Consumer protection under the Unfair Commercial Practices

advertisement

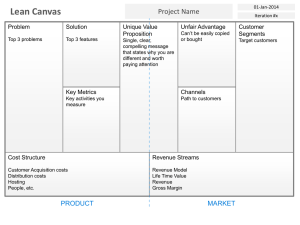

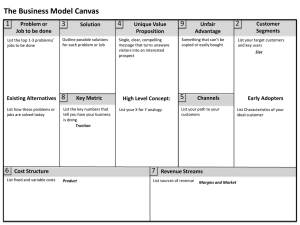

The reasonably circumspect, the gullible and the plain stupid Consumer protection under the Unfair Commercial Practices Directive and the financial services industry Willem van Boom April 2013 Main points • Regulation of B2C commercial practices in financial services • • • • • The UCP Directive does not perform well on any of these issues; it • • • • • Must balance ‘individual responsibility’ against societal need for systemic stability Has to respond to local needs, situations and practices Must be in line with the maturity of the market Must be flexible to respond to new developments ∂ Relies largely on the ‘informed choice-making’ homo economicus model Neglects not only the gullible and plain stupid but also the homo heuristicus Erroneously assumes maximum harmonisation strikes the proper balance Stifles rather than nourishes innovation in consumer protection in financial services Therefore, the exclusion of financial services from the maximum harmonisation scope of the Directive was a wise decision; maintaining it is even wiser Structure of my talk 1. Main features of the UCP Directive 2. Some examples of dubious practices in financial services that illustrate the need for – – – – Balancing ‘individual responsibility’ against societal need for systemic stability Responsiveness to local needs, situations and practices Consistency with degree of maturity ∂ of the market Flexibility to respond to new developments 3. Why the UCP Directive’s framework does not always suffice 4. Why leaving leeway to member states is the best option 5. The 2013 Review by the European Commission ∂ 1. Main features of the UCP Directive Directive 2005/29/EC of 11 May 2005 (OJ L 149/22) (Unfair Commercial Practices Directive) Consumer Protection from Unfair Trading Regulations 2008 (the CPRs) S.213 Enterprise Act 2002: FCA is designated enforcer General UCP framework General clause (art. 5) practices (1) contrary to professional diligence that (2) distort transactional decision-making process of average consumer Misleading practices (art. 6-7) ∂ Actions Omissions (eg, untruths, framing) (omitting material information) Aggressive practices (art. 8-9) Black list – practices deemed unfair (Annex I) General UCP framework • Practice: any B2C act, omission, communication, etcetera, connected with economic motives • • Before contract conduct (eg., Incomprehensible or ambiguous general contract terms) After sales conduct (eg., switching barriers, aggressive debt collection) General clause (art. 5) practices (1) contrary to professional diligence that (2) distort transactional decision-making process of average consumer Misleading practices (art. 6-7) ∂ Actions Omissions (eg, untruths, framing) (omitting material information) Aggressive practices (art. 8-9) Black list – practices deemed unfair (Annex I) • • • Unfair = practice ‘contrary to the requirements of professional diligence’ which materially distort or are likely to materially distort the economic behaviour of the average (targeted) consumer with regard to a product or service Misleading actions and omissions: false, deceptive, omitting material information, etc. Aggressive: by harassment, coercion, or undue influence, has potential for significantly impairing freedom of choice or conduct General UCP framework General clause (art. 5) practices (1) contrary to professional diligence that (2) distort transactional decision-making process of average consumer Misleading practices (art. 6-7) ∂ Actions Omissions (eg, untruths, framing) (omitting material information) Aggressive practices (art. 8-9) Black list – practices deemed unfair (Annex I) • General UCP framework Annex: practices deemed unfair • • Eg., bait advertising, bait & switch, promotional pyramid schemes Eg., “Requiring a consumer who wishes to claim on an insurance policy to produce documents which could not reasonably be considered relevant as to whether the claim was valid, or failing systematically to respond to pertinent correspondence, in order to dissuade a consumer from exercising his contractual rights” General clause (art. 5) practices (1) contrary to professional diligence that (2) distort transactional decision-making process of average consumer Misleading practices (art. 6-7) ∂ Actions Omissions (eg, untruths, framing) (omitting material information) Aggressive practices (art. 8-9) Black list – practices deemed unfair (Annex I) • The average consumer, who is reasonably well informed and reasonably observant and circumspect as interpreted by the European Court of Justice • The average consumer test is