T 3 Impact Analysis

advertisement

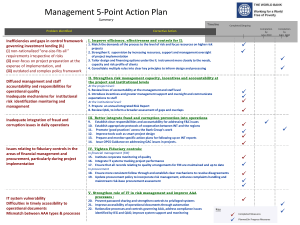

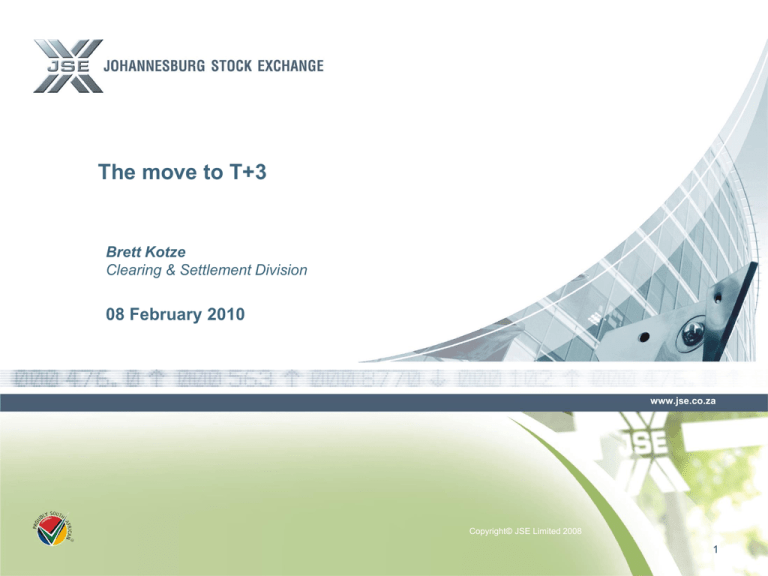

The move to T+3 Brett Kotze Clearing & Settlement Division 08 February 2010 www.jse.co.za Copyright© JSE Limited 2008 1 Agenda Introduction Settlement timelines – on-exchange and off-exchange Separation of Proprietary Deals and Controlled Clients Settlement Assurance for T+3 Corporate Actions Securities Lending & Borrowing Conversion from T+5 to T+3 www.jse.co.za 2 Moving to T+3 Project Phase 1 Producing a document detailing the potential barriers and the high-level activities to overcome such barriers (to accompany the JSE’s 2008 license renewal application); Phase 2 Nomination of responsible parties to further the investigations within their working groups, coordinated by the JSE, with their combined outputs being the creation of a “Blueprint for T+3” document; and Phase 3 Impact analysis and agreeing an implementation plan for T+3 with all market participants www.jse.co.za 3 Phase 1: Output The JSE submitted the document detailing the barriers and the high-level activities to overcome such barriers to the FSB with the JSE’s 2008 license renewal; The FSB accepted the document and requested a quarterly update on the status of the action items; The JSE initiated Phase 2 with the parties that would address the 58 action items. www.jse.co.za 4 Phase 2: Further Investigations Phase 2 was about getting the nominated parties to further investigate the action items and identified issues and define solutions (the “blueprints”); The workgroups reported into the JSE Clearing & Settlement Division; Representatives from the Clearing & Settlement Division (and other JSE Divisions where applicable) sat on each committee or workgroup; Forms of Business Requirement Specifications were created and signed off by the market; and Blueprint completed by the JSE. www.jse.co.za 5 Phase 2: Completion of blueprint The output for Phase 2 was the creation of a blueprint for the move to T+3 which was tabled and approved by JSE Exco in May 2009 www.jse.co.za 6 Phase 3: Impact Analysis and Implementation Plan Phase 3 is about the impact analysis and implementation plan for moving to T+3; The implementation plan will detail how the transition from T+5 to T+3 is going to be managed; Where possible, changes will be made immediately, as opposed to waiting for moving to T+3 (has already started); and JSE SRP dependency - how the systems may be developed for T+3 and implemented in 2011 after SRP. www.jse.co.za 7 JSE Impact Analysis and Implementation Plan CSAC – sub-committee reconstituted Met on 29 May 2009 All market constituents on sub-committee JSE on committee – also Project Managed by JSE www.jse.co.za 8 Phase 4 Project Management System Changes Management of timelines Changes to Listing requirements Changes to JSE and Strate Rules and Directives Marketing and Education Making sure everyone is ready to go-live Go-live www.jse.co.za 9 Current T+5 Settlement Cycle T+1 T T+2 T+3 T+4 T+5 Settlement Order Deal Execution Deal Allocation Deemed Affirmation Client / Broker Contract Note Client Affirmation to CSDP or Client Rejection to Broker Broker Re-Allocation Client Affirmation on Re-Allocation Broker Net Non-Controlled Client Breach Principal Assumption CSDP Commitment SA Margining Broker Borrowing CSDP Commit SA Borrowing Failed Trade www.jse.co.za Settlement Possible T+3 Settlement Cycle