International Insurance

advertisement

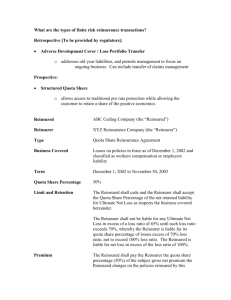

Introduction to Risk Management and Insurance Finance Department of Shanghai University 1. Fundamentals & Terminology Risks---Risk Management---Insurance Mathematical Foundation of Insurance---Law of Large Numbers Definition of Insurance Financial Definition---Redistribution Legal Definition---Contracts Others: the Insurer, the Insured, a Premium, a Policy, the Insured’s Exposure to Loss, Right & Duty Terminology: Loss, Chance of Loss, Peril & Hazard: Moral Hazard, Morale Hazard Proximate Cause Insurable Loss: Direct Losses & Indirect Losses Pure Risk, Speculative Risk, Risk Management Building Blocks of an Insurance Premium A. The Actual Cost of the Losses B. The Expenses of Operating and Maintaining the Insurance Pool C. An Allowance for Unexpected Losses, or the Risk Factor for the Insurance Pool D. Earnings on Investment An Insurance Premium=A+B+C-D Sometimes an insurance premium can be priced below the level of expected losses. 2. Insurable Loss Exposures Not all potential losses are a good subject for insurance I. Ideal insurable loss exposure 1. A large group of similar items exposed to the same 2. 3. 4. peril. Accidental losses. Definite losses capable of causing economic hardship. Extremely low probability of a catastrophic loss to the insurance pool. II. Risk Classification Subsidization Adverse Selection Principles of risk classification---fairness Separation and class homogeneity Reliability Incentive value Social acceptability 3. Risk Management The risk management is carried out by firms before they go to buy insurance. The purpose is to reduce the risks exposure. I. Risk Management Staff Head: a manager with overall responsibility Insurance expert Claims manager Loss control engineer Employee benefits specialist Financial analyst II. Statement of objectives and principles 1. Objectives: Survival, Growth, and Responsibility 2. Principles: Efficiency and Compliance 3. Risk Management Manual General Guidelines: (1) Engage in loss prevention activities as if all chance of loss remained with the company (2) Assume all risks that are not significant in relation to the company’s financial strength (3) Insure all risks not assumed Example: protecting the company’s property against fire and associated perils: commitment to loss control, good housekeeping, sprinklers, adequate water supply, emergency organizations, regular inspections There are three steps in risk management process III. Step One: Identification and measurement of exposures Direct property losses Losses of income and extra expenses following a property loss Losses arising from lawsuits called liability losses Losses caused by the death, disability, or unplanned retirement of key people Estimation of maximum loss Emergency planning—disaster recovery IV. Step Two: loss control and risk financing (1) Loss control Risk avoidance Loss prevention Loss reduction (2) Risk financing Risk assumption Self-insurance and financed risk retention Risk transfer other than insurance Insurance V. Step Three: regular review of the risk management program VI. Financial Risk Management Interest rate risk (swap) Credit risk (investigation) Currency risk (option, futures, forward) Liquidity risk (allowance) Market risk (hedging) 4. Private Insurance Companies I. Two different types of insurance companies: Mutual insurance company Stock insurance company 1. Mutual insurance companies: non-profit The owners are the policyholders insured by the corporation Advance premium mutual Assessment mutual Factory mutual 2. Stock insurance companies 3. Demutualization: The conversion from mutual to stock insurance companies. II. Lloyd’s of London: one of the most important insurance markets Established in 1688. In 1969 foreigners were allowed to become names of Lloyd. In 1990s Lloyd’s membership was 18,000 individuals organized in about 170 syndicates. An individual needed a net worth of at least 250 thousand pounds, with at least 150 thousand pounds in liquid assets, to become a name. III. Blue cross and Blue shield, HMOs and PPOs. 5. Insurance Occupation In recent years in the U.S., some 2.2 million people were employed in the insurance industry, among whom 1.5 million work in home offices and 700,000 work as agents, brokers, or in service organizations. I. Insurance agents & brokers 1. 2. 3. 4. Insurance agent---the link between the insurance company and the insurance consumer. Duties of the agent Agency contracts: specify the authorities to the agent. Agent should act within the limit of the authorities. Two other fundamental legal doctrines. Insurance broker 1. A broker is the agent of the insurance applicant. 