Fixing the Financial System – Efforts at Reform in

advertisement

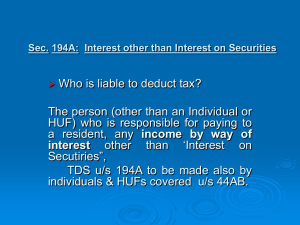

Fixing the Financial System – Efforts at Reform in 2010 AGA Winter Seminar January 2011 2010 Highlights • • • • • • Squam Lake Report “Flash Crash” Investigation of 5/6/10 The Valukas Report on Lehman Bros. SEC action on “Window Dressing” Basel III banking reforms Settlement: Securities & Exchange Commission vs State of New Jersey 2010 Highlights p. 2 • Status of Freddie/Fannie • Several FASB issues • NYSE Commission Report on Corporate Governance • Financial Crisis Inquiry Commission report now due January 2011 • Dodd/Frank Financial Reform Bill Background Economic Trends • Increasing concentration of bank capital – 3 large banks • Union of banking and investment capital in same firms since repeal of Glass-Steagall • Unsustainable federal spending • Recovery underway but weak job growth • Heightened income stratification • So-called “Shadow Banking System” Background: Shadow Banking • • • • Generally don’t accept traditional deposits So not subject to regulatory oversight Unregulated activity by regulated entities Examples: money market funds, hedge funds, finance companies, GSEs, SPEs • Examples: many derivatives, credit default swaps, repurchase agreements • Vulnerability; lack of transparency Squam Lake Report • Subtitled, “Fixing the Financial System” • Bipartisan panel/advisors to both parties • Based on recommendations of 15 economists that includes: • 8 of 9 past presidents of American Finance Association • And includes Robert Shiller, author of Irrational Exuberance Squam Lake Recommendations • Central bank should be the systemic regulator • Address critical information gaps • Improve regulation/disclosure of retirement savings • Strengthen bank capital requirements • Encourage clearinghouse/ exchange for credit default swaps Squam Lake Report p. 3 • More flexibility in recapitalizing troubled financial institutions • “ A Living Will” for large financial institutions; i.e. “planned demise” • The final chapter: “Replaying the world financial crisis, how our recommendations might have helped.” Flash Crash: a “Major Anomaly” • May 6, 2010 2:45 PM sudden plunge • DJIA fell 600 points in 5 minutes, regained most of loss in next 10 minutes • Unsettling impact highlights role of trading • No full explanation until SEC/CFTC (Commodities Futures Trading Commission) report issued 10/1/10 • Culprit: a mutual fund sell algorithm “Flash Crash” p. 2 • • • • • Waddell & Reed Asset Strategy Portfolio: A “Go Anywhere” mutual fund Sell order for S & P 500 futures with 75,000 contracts totaling $4 billion Whole incident highlights high frequency trading/market risk • SEC still evaluating “circuit breakers” Valukus Report on Lehman • Anton Valukus report to bankruptcy court on March 12, 2010 • Found “materially misleading” accounting activities designed to remove assets from the balance sheet • Steps approved by Ernst & Young • Executive level whistle blower fired • Firm realized it was overleveraged and: Valukus Report: “Repo 105” • Just before end of quarter, exchanges assets for cash in “repo” market - $49 bill. • Values the assets at 105% of cash received to treat it as a sale transaction • Reports lower leverage in quarterly filing • Reverses the exchange several days later, essentially hiding assets to make firm appear stronger Bank “Window Dressing” • Spring 2010: Wall Street Journal investigation into bank quarterly reporting • July 2010 BOA admitted temporally shedding debt to meet internal goals • Not illegal but deceptive; much smaller in scope than Lehman Brothers Repo 105 activity “Window Dressing” p. 2 • Called a “dollar roll” trade: • Traded mortgage backed securities for cash and agreed to repurchase shortly w/ similar securities – • September 2010 SEC Commissioners unanimously propose reinstatement of 1994 rule on additional disclosure of trading to address this Basel III “The objective of the Basel Committee’s reform package is to improve the banking sector’s ability to absorb shock arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy.” – BCBS press release 12/19/09 Basel III • Basel Committee on Bank Supervision • Report issued to G-20 Nations meeting in South Korea November 2010 - Tighter capital requirements: 4.5% of common equity by 2015, further 2.5% by 2019 - Leverage ratios; counter-cyclical buffers Status of Fannie Mae and Freddie Mac • • • • Federal National Mortgage Association Federal Home Loan Mortgage Association GSE: Government Sponsored Entity 9/7/08: Conservatorship by Federal Housing Finance Agency (FHFA). • Purchases loans, securitizes them, sells them in the