Strategic

Control and

Corporate

Governance

chapter 9

Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education

.

Learning Objectives

9-2

After reading this chapter, you should have a

good understanding of:

LO9.1 The value of effective strategic control

systems in strategy implementation.

LO9.2 The key difference between “traditional” and

“contemporary” control systems.

LO9.3 The imperative for “contemporary” control

systems in today’s complex and rapidly changing

competitive and general environments.

Learning Objectives

9-3

LO9.4 The benefits of having the proper balance

among the three levers of behavioral control: culture,

rewards and incentives, and boundaries.

LO9.5 The three key participants in corporate

governance: shareholders, management (led by the

CEO), and the board of directors.

LO9.6 The role of corporate governance

mechanisms in ensuring that the interests of

managers are aligned with those of shareholders

from both the United States and international

perspectives.

Strategic Control

9-4

Consider…

Once strategy is formulated, it must be

implemented, and part of implementation is

establishing a mechanism for monitoring

and correcting organizational performance.

This control mechanism must be consistent

with the strategy the firm is following.

How does a firm make sure all key

stakeholders are moving in the right

direction?

Strategic Control

9-5

Strategic

control involves monitoring

performance toward strategic goals and

taking corrective action when needed via

effective systems:

Informational

control systems

Behavioral control systems

Corporate governance

Strategic Control:

Traditional Approach

9-6

The

traditional approach to strategic

control is sequential

Strategies

are formulated, goals are set

Strategies are implemented

Performance is measured against goals

Exhibit 9.1 Traditional Approach to Strategic Control

Strategic Control:

Traditional Approach

9-7

Control

= feedback loop from

performance measurement to strategy

formulation

Involves lengthy time lags, “single-loop”

learning

Most appropriate when

Environment

is stable and relatively simple

Objectives can be measured with certainty

Little need for complex measures of

performance

Strategic Control:

Contemporary Approach

9-8

Relationships

between strategy

formulation, implementation, & control

are highly interactive, utilizing

Informational

control

Behavioral control

Exhibit 9.2 Contemporary Approach to Strategic Control

Strategic Control:

Contemporary Approach

9-9

Informational

control = concerned with

whether or not the organization is

“doing the right things”

Behavioral control = concerned with

whether or not the organization is

“doing things right” in the

implementation of its strategy

Both types of control are necessary, but

not sufficient, conditions for success

Question?

9-10

Top managers at ABC Company meet every

Friday to review daily operational reports and

year-to-date data. This is an example of

A.

B.

C.

D.

behavioral control.

informational control.

strategy formulation.

strategy implementation.

Informational Control

9-11

Informational

control deals with both the

internal & external environment

Do the organization’s goals and

strategies still “fit” within the context of

the current strategic environment?

Two key issues:

Scan

& monitor the external environment

Continuously monitor the internal

environment

Informational Control

9-12

Informational

control = ongoing process

of organizational learning

Focus on constantly changing

information - continuous monitoring,

testing, review

Updates & challenges assumptions, so

Time

lags are shortened

Changes are detected earlier

Speed & flexibility of response is enhanced

Question?

9-13

Which of the following is not one of the

characteristics of a contemporary control

system?

A.

B.

C.

D.

It is a key catalyst for an ongoing debate about

underlying data, assumptions, and action plans.

It must focus on constantly changing information

that is strategically important.

It circumvents the need for face-to-face meetings

among superiors, subordinates, and peers.

It generates information that is important enough

to demand regular and frequent attention.