not a statistical test but a normative test by national court/authorities • Particular groups of vulnerable consumers (elderly, children) are gauged according to the average∂ member of their group • The UCP Directive seems to protect the average homo economicus, not the gullible, inattentive, uninterested or distracted homo heuristicus Maximum harmonization – – – – Level playing field and internal market rhetoric More restrictive national rules banned Breadth of scope is enormous national courts & agencies need to apply the general standard case-by-case; supplementing Black List is prohibited • Eg., generic prohibition of bundling products is not allowed (ECJ 2009; 2010) ∂ Exceptions – – – – UCPD is without prejudice to contract law (art. 3 (1)) Specific EU rules on UCPs have priority (art. 3 (4)) MS may impose more restrictive rules on financial services (art. 3 (9)) Financial services exception up for review ∂ 2. Some examples of dubious practices in financial services Payment Protection Insurance • • • PPI seems to be a particular UK ‘problem’ Most complained over financial product Number of (successful) claims on PPI low compared to other types of insurance • • • • • • Agressive marketing (over-the-counter & bundled sales) Commission driven sales ∂ Consumers do not consider the need for the product About half of them don’t even know they have/had one Dissuasive claims handling; broad coverage exceptions Interventions: • • OFT fining for unfair practices Competition Commission Order for restructuring product and commercial practices (unbundling sales process) Dutch “stock lease” products • • • • • • • • 1990s retail product; no specific regulations in place Aggressively marketed, targetting (also) less educated & less affluent classes For as little as €20 per month, the impecunious could profit from the stock boom and build equity in a short period (2, 5 yrs.) None of the products clearly communicated concepts such as ‘borrowing’, ‘loan’ or ‘risk of residual debt’ but emphasised ‘profit’ and ‘saving’ ∂ Inherently dangerous product (borrowing money to ‘lease’ stock), only viable under the assumption of continuously rising stock value Millions of policies sold; billions in debt incurred Interventions: steady increase of regulation standardising information and marketing methods Supreme Court: UCP ‘average consumer’ would read carefully, see through the sales talk and be aware of the risks Other examples • Long-term equity building endowment policies • • • Recent German research show that most of these policies do not reach maturity since consumers mostly opt for early termination Structural mismatch between product features and needs? Why do we have them? Marketing methods (eg., bundling with mortgages) and barriers to exit/switch by restrictive & ambiguous contract terms ∂ • ‘Pyramid schemes’ – unsustainable product based on perpetual recruitment of participants (eg Ponzi scheme) • • A product which probably only becomes viable when using UCPs Completely banned in various countries ∂ 3. Why the UCP Directive’s framework does not always suffice • • The ‘success’ of an unfair commercial practice is a reciprocal process: it takes two to tango Real consumers sometimes perform below the standard of the ‘average consumer’ • • • Across Europe, around half of consumers (52%) tend to take the first product they see when obtaining a current bank account or credit card (Eurobarometer 2012/373) Real consumers can be intellectually lazy, inert, uninterested, gullible, ∂ with ‘back against the wall’, less plain stupid but also: underprivileged resilient or lacking ability to defer gratification There is limited opportunity for learning from mistakes • • Some products you only buy once 56% of individuals who own a financial product have not purchased any of these within the last five years (Eurobarometer 2012/373) Example: development of Dutch home owners’ mortgage types Interest only Unit-lined equity investment basis Equity savings basis (with profits endowment) Life insurance basis Non-linear capital & interest repayment ∂ • • • • • • Lineair capital repayment other Then: 1990s ‘cowboy’ banks started handing out easy mortgage loans, enticing consumers to ride the ever higher waves of property price increases Intricate bundling of products, driven by undisclosed commission-basis Influencing ‘average consumers’ with financial products is more subtle than the ‘informed choice’ paradigm can address The ‘greed button’ is easily pressed – no matter how average you are The systemic consequences can be enormous – calling for more drastic intervention than the UCP framework offers Now: legislative framework of full transparency of agent commissions, c.a.r., unbundling