ERISA Section 408(b)(2) Fee Disclosures

advertisement

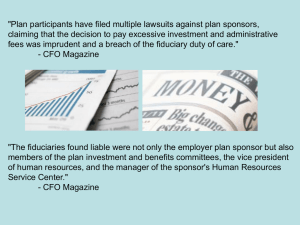

Washington Update: The Changing Face of 401(k) Plan Regulation Presented by Marcia S. Wagner, Esq. Introduction Regulatory Developments Impacting Retirement Plans Tremendous regulatory activity in 2010. Republican-led House unlikely to impact rulemaking agenda in 2011. 2 Governmental Policy Objectives for Rule Changes Regulatory activity can be tied back to government’s policy objectives. Five key objectives: Improving transparency Greater accountability Helping participants make better decisions Making retirement savings last Improving target date disclosures 3 Policy Objective #1: Improving Transparency Through 408(b)(2) Fee Disclosures Governmental policy based on GAO reports. “Hidden” fees Potential conflicts of interest New rules issued by DOL under Section 408(b)(2) of ERISA. 408(b)(2) Fee Disclosures must be delivered to all existing plan clients. Deadline - January 1, 2012. Must also deliver 408(b)(2) Fee Disclosures to new clients or when services are extended. 4 Improving Transparency Through 408(b)(2) Fee Disclosures (cont’d) ERISA 408(b)(2) is designed to address fee oversight problem for fiduciaries. Fiduciaries have duty to evaluate provider’s compensation. Currently, providers are not obligated to disclose all compensation. 408(b)(2) Fee Disclosures will force providers to disclose relevant info. Many providers currently receive “hidden” indirect compensation. If plan sponsor is unaware of indirect compensation, it has no way to ensure fees are reasonable. Plan participants may be harmed by excessive fees. 5 ERISA 408(b)(2) and Prohibited Transaction Rules Payment of provider’s fee with plan assets is a “prohibited transaction.” But exemption is available under ERISA 408(b)(2). Fee payments are exempt if services are provided under a reasonable arrangement for reasonable compensation. Arrangement is reasonable only if 408(b)(2) Fee Disclosures are made. Plan fiduciaries will need to review 408(b)(2) Fee Disclosures carefully. Duty to ensure fees are reasonable before engaging provider. 6 Policy Objective #2: Greater Accountability for Providers of “Investment Advice” DOL’s “investment advice” proposal will impact retirement plan industry Limits how pension consultants and advisors may advise plan clients. Current rules Functional approach to determining fiduciary status. Any provider of “investment advice” is a fiduciary. Existing definition under DOL regulation uses 5-factor test. 7 DOL Proposal to Change Definition for Investment Advice 8 Avoiding Fiduciary Status Under the DOL’s “Investment Advice” Proposal DOL proposal provides relief from “investment advice” rules if: Advisor can demonstrate that… …plan client knows that advisor is acting as a seller… …whose interests are adverse to plan client… …and is not providing impartial advice. 9 Potential Impact on Financial Advisors (FAs) FAs are typically associated with non-fiduciary broker-dealers or fiduciary RIAs. If adopted, DOL proposal would cause many brokers to become fiduciaries. ERISA prohibits any fiduciary from receiving variable compensation. Possible strategies for broker-dealers if DOL proposal is adopted. Dual registration as RIA and charging level, asset-based fee. Preserving non-fiduciary status in compliance with any rule changes. SEC authorized to impose fiduciary standard on brokers under Dodd-Frank Act. 10 Policy Objective #3: Helping Participants Make Better Investment Decisions Final Rules on Participant-Level Fee Disclosures Mandatory disclosures for plans with participant-directed investments. New rules go into effect for plan years beginning on or after Nov. 1, 2011. 11 Policy Objective #3: Helping Participants Make Better Investment Decisions (cont’d) Proposed Rules on Participant-Level Investment Advice Prohibited transaction rules stop fiduciary advisors from providing conflicted advice to participants. DOL proposes regulations on March 2, 2010. Requirements Under Proposed Rules FA and advisory firm must receive level compensation for advising participants. No restriction on affiliates, which may earn additional compensation. Alternatively, FA and advisory firm can earn variable compensation, but only if advice to participants is based on computer model. 