Tackling the DOL’s New Rules

in 2012

What You Need to Know to Stay Ahead

December 1, 2011

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

Panelists

Alison Cooke Mintzer (moderator)

Editor-in-Chief

PLANADVISER

Joseph Lee

Director, Head of DC Advisor-Sold Distribution

BlackRock

Marcia Wagner

Principal

The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

2

The changing DC landscape

• DC market is growing

– Currently $4.0T, expected to grow to $5.5T by 2015

– Advisor opportunity expected to grow to $2.4T by 2015*

• Role of DC plan has changed

– Supplementary retirement savings program perhaps THE retirement savings program

• Regulation/legislation is driving decisions

– Fee transparency

– Role of fiduciary

– QDIA

• Plan Sponsors will rely on experts to deliver better participant outcomes

– Looking to understand and execute their fiduciary responsibility to mitigate their risk

– Require expertise on all aspects of plan design – not just investments

– Must be able to demonstrate value for the fee

* Source: Combination of BLK & 3rd party data sources

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

3

Transforming the Retirement System

• Regulatory landscape is changing

• DOL is rolling out new rules for 2012

– Fee disclosures for plan sponsors

– Participant-level fee disclosures

– Broader “fiduciary” definition

• Proposed rulemaking

• DOL interaction with White House

– Working with White House’s middle class task force

– Coordinated actions to improve retirement security

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

4

401(k) fiduciary toolkit

• Plan sponsors need to understand their current and new fiduciary responsibilities

• Advisors can help plan clients navigate the changing regulatory landscape

• Topics covered by fiduciary toolkit

– Plan fees

– Fiduciary status

– Fiduciary liability

– Rollover assets

– Investment duties

– Investment menu

– Due diligence

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

5

I.

Fee disclosures to participants

II.

408(b)(2) disclosures

III. Broader “Fiduciary” definition

IV. Investment education vs. advice

V.

Strategy and fiduciary pointers

VI. Partnering with BlackRock

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

6

DOL finalizes participant fee disclosure regulations

• DOL issues final regulations on October 14, 2010

– DOL press release explained that existing law did not require plans to provide necessary information

– New rule requires comparison of plan’s investments

• Types of plans covered

– New regulations apply to DC plans with participant-directed investments

– Covers plan even if not designed to comply with ERISA Section 404(c)

• Coverage of participants

– New regulations apply to all eligible employees

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

7

Annual and quarterly disclosure of plan-related information

• Must disclose general info about plan

– Must include explanation of general admin. service fees and individual expenses on annual basis

– Must disclose dollar amount of fees / expenses charged to participant accounts on quarterly basis

• Disclosure only required for fees / expenses not embedded in expenses of investments

– If service provider only receives indirect compensation from investments, provider’s fees are not subject to this

disclosure requirement

– But must disclose that a portion of general admin. service fees is paid from expenses of investments

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

8

Annual disclosure of investment-related information

• Must disclose fee and performance-related info for plan’s investment alternatives

– This disclosure must be in comparative format

– Must be provided on annual basis

• Required information for disclosure in comparative format includes

– Name and type of investment option

– Investment performance data

– Benchmark performance data

– Total annual operating expenses for each investment and any extra shareholder-type fees

– Internet website address

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

9

Other requirements

• Info that must be available upon request

– Prospectuses, shareholder reports and financial statements provided to plan

• Form of disclosure

– Must be understood by average participant

• Impact on sponsor’s other fiduciary duties

– No relief for duty to prudently select / monitor plan’s providers and investments

– New regulations modify ERISA 404(c) disclosures

• Effective date

– Plan years beginning on or after November 1, 2011

– Initial disclosures due May 31, 2012 for calendar year plans

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

10

Fee disclosures to participants practical implications

• Automatic delivery of fund prospectuses will no longer be required under ERISA 404(c)

• Participant education

– New rules become effective May 31, 2012 for calendar year plans

– Participants should be educated before then

– Participants are likely to scrutinize plan’s investments and fees

• Advisers can help sponsors prepare

– Complete the investment portion of comparative table (e.g. investment and benchmark performance data)

– Discuss with plan’s recordkeeper the impact of the new rules on existing fee disclosures

– Meet with participants and review investment and fee information through educational sessions

– If plan sponsor has fee-related concerns, remind plan sponsor that its fiduciary review process can be

enhanced

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

11

I.

