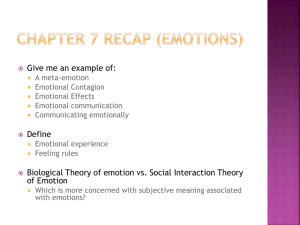

Labor & Employment

Women Executives

Networking Briefing

OFCCP, Federal Contractors &

The Obama Administration

The New Compliance Requirements

April 1, 2009

Washington, D.C.

Presenters:

1

Constance A. Wilkinson, Esq.

John Ki, Esq.

Nondiscrimination and Affirmative Action

Federal government contractors subject to Executive

Order 11246, Section 503 of the Rehabilitation Act of

1973, Vietnam Veterans’ Readjustment Act of 1974 (all

as amended)

Taken together, these laws prohibit discrimination and

require Federal contractors and subcontractors to take

affirmative action to ensure that all individuals have

an equal opportunity for employment, without regard to

race, color, religion, sex, national origin, disability or

status as a Vietnam era or special disabled veteran.

Enforced by the Office of Federal Contract Compliance

Programs (OFCCP)

2

FY 2008

During Fiscal Year (FY) 2008, the OFCCP recovered a

record $67,510,982 in back pay and salary and benefits

on behalf of 24,508 individuals

The FY 2008 financial recovery is a more than 20%

increase over the amount recovered in FY 2007

($51,680,950) and a 133% increase over the amount

recovered in FY 2001 ($28,975,000)

99% was recovered in cases of systemic discrimination

or those involving a significant number of workers or

applicants subjected to discrimination because of an

unlawful employment practice or policy

3

Not Your Father’s Affirmative Action

Specifically prohibits quota and preferential

hiring and promotions under the guise of

affirmative action numerical goals (41 CFR

60-2.12(e), 60-2.30 and 60-2.15)

“No quotas” mantra was emphasized under

Bush administration

4

Affirmative Action Plans

5

Goal Setting Reports

Workforce Analysis or Organizational Profile

Job Group Analysis

Availability Analysis and Backup Census Data

Utilization (Comparison of Incumbency to Availability)

Goals

Personnel Activity Reports

Placement Activity Report

Narrative Discussion of Prior Years’ Goals

Impact Ratio Analysis

• Adverse Impact Analysis

• Overall Selection Rate Analysis

• Two Standard Deviation Analysis

Compensation Analysis

Special Rules

Internet Applicant Rule

Racial categories (two or more races)

Focus on statistical analysis: impact-ratio

analysis

6

What Now?

What do you do with your written AAP?

Self-Analysis

Identification of Problem Areas

Proactive Approach

7

OFCCP Audits

“Contracts First”

Corporate Scheduling Announcement Letters

(CSAL)

30-Days from receipt of letter to submit AAP

8

Audit Review

“Active Case Management” (ACM)

Priority review – looking for statistical indicators

of adverse impact

Desk audit vs. On site audit

1 in every 50 will be subject to full on-site review

9

Best practices

NO RED FLAGS

Ensure that underlying data is accurate and

reliable

If red flags appear, address them “as much as

possible” before submitting the AAP

10

Consequences

Conciliation Agreement

Monetary penalties, including fines

Back pay

Debarment

Ongoing scrutiny

11

What to look forward to. . .

Continued focus on statistical indicators,

but expect a pullback from “single-minded

focus” on statistical back to other aspects

of AAPs

Online filing of AAPs

Compensation analysis

More enforcement

12

Obama Executive Orders

"Notification of Employee Rights Under Federal Labor

Laws”

Requires employers that contract with the federal

government to formally notify employees of their rights

under the NLRA

Until now, employers have generally not been required to

affirmatively post notices advising employees of their

rights under the NLRA.

13

Obama Executive Order

"Nondisplacement of Qualified Workers Under

Service Contractors"

Requires contractors, when they replace another

contractor, to offer employment to the previous

contractor’s employees on that job (other than

managerial and supervisory personnel) — giving

the workers a so-called “right of first refusal.”

14

Obama Executive Order

"Economy in Government Contracting“

Prohibits government agencies from considering

as "allowable costs" those costs and expenses

incurred by federal contractors to influence

workers in deciding whether to form unions

and/or engage in collective bargaining.

