Ethics Class - Society of Financial Service Professionals

advertisement

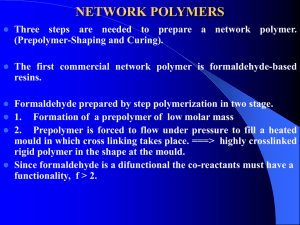

GUIDELINES FOR PROFESSIONAL ETHICAL CONDUCT Society of Financial Services Professionals – Central Illinois Chapter Society of Financial Services Professionals A multidisciplinary network of credentialed financial professionals. Committed to providing education opportunities National website – www.financialpro.org Chapter website – www.fsp-centralil.org Purpose Understand the CFP Board Code of Ethics & Professional Responsibility. Understand relationship between CFP Board Code and FSP Code. Foster awareness of ethical issues in the profession. Resolve “gray” areas using ethical decision making skills. Agenda Ethics and Professional Responsibility CFP Board Code of Ethics & Professional Responsibility Comparison of CFP Board Code and FSP Code Ethical Decision Making Tool Case Application Common Sense Ethics Doing the Right Thing: Rules, Principles and Respect Character: Values and Identity Sound Judgment: Using your Head Professional Ethics CHARACTER SOUND JUDGMENT INDIVIDUAL PERSONAL VALUES and IDENTITY DECISION MAKING SKILLS PROFESSIONAL SOCIETY VALUES TRADITIONS LEADERSHIP STANDARDS PRACTICES RESOURCES Copyright 1993 Resources for Ethics and Management CFP Board Code of Ethics & Professional Responsibility Applicability of the Code Scope of the Code Compliance & Terminology Principles Rules of Conduct and Practice Standards Quiz Preamble & Applicability Source = CFP Board of Standards Principles & Rules guide behavior Applies to all CFP Board certificants and registrants Accepting right to use CFP marks = Agreeing to be bound by Code Composition & Scope Two components: Principles & Rules Building blocks of Code Neither define behavior for purposes of civil liability Principles General statements of ethical ideals Aspirational Apply to all CFP Board certificants Rules Practical and specific to given situations Not all Rules apply to all CFP Board certificants Principles Aspirational standards of exemplary professional conduct CFP Board certificants strive toward that level of professional conduct 1. Integrity 5. Confidentiality 2. Objectivity 6. Professionalism 3. Competence 7. Diligence 4. Fairness Principles 1, 2 and 3 1. INTEGRITY: A CFP Board certificant shall offer and provide professional services with integrity. 2. OBJECTIVITY: A CFP Board certificant shall be objective in providing professional services to clients. 3. COMPETENCE: A CFP Board certificant shall provide services to clients competently & maintain the necessary knowledge and skill to do so in those areas in which he/she is engaged. Principles 4 and 5 4. FAIRNESS: A CFP Board certificant shall perform professional services in a manner that is fair and reasonable to clients, principals, partners and employers, and shall disclose conflicts of interest in providing such services. 5. Confidentiality: A CFP Board certificant shall not disclose confidential client information without the specific consent of the client unless In response to legal process To defend against charges of wrongdoing In connection with a civil dispute Principles 6 and 7 6. PROFESSIONALISM: A CFP Board certificant’s conduct in all matters shall reflect credit upon the profession. 7. DILIGENCE: A CFP Board certificant shall act diligently in providing professional services. Test Your Knowledge Bud Boaster, CFP, has a habit of bragging about the net worth of his high-end clients. Polly Procrastinator, CFP, is known for her extraordinary expertise in asset allocation, but she also has a reputation for not returning calls and missing deadlines. Charlie Chatter, CFP, heard an unsubstantiated rumor about the financial stability of a local brokerdeal firm. Without further investigation, he shared this information with 2 colleagues, 3 clients, and his barber. Compliance All CFP Board certificants must comply Drivers for compliance: Understanding/knowledge of Code Influences of fellow professionals & public opinion Disciplinary proceedings FSP Code of Professional Responsibility Background Preamble Canons Rules and Applications Disciplinary Procedures Background A professional Possesses knowledge or expertise Serves others Works to enhance reputation Self-regulates FSP Code introduced in 1961, revised in 1988 and again in 2000. Changes in financial services Multiple credentials Services beyond insurance New ethical challenges Preamble Introduces the Code All FSP members are automatically bound by its provisions Lofty aspirations (Canons) and enforceable minimum standards of ethical conduct (Rules) Diversity of membership Advisory opinions Canons Aspirational standards of exemplary professional conduct Members strive toward that level of professional conduct Significant similarity to CFP Board Code 1. Fairness 5. Diligence 2. Competence 6. Professionalism 3. Confidentiality 7. Self-Regulation 4. Integrity Canons 1, 2 and 3 1. FAIRNESS: A member shall apply the “Golden Rule” to all he or she serves and especially avoid harm to others. 