Omni Circular Powerpoint

advertisement

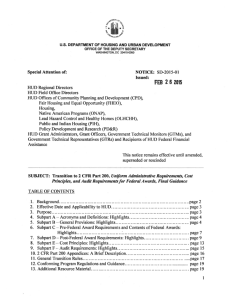

OMB GRANT REFORM: THE OMNI CIRCULAR 1 New Regulations: “OMB Uniform Administrative Requirements, Cost Principles and Audit Requirements for Federal Awards” Also known as the OMB Omni Circular (or “Super Circular”). Published in the Federal Register on December 26, 2013 at 2 CFR Part 200. Federal Agencies (e.g. HUD) were supposed to publish their implementing regulations and guidance effective one year from the publication date – December 26, 2014. Single audit changes effective 12/31/2015. 2 Status of HUD Implementation As of the date of this writing, March 30, 2015, HUD has not published their conforming regulations as required. Jason Casterline of Casterline Associates PC and PHADA conducted a conference call with HUD on March 20, 2015, and they indicated regs are coming soon. HUD did publish a notice, SD 2015-01 on February 26, 2015, which will be discussed in detail in this session. Also expected: FAQs and other clarifying material. 3 Objectives of Omni Circular Reduce administrative burden for those receiving federal awards, while also reducing risk of waste, fraud and abuse. Improve the integrity of financial management and operation of federal programs. Strengthen accountability for federal dollars by improving policies that protect against waste, fraud, and abuse. Increase impact and accessibility of programs by minimizing time spent complying with unnecessarily burdensome administrative requirements. 4 Objectives (continued) Reorient recipients toward achieving program objectives. Grants awarded based on merit. Increased management focus on performance outcomes. Streamlined rules governing federal funds. Single audit oversight tool is better focused to reduce waste, fraud, and abuse. 5 Includes Streamlining and Consolidation of Circulars A-21 Cost Principles for Educational Institutions A-50 Audit Follow-Up, related to Single Audit A-87 Cost Principles for State, Local, and Indian Tribal Governments A-89 Federal Domestic Assistance Program Information A-102 Awards and Cooperative Agreements with State and Local Governments A-110 Uniform Administrative Requirements for Awards and Other Agreements with Institutions of Higher Education, Hospitals, and Other Nonprofit Organizations A-122 Cost Principles for Non-Profit Organizations A-133 Audits of States, Local Governments and Non-Profit Organizations 6 Three Major Areas of Change 1 2 3 Reforms to administration requirements Reforms to cost principles Audit requirements 7 Specific Content Subpart A: Acronyms and Definitions Subpart B: General Provisions Subpart C: Pre-Federal Award Requirements and Contents of Federal Awards Subpart D: Post-Federal Award Requirements Standards for Financial & Program Mgmt Subpart E: Cost Principles Subpart F: Audit Requirements Note: we will first discuss a variety of topics and changes, and then dig into more detail with a review of HUD Notice SD 2015-01 8 Shift in Focus The Omni Circular shifts focus from compliance to performance. Compliance is still important of course but auditors and regulators are supposed to emphasize outcomes more than process (at least this is the idea). There is major emphasis on accountability with enhanced policies designed to protect again waste, fraud, and abuse (with new certification requirements – see next page). 9 Certification 200.208 Certification for all annual financial reports and requests for payments: “By signing this report, I certify to the best of my knowledge and belief that the report is true, complete and accurate and the expenditures disbursements and cash receipts are for the purposes and objectives set forth in the terms and conditions of the federal award. I am aware that any false, fictitious or fraudulent information or the omission of any material fact, may subject me to criminal, civil, or administrative penalties for fraud, false statements, false claims, or otherwise.” 10 Focus on Performance Changes 200.102 Authority for OMB to waive certain compliance requirements and approve new strategies for innovative program designs that improve cost-effectiveness and encourage effective collaboration across programs. 200.201 Fixed amount awards focused on meeting performance milestones. 200.301 Emphasis on performance goals and performance reporting. 11 Performance Measurement - More 200.301: Recipients must use standard government wide (i.e. PHA wide) information collection when providing financial and performance information and to related the data to performance. Recipients must also provide cost information to demonstrate cost effective practices. Federal awarding agency should provide recipients with clear performance goals, indicators, and milestones to report. 