secondary market with the assumption of federal guarantees Fannie/Freddie p. 2 • As of December 2010 – FHFA estimates total cost $320 billion. • Challenge of shrinking or winding down: Avoiding further damage to the housing market • Congressional committees to take up in early 2011 SEC vs New Jersey • August 2010 – first securities fraud case against a state • Charged N.J. mislead bond investors as to health of 2 large pension funds 2001 – 07. • Failed to properly fund the accounts • N.J. settled w/ SEC • SEC warning to government entities FASB Issues • New Chair appointed – Leslie Seidman • Mark to Market Accounting • Off Balance Sheet Reporting – FASB 140 replaced with FASB 167 NYSE Commission on Corporate Governance • White Paper on 10 core governance principles. • 1st principles is: “Fundamental objective should be to build long-term sustainable growth in shareholder value.” • 2nd principle mentions risk management and internal control • Available on Protiviti web site Financial Crisis Inquiry Commission • FCIC established by law in 2009 to investigate and issue a report, now due in January 2011 • Bipartisan; former Treasurer of CA Phil Angeledes is the Chair; former Rep. Bill Thomas Co-Chair • Hearings on C-Span and White Papers on Commission web site • December 15, 2010 minority document Dodd-Frank Wall Street Reform and Consumer Protection Act • Enacted into law July 21, 2010 • Most comprehensive financial reform legislation since the 1930’s • Intensive period of rule-making now underway • Estimated 243 rules; 67 one-time studies/reports; 22 new periodic reports Dodd Frank Overview Today • • • • • • • Federal organizational changes Systemic risk management – FSOC Office of Financial Research Orderly liquidation regime Bank capitalization & securitization issues Proprietary trading reforms Derivative reforms Dodd Frank Overview p. 2 • • • • • • • • Hedge Fund developments Credit rating agency reforms Insurance industry developments Bureau of Consumer Financial Protection Mortgage reforms SEC whistleblower rules Municipal securities actions Other miscellaneous developments Oversight Changes • OTS eliminated, duties to OCC/ FDIC • Identification and monitoring of systemically risky firms and a living will for some firms • More oversight of derivative markets • Broad consumer product oversight • Some oversight of hedge funds Financial Stability Oversight Council - Structure • Chaired by Secretary of Treasury • Voting Members: Heads of Treasury, Fed Reserve, SEC, FDIC, CFTC, FHFA, OCC, NCUA, Bureau of Consumer Financial Protection, insurance representative • Nonvoting Members: Directors of Office of Financial Research and Federal Insurance Office, State Insurance, Banking, Securities Commissioners Financial Stability Oversight Council - Tasks • • • • Identify risks to US financial system Identify systemically important companies Make recommendations to Fed Reserve Requires risk committees, stress testing, and orderly liquidation plans • Inclusion of off-balance sheet reporting • “Hotel California” provision Office of Financial Research • To support Financial Stability Oversight Council • Housed in Treasury but largely independent authority to gather information backed by subpoena power • Director appointed by President but w/ advice and consent of Congress • Mandated reports Orderly Liquidation • Resolution regime (like w/ FDIC) would make future bailouts unnecessary • Under certain conditions would replace bankruptcy code • Guidelines re: oversight, procedures, hierarchy for claims • Orderly Liquidation Authority Panel Orderly Liquidation p. 2 • Orderly Liquidation Fund • “Taxpayers shall bear no losses from liquidating any financial company under this title and any losses shall be the responsibility of the financial sector recovered through assessment.” Bank Capital & Securitization • Collins Amendment drafted by FDIC • Generally more stringent leverage and risk based capital requirements • Reflects changes proposed in Basel III agreements • Federal Reserve to establish new standards Securitization • Process of turning mortgages, loans into marketable securities • Generally requires firms to retain some of the risk • Separate risk retention for different asset classes • Specifies federal rule making The “Volcker Rule” • Generally limits extent of proprietary trading • Amends Bank Holding Company Act of 1956: aim is to reduce speculative investment of large firms • Certain permitted activities and exemptions • 2 year transition Derivatives • “Financial contract whose value is linked to an underlying price or variable” • CFTC regulates commodity futures & options on futures; SEC regulates options