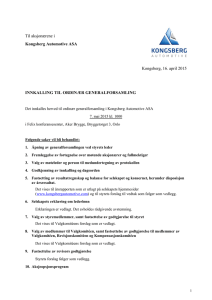

Innkalling Generalforsamling

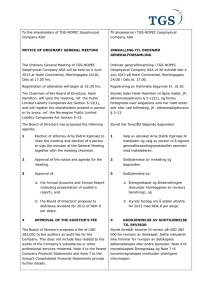

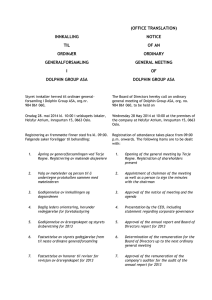

advertisement