presenter-slides

advertisement

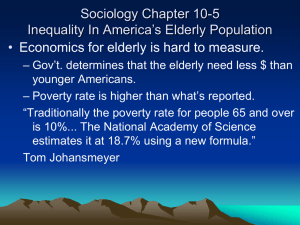

The Social Safety Net for the Elderly Kathleen McGarry University of California, Los Angeles and NBER Prepared for “The Legacy of the War on Poverty: A 50-Year Retrospective” June 12-13, 2012, Ann Arbor, MI Situation for the Elderly Differs • Poverty rates for the elderly were abysmal, far worse than those for the non-elderly. In 1959: • ▫ ▫ ▫ Poverty rate for the elderly was 35.2% Poverty rate for children was 27.2% Poverty rate for those ages 18-64 was 17% Situation for the Elderly Differs • Poverty rates for the elderly were abysmal, far worse than those for the non-elderly. In 1959: • ▫ ▫ ▫ • Poverty rate for the elderly was 35.2% Poverty rate for children was 27.2% Poverty rate for those ages 18-64 was 17% Poverty rate in 2010: ▫ ▫ ▫ Poverty rate for the elderly was 9% Poverty rate for children was 22% Poverty rate for those ages 18-64 was 13.7% Programs Prior to 1964: Social Security • Established 1935 and gradually expanded during the 1940s and 1950s. Progressive benefit formula • ▫ • Terrific return on investment for earlier cohorts. ▫ • • Higher replacement rates for low income workers Ida May Fuller paid $24.75 over 3 years, received $22,888.92 in benefits by her death at age 100. Annuity aspect protects oldest old Benefits for spouses and survivors, thus contributes to well-being of the non-elderly. Programs Prior to 1964: OAA • Old Age Assistance programs state run programs stemming back to 1920s. In 1935, 30 states had such programs ▫ Established precedent of assisting the elderly • Social Security Act of 1935 provided matching funds to states to expand these programs. Benefits were low and varied greatly across states • ▫ In 1960 $40 Mississippi to $275 Washington State ($306 and $2,108 in 2010 $) Variation in restrictions on benefits ▫ lien laws, residency requirement, relative responsibility Programs Prior to 1964: OAA (cont’d) • Despite problems with programs, in 1950 more individuals receiving OAA than Social Security (2.8 vs. 2.1 million) Those receiving OAA still had very low income • ▫ Median family income of OAA recipients in 1973 was $1,851 ($9,091 in 2010 dollars) The War On Poverty and the Elderly • Central component is the Older Americans Act ▫ • • • It was the responsibility of government to: “assist our older people to secure equal opportunity to the full and free enjoyment of the following objectives … adequate income in retirement,” … “suitable housing,” and “no discriminatory personnel practices because of age.” Established Administration on Aging Demonstrated importance of the elderly Set the stage for increases in Social Security and for the establishment of SSI Social Security and the War On Poverty • • • In 1964 75% of elderly received Social Security Average retired worker benefit $544.98 (2010$) Run up in benefits: ▫ ▫ ▫ 1965: 7% increase 1967: 13% increase Johnson’s signing statement of 1967 amendments: “This means that 9 million people will have risen above the poverty line since the beginning of 1964” Social Security and the War On Poverty • Increase in benefits continued after Johnson: ▫ ▫ ▫ Tax Reform Act of 1969: 15% increase 1971: 10% increase 1972: 20% increase • Total of nearly 85 percent increase 1964—1972 • 1972 Amendments also indexed benefits ▫ Protected elderly against erosion of benefits over time. SSI and the War On Poverty • Replaced state run OAA programs with uniform federal guaranteed income program for elderly ▫ ▫ • Began paying benefits in 1974 with guarantees of $140 and $210/mo ($698, $1,048 currently) Benefit = Guarantee – Countable income • ▫ • Administered by Social Security Administration Part of Nixon’s Family Assistance Plan Countable income=income – (first $60 earned+ ½ remainder, first $20 unearned) Asset test initially $1500/$2250, now $2000/3000 SSI and the War On Poverty (continued) ▫ ▫ Income disregards unchanged since 1972 Asset limits increased once but if increased with the CPI would be $7,000 / $10,500 today • States can supplement federal guarantees ▫ 2011 all but 6 states had some supplemental program ▫ Maximum is $1,039 / $1,539 in Alaska California is $830 / $,1407 Michigan is $688 / $1,039 Massachusetts is $803 / $1213 Maximums are typically below the