12 Stronger Oversight Section / Changes 200.112, 200.113 Emphasis on conflict of interest policies and procedures § 200.112 Conflict of interest. The Federal awarding agency must establish conflict of interest policies for Federal awards. The nonFederal entity must disclose in writing any potential conflict of interest to the Federal awarding agency or pass-through entity in accordance with applicable Federal awarding agency policy. 13 Stronger Oversight (cont’d) § 200.113 Mandatory disclosures. The non- Federal entity or applicant for a Federal award must disclose, in a timely manner, in writing to the Federal awarding agency or pass-through entity all violations of Federal criminal law involving fraud, bribery, or gratuity violations potentially affecting the Federal award. Failure to make required disclosures can result in any of the remedies described in § 200.338 Remedies for noncompliance, including suspension or debarment. Includes Tenant Fraud? Landlord Fraud? HUD interpretation not yet known. 14 Stronger Oversight (cont’d) 200.503 Emphasis for federal agencies to build on single audit results, rather than repeating procedures: (a) An audit conducted in accordance with this Part must be in lieu of any financial audit of Federal awards which a nonFederal entity is required to undergo under any other Federal statute or regulation. To the extent that such audit provides a Federal agency with the information it requires to carry out its responsibilities under Federal statute or regulation, a Federal agency must rely upon and use that information. 15 Stronger Oversight (cont’d) (b) Notwithstanding subsection (a), a Federal agency, Inspectors General, or GAO may conduct or arrange for additional audits which are necessary to carry out its responsibilities under Federal statute or regulation... except that the Federal agency must plan such audits to not be duplicative of other audits of Federal awards…Any additional audits must be planned and performed in such a way as to build upon work performed, including the audit documentation, sampling, and testing already performed, by other auditors. 16 Stronger Oversight (cont’d) 200.331 Subrecipient monitoring requirements enhanced. 200.303 Internal control guidance added to administrative requirements (COSO and green book tied in). 17 Internal Controls 200.303 (more) Recipients are required to have internal controls in place that safeguard assets and provide reasonable assurance of compliance with federal statutes and regulations. Available resources: Comptroller General “Standards for Internal Control” (also known as the Green Book) Internal Control Framework issued by the Committee on Sponsoring Organizations (COSO) Appendix XI Compliance Supplement Part 6 Internal Control (will follow COSO and Green Book in 2015) 18 Technology Section/Changes 200.335 The Omni-Circular requires, where feasible, for federal agencies and recipients such as PHAs to move toward a paperless environment with electronic storage rather than printed paper. Like much of what is coming from the Omni Circular, it is not clear yet what HUD will require in this regard. 19 Technology (continued) § 200.335 “Methods for collection, transmission and storage of information. In accordance with the May 2013 Executive Order on Making Open and Machine Readable the New Default for Government Information, the Federal awarding agency and the non-Federal entity should, whenever practicable, collect, transmit, and store Federal award-related information in open and machine readable formats rather than in closed formats or on paper.” 20 Technology (continued) 200.94 Defined that computers that cost below capitalization threshold are considered supplies, not equipment: “Supplies means all tangible personal property other than those described in § 200.33 Equipment. A computing device is a supply if the acquisition cost is less than the lesser of the capitalization level established by the non-Federal entity for financial statement purposes or $5,000, regardless of the length of its useful life.” 21 Procurement 200.318: Agencies but have their own written procurement procedures, which must comply with both State and Federal laws and regulations. Must maintain oversight to ensure contractors comply with terms and conditions of contracts and purchase orders. Must have written standards of conduct covering conflicts of interest for employees engaged in selection / award / administration. Must maintain records to detail history of procurements. 