2. A broker is needed when the applicant wants to tailor out specific insurance requirements Licensing requirements Direct writers---employed by insurers Independent agents II. Loss adjuster Employees, independent adjustment bureaus Public adjusters---an agent of the insured. reservation of rights waiver and estoppel III. Underwriter IV. Actuary 6.Insurance Regulation Regulation represents the rules by which the game is played. The government as market regulator: to protect the weak group. I. The reasons for insurance regulation Widespread severe impact of insurer insolvency Unequal knowledge and bargaining power of the buyer and seller Unique problem of insurance pricing Promotion of social goals Promoting solvency: the most important goal of insurance regulation Unequal knowledge and bargaining power 1.lack of technical expertise on consumer’s side 2.deterioration of competition 3.complexity of insurance contract 4.insurance is an intangible good Prices: insurers set prices before costs are fully known Promotion of social goals. II. Regulated Activities Legal Reserve and Surplus Admitted Assets/Nonadmitted Assets Property Insurance Reserve Accounts: unearned premium reserve/loss reserve Life Insurance Reserve Accounts: increase with the passage of time Asset Valuation Reserve/Interest Maintenance Reserve Regular Audits and Solvency Testing Audits by the state insurance department once every three years IRIS monitoring Risk-based capital as against minimum capital requirements Guaranty Funds Rate Regulations Investment Activities Policy Form Approval and Expense Limitations Qualifications or Licenses 7. Insurance Contracts I. Contract: Valid, Voidable, Void Binder: a temporary property insurance contract before the issuance of the formal insurance contract. Conditional Receipt: a temporary life insurance contract when the applicants submit a premium payment. Difference between a binder and a conditional receipt: the payment of the premium. II. Elements of a valid contract Offer, Counteroffer, Acceptance Consideration: exchangeable value---premium against contingent promises. Capacity: minors, insane, intoxicated are incapable. Legal Purpose. III. Insurance Contracts Principle of Indemnity Three exceptions to the rule: life insurance, replacement-cost insurance, valued insurance policies Insurable Interest The insured should have a financial interest in the loss Property Insurance: measured at the time of loss. More than one party: owner, co-owner, mortgage Life Insurance: measured at the time of purchasing the policy Close family relationships, creditor and debtor, close employment relations Actual Cash Value Actual Cash Value=Replacement Cost-Depreciation Subrogation A is responsible for B’s loss. B can claim the loss from the insurer, and the company has the subrogation right to sue A. If it collects from A more than it compensates B, the balance belongs to B. An insurer has no right to subrogate against its own insureds. Contract of Adhesion Any ambiguous language will be construed against the drafter of the contract Reasonable expectations: misleading locations, unreasonable evidence The Personal Feature Assignment: Property insurance: transfer of rights & duties with the consent of the insurer Life insurance: change of beneficiary Assumption Reinsurance Utmost Good Faith Warranty Representations: answering questions Concealment IV. Discharge of Insurance Contracts 8. Rate of Premium I. Pure rate of premium =premium÷insurance amount Rate of premium=pure rate of premiumX(1+extra charge) II. Principle of the rate of premium Fairness Premium=p.S p: chance of loss,S:insurance amount Solvency: avoid vicious competition Comparative stability Encouraging loss reduction III. Setting of property premium Rate of loss=compensation÷insurance amount Deviation: usual 10 percent This is also the adjustment rate Rate of property premium: Rate of lossX(1+10%)X(1+g) ÷(1+y) g: extra rate, y: investment gain. IV. Rate of life premium F=nP n:number of payment years, P:premium 9.Basic Property and Liability Insurance Contracts Commercial and personal property insurance policies have the following common elements: declarations, insuring agreements, deductibles, definitions, exclusions, endorsements or riders, and conditions Checklist to determine whether an insurer is obligated to pay a claim 1. 2. 3. 4. Is the property covered? Is the person covered? Is the loss caused by a covered peril? Do any deductibles or exclusions apply to the loss? 5. Do policy conditions limit the amount of coverage? 6. Is the location of the loss covered? 7. Did the loss occur during a covered time period? I. Standard Policy: for most widely used property & liability insurance contracts II. Basic parts of an insurance policy Declarations Insuring Agreement Deductibles Definitions Exclusions Endorsements III. Conditions Fraud Suspension of Coverage Cancellation Other Insurance Duties after a Loss Appraisal Salvage Claims Payment IV. Conclusion 10. The Personal Auto Policy The Auto Policy is an independent category of insurance I. The Personal Auto Policy (PAP) layout Declarations Named Insured Vehicles Covered Premium Charged Insuring Agreements describe the insurance in broad terms Definitions II. Part A---Liability Limit of Liability Single Limit of Liability Split Limits Insureds Exclusions III. Part B---Medical Payments Reasonable expenses on a no-fault basis within 3 years from the date of the accident IV. Part C---Uninsured Motorist Coverage Purpose: protect people from the loss of accident caused by another uninsured motorist Uninsured motorist: Drivers without insurance Drivers with less insurance than the minimum required by the state law Hit-and –run Drivers Drivers with coverage provided by insolvent insurers Contact or no-contact rules Underinsured motorists V. Part D---Damage to Your Auto Collision Exclusions Other-than-collision Coverage Loss Settlement Actual Cash Value (ACV) VI. Part E---Duties after An