Fee disclosures to participants

II.

408(b)(2) disclosures

III. Broader “Fiduciary” definition

IV. Investment education vs. advice

V.

Strategy and fiduciary pointers

VI. Partnering with BlackRock

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

12

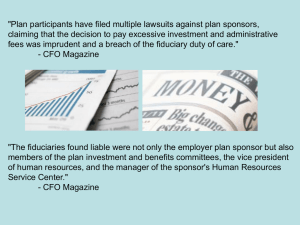

When are service providers conflicted?

• Plan sponsor is looking for provider of administrative services

• Provider offers 2 options

– Services ordered a la carte: $10,000.00

– Pre-packaged services and menu: $4,000.00

• Plan sponsor may incorrectly conclude pre-packaged option is best for participants

– Doesn’t realize that provider receives “hidden” compensation from funds and fund managers

– Full compensation may be more than $10,000

– Hidden cost is actually shifted to participants

• Provider has incentive to steer uninformed clients to more profitable option

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

13

Retirement security initiative

• Improving transparency of 401(k) fees

– Administration’s goal is to make sure workers and plan sponsors are getting services at a fair price

– Pushing to “finalize” interim final regulations this year

• Rationale for interim 408(b)(2) regulations

– DOL efforts to educate plan sponsors about 401(k) plan fees started with November 1997 hearing

– Plan sponsors still not asking the right questions

– DOL will now require providers to furnish the fee info sponsors should be requesting

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

14

Covered providers and disclosures

• Covered service providers

– Fiduciaries (including ERISA fiduciary or RIA)

– Providers of recordkeeping and brokerage services

– Providers of accounting, actuarial, legal and other professional services if they receive indirect fees

• Required to disclose compensation in writing

– Must be provided before entering into contract

– Formal contract not required

– Indirect compensation requires more detailed disclosure

– Service-by-service disclosure of fees is generally not required

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

15

Disclosure of compensation

• Format and manner of disclosure

– Dollar amount, formula, percentage of plan assets, per capita charge, or any other reasonable method

– Whether fees will be billed or deducted and any other manner of receipt must be disclosed

• Compensation shared among related parties

– Generally, compensation paid to affiliates or subcontractors does not have to be disclosed

– But must disclose if payment flows to related party on transactional basis (e.g., commissions, 12b-1 fees)

• Special rules for platform providers

– Must provide fee info for each investment alternative

– Requirement can be met by passing through fund prospectuses

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

16

Timing for 408(b)(2) disclosures

• Required deadlines

– Disclosure must be made reasonably in advance of starting or renewing services

– Changes to info must be made no later than 60 days after provider becomes aware of change

– Erroneous info will not result in violation if provider has acted in good faith and with diligence

– Errors and omissions must be disclosed within 30 days after coming to light

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

17

Prohibited transactions and interim 408(b)(2) regulations

• If provider fails to make disclosure, plan’s payment of fees is a prohibited transaction

– Disclosure failures can be cured

– Plan must make written request for information, and provider must respond within 90 days

– Refusal or inability to comply with request requires plan fiduciary to notify DOL

• No fiduciary conflicts permitted

– 408(b)(2) disclosure does not cure self-dealing violations

• Outlook

– Effective date delayed from July 16, 2011 to April 1, 2012

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

18

408(b)(2) disclosures practical implications

• Providers must furnish detailed fee disclosures by April 1, 2012

• Vendors, including platform providers, are responding in different ways

– Some are bundling all services (e.g. RIA and B-D)

– Some are merely disclosing their own fees, without reference to other providers

– Some providers are subcontracting this disclosure responsibility

– The FA should determine who is responsible for disclosure and who is making which disclosures

• Financial advisors can add value by “quarterbacking” to make sure all providers know and make

disclosures, and keep their plan sponsors informed as to what they will be receiving and from whom

• Plan sponsors have duty to ensure plan’s fees are reasonable under ERISA

• Plans sponsors are likely to need assistance in light of complexity of plan arrangements

• Advisors can assist with

– Prudent evaluation of fees

– Negotiating lower fees and / or expanded services, and

– Search for alternative arrangements, if necessary

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

19

I.

Fee disclosures to participants

II.

408(b)(2) disclosures

III. Broader “Fiduciary” definition

IV. Investment education vs. advice

V.

