Macroeconomic turmoil: causes and consequences for

advertisement

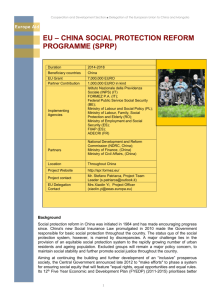

Macroeconomic turmoil: causes and consequences for pension reform • Macroeconomic turmoil • Financial Sector reform risks • consequences for coreporate risk management Average Implied Volatility STOXX50 24 months to maturity options Growth is slowing down again Where did things go wrong? • US: paralysis but are things perking up? • Europe: if only there would have been paralysis… – PIIGS – is institutional reform the panacea? – so what is? • the future of the Euro US Housing Prices Yet recovery in sight? US unemployment outlook gloomy US unemployment: Obama’s policies based on misdiagnosis • US employment policy relies on Keynesian fiscal and monetary pump-priming • But unemployment structural? – because of prolonged housing boom too many workers in construction sector – and how do you transform a bricklayer into a bookkeeper? • What is needed – focused labor market policies – infrastructure projects (necessary in US, sucks up excess labor) • But politicians paralysed because of elections 11/12 Unrest is spreading in Europe Flight to Safety again… But situation in France, Germany, UK… (Lagarde’s chains of contagion) December 2010: European Bank Exposure (bE) to the debt of: Greece Ireland Portugal Spain Italy Germany 36.8 138.6 37.2 181.6 153.7 France 53.5 50.1 41.9 162.4 418.9 UK 12 148.5 22.4 110.8 66.8 Netherlands 4.7 21.2 5.1 72.7 43.2 Spain 78.3 Interbank counterparty worries are back Capital ratios and market Reality… Future of the Eurozone • break up barely averted (Greek referendum plans…) • How do we get out of the current crisis? – Greece – containment to Greece • And how do we prevent this from happening again? Consequences of uniform monetary policy Future of the Eurozone • Central budget control necessary to credibly commit to sustainable debt prospects • But the Euro needs more for cohesion: Taylor graph • Do we need within-eurozone fiscal offsets when uniform monetary policy is inappropriate? – substitute for fiscal redistribution, labor mobility? • And transfer of power to the Brussels just when Brussels is failing conspicuously??? Macro-volatility and the financial sector • Pensionreform • financial sector reform: threat or panacea? • what does it mean for corporate risk management? Pensions and Risk • Risksharing and pension systems – risk sharing can reduce and reallocate risk • if shocks are systemic (hit everybody) and permanent, risk reduction impossible through risk sharing – demographic risk cannot be reduced thr risk sharing – inflation risk systemic, but not permanent? – idem financial market risks? • Can risk be reallocated to groups better placed to handle it? – young can handle risk better than old – but do not just shift downside risk!! • Risk sharing should be fairly priced for sustainability – no group should be predictably better off outside the system interest rate misery Rentetermijnstructuur (zero coupon rentes) Procenten 6.0 5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0 5 10 15 20 25 30 35 40 45 looptijd in jaren per 31-08-2010 per 28-02-2011 per 31-08-2011 50 55 60 Long term challenge: demographic change is a world wide issue: IMF WEO 2005 Key issue in pension system Redesign • Intergenerational fairness: no group should predictably be better off outside the system • STAR agreement fails on this criterion: using expected return on assets to value pension fund obligations • leads to excessive & premature indexation • uncontrollable risktaking incentives (US experience!!) • solution: stick to market prices (swapcurve) to value future obligations • otherwise transition (“invaren” oude contracten) clashes with ECHR (“EVRM”) • because young better off outside the new system Financial sector reforms • Prime victim credit crisis: confidence in self regulation – banking sector is conspicuously failing to reform itself • Much stronger regulation financial sector unavoidable • But lack of understanding of financial markets and misreading of the causes of the credit crisis is plaguing current reform plans • Potentially harmful consequences for SMEs (“MKB”) • Trade off stability and financial innovation? Financial Sector Reform…. •Why did banks take on all that risk? Capital ratios and market Reality… Political Hobbyhorses damaging • flirtation with narrow banking – misreads causes crisis: involvement investment banks in capital markets was the problem, not risky investment of deposits – would cause a major funding gap in the netherlands – would not solve the real problem (capital market risk spilling over into highly leveraged banking system) • irrational fear/ignorance of derivatives – may greatly raise costs of and complicate risk management • move of credit derivatives to clearing systems – introduces new TBTF player – multiple clearing houses may increase uncertainty about counterparty risk – slow down financial innovation; trade off with stability? Ideological obsessions will backfire • attempts to circumvent CDS market harm liquidity – July 21 Brussels agreement case in point – CDS contracts play a key role in liquidity provision – politicians ignore that at their peril: Italy, Spain problems week after July 21 • Financial transaction tax will – reduce liquidity – increase volatility – raise costs of financial intermediation • Bonus discussions misfocused • no progress made on filling in concept of macro-prudential supervision • no serious discussion of conceptual framework for dealing with distressed banks – discussions seem mostly inspired by desire for revenge – fail to recognise implications of systemic importance large banks So what does all this mean for corporate financial policy? • accept increased volatility as a fact of life • do not take liquidity for granted: financial/liquidity planning becomes a core business interest • risk management likely to become more expensive • put higher value on flexibility within the corporation • introduce methods to value flexibility in decision making – NPV approach tp project analysis outdated: underprices flexibility – real options approach offer a complement to NPV approach • CFO/Treasury not just a support service anymore, move center-stage…