Reducing the timeframe in which to conduct the existing processes and activities will result in quicker settlement. www.jse.co.za On-market activities current versus future Action Current Timings – T+5 Future Timings – T+3 Settlement Orders – non-controlled clients T - Batch T - Realtime after allocations Client Affirmation to CSDP/Rejection to broker T+2 (12h00) T+1 (18h00) Deemed Affirmation Client T+2 (12h00) T+1 (18h00) Broker re-allocation T+2 (16h00) T+1 (18h00) Client affirmation of re-allocation T+2 (16h00) T+1 (18h00) Brokers nets T+2 (EOD) T+1 (EOD) www.jse.co.za On-market activities current versus future Cont… Action Current Timings – T+5 Future Timings – T+3 Non-controlled client breach T+3 (12h00) T+2 (12h00) Principal Assumption T+4 (10h00) T+2 (16h00) Margining T+3 (EOD) T+1 (EOD) Broker borrowing on Principal Assumption T+4 (10h00 to 12h00) T+2 (16h00 to 18h00) Settlement Authority SLB T+4 (12h00 to 16h00) T+3 (08h00 to 10h00) Failed Trade/Rolling Of Settlement T+4 (16h00 to 18h00) T+3 (10h00 to 12h00) Settlement T+5 T+3 www.jse.co.za Off-markets activities current versus future Type Current Settlement Cycle Reporting Time Commit / BTB Time Future Settlement Cycle Reporting Time Commit / BTB Time Depository Receipts Min T+1 15h00 (S-1) 17h00 (S-1) Min T+1 11h00 (S-1) 15h00 (S-1) Off-markets T+5 12h30 (S-2) 17h00 (S-2) T+3 11h00 (S-1) 15h00 (S-1) Acct Transfers Inter- CSDP Min T+1 15h00 (S-1) 17h00 (S-1) Min T+0 14h00 (S) 15h00 (S) Acct Transfers Intra- CSDP Min T+0 18h00 (S) 18h00 (S) Min T+0 18h00 (S) 18h00 (S) Acct Transfers on RD N/A where elective CA Min T+0 09h00 (S) 10h00 (S) Portfolio Moves InterCSDP Min T+1 Min T+0 14h00 (S) 15h00 (S) 15h00 (S-1) 17h00 (S-1) www.jse.co.za Off-markets activities current versus future Cont… Type Current Settlement Cycle Reporting Time Commit / BTB Time Future Settlement Cycle Reporting Time Commit / BTB Time Portfolio Moves Intra – CSDP Min T+0 18h00 (S) 18h00 (S) Min T+0 18h00 (S) 18h00 (S) Portfolio Moves on RD N/A where elective CA Min T+0 09h00 (S) 10h00 (S) Off-market SLB Min T+1 15h00 (S-1) 17h00 (S-1) Min T+1 13h00 (S-1) 14h00 (S-1) SLB BP Min T+1 15h00 (S-1) 17h00 (S-1) Min T+1 13h00 (S-1) 14h00 (S-1) SLB Rev Substitution Min T+1 10h00 (S-1) 12h00 (S-1) Min T+1 17h00 (S-1) 18h00 (S-1) SLB Returns (Off-market and BPs) Min T+0 (BPs) 09h00 (S) 10h00 (S) Min T+1 17h00 (S-1) 18h00 (S-1) www.jse.co.za Off-markets activities current versus future Cont… Type Current Settlement Cycle Reporting Time Off-market SLB on RD – By Exception N/A SLB BP on RD – By Exception Min T+0 09h00 (S) Same day SLB Returns (Off-markets and BP on RD – By Exception Min T+0 (BPs) 09h00 (S) Commit / BTB Time Future Settlement Cycle Reporting Time Commit / BTB Time Min T+0 09h00 (S) 10h00 (S) 10h00 (S) Min T+0 09h00 (S) 10h00 (S) 10h00 (S) Min T+0 09h00 (S) 10h00 (S) www.jse.co.za Separation of Controlled Clients from Proprietary accounts From A risk management perspective agreed to separate controlled clients and proprietary deals Linked to T+3 due to Impact of system Separate custody accounts May be same or different CSDP for custody accounts EOD T+1 a brokers net will be created for proprietary accounts and a controlled clients net for controlled clients Per instrument /per trade type/per settlement day www.jse.co.za Controlled Clients Net S Client A 1,000 AAA P S Client B P 200 AAA S Client C P 800 AAA Controlled client net created for DVP 400 