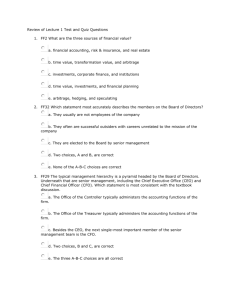

Strategic Control and

Corporate Governance

Chapter Nine

McGraw-Hill/Irwin

Copyright © 2010 by The McGraw-Hill Companies, Inc. All rights reserved.

Strategic Control

• Strategic control

the process of monitoring and correcting a

firm’s strategy and performance

Informational, behavioral

9-2

Ensuring Informational Control

• Traditional control system

1. strategies are formulated and top

management sets goals

2. strategies are implemented

3. performance is measured against the

predetermined goal set

9-3

Traditional Approach

to Strategic Control

• Most appropriate when

Environment is stable and relatively simple

Goals and objectives can be measured with

certainty

Little need for complex measures of

performance

9-4

Contemporary Approach to Strategic

Control

• Contemporary control system

Continually monitoring the environments

(internal and external)

Identifying trends and events that signal the

need to revise strategies, goals and

objectives

9-5

Contemporary Approach

to Strategic Control

• Informational

control

Concerned with

whether or not the

organization is “doing

the right things”

• Behavioral control

Concerned with

whether or not the

organization is “doing

things right” in the

implementation of its

strategy

9-6

Informational Control

• Two key issues

Scan and monitor external environment

(general and industry)

Continuously monitor the internal

environment

9-7

Effectiveness of Contemporary Control

Systems

1. Focus on constantly changing information that

has potential strategic importance.

2. The information is important enough to demand

frequent and regular attention from all levels of

the organization.

3. The data and information generated are best

interpreted and discussed in face-to-face

meetings.

4. The control system is a key catalyst for an

ongoing debate about underlying data,

assumptions, and action plans.

9-8

Behavioral Control

• Behavioral control is focused on

implementation—doing things right

• Three key control “levers”

Culture

Rewards

Boundaries

9-9

Reasons for an increased emphasis on

culture and rewards

1. The competitive

environment is

increasingly

complex and

unpredictable,

demanding both

flexibility and quick

response to its

challenges.

2. The implicit longterm contract

between the

organization and its

key employees has

been eroded.

9-10

Building a Strong and Effective

Culture

• Organizational culture

a system of shared values and beliefs that

shape a company’s people, organizational

structures, and control systems to produce

behavioral norms.

9-11

Building a Strong and Effective

Culture

• Culture sets implicit boundaries (unwritten

standards of acceptable behavior)

Dress

Ethical matters

The way an organization conducts its

business

9-12

Motivating with Rewards and

Incentives

• Rewards and incentive systems

Powerful means of influencing an

organization’s culture

Focuses efforts on high-priority tasks

Motivates individual and collective task

performance

Can be an effective motivator and control

mechanism

9-13

Motivating with Rewards and

Incentives

• Potential downside

Subcultures may arise in different business

units with multiple reward systems

May reflect differences among functional

areas, products, services and divisions

9-14

Setting Boundaries and Constraints

• Focus efforts on strategic priorities

• Providing short-term objectives and action

plans

Specific and measurable

Specific time horizon for attainment

Achievable, but challenging

9-15

Role of Corporate Governance

• Corporate governance

the relationship among various participants in

determining the direction and performance of

corporations.

primary participants are the shareholders, the

management, and the board of directors.”

9-16

Agency Theory

• Deals with the relationship between

Principals – who are owners of the firm

(stockholders), and the

Agents – who are the people paid by

principals to perform a job on their behalf

(management)

9-17

Agency Theory: Two Problems

1. The conflicting

goals of principals

and agents, along

with the difficulty of

principals to monitor

the agents, and

2. The different

attitudes and

preferences towards

risk of principals and

agents.

9-18

Governance Mechanisms

• Board of directors

a group that has a fiduciary duty to ensure

that the company is run consistently with the

long-term interests of the owners, or

shareholders, of a corporation and that acts

as an intermediary between the shareholders

and management.

9-19

Governance Mechanisms

• Shareholder activism

actions by large shareholders, both

institutions and individuals, to protect their

interests when they feel that managerial

actions diverge from shareholder value

maximization.

9-20

TIAA-CREF’s Principles on the Role of Stock

in Executive Compensation

9-21

External Governance

Control Mechanisms

•

•

•

•

•

Market for corporate control

Auditors

Banks and analysts

Regulatory bodies

Media and public activists

9-22

Sarbanes-Oxley Act

• Auditors

Barred from certain types of non-audit work

Not allowed to destroy records for five years

Lead partners auditing a firm should be

changed at least every five years

9-23

Sarbanes-Oxley Act

• CEOs and CFOs

Must fully reveal off-balance sheet finances

Vouch for the accuracy of information

revealed

• Executives

Must promptly reveal the sale of shares in

firms they manage

Are not allowed to sell shares when other

employees cannot

9-24