Behavioral Control

9-14

Behavioral

control = focused on

implementation – “doing things right”

Influences the actions of employees via:

Culture

Rewards

Boundaries

Exhibit 9.3 Essential Elements of Behavioral Control

Behavioral Control: Culture

9-15

Organizational

culture is a system of

Shared

values (what is important)

Beliefs (how things work)

Organizational

culture shapes a firm’s

People

Organizational

structures

Control systems

Organizational

Behavioral

culture produces

norms (the way we do things

around here)

Behavioral Control: Culture

9-16

Organizational

culture sets implicit

boundaries regarding:

Dress

Ethical

matters

The way an organization conducts its

business

A

strong culture

Leads

to greater employee engagement

Provides a common purpose and identity

Reduces monitoring costs

Behavioral Control: Culture

9-17

Effective

organizational cultures must be

Cultivated

Encouraged

Fertilized

Organizational

maintained by

cultures can be

Storytelling

Rallies

or pep talks by top executives

Behavioral Control: Rewards

9-18

Reward

systems & incentive programs:

Powerful

means of influencing an

organization’s culture

Focus efforts on high-priority tasks

Motivate individual & collective task

performance

Can be an effective motivator & control

mechanism

Behavioral Control: Rewards

9-19

Potential

downside:

Individual

actions are not related to

compensation; employees are rewarded for

the wrong things

Different business units have differing

rewards systems

Behavior reinforced within subcultures may

reflect value differences in opposition to

the dominant culture

Reward systems may lead to information

hoarding, working at cross purposes

Behavioral Control: Rewards

9-20

Exhibit 9.4 Characteristics of Effective Reward and Evaluation Systems

Behavioral Control: Boundaries

9-21

Boundaries

Focusing

and constraints can be useful

individual efforts on strategic

priorities

Providing short-term objectives and action

plans to channel efforts

Specific,

measurable, including a specific time

horizon for attainment

Achievable, yet challenging enough to motivate

Individual managers held accountable for

implementation

Question?

9-22

Rules and regulations, rather than culture or

rewards, would probably be used for strategic

control at what type of company?

A.

B.

C.

D.

Software developer

Stock brokerage firm

Manufacturer of mass-produced products

High-tech research facility

Behavioral Control: Boundaries

9-23

Boundaries

and constraints can also

Improve

efficiency and effectiveness through

rule-based controls, appropriate when

Environments

are stable and predictable

Employees are largely unskilled and

interchangeable

Consistency in product and services is critical

The risk of malfeasance is extremely high

Minimize

improper and unethical conduct via

Anti-bribery

policies

Regulations and sanctions – i.e. Sarbanes-Oxley

Behavioral Control Systems

9-24

Exhibit 9.5 Organizational Control: Alternative Approaches

Behavioral Control Systems

9-25

Rewards

and incentives, plus a strong

culture, reduce the need for external

controls, IF organizations

Hire

the right people

Train people in the dominant cultural values

Have managerial role models

Have reward systems clearly aligned with

organizational goals and objectives

Example:

Building a Strong, Rewarding Culture

9-26

Zappos hires only one out of 100 applicants - a

hiring process that is weighted 50% on job skills &

50% on the potential to mesh with Zappos’ culture.

Call center reps are measured based on how much

time they spend with customers, not how many calls

they take

Rewards include Zollars (Zappos dollars) given

by peers to peers for deserving behaviors

Because Zappos has a strong culture they can…

Run primarily using recognition with few “incentive”

programs

Eschew traditional programs – use what works for them

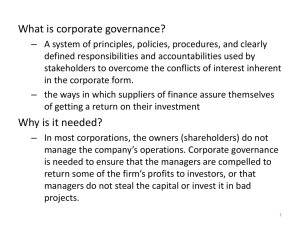

Corporate Governance

9-27

Corporate

governance controls focus on

relationships between

The

shareholders

The management (led by the Chief Executive

Officer - CEO)

The Board of Directors

How

can corporations succeed (or fail) in

aligning managerial motives with

The

interests of the shareholders

The interests of the board of directors

Corporate Governance

9-28

The

separation of owners (shareholders) &

management in a modern corporation

Shareholders

(investors) have limited liability

& can participate in the profits without taking

direct responsibility for operations

Management can run the company without

personally providing any funds

The Board of Directors are elected by

shareholders & have a fiduciary obligation to

protect shareholder interests

Corporate Governance:

Agency Theory

9-29

Agency

theory deals with the relationship

between principals & agents

What to do when the goals of the

principals and agents conflict?

What to do when it is difficult or

expensive for the principal to verify what

the agent is actually doing?