Accident or Loss VII. Part F---General Provisions Bankruptcy Fraud Compliance Subrogation Territory Covered 11. Commercial Property Insurance I. Commercial Insurance Business Firms Purchase Insurance II. Commercial Package Policy A package of policies providing insurance coverage to a broad range of organizations Components of CPP: Common Declarations Common Conditions Commercial Property, Commercial General Liability, Crime, Inland Marine, Commercial Auto, Boiler, Farm, etc. Insureds must purchase at least two of the package’s components, and as many as they need. III. Building and Personal Property Form Property Covered: Building, Business Personal Property, Personal Property Property excluded from Coverage Perils Covered: The Basic Form, The Broad Form, The Special Form Definition of Fire Hostile Fire, Friendly Fire Reporting Forms Business Income Coverage Indirect Losses Business Income from Dependent Properties Additional Forms Property Insurance Rating: Class Rating, Schedule Rating IV. Transportation Insurance Ocean Marine Insurance: the origin of any insurance Ocean Marine Coverages The Hull Exposure The Cargo Exposure: Particular Average, General Average The Loss of Freight The Liability Loss Exposure The list of perils is very broad. Ocean Marine Insurance Rating Based on the judgment of the underwriters, includes: The seaworthiness of the ship The experience and ability of captain and crew The potential for loss of the cargo The route and the season The coverage provided by the policy V. Aviation Insurance Purchased by the owners and operators of aircraft, airport operators, and by companies building and supplying parts for aircraft, but not passengers. Including planes, helicopters, hot air balloons, hang gliders and space satellites. Aircraft owners purchase: property insurance:aircraft hull liability insurance The core problem facing aviation insurers is the weakening of law of large numbers Aircraft insurance premium: a function of the perils covered. VI. Automobile Property Insurance Commercial Auto Component provides both liability and property coverage. The commercial auto policy covers: Medical Expenses: drivers A and B and passengers Lost income and services: drivers A, B and passengers Damage to automobiles: A and B Additional property Ambulance expense Funeral expense Investigation expense Legal expense The cause of the loss: Collision or not collision Collision Coverage Comprehensive Coverage VII. Automobile Liability Insurance A. Liability Insurance: The third-party insurance (The passengers in the auto are not the thirdparty) If A’s loss was caused by the negligence of B, A could sue B in a tort case. B’s insurer should compensate A according to the judgment, or settle with A without litigation. B. No-Fault Automobile Insurance All parties receive compensation from their own insurer, regardless of who caused the accident. No-fault insurance is to speed the compensation in less serious traffic accidents. After some threshold of damage has been reached, the injured party may revert to the liability system to seek compensation. C. No-Fault Vs. Tort Liability The shortcomings of tort liability: Too small proportion of money used for compensation Unfair indemnity Slow recovery Difficult to prove negligence The supporting points to tort liability. The no-fault insurance provides one more option to the insureds so that it is more flexible. D. Commercial Automobile Insurance Business Auto Coverage Form Garage Coverage Form 12. Reinsurance One insurance company purchases insurance from other insurance companies. Primary insurer/ceding insurer Reinsurer Facultative reinsurance Treaty reinsurance/Automatic reinsurance I. Reinsurance Coverage Pro rata reinsurance Excess-of-loss reinsurance The insured will most likely be unaware of any reinsurance coverage agreement. It receives one check in the event of a loss. II. Catastrophe Reinsurance Example: total 100 million 5 million: insured 10 million: primary insurer 25 million: first reinsurer 60 million: catastrophe reinsurer III. Reasons for Reinsurance Stability in operating results (enlarges financial strength) Reduction of size of the reserves Services provided by the reinsurer Improves relations between a company and its agents by accepting the large-sized exposures Allowing an insurer to profit without marketing a product to the public IV. For and against For: spread the losses abroad Against: not subject to the same level of regulation V. Providers of Reinsurance Professional reinsurance companies Primary insurance companies Self-insurance subsidiaries of noninsurance companies International insurance firms A reinsurer can purchase reinsurance again: retrocession 13. Life Insurance policies Broad meaning and narrow meaning Three distinct types of life insurance: Life insurance Health insurance Annuities Life insurance has a savings function I. Three ways life insurance is distributed A. Group life insurance B. Industrial or debit life insurance C. Individual life insurance Group Life Insurance Provided to a well-defined group of people who are associated for some purpose other than purchasing life insurance Generally costs less than similar individually purchased insurance Industrial Life Insurance: small amounts Individual Life Insurance: also called ordinary life insurance II. Term Insurance