Strategy and fiduciary pointers

VI. Partnering with BlackRock

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

20

DOL’s campaign to expose conflicts

• DOL strategy

– Roll out new fee disclosure rules

– Impose fiduciary status on more providers

– Force non-fiduciary advisors to make disclaimers

• DOL releases proposed regulations on October 21, 2010

– Broadens “investment advice fiduciary” definition

– Withdrawn on September 19, 2011

– To be re-proposed with more input from public

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

21

Overview of existing definition

• If you provide investment advice, you are automatically deemed a fiduciary

• DOL’s current definition for investment advice is based on 5-factor test

– Advice on value or advisability of investments

– that is provided on a regular basis

– pursuant to a mutual agreement or understanding

– that such services will serve as a primary basis for investment decisions, and

– that individualized advice will be based on the particular needs of the plan

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

22

Overview of DOL’s initial proposal

• Existing definition

– Advice may be investment advice if it is primary basis for plan decisions and given on regular basis

• DOL’s initial proposal

– Include any advice that may be considered by plan

– May include casual advice or one-time advice

– Non-fiduciary advisors must make disclaimer

1.advisor is acting as seller of securities

2.advisor’s interests are adverse to client

3.advice is not impartial

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

23

Broader “Fiduciary” definition potential implications

• Non-fiduciary advisors

– Would need to change service model

– Must disclose they are not providing impartial advice

– Or they could accept fiduciary status under ERISA

• Re-proposed rule in 2012

– New definition to include individualized advice only

– Will be similar in approach to DOL’s initial proposal

– DOL is coordinating with SEC

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

24

I.

Fee disclosures to participants

II.

408(b)(2) disclosures

III. Broader “Fiduciary” definition

IV. Investment education vs. advice

V.

Strategy and fiduciary pointers

VI. Partnering with BlackRock

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

25

Investment education vs. advice

• How should investment assistance be provided to plan participants?

– Education to help them make informed decisions?

– Advices that tells participants exactly how to invest

• A new way to think about participant education

– Education only

– Education and advice

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

26

Education only or education and advice

• Advice program should be in addition to education program

• 3 basic choices for plan sponsors

– Education only (with no advice)

– Education and non-discretionary advice

– Education and discretionary advice

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

27

Investment education

• Plan menu disclosures required by

– Old 404(c) regulations

– New participant-level disclosure rules

• Investment concepts education

– Must be understood by “average” plan participant

• Similar to SPD readability standard

– Pegged to typical participant’s financial literacy

• Allocation decision support

– Can replace poor decision making by participants

– Can be incorporated into broader programs

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

28

Non-fiduciary nature of investment education

• Provider of “investment education” is not a plan fiduciary

• DOL interpretive bulletin 96-1 has 4 safe harbors for non-fiduciary education

– Plan information (e.g. plan terms, menu information)

– Investment information (e.g. financial concepts, risk tolerance)

– Asset allocation models

– Interactive materials (e.g. worksheets)

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

29

Potential liability for providing investment advice

• ERISA does not require plan sponsors to offer advice

– But if any advice is offered, fiduciary standards apply

– Co-fiduciary liability if plan sponsor imprudently reflects advice provider

• DOL’s existing proposal would broaden “investment advice” definition

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

30

Investment education vs. advice practical implications

• Every plan needs investment education

• Advisors are well positioned to provide or facilitate investment education with no fiduciary risk

• Investment advice is an opportunity for advisors willing and able to assume fiduciary responsibility

– Level fee generally required

– Variable fees possible under participant investment advice regulations with

• Computer model, or

• Level fees for RIA / B-D and advisors; variable fee for affiliates

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

31

I.

Fee disclosures to participants

II.

408(b)(2) disclosures

III. Broader “Fiduciary” definition

IV. Investment education vs. advice

V.

Strategy and fiduciary pointers

VI. Partnering with BlackRock

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

32

Additional fiduciary pointers

• Investment duties under ERISA are procedural, so be sure to follow a deliberate process

• Develop separate fee policy statement for fiduciary review of investment and administrative fees

– Benchmark fees annually

– Put plan out to bid every three years

• Be proactive in reviewing plan’s menu (including investment fees) quarterly

• Encourage plan sponsors and fiduciaries to investigate their liability protection (bonding, indemnity)

• Determine whether and for what purposes the advisor will be a fiduciary (e.g. nondiscretionary 3(21) vs.

discretionary 3(38))

• Use 401(k) fiduciary toolkit

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

33

I.