What happens when the principal and the

agent have different attitudes and

preferences toward risk?

Corporate Governance

Mechanisms

9-30

Corporate

governance mechanisms:

aligning the interests of owners and

managers through

A

committed and involved Board of Directors

Shareholder activism

Managerial rewards and incentives

Contract-based

outcomes

CEO duality – should the CEO also be chairman of

the board of directors?

Corporate Governance

Mechanisms

9-31

Duties

of the Board of Directors

Regularly

evaluate, and, if necessary, replace

the CEO; determine management

compensation; review succession planning.

Review & approve financial objectives, major

strategies, and plans of the Corporation.

Provide advice and counsel to top management.

Select & recommend candidates for the Board

of Directors; evaluate board processes.

Review the adequacy of all compliance systems.

Corporate Governance

Mechanisms

9-32

An

effective Board of Directors should

Become

active, critical participants

Ensure that strategic plans undergo rigorous

scrutiny

Evaluate managers against high performance

standards

Take control of the succession process

Practice director independence

No

interlocking directorships

Insist

that directors own significant stock in

the company

Corporate Governance

Mechanisms

9-33

Individual

shareholders have rights:

To

sell stock, vote the proxy, bring suit for

damages, get information, receive residual

rights following the company’s liquidation

Collectively,

shareholders have power:

To

direct the course of corporations, file

shareholder action suits, demand key issues

be brought up for proxy votes

Institutional

By

investors can be aggressive:

reviewing performance, requesting changes

in the firm’s governance structure, filing court

action, becoming major shareholders

Corporate Governance

Mechanisms

9-34

Boards

are responsible for managerial

rewards and incentives

Boards

can require that CEOs become

substantial owners of company stock

Salaries, bonuses, and stock options can be

structured so as to provide rewards for

superior performance and penalties for poor

performance

Dismissal for poor performance should be a

realistic threat

Corporate Governance

Mechanisms: CEO Duality?

9-35

Unity of Command:

(in favor of) Duality

Provides clear focus

Eliminates confusion

and conflict

Enhances a firm’s

responsiveness

Enables quick

decisions based on

first-hand knowledge

Agency Theory:

(in favor of) Separation

Safeguards against

corruption or

incompetence

Removes conflict of

interest, especially

regarding CEO

succession

Improves perceptions

of legitimacy

Corporate Governance

Mechanisms

9-36

External

The

governance control mechanisms

market for corporate control

The

takeover constraint

Auditors

Enron,

Banks

WorldCom?

and analysts

Lehman

Brothers, Countrywide?

Regulatory

bodies

Securities

and Exchange Commission (SEC)

The Sarbanes-Oxley Act

Media

and public activists

Bloomberg

Businessweek, Ralph Nader

Example:

Corporate Governance & Stakeholder Groups

9-37

AIG (American International Group) paid $218

million in bonuses to its financial services division

employees AFTER receiving an $85 billion bailout

from the U.S. government

The U.S. House of representatives complained

AIG leadership caved in

AIG financial services managers were

left without an income

Many AIG financial services managers were AIG

shareholders

Was corporate governance effective? Were external

governance control mechanisms inappropriate?

International Corporate

Governance

9-38

Principal

– principal conflicts (vs principal –

agent conflicts) involve

Concentrated

ownership, or family ownership

Motivation

to engage in expropriation of minority

shareholders for personal gain

Business

action

groups who can take coordinated

Japanese

Few

keiretsus, Korean chaebols

external regulatory constraints

International Corporate

Governance

9-39

Exhibit 9.9 Principal-Agent Conflicts and Principal-Principal Conflicts:

A Diagram

Source: Young, M.N., Peng, M.W., Ahlstrom, D., Bruton, G.D., & Jiang, 2008. Principal-Principal Conflicts in

Corporate Governance. Journal of Management Studies 45(1):196-220; and Peng, M.V. 2006. Global Strategy.

Cincinnati: Thomson South-Western. We are very appreciative of the helpful comments of Mike Young of Hong

Kong Baptist University and Mike Peng of the University of Texas at Dallas.