AAA shares www.jse.co.za Brokers Net- Same Broker S Stock Acct A P 2,000 AAA S Stock Acct B P 200 AAA S Stock Acct C P 600 AAA Brokers net created for RVP 1,200 AAA shares www.jse.co.za Settlement Allegements EOD T+1 Brokers Custody Acct Brokers Net ECS Controlled Clients Net Strate Controlled Clients Custody Acct www.jse.co.za Controlled Clients Net S Client A 1,000 AAA P S Client B P 200 AAA S Client C P 800 AAA No Securities Compulsory Reverse Substitution Brokers net created for DVP 400 AAA shares www.jse.co.za Compulsory Reverse Substitution Controlled clients S Brokers custody Acct MT 586 200 AAA P RVP 1,200 AAA S Controlled Clients P Acct DVP 400 AAA MT 586 200 AAA Reverse Substituted www.jse.co.za Daily Reconciliation MT 535 MT 535 Controlled Clients Custody Acct Brokers Custody Acct MSS MSS www.jse.co.za Rolling Of Settlement New Leg Process NON-CONTR S CLIENT B P NON-CONTR S CLIENT A P 100 AAA 100 AAA 100 AAA 100 AAA BROKER C BROKER D P S 100 AAA 100 AAA 100 AAA 100 AAA 0 S 100 AAA P 100 AAA NEW CONTRACT NOTE FOR NEW SETTLEMENT DATE WITH ORIGINAL TRADE DATE 100 AAA 100 AAA 0 SETTLEMENT AUTHORITY WILL BOOK SETTLEMENT ORDERS 100 AAA www.jse.co.za Failed Trades Retransactions Settlement Process NON-CONTR S CLIENT B P NON-CONTR S CLIENT A P 100 AAA 100 AAA 0 100 AAA VOLUNTARY REVERSE SUBS COMPULSORY REVERSE SUBS BROKER C 100 AAA 100 AAA 0 S 100 AAA 0 CONTRACT NOTE CANCELLED BROKER D P S 100 AAA P 100 AAA 0 SETTLEMENT AUTHORITY WILL BOOK SETTLEMENT ORDERS 100 AAA www.jse.co.za Failed Trades Retransactions New Leg Process NON-CONTR S CLIENT B P NON-CONTR S CLIENT A P 100 AAA 100 AAA 0 BROKER C S 100 AAA BROKER D P 100 AAA S 100 AAA P 100 AAA NEW CONTRACT NOTE WITH ORIGINAL TRADE DATE 100 AAA 100 AAA RETRANSACT 0 0 CLAIM LOSS/PROFIT www.jse.co.za Failed Trades Compensation Settlement Process NON-CONTR S CLIENT B P NON-CONTR S CLIENT A P 100 AAA 100 AAA 0 100 AAA VOLUNTARY REVERSE SUBS COMPULSORY REVERSE SUBS BROKER C 100 AAA 100 AAA 0 S 100 AAA 0 CONTRACT NOTE CANCELLED BROKER D P S 100 AAA P 100 AAA 0 SETTLEMENT AUTHORITY WILL BOOK SETTLEMENT ORDERS 100 AAA www.jse.co.za Failed Trades Compensation Compensation Process NON-CONTR S CLIENT B P NON-CONTR S CLIENT A P BROKER C P S 100 AAA BROKER D 100 AAA 0 S 100 AAA P 100 AAA 0 COMPENSATION PAID www.jse.co.za T+3: Barrier 4 – Corporate Actions www.jse.co.za Copyright© JSE Limited 2008 Analysis Barrier 4.1 - Corporate Action Model The types of Corporate Action Events have been broken down into the following categories: Mandatory Events; Elective Events Choice/Voluntary Events; and Warrants www.jse.co.za Analysis Best Practice Principles The Corporate Actions Model for T+3 has been devised to adhere to the following principles: Entitlements can be traded on LDT + 1; Payment Date is as close to Record Date as possible (RD + 1) Based on the high-level recommendations from the Giovannini Group and International Organization of Securities Commissions (IOSCO) www.jse.co.za Corporate Action Events Mandatory Events www.jse.co.za Mandatory Events Market Decision: Event Information The minimum required information on Declaration Date for Mandatory Events must be: Last Day to Trade (Cum), Ex Date, Record Date and Expected Pay Date Cash Rates and Share Ratios can be announced no later than Finalisation Date by 12h00. Exceptions to this will be dealt with on a case by case basis. If applicable (Mandatory Security or Mandatory Cash and