crop The Dust Bowl • Areas hardest hit – Kansas, Oklahoma, New Mexico, and Colorado • Many farmers migrated to the West, particularly California • Dust storms powerful enough to send dust to NYC, D.C., and other East coast cities “Black Sunday”, April 14, 1935 is widely considered to be one of the worst dust storms in history. Clogging radiators and minimizing visibility, cars were unable to drive safely. Dust storms like these would completely remove the topsoil and deposit as far as Canada. Any new seedlings would be uprooted by severe winds, choked by dust, or zapped by the constant electrical charges of the waterless storms. The Drought Ends • Federal education program: how-tofarm films emphasize proper techniques to save soil • Decreased demand for staple crops • Drought cycle ends in some areas • Parts of Texas, Kansas, and Oklahoma never recover from Dust Bowl Summary • The Great Depression was caused by many factors: – Overproduction – Credit debt – Rampant consumerism – Stock speculation – Increased gap between the rich and the poor – Political philosophy of laissez-faire The Crash • Stock Market crash was a chain reaction – Investors sell watered down stocks quickly – Investors cash out sell tickets – Run on banks – Banks close – Credit not granted to businesses – Businesses close – Unemployment Hoover • Hoover fails to economically or politically address the crisis – Emphasized indirect aid, small federal relief efforts, isolated construction projects – Considered it a part of a regular economic cycle – Harshly treated the Bonus Army – Fails to be re-elected in 1932