poverty line SSI and the War On Poverty (continued) • Those eligible are truly poor but participation in SSI is low, approximately 50-55% ▫ ▫ ▫ Measured in 1974, 1984, 1993 Why? Lack of knowledge, stigma, not feeling needy Numerous outreach efforts have been unsuccessful • Bounties, door to door canvasing, intensive advertising, direct contact from Social Security Alternative of minimum Social Security benefit ▫ Cannot be targeted at needy Outcomes: Social Security • Social Security played an important role in reducing poverty among the elderly ▫ ▫ Engelhardt and Gruber estimate it is responsible for the entire decline Indexation of benefits important for continued success and for the difference in the recent experience of elderly and non-elderly Outcomes: SSI • SSI also played an important role for low income elderly ▫ 26 states had OAA benefits below federal guarantee ▫ ▫ ▫ ▫ e.g. Mississippi at $75 (federal guarantee $140) Median income of OAA recipients rose by 1/3 with transition to SSI And 2.8 million individuals became newly eligible. Estimate of 20% reduction in poverty (2.5 percentage points) Estimate of 30%+ reduction in poverty gap Still remain substantial problems • Differences by race and ethnicity: ▫ ▫ ▫ Rate for elderly blacks fell from 62.5% in 1965 to 21.9% now But rate for elderly whites now is 7.7% Poverty rate for elderly Hispanics is 18% Still remain substantial problems • Differences by race and ethnicity: ▫ Rate for elderly blacks fell from 62.5% in 1965 to 21.9% now But rate for elderly whites now is 7.7% Poverty rate for elderly Hispanics is 18% ▫ ▫ • Poverty rate for elderly women living alone: ▫ ▫ Fell from 63.3% in 1959 to 19.1% now Large racial / ethnic differences. In 1999: Black women living alone 44% Hispanic women living alone 58% Changes in composition of income Redistribution • • • Progressive benefit schedule Regressive tax structure Other regressive components ▫ ▫ Transfers from short lived to long lived Transfers from singles and dual earner couples to one earner couples Unmeasured Resources / Expenses • Resources omitted from poverty calculations ▫ In-kind transfers: ▫ ▫ ▫ ▫ • Medicare / Medicaid, Food stamps, LIHEAP, Housing assistance Value of Owner occupied homes Assets have increased over time Leisure time Home production Costs ▫ ▫ Medical expenses Limitations regarding home production Home ownership 2010 by age Median net worth by age Other Gains / Changes • Living Arrangements ▫ Greater independence ▫ In 1940, 18% of elderly widows lived alone In 1960, 36% lived alone (40% with children) In 1990, 62% lived alone (20% with children) Changes obscures improvements in poverty Other Gains / Changes • Living Arrangements ▫ Greater independence ▫ • In 1940, 18% of elderly widows lived alone In 1960, 36% lived alone (40% with children) In 1990, 62% lived alone (20% with children) Changes obscures improvements in poverty Trend towards early retirement ▫ ▫ ▫ ▫ Feasible with Social Security increases In 1960 lfpr men 65+ was 33.1 % In 1990 lfpr men 65+ was 16.3 % (Has risen since) Labor Force Participation Men 65+ 50 45 40 35 30 25 20 15 10 1950 1960 1970 1980 1990 2000 2010 Other Gains / Changes • Living Arrangements ▫ ▫ • Greater independence Changes obscures improvements in poverty Trend towards early retirement ▫ ▫ ▫ ▫ • Feasible with Social Security increases In 1960 lfpr men 65+ was 33.1 % In 1990 lfpr men 65+ was 16.3 % (Has risen since) Life expectancy ▫ ▫ In 1960 life expectancy at 65 was 14.3 yrs In 2007 life expectancy at was 18.6 yrs Life expectancy at age 65 Future • Shift to defined contribution (DC) pensions and away from defined benefit plans ▫ ▫ • Elderly will need to manage their resources Exposure to risk in financial markets, fraud Changes in Social Security and Medicare ▫ • Likely declines in real value of benefits Possibility of needing long term care ▫ ▫ ▫ Not covered by Medicare Average $80,000+ per year Fewer children Future • Policies to encourage savings through private pension plans and survivor benefits ▫ ▫ ▫ • • Default options (Choi, Laibson, Madrian) REACT, ERISA (survivor benefits) Newer tax advantages savings plans Health improvements allow for longer work life and trend towards early retirement is reversing CLASS Act and tax advantage LTC plans