The Shareholders

advertisement

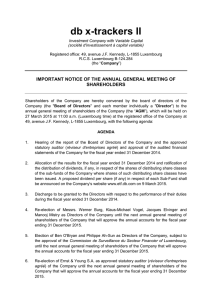

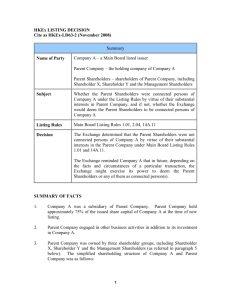

Ownership, Control and Compensation 1 Who is a shareholder Owner Beneficiary Risk bearer Decision maker (internal control). 2 Types of Shares Ordinary shares Preference Shares Other types 3 Features of Ordinary Shares Permanency No nominal cost to the company Residual claim on profits Residual claim on assets Voting rights Cumulative voting rights Right of purchasing new shares 4 Classification of Equity shareholders Internal (invest to own and run) Corporate shareholders (holding companies) Families, groups of friends External (invest only for a return) Individuals Institutional investors. 5 Internal Shareholders Controlling shareholders Majority not a necessity Scene in the West Situation in Pakistan 6 External Shareholders Generally not on the board. Lack of unity Lack of interest Therefore, lack of influence 7 Small Private Shareholders Individuals Only interest in share price change No long term interest Only a little interest in earnings Reactive buyers/sellers Big losers when things go bad No influence over Boards 8 Large Private Shareholders Individuals (but may be acting through trusts, private limited companies, etc.) Have long term interest in the company May have great influence on the company May provide bulk of executive directors In Pakistan, these people are the focus of corporate governance endeavors. 9 Corporate Shareholders Holding companies Multinationals Groups 10 Institutional Investors Mutual Funds Managed Funds Pension Funds Life Insurance companies Banks In UK, it is believed that institutional shareholders hold, on an overall basis, a majority of shares of all listed companies. 11 Institutional Investors Perspective Long term interest in share value growth. Current returns are still important. Ability to evaluate performance. Power and ability to influence Boards. But do they have the time to pay attention to every single company. Monitoring systems for danger signals. 12 Role of II’s Capability and Capacity to influence. Dialogue with directors Regular evaluation of financial reports Flag off danger signals Sharing info with other stakeholders Judicious use of Vote Could / should seek representation on board 13 Some interesting facts 10% of EDs in European companies do not know who their top 50 shareholders are. 25% of their CEOs had met only half of their top 50 shareholders In Pakistan, most listed companies have majority held by a family or group and they do not seem to attach any importance to any other shareholder. 14 Shareholders’ Expectations from a Company Accountability of board members Transparency in all transactions Company interest over self interest Effective and efficient management leading to good returns and capital growth. Fair share of real profits. 15 Shareholders’ Hold on Board Shareholders must approve: Class 1 transactions Related party transactions Financial statements Large size relative to size of the company Audit report is for shareholders Directors remuneration Shareholders elect and can remove directors. 16 Tools of Control Defined Procedures CONTROLS Only one way of doing an action Segregation of duties (internal check) Physical (cash in safe, maintenance) Managerial (e.g. budgets, limits, approvals, etc.) Supervision Accounting and auditing checks Selection of right personnel 17 Communication between Shareholders & Board Direction: One way reporting or Two way communication Nature: Formal or Informal communication Scope: All or some shareholders Frequency: Regular or irregular, need based. 18 Communication Instruments Statutory reports Chairman’s report (OFR) Compliance reports Newsletters, circulars Meetings with major shareholders Correspondence 19 Shareholders Activism Refers to stand taken by shareholders against recommendations of the Board. Do they have adequate rights or power? Result less important than show of dissent. Can work only if institutional investors participate. Do institutional investors have a duty to communicate with other shareholders? 20 Shareholders’ Activism - 2 If institutional investors join hands with smaller shareholders: Monitoring of board performance Direct intervention Regular evaluation and sharing of analysis But remember, institutional investor organizations are all run by managers so they have affinity for managers. 21 Areas of Dissent Re-election of directors Re-appointment of auditors Approval of directors’ remuneration Approval of annual accounts Dividend recommendations Changes in share capital Other approvals 22