2. COMPETENCE: A member will earn a high-level of knowledge and will continually improve one’s competence. 3. CONFIDENTIALITY: A member will treat information obtained with the highest level of confidentiality. Canons 4, 5 and 6 4. INTEGRITY: A member shall always place the client’s interest above his/her own. 5. DILIGENCE: A member must apply his or her skills in a prompt and thorough manner. 6. PROFESSIONALISM: A member has the responsibility to cooperate with other professionals and to enhance the profession’s public image. Canon 7 7. SELF-REGULATON: A member will uphold and facilitate enforcement of the Code of Professional Responsibility. Code Comparison Certified Financial Planner Board of Standards Society of Financial Service Professionals 1. Integrity 1. Fairness 2. Objectivity 2. Competence 3. Competence 3. Confidentiality 4. Fairness 4. Integrity 5. Confidentiality 5. Diligence 6. Professionalism 6. Professionalism 7. Diligence 7. Self Regulation Six Questions Guidelines 1 2 3 4 5 6 Why is this bothering me? Who else matters? Clients? Carriers? Professional Colleagues? Employees? Regulators? What is my responsibility? What are the ethical concerns? What Principles/Canons & Rules of the Codes apply? Who can I ask for advice? Am I being true to myself? To the values of CFP Board/FSP? Adapted with permission from Michael Rion, The Responsible Manager, Copyright 1996. BREAK (10 minutes) Case Discussion Instructions Read the case. Select a discussion leader and a recorder who will give a brief report to the whole group. Discuss and answer the questions at the end of the case. Agree on key points to present to the whole group. Financial Planning with Linda Things to Discuss Updating our wills Rebalancing our taxable investment portfolio Trusts – do we need something for the kids? Long term care insurance – now or later? Summary for Case #1 All Things to All People? Refrain from giving advice in areas beyond the member’s expertise Abide by all local, state and national laws and regulations affecting professional activities Summary for Case #2 What Would You Like to Know? Treat the client as you would like to be treated including disclosure of important aspects of the professional relationship. Establish confidentiality at the outset. Maintain an open, honest relationship. Summary for Case #3 A Little Knowledge Act only in accordance with authority given by client. Abide by applicable laws, rules and regulations. Summary for Case #4 Is the Customer Always Right? Treating others as you would want to be treated and avoiding conflict of interest argue for raising the 401(k) option. Identifying the 401(k) option suggests competent, objective financial planning. Honesty builds positive business relationships. BREAK (10 minutes) Summary for Case #5 What Really Counts? Treat others as we want to be treated, avoid conflicts of interest and disclose relevant information. Stay current with the latest business models. Raise any concerns about transactional approaches in appropriate professional circles. Summary for Case #6 Breaking Up is Hard to Do Treat all clients as you would like to be treated. Honor your promises and explain limitations and challenges honestly. Anticipate the problem and seek creative solutions with advice from others. Summary for Case #7 Mind Your Own Business? Offer your best advice to the client, even if it is uncomfortable. Honor confidentiality of the client relationship in talking to other family members. Make strong efforts to ensure client realizes implications of decision. Summary for Case #8 The Road Not Taken Ensure that recommendations do not cause harm; if you did cause harm, help to correct it. Make sure recommendations are appropriate and keep up to date with client needs. Cooperate fully in any ethics complaint investigations Summary Read and understand the Codes. Use the Codes for guidance. Use the Six Questions Guidelines too. Ask for help! Share questions, ideas, information, application examples.