Governance of the Treasury Function

advertisement

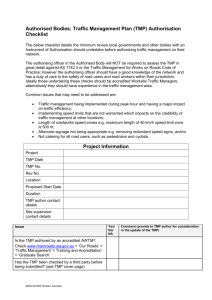

Governance of the Treasury Function CIPFA Scottish Treasury Management Forum Alan George, Regional Director 23rd February 2012 Governance and Accountability Definition of Corporate Governance Key Principles of Corporate Governance: Openness “The system by which organisations are directed and controlled” Cadbury Report 1992 Integrity Accountability 2 Corporate Governance To comply with key principles, Authorities need to consider Organisational structures and processes Financial reporting and internal controls Standards of behaviour Code of Conduct 3 Delivering good governance in Local Government (CIPFA / SOLACE) Consider the effectiveness of the Authority’s risk management arrangements and the control environment Seek assurance that action is being taken on risk-related issues identified by auditors and inspectors Be satisfied that the authority’s assurance statements properly reflect the risk environment and any actions required to improve it 4 Delivering good governance in Local Government (CIPFA / SOLACE) Approve (but not direct) the Internal Audit Strategy and monitor performance Review summary Internal Audit reports, and seek assurance that appropriate action has been taken Receive the annual report of the Head of Internal Audit Consider the reports of external audit and inspections 5 Definition of Treasury Management The Management of the organisation’s... Investments Cash flows Banking Money market and capital market transactions Effective control of the RISKS associated with those activities Pursuit of optimum performance consistent with those RISKS 6 Treasury Management Legislation CIPFA’s Codes of Practice Key Drivers Risk Appetite Capital Expenditure Plans Strategic Documents 7 Strategic Considerations Capital Programme Balance Sheet Position Deliverability of Schemes Budget Pressures Slippage etc Security of Capital Budget Profiling – Capital and Revenue Capital Receipts Cash Flow Management 8 Treasury Risk Management Credit and Counterparty risk Liquidity risk Interest Rate risk Exchange Rate risk Refinancing risk Legal & Regulatory risk Fraud, error, corruption and contingency management Market value of investments 9 TM Risk Management “the ongoing activity of adjusting the authority’s treasury exposure due to changing market and domestic circumstances in order to manage risk and achieve better value in relation to the authority’s objectives” o o Doing nothing does not avoid or minimise risk Risk can be failure to take advantage of opportunities 10 Balance Sheet o o o o o o Year end Level of Reserves and Balances Cash Position Capital Financing Requirement (CFR) External Borrowing Internal Borrowing 11 Council Balance Sheet • Reserves & Balances • • • • GF Balances HRA Balances Earmarked Reserves Capital Grants etc Provisions Working capital surplus Total reserves & balances Investments Internal Investments = £145m = £15m = £10m = £65m = £40m = £15m = £ 15m = £160m = £ 95m = £ 65m 12 Key Balance Sheet issues • Capital Financing Requirement = £370m • External Borrowing = £305m • Under borrowed = £ 65m • Internal Investments = £ 65m • Capex over next 3 years = £215m • CFR Forecasts = £392m (11/12) = £398m (12/13) = £390m (13/14) 13 Risk Management 1. Risk management is the identification and assessing of the risks to which an organisation may be exposed 2. Assigning ownership of risks to specific individuals to manage 3. The mitigation of those risks by implementing suitable control and management measures 4. The acceptance of the residual risks as being risks worth running 5. Periodic monitoring and reviewing of risks and risk management 14 TM Code of Practice – summary o o o o o o o o o Responsibility for Risk Management lies with the organisation Enhanced member involvement and understanding Better Scrutiny Training Reporting requirements – Quarterly / Half Yearly Reliance on Credit Ratings Diversification Monitoring of Indicators Borrowing in advance – clear business case in place 15 Why is a Code needed? • • • • • • To reflect Audit Commission’s report and findings CLG and Treasury Select Committee review Credit Crunch and Impact on banking system Risk appetite Increase in risk exposure To maintain high and consistent standards in looking after public funds for all Local Authorities, Police Authorities etc 16 The Code’s four clauses: • Formal adoption of the “Four Clauses” o o o o • Clause 1 - Policies and Practices Clause 2 - Reporting Requirements Clause 3 - Delegation Clause 4 - Scrutiny Make the “Four Clauses” part of standing orders and financial regulations 17 Clause 3: Delegation of responsibility for treasury management to: • Cabinet / Committee / Council for implementing and monitoring the TMPS & TMPs • The responsible officer (S95) – for the execution & administration of TM decisions in accordance with the TMPS and TMPs 18 Clause 4: Scrutiny The following body or group of individuals is nominated to be responsible for ensuring effective scrutiny of the TM strategy and polices: Scrutiny Panel Governance Committee Audit & Governance Committee 19 Treasury Management Strategy Statement Debt and investment portfolios:– o o o o o o Interest rate forecast Prudential and Treasury Management Indicators Explanation of gross v. net debt Policy on borrowing in advance of need Policy on use of external service providers Any extraordinary issues 20 The Financial Control Environment Sound systems and procedures Chief Finance Officer – s.95 - ensuring adequate accounting records and expenditure is within affordable limits Financial Regulations, Financial Plans and Strategies Medium Term Financial Plan (MTFP) and Annual Budgets Sound decision making framework Audit Committee Internal and External Audit 21 CIPFA guidance for Local Authorities: o o o o The Audit Committee (Corporate Governance Committee) is a critical component in the overall corporate governance process It should be independent from the executive and scrutiny functions It should provide assurance to elected members and members of the public that systems on internal control are effective It should provide assurance about the organisation’s arrangements for managing risks 22 Treasury Management Practices • TMP 1 TMP 2 TMP 3 TMP 4 TMP 5 • TMP 6 • TMP 7 TMP 8 TMP 9 TMP 10 TMP 11 TMP 12 • • • • • • • • • Treasury risk management Performance measurement Decision - making and analysis Approved instruments, methods and techniques Organisation, clarity and segregation of responsibilities & dealing arrangements Reporting requirements and management information arrangements Budgeting, accounting and audit arrangements Cash and cash flow management Money laundering Training and qualifications Use of external service providers Corporate governance 23