12 Policy Objective #4: Making Savings Last Through Retirement Promoting Availability of Lifetime Income Options Millions of retirees are beginning to draw down on retirement savings. Government policy objective to help reduce risk of outliving retirement assets. DOL/IRS and Treasury issue Request for Information on Feb. 2, 2010. RFI is pre-rulemaking starting point for agencies. Roughly 800 comments submitted from public. 13 Agencies Hold Joint Hearing on Lifetime Income Options DOL/IRS and Treasury follow up on public comments submitted in response to RFI. Agencies hold extended hearing on Sept. 14 and Sept. 15, 2010. Hearing focuses on narrow topics of interest to regulators. 14 Policy Objective #5: Improving Disclosures for Target Date Funds Market losses in 2008 give rise to concerns about TDFs. DOL and SEC hold joint public hearing on TDFs in June 2009. Ultimately leads to co-publishing of Investor Bulletin in May 2010. SEC proposes reg’s for TDF marketing materials in June 2010. DOL proposes changes to QDIA reg’s on Nov. 30, 2010. Triggered whenever TDFs are designated as plan’s QDIA. QDIA rules provide fiduciary safe harbor, making participants responsible for their “passive” decision to invest in QDIA. 15 DOL Proposal to Improve TDF Disclosures Proposed Changes to DOL’s Existing QDIA Regulations Additional info must be included in annual QDIA notice to participants. Must include TDF’s investments, performance, fees, glide path illustration, relevance of target date, disclaimers and other info. Proposed Changes to New Rules on Participant-Level Fee Disclosures Additional info must be included in annual comparative chart for participants. DOL Confirms Future Publication of “Tips” to Assist Plan Fiduciaries 16 Action Items for Plan Sponsors Regulatory changes are administrative “interpretations” of statutory law. DOL rules changes are interpretive requirements of existing fiduciary law. Pending rule changes can also be viewed as “best practices” for today. Evaluate the plan’s service providers. Ask provider for information on qualifications, services and fees. Prudently evaluate information in accordance with fiduciary duties. Ask when 408(b)(2) Fee Disclosures will be provided. 17 Action Items for Plan Sponsors (cont’d) Enhance education for participants in key areas. Comparative information for investment options. Detailed information on plan’s fees and services. Education on withdrawal strategies and post-retirement budgeting. Meaningful disclosures on plan’s TDF series. 18 Action Items for Financial Advisors DOL “investment advice” proposal is likely to impact 401(k) advisory business. Providers of investment-related services should review business practices. Review is critical for non-fiduciary advisors. Consider possible scenarios if DOL’s proposal is adopted. Accept status as “Investment Advice Fiduciaries.” Make required disclaimers to avoid fiduciary status. 19 Conclusion Plans sponsors should understand how DOL’s pending rules will impact them. Be proactive in managing plan and adopting practices. Financial advisors can provide assistance. Providers of investment services should also prepare themselves. DOL proposal to broaden “Investment Advice Fiduciary” definition. 20 This presentation is intended for general informational purposes only, and it does not constitute legal, tax or investment advice on the part of The Wagner Law Group. Plan sponsors and other fiduciaries should consult with their own legal counsel to understand the nature and scope of their responsibilities under the Employee Retirement Income Security Act of 1974 (ERISA) and other applicable law. This presentation highlights certain factors which may be considered by plan sponsors and other fiduciaries in evaluating the services provided to plans and the related fees for such services. Future legislative or regulatory developments may significantly impact such fiduciary reviews and modify the existing guidance as to how plan services and the related fees are to be evaluated. Please be sure to consult with your own legal counsel concerning such future developments. 21 Washington Update: The Changing Face of 401(k) Plan Regulation Marcia S. Wagner, Esq. 99 Summer Street, 13th Floor Boston, MA 02110 Tel: (617) 357-5200 Fax: (617) 357-5250 Website: www.erisa-lawyers.com marcia@wagnerlawgroup.com 22 A0057838