Security): Delisting Date/Termination Date, Suspension Date, Effective Date New ISIN www.jse.co.za Mandatory Events Market Decision The Market has agreed on the following: Should not all information have been made available on Declaration Date then the cut off date for the Event Finalisation should be no later than 12h00 on Finalisation Date. Exceptions to this will be dealt with on a case by case basis. Record Date will always be a Friday. In the event of a Public Holiday, Record Date will be the previous business day. Pre-Advices will be sent from Strate from 16h00 onwards. www.jse.co.za Mandatory Events New Timeline (all Mandatory Events) 1 Day 1 Day Matched ready for 10h00 Settlement for same day returns Declaration Date RD – 13 or earlier Finalisation Date Last Day to Trade RD - 8 LDT RD - 3 First Day to Trade with New Entitlement Record Date Payment Date LDT + 3 RD +1 LDT + 2 LDT + 1 RD RD - 2 www.jse.co.za Corporate Action Events Elective Choice/Voluntary Events www.jse.co.za Elective Events - Choice/Voluntary Events New Timeline - Elective Events (Excluding Dividend Reinvestments) 1 Day 1 Day [ 15h00 Strate to send elections to TS 14h00 Strate to send Pre-Advice 13h00 12h00 10h00 10h00 Declaration Date RD – 13 or earlier Finalisation Date Last Day to Trade RD - 8 LDT RD - 3 First Day to Trade with New Entitlement LDT + 1 RD - 2 LDT + 2 Amended elections may be submitted Elections submitted to Strate (Projected Holdings if settlement has not taken place) Event Eligibility Calculated (where settlement has taken place) Broker submits elections to CSD Participants Matched ready for Settlement for same day returns Cash Entitlements paid on receipt of Cash B.O.D Security Entitlements Posted Payment Date Record Date & Election Deadline Date Withdrawal Date (if applicable) LDT + 3 RD + 1 www.jse.co.za Elective Events - Choice/Voluntary Events Market Decision: Event Information The minimum required information on Declaration Date for Elective Events must be: Last Day to Trade (Cum), Ex Date, Record Date, Election Deadline Date and Expected Pay Date Cash Rates and Share Ratios can be announced no later than 12h00 on Finalisation Date. Default Option and whether Part Elections and/or Restrictions are applicable Elections will be sent to Strate at 13h00 with possible amendments being submitted up until 14h00. Pre-Advices will be sent from Strate from 14h00 onwards. www.jse.co.za Strate to forward Election Instructions to Transfer Secretary at 15h00 Elective Events - Choice/Voluntary Events New Timeline - Dividend Reinvestments E.O.D Send Record Date Positions 13h00 Elections submitted to Strate 10h00 Broker submits elections to CSD Participant 10h00 Matched ready for Settlement for same day returns Declaration Date RD – 13 or earlier Finalisation Date Last Day to Trade LDT + 1 RD - 2 RD – 8 LDT Announcement of SA Dividend Rate RD - 3 LDT + 2 Cash Entitlements paid on receipt of Cash Record Date Record Date + 10 Cash Payment Date LDT +3 Election Deadline Date RD + 20 Share Ratio advised by Transfer Secretary RD + 39 Security Entitlements processed by Transfer B.O.D Secretary Securities and Fractions Payment Date RD + 40 www.jse.co.za Elective Events – Dividend Reinvestments Market Decision: Before Declaration and Finalisation Date The minimum required information on Declaration Date for Dividend Reinvestments must be: Last Day to Trade (Cum), Ex Date, Record Date, Election Deadline Date