ASPE - FocusROI

advertisement

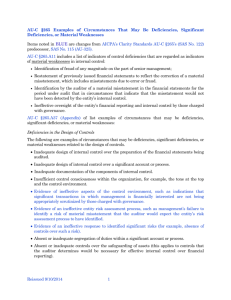

ASPE Common Presentation and Disclosure Deficiencies M A R C U S G U E N T H ER C PA , C A , M BA FO C U S R OI I N C MGUENTHER@FOCUSROI.COM Copyright FocusROI 2014 Self-evaluation questions 1. Do our audit files specifically assess the RMM for financial statement presentation and disclosure and design the appropriate response? 2. Is a fully referenced copy of the final financial statements, including the notes to the FS included in the file showing where numbers came from with the appropriate audit evidence? 3. Does the firm have a step-by-step training program for all new senior staff on how to prepare financial statements and use the firm tools? 4. Does the firm have an up-to-date notes library and F/S template for the staff to use? 5. Does the firm use a disclosure checklist when preparing and/or reviewing the F/S? 6. Do all F/S (both audit and review) go through a final QC process before being released? 7. Have previous inspection or monitoring deficiencies been addressed? 2 How wrong are the F/S? Major deficiency Significant deficiency Auditor’s report should have been qualified. Accounting policy note for estimation Typos in notes. uncertainty missing. Material related party transaction not disclosed. Note does not balance to amount on Note numbering is off by one balance sheet. number. FV of material free-standing derivative (FX contracts) not disclosed. Callable debt or debt with covenant violations presented as long-term. Reconciliation of tax expense to statutory rate note missing (taxes payable method). Government remittances not disclosed separately. Capital leases accounted for as operating leases. Related party note did not describe measurement basis and nature of relationship. Revenue presented gross rather than Measurement uncertainty note net. omitted. Minor deficiency Amortization rate for equipment is wrong in the accounting policy note. Interest on long-term debt was not disclosed separately from other interest. Cash and cash equivalents not defined. Financing item presented under Investing activities on cash flow statement. 3 Who is responsible for ensure the F/S are fairly presented in accordance with GAAP? 4 Independent Auditor’s Report - CAS 700 Introductory paragraph…. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with Canadian accounting standards for private enterprises, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Inherent Risks Sources and effects Risk Sources Business Strategy Culture. Environment Transactions & Data Management Information & Reports Financial Statements Risk Effects Deficiencies – inspection findings Independent Auditor’s Report Deficiency Comment • Wrong auditor’s report – Pre-CAS 700 • CAS 700 has specific • Auditor’s report versus “Independent auditor’s” requirements for the format report. and wording of the report. • Addressed to wrong addressee (users). • Firms should stick to the exact • Description of statements listed does not match wording. the titles used on the statements or index. • ANY modified reports should • Incorrect modifications to auditor’s report. go through a thorough analysis • (i.e. Qualified opinion over pervasive and and material matter.) • Incorrect use of “Emphasis of Matter or Other Matter” paragraphs. • Did not include place or name of firm below conclusion. 7 Deficiencies – inspection findings Deficiency Comment Related party transactions did not adequately describe the nature, extent or nature of related party transactions. • Often descriptions are too vague • Under s. 3840, an enterprise shall disclose: description of the relationship between the transacting parties, the measurement basis used, terms and conditions relating thereto. Did not disclose nature and extent of financial instruments, including credit risk, currency risk etc. • S. 3856 .53 requires an entity to disclose: the exposures to risk and how they arise, as well as any change in risk exposures from the previous period. • Notes are generic and do not address entity specific risks. • Best practice is to also discuss how the entity manages these risks. 8 Deficiencies – inspection findings Deficiency Comment Debt due on demand, including related • As per s. 1510.13, “Non-current party debt is classified as long-term classification of debt is based on facts debt. existing at the balance sheet date rather than on expectations regarding future refinancing or renegotiation”. • If the creditor has the unilateral right to demand payment within one year at the B/S date , it must be classified as current debt unless that right has been waived. Government remittances were not • Required under s. 1510.15 on face or notes separately disclosed. to f/s/ • Practitioners not aware of requirement or definition of what constitutes a “Government remittance”. 9 Deficiencies – inspection findings Deficiency Comment Income taxes accounting policy note • Should disclose accounting policy note was not included. since there are alternative policy choices. When using the taxes payable method of accounting for income taxes, no reconciliation of the income tax rate/expense related to the income or loss for the period as disclosed. • 3465.88b) requires “a reconciliation of the income tax rate or expense related to income or loss for the period…to the statutory income tax rate or the dollar amount that would result from its application, including the nature and amount of each significant reconciling item.” 10 Deficiencies – inspection findings Deficiency Comment Revenue - Inadequate disclosure of • S. 3400.31 requires entity to disclose revenue recognition policy, (i.e. did revenue recognition policy for each not describe policy for each material material transaction stream. revenue type). Revenue – accounting policy does • S. 3400.34 states the “objective of this not adequately describe how disclosure is to assist the reader in revenue is recognized. (i.e. too understanding the sources of revenue vague or generic). and their effect on the financial statements”. Major categories of revenue not • S.3400.33 requires major categories of disclosed. revenue to be disclosed on the face of the income statement or in the notes to the F/S. 11 Deficiencies – inspection findings Deficiency Comment Inadequate disclosure of share • S. 3240 requires entity to classify capital, including the classification of preferred shares as equity or debt preferred shares NOT issued in a tax based on the characteristics. planning arrangement. • Guidance for shares issued in tax planning arrangement is under s.3856.23. When adopting ASPE or ASNFPOs, • S.1500 or s.1501 are mandatory. F/S did not present and opening • Entity shall “prepare and present” an balance sheet and follow guidance opening balance sheet at the date for in s. 1500 or 1501. transition. 12 FocusROI Services In house and web based Training Quality Control Monitoring Small group Coaching www.focusroi.com 416 594 0005 info@focusroi.com Please contact us for further information info@focusROI.com 416 594 0005