on securities; swaps on OTC (exempt) • OTC controlled by small banking group • Market at 700 trillion in 2008 Derivatives p. 2 • Regulates most derivative transactions • More derivatives traded and cleared through regulated exchanges • Divides jurisdiction between SEC/CFTC • Required studies and rule-making process has begun; area where rule-making will lead to more clarity Hedge Funds • • • • Outside federal securities law Not a big role in current financial crisis High leverage, trading strategies Maybe 1/5 of trading on NYSE; very significant market presence • Risk seen in 1998 Long Term Capital Management bailout and the Madoff scandal Hedge Funds p. 2 • Registration for advisors w/ funds over $150 million • Recordkeeping/reporting requirements • Small advisors regulated by States (or SEC if state does not do that) • Requires several major studies of investors, short selling, and of feeder funds. Credit Rating Agencies • Fitch, Moody’s, Standard & Poor’s • SEC provides credit rating agencies with a NRSRO designation: Nationally Recognized Statistical Rating Organization • Important as many state and federal laws and regulations reference this designation Credit Rating Agencies p. 2 • Amends Credit Rating Agency Reform Act passed in 2006 • New Office of Credit Ratings reports to SEC Chair • Firewall rules between rating and marketing activities • Rules on independent directors, compliance officer, internal control Insurance Industry • Insurance regulation generally left to states based on 1945 law • Federal Insurance Office located in Treasury Department; limited activity • No direct substantive regulatory authority • Locates insurance expertise in Treasury • Collects information and recommendations for Financial Stability Oversight Council Bureau of Consumer Financial Protection • Fragmented system around consumer lending and financial products • Housed in Federal Reserve but has independent authority • Director appointed by President but advice and consent of Congress • Regulates broad array of consumer financial products but some exemptions including car dealers Bureau of Consumer Financial Protection p. 2 • Oversight over: deposit taking, mortgages, credit cards, loan servicing, check guaranteeing, collection of consumer reporting data, debt collection, real estate settlement, money transmitting, financial data processing • Exceptions includes accountants Mortgage Reform • National underwriting standards for residential loans • Reasonable ability of borrower to repay • Limits on some abusive practices, i.e. balloon payment, prepayment penalty, • Guidance on mortgage servicing and escrow • Restricts payment to mortgage originators Other Activities • Creates SEC “Office of Investor Advocate” and ombudsman • Guidance on fiduciary duty of broker /dealers with customers • Rules regarding accountability and executive compensation • Debit card interchange fees • Permanent increase deposit insurance Other Protections/Activities • SEC study on financial intermediaries i.e. “feeder funds.” • Independent verification of client assets in custody of various investment advisors • SEC study on short selling • SEC to be partially self funded • New class of SEC registrant: municipal advisor SEC Whistleblower Bounty • SEC proposed rules now available • Original information on fraud could net 30% of monetary sanctions over $1m. • Fear this will undermine company internal control, fraud and ethics programs in place since 2002 Sarbanes Oxley Law making it more difficult for a firm to police itself Municipal Securities • Establishes SEC registration of “municipal advisors” and defines their fiduciary duty • Expands Municipal Securities Rulemaking Board (MSRB) authority • Reconstitutes MSRB with a majority of independent board members • Studies on role of GASB Dodd-Frank: Conclusions • Assumes new products/new issues; ability for flexible response • Most controversy around derivatives, “Volcker Rule ” and Consumer Financial Protection Board • Funding issues have already arisen • Many observers: the rule-making process will lead to more clarity • A “long and winding road.” Books & Other Resources • • • • • In Fed We Trust – David Weisel The Squam Lake Report The Big Short – Michael Lewis Too Big To Fail – Andrew Ross Sorkin A Colossal Failure of Common Sense – Lawrence McDonald • Article: “What Good Is Wall Street,” New Yorker magazine 11/24/10 – John Cassidy • Irrational Exuberance – Robert Shiller Other Resources p. 2 • Financial Crisis Inquiry Commission • Cambridge Winter Center for Financial Institutions • Congressional Research Service • Law firm summaries on Dodd-Frank (Davis Polk; Cadwalader; Skadden Arps)