15

Final Rule: Federal Ethics

Contractor Business Ethics Compliance

Program and Disclosure Requirements,

73 Fed. Reg. 67064-67093 (Nov. 12, 2008),

effective Dec. 12, 2008

– Revised FAR 52.203-13 to impose more stringent

compliance and reporting requirements

– For all contractors:

– Mandatory disclosure

– Code of business ethics and conduct

– For other than small business or commercial items:

– Business ethics awareness and compliance program

– Internal control system

– Subcontract flow down (if >$5M, 120 days term)

16

Mandatory Disclosure

WHAT? Timely disclose “credible evidence” of -– “Significant overpayments”, under FAR

– Federal criminal law violations, including fraud,

conflict of interest, bribery, improper gratuities

– Civil False Claims Act violations

– In connection with contract/subcontract award,

performance, closeout

BY WHOM? Include conduct of the contractor’s

principal, employee, agent or subcontractor

TO WHOM? Disclose to the agency OIG, copy

the Contracting Officer

17

Mandatory Disclosure

WHEN? “Timely” is undefined

“Credible evidence” standard is undefined

but requires “preliminary examination of

the evidence to determine its credibility”

– Conduct internal investigation of allegations

– Determine whether “credible evidence” of a

violation exists, based on the facts, the legal

standards, and expert advice, as necessary

– Document the investigation and the basis for

the decision whether or not to disclose

18

Mandatory Disclosure

STARTING WHEN? Multi-year contracts may include FAR 52.203-

13 (December 2007), but

Mandatory disclosure requirement, effective 12/12/08, is driven by

statute

FAR subjects contractors to penalty for noncompliance with

mandatory disclosure requirement, “whether or not the clause at

52.203–13 is applicable,” by providing that a contractor may be

suspended and/or debarred for knowing failure by a principal to

timely disclose credible evidence of the referenced violations

Three-year “look-back” period is based on “final payment” under

closed contacts

– Prior contracts may be subject to reporting obligations depending on

timing of audit/closeout

19

Implications for Federal Contractors

Cost accounting and charging

Certifications

– Certificate of Current Cost or Pricing Data

– Certification of Final Indirect Costs

– Certification and Disclosure of Payments to

Influence Certain Federal Transactions

– COI certifications

Reports

– EEO, Small Business Subcontracting Plan

20

Comparison to 2007 Rule

Awareness-compliance program expressly

requires an “effective training program”

– “Reasonable steps to communicate

periodically and in a practical manner” the

contractor’s standards and procedures

– Extends to “principals” and subcontractors

and agents, as appropriate

Internal control system requires screening

of principals and periodic review of

program to assess effectiveness and risk

21

Compliance Strategies

List contracts within scope of reporting

obligation

Identify “principals”

– Principal means an officer, director, owner,

partner, or a person having primary

management or supervisory responsibilities

within a business entity

– Intended to be construed broadly

Survey and obtain disclosure statements

22

Compliance Strategies

Assess/supplement training materials to ensure appropriate

coverage of legal standards

– False Claims Act, conflict of interest, procurement integrity

Review adequacy of internal procedures to identify and assess

possible violations for determination of “credible evidence”

– Coordination by CCO or others?

– Need for revision of subcontract/teaming agreements to flow-down

disclosure requirements and permit investigation and disclosure of

business partner violations

Consider appropriate level of legal involvement in internal

investigation and deliberation

– Process, but not underlying violation, may be subject to attorney-client

communication and attorney work-product privileges

Mark written disclosures with restrictive legend

– Confidential and Proprietary - Exempt from release under FOIA

23

Open Issues/Questions

Agency-specific requirements for content/form of

disclosure

Effect of consideration of disclosures in past

performance and responsibility determinations

Need to reconcile the “adequate evidence” standard for

suspension decisions (FAR 9.407-1(B)(1) with the

“credible evidence” standard for mandatory disclosures

Timeframe for incorporating DEC 2008 version of clause

into current contracts

– Modification with consideration?

• Extension of time for implementation?

24