of products, and effectively a prohibition of interest only mortgages • In financial services, subtle commercial practices can be linked with product and market features (eg, credence goods and intransparent markets) • Therefore, national regulators need to go beyond the ‘informed choice paradigm’ • By weighing and balancing various considerations Cf. relevant aspects to balance by FCA • • • • • • • • Differences in consumer risk appetite, experience and expertise Consumer needs for timely provision of information and advice that is accurate and fit for purpose An appropriate ‘level of care’ provided by service providers having regard to the degree of risk involved and the capabilities of the consumers in question the differing expectations that consumers may have in relation to different products the needs of different consumers for information that enables them to make informed choices the general principle that consumers should take responsibility for their decisions the ease of access to services for consumers in socially or economically deprived areas switching ease ∂ Therefore, sectoral rules: • May do more for the gullible and plain stupid consumer • May do more to address local consequences of consumer inertia and disinterest • By varying from “informed choicemaking paradigm” to intervention in “access to products” • Within “informed choicemaking paradigm” • Eg., communication and promotion of financial products needs to be clear, fair and not misleading (eg., avoiding small print, misnomers) • Eg., mandatory use of standardised concepts (eg., APR) and presentations (eg., key facts illustrations) • Eg., mandatory use of wealth warnings, eg. “Your home may be repossessed if you do not keep up repayments on your mortgage.” (MCOB 3.6.13) • Eg., mandatory disclosure of agent remuneration arrangements ∂ • Within intervention in ‘access to products’ • Prohibition of doorstep selling of financial products, telemarketing etc. • Interest rate caps for consumer credit • Outright bans on products because they are always pushed by using UCPs (eg., pyramid schemes) or feed on deprivation (eg., pay day loans) • As a result, the “informed choice” paradigm is valuable but may not be sufficient • UCP framework stresses ‘individual responsibility’ through informed choice-making • However, it does not address specific needs for systemic stability • In many consumers, the ‘blind greed’ button is easily pressed – risking systemic instabilities ∂ • The UCP framework is built on open-textured standards to be applied on case-by-case basis (Black List is exhaustive) • The exhaustive Black List obstructs flexibility to respond to new developments • Whereas stability of some financial products may be better served by standardised rules • The need for such standardisation depends on national setting and institutional framework • ∂ 4. Why leaving leeway to member states is the best option • What is relevant for one market may not be relevant for others • Stark differences in maturation of markets between EU15 and NMS12 • Eg., 27-28% of Romanian/Bulgarian consumers have a current account (Eurobarometer 2012/373) • ∂ Consistent lack of cross-border competition: 94% of consumers have never purchased financial products in other MS, 80% would not consider buying a financial product in another EU country Different markets, different needs: The Netherlands needs a standard notification period of 3 months for announcing new interest rates at end of fixed rate period to avoid UCP of late notification ∂ ∂ 5. The 2013 Review by the European Commission EC Report March 2013 “The results of the investigation conducted in the areas of financial services (…) indicate that it would not be appropriate to [have full harmonisation in financial services UCPs]. The main reasons are: • the higher financial risk in respect of financial services (…) (as compared to other goods and services); • the particular inexperience of consumers in these areas (combined with a lack of transparency (…) of financial ∂ operations); • particular vulnerabilities found (…) that make consumers susceptible to both promotional practices and pressure; • the experience of the competent financial enforcement bodies with a nationally grown system; • and finally the functioning and the stability of the financial markets as such.” Conclusions • • • • The conclusions of the Commission are in line with findings The Commission’s reasoning, however, seems at odds with the Directive’s ‘informed choice’ paradigm The ‘informed choice’ paradigm is∂not sufficient to warrant correct functioning of B2C markets in financial services Further regulatory policies are to be designed at national level, addressing local needs and situations