and Expected Pay Date, SA Rate Conversion Date SA Dividend Rate announced no later than 12h00 Finalisation Date. Dividend rate in foreign currency and whether Part Elections are applicable Restrictions All announcements on Finalisation Date will be made by 12h00. Strate to send Record Date Positions at E.O.D Record Date Elections will be sent to Strate at 13h00 on Election Deadline Date www.jse.co.za Spreadsheets and Fractions Spreadsheets and Fractions Barrier 4.9 and Barrier 4.3 www.jse.co.za Spreadsheets and Fractions Market Decision It has been decided that for all companies listed locally, the rounding convention utilised will be to round down all entitlements. Fractional payments will be paid in cash, with a tolerance level to be decided on at a later stage. Spreadsheets will be required for Initial Public Offerings (IPOs). For Foreign and Dual-Listed Companies, their rounding principles/conventions will be applied. Restrictions will be communicated and it will be the beneficial owner’s obligation to observe such restrictions and adhere to legislative requirements of their own jurisdiction. CSD Participants will not monitor this and should an investor remain silent or make an election, it will be deemed to indicate that the investor can receive such entitlements. www.jse.co.za Parked Action Items Parked Action Items www.jse.co.za Parked Action Items It was agreed by all Market participants that the following action items will be parked and discussed at a later stage: The Elimination of Spreadsheets for surplus rights take-ups, and; The impact of tax legislation on the Corporate Actions model for T+3. www.jse.co.za Securities Lending & Borrowing Increase Liquidity Securities Lending & Borrowing is an enabler for T+3 Focus is on creating more liquidity around Securities Lending & Borrowing:• Education with lenders that they will be protected on any corporate action entitlements – do not have to recall • Education that lenders may start lending out entitlements from LDT+1 for PD • Increase limits for lending – Pension Funds,etc • More lenders • Controlled clients loaning out shares www.jse.co.za Securities Lending & Borrowing Automation Same day Securities Lending & Borrowing Same day Securities Lending & Borrowing returns Collateral movements – securities – Linked to STT Changes to Securities Lending & Borrowing for Corporate Actions Automation of loan confirmations - FIX www.jse.co.za Securities Lending & Borrowing Settlement Authority Educate the market on the role of the JSE Settlement Authority – settlement related Set up direct arrangements with Pension Funds, etc Possible systems to be implemented www.jse.co.za Conversion W T F C M T W T T+1 T+2 O T+3 T+4 T+5 T T+1 N T+2 T+3 T+4 T+5 T V T+1 T+2 T+3 T+4 E T T+1 T+2 T+3 T T+1 T+2 T+3 CA T T+1 T+2 T+3 T T+1 T+2 T+3 T T+1 T+2 RD PD R S I O T F M T T+5 CA N LDT LDT www.jse.co.za Assumptions Limit amount of Corporate Actions No huge market activity – price movements No jobbing across settlement days Migration will not take place over a month end Migration will not take place over a futures close out No public holidays on week of migration www.jse.co.za Actions Market education on conversion process and requirements Securities Lending & Borrowing Rolling Of Settlement Off-market timelines may be moved to facilitate settlement with no penalties Align timelines where possible before go-live of T+3 www.jse.co.za www.jse.co.za 51