Insurer is to pay the beneficiary if the insured dies within a specified period Term insurance does not build savings or cash value Types of term life insurance: Single-year term policies Five-year term policies Longer-term policies Term-to-a-specified age policies Multiyear term policies may have benefits that decrease, increase, or remain level Decreasing term policy: premiums remain the same Increasing term policy: premiums increase at each renewal Level term policies: pay the same amount of benefits Renewable term policies: renew the policy at the end of each term at a higher premium Convertable term policies: convert the policy to a whole life policy (from non-savings to savings) at a higher premium Reentry term policies: insured to pass regular medical examinations to qualify for low rates Use of term life insurance The need for life insurance is temporary, or People need the maximum coverage with limited financial resources III. Whole Life Insurance The policies promise to pay the beneficiary whenever death occurs Difference from both property insurance and term life insurance: the insurer must eventually pay a claim on every whole life policy Cash Value: Positive difference between level-premium and mortality cost, plus its interest. Contractual rights of cash value: Withdraw all cash value if policy owners want to end the policy Convert it to purchase an annuity Borrow all or a proportion of cash value Some terminally ill insureds can receive “accelerated death benefit”---a percentage of a policy’s face Types of whole life policies Single-premium whole life insurance: insureds pay a large premium once and all Continuous-premium whole life insurance: insureds pay a level-premium until his death Limited-payment whole life insurance: insureds pay a level-premium for a limited number of years Modified whole life insurance: level-premium rising in stair steps Combination whole life insurance: decrease term policy combines with additions to the whole life policy premium The Use of Whole Life Insurance Whole life insurance policies meet people’s needs for permanent protection combined with savings Reasons for saving with life insurance Example of a whole life ledger sheet IV. Buy Term and Invest the Difference: There is difference between a term insurance premium and a whole life insurance premium. People can buy term policy and invest the difference to other products. V. Universal Life Insurance People buy a term policy and invest an additional amount with the insurance company. The minimum premium is to keep a term insurance in force. The insured is allowed to determine the amount and frequency of the premium payments within limits. A guaranteed rate is specified in the contract, while an excess interest rate is determined by a formula or by company declaration. Universal Life Insurance Death Benefits Plan A: A death benefit remains unchanged at first, then, after the cash value passes a threshold, the cash value is added to the death benefit. Plan B: A death benefit increases with the growth of the cash value. Advantages of Universal Life Insurance Flexibility of Premium Payments Ability to earn a great return when interest rates rise Flexibility of death benefits Example of a Ledger Sheet for Universal Life Insurance V. Variable Life Insurance A modification of universal life insurance One insured has two accounts: an insurance account and a separate account VI. Annuities 14. Medical Expense and Disability Insurance I. Increasing Heath Care Costs From 1970—1995 average U.S. consumption prices increased 3.93 times (annual rate of 5.4%) while medical care price increased 6.49 times (annual rate of 7.5%) In the developed countries, some European countries has not enforced the commercial medicare plans. II. Common Contract Provisions Entire contract Grace period Reinstatement Incontestable clause Claims Physical exam and autopsy Legal action Change of beneficiary Optional contract provisions Definitions and exclusions III. Five Kinds of Health Insurance Coverage A. Basic medical expense insurance Covers the costs of both hospitalization and outpatient Blue Cross and Blue Shield insurance policies pay benefit directly to the service provider Insurance companies other than Blue Cross typically provide “reasonable and customary” payments First dollar coverage: basic medical insurance policies often have no-deductible provision Surgical contracts Specify a maximum amount of coverage. If one patient needs more than one procedures, the most expensive treatment determines the payment. B. Major Medical Insurance Major medical policies have a substantial deductible provision Major medical policies have a participation provision Major medical policies have a high limit of liability C. Disability Income Insurance Replaces income not earned because of illness or accident. Short-term: 30 weeks with an elimination period of 1 week. Long-term: from the date of disability to retirement with an elimination period of 6 months. It is a logical complement to life insurance. D. Medicare Supplement Insurance Is to supplement benefits provided under the Medicare program. IV. Long-Term Care Insurance V. Health Insurance Providers Life insurance companies, Blue Cross, Blue Shield, In recent years, HMOs: health maintenance organizations PPOs: preferred provider organizations