Fee disclosures to participants

II.

408(b)(2) disclosures

III. Broader “Fiduciary” definition

IV. Investment education vs. advice

V.

Strategy and fiduciary pointers

VI. Partnering with BlackRock

Content provided by The Wagner Law Group

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

34

BlackRock: providing you with the toolkit to stay ahead

To help you stay ahead, we partnered with Marcia Wagner to develop the BlackRock 401(k) Fiduciary

Toolkit, providing you with insights, best practices and strategy tips on key fiduciary topics:

- Plan fees

- Rollover assets

- Fiduciary status

- Investment menu

- Fiduciary liability

- Due diligence

- Investment duties

Fiduciary Checklist

401(k) Fiduciary Toolkit

Online Resource Center

www.blackrock.com/fiduciarytoolkit

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

35

More resources to help you start conversations and support your position

Thought Leadership

Advisor Resources

Investment Support

•

•

•

•

•

•

DCfocus magazine

White papers / research

Practice management

Plan sponsor “door openers”

Analytics and tools

Product brochures

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

36

BlackRock DC at your fingertips

www.blackrock.com/dc

Introducing BlackRock's new DC website, a dedicated site for plan sponsors and retirement plan advisors

Practice Management and Value Add

Tools and Analytics

Thought Leadership, Research and Insight

Timely Updates on DC Trends

(Follow us on Twitter @blackrockusdc)

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

37

BlackRock: An extension of your team

BlackRock is committed to supporting

your business and we look forward to

helping you enhance your practice.

•NH

•WA

•MT

•VT

•ND

•ID

Contact your BlackRock DC Advisor

Consultant or call 877-99-BLKDC

(877-992-5532).

•WY

•UT

•CA

•AZ

•CO

•NY

•MI

•PA

•IA

•KS

•OK

•NM

•MO

•AR

•TX

•AK

•MA

•WI

•SD

•NE

•NV

•ME

•MN

•OR

•LA

•IL •IN •OH

•WV

•VA

•KY

•NC

•TN

•RI

•CT

•NJ

•DE

•MD

•SC

•MS •AL

•GA

•FL

•HI

Joe Lee

Head of USDC Advisor –

Sold Distribution

DC Advisor Consultant

Territory

609-282-2220

Phone Number

joseph.lee@blackrock.com

Email Address

Internal DC Advisor Consultant

Chris Mango

Northeast

617-960-6442

christian.mango@blackrock.com

Michael Murray

609-282-4853

michael.murray@blackrock.com

Mitch Horan

NY / NJ Metro

201-803-1718

mitchell.horan@blackrock.com

Joe Rosenthal

609-282-4728

joseph.rosenthal@blackrock.com

David Quester

Mid-Atlantic

610-930-6616

david.quester@blackrock.com

Eben Wheeler

Southeast

704-292-5437

eben.wheeler@blackrock.com

Jeff Stevens

Midwest

763-232-6790

jeff.stevens@blackrock.com

TBD

Pacific Northwest

Matthew Stebner

609-282-4883

matthew.stebner@blackrock.com

Robert J. Cruz

South Central

469-585-6375

robert.cruz@blackrock.com

Art Villar

Southwest

562-354-6077

art.villar@blackrock.com

Don Allen

609-282-4882

don.allen@blackrock.com

Allison Rumpp

609-282-4854

allison.rumpp@blackrock.com

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

38

Important Notes

This material is provided to you for informational purposes only.

Opinions expressed are current opinions as of the date appearing in this material only.

BlackRock, Inc. and its subsidiaries (together, "BlackRock") do not provide investment advice regarding any

security, manager or market. This material is provided as an educational tool and should not be considered

investment advice. BlackRock cannot be held responsible for any direct or incidental loss resulting from applying

any of the information provided in this publication or from any other source mentioned. BlackRock is not engaged

in rendering any legal, tax or accounting advice. Please consult with a qualified professional for this type of advice.

Copyright 2011 BlackRock, Inc. All rights reserved.

11-1192

(A0065897)

FOR FINANCIAL PROFESSIONAL USE ONLY. Not to be distributed to the general public.

39

![Mark Whitenack Digital Assets PowerPoint Presentation []](http://s2.studylib.net/store/data/005383425_1-9cf830a5f2e9fc777daa963eb9460c8e-300x300.png)