22 Procurement Methods Five procurement methods described: Micro-purchase (new threshhold is $3,000, no competition required) Small Purchase Procedures Sealed Bids / Formal Advertising Competitive Proposal when Sealed Bid not appropriate Noncompetitive Proposals / Sole Source 23 Standardized Requirements Section / Changes Consistent definitions 200.203 Notice of Funding Opportunities 200.210, 200.301, 200.327, 200.328 Award, Application and Reporting Requirements 200.305 Payment of interest earned on federal funds 24 Indirect/Direct Costs Section / Changes Appendix VII, Indirect Cost Allocation plans – pg 78688 in the 12/26/2013 federal register – discusses direct and indirect costs and gives guidance on allocation of indirect costs, applicable to those PHAs that do not use the management fee approach and/or programs that do not allow that. This also was previously part of OMB A-87. Generally, indirect costs may still be allocated based upon the percentage of direct labor charged to a given program (same as before). 25 Other Items Actions to Increase Competition in grants: The Omni Circular requires public notice for grants through the Catalog of Federal Domestic Assistance (CFDA). The notice must include: program description, purpose, goals and measurement, projected total amount of funds available for the program, anticipated source of funds, general eligibility requirements, and applicability of single audit requirements. According to OMB HUD must also describe the merit review process in the corresponding funding opportunity for each grant application. 26 Other Items (continued) Risk analysis of potential grantees: Prior to making a federal award, the OMB Omni Circular requires HUD to have a framework in place to determine the eligibility and risks of applicants. Risk factors include: financial stability, quality of management systems, performance history, audit findings, and the applicants' effectiveness in implementing statutory and regulatory requirements. Evaluation criteria must once again be described in the announcement of funding opportunity. 27 Selected Items of Cost One of the areas you should definitely take a look at is the list of definitions for allowable costs. “General Provisions for Selected Items of Cost” – begins at 2 CFR 200.420, also found at pg 78644 in the 12/26/2013 federal register. This used to be included in OMB A-87 and discusses what costs are allowable and not allowable. There are a couple of items in here that are strange, but please note the following: “200.240… In case of a discrepancy between the provisions of a specific Federal award and the provisions below, the Federal award governs.” HUD might issue clarifying rules to allow the following: 28 Selected Items of Cost § 200.426 Bad debts (see note bottom of previous slide): Bad debts (debts which have been determined to be uncollectable), including losses (whether actual or estimated) arising from uncollectable accounts and other claims, are unallowable. Related collection costs, and related legal costs, arising from such debts after they have been determined to be uncollectable are also unallowable. [This was in OMB A-87 prior to the SuperCircular and generally allowed by HUD previously] § 200.431 Compensation/fringe benefits (see note bottom of previous slide): …(f) Automobiles. That portion of automobile costs furnished by the entity that relates to personal use by employees (including transportation to and from work) is unallowable as fringe benefit or indirect (F&A) costs regardless of whether the cost is reported as taxable income to the employees. 29 Single Audit Changes Single Audit changes are effective for years ending on or after December 31, 2015. Single audit threshold raised to $750,000. Low risk auditee criteria updated. Type A program threshold raised to $750,000 (or still 3% $3M, .3% larger entities). Type Bs – not required to identify more high risk Type Bs than at least 25% low risk type As, and other changes to Type A / Type B. 30 Single Audit Changes Questioned costs threshold raised to $25,000 Questioned costs section requires description of how calculated Findings require “perspective” section (isolated, prevalent, type of sampling used) Repeat findings require identification as repeat and prior finding reference number 31 Single Audit Changes Coverage requirements for major programs tested changed to 20% for low risk auditees and 40% for non low risk auditees Online publication of reports (clearinghouse) “Next business day” due date Federal due date still nine months after fiscal year end Modification to 14 compliance requirements will be known with future release of compliance supplement 32