Asset Management

advertisement

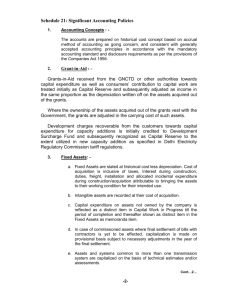

ASSET MANAGEMENT/ MAINTENANCE OF ASSET REGISTERS Assets Register The maintenance of Assets Register of All the Public Sector Undertakings is a statutorily requirement as per Indian Company's Act 1956. Assets Two Types Current assets : Cash in hand, Amount receivable from other organization, Bank Balance. (shown in the Balance Sheet) Fixed assets: Infrastructure of the company such as Land, Building, Apparatus & Plants Fixed assets Tangible assets: Tangible assets are those assets having physical substance that can be seen and touched like Buildings, Plant and machinery Intangible Assets: Intangible assets are those assets that are not having any physical substance but however future economic benefits are expected to flow from them to the enterprise viz. goodwill, trademark, computer software, IPR, Patents Company expenditure On the basis of nature of activities, the expenditure incurred on behalf of company will either be revenue expenditure or capital expenditure The capital nature of expenditure is initially booked under Inventory, Work in Progress or directly under Fixed Asset Fixed Asset - the depreciation on such assets starts the date of booking under Fixed Asset . if capital nature of expenditure is booked under WIP or Inventory, the depreciation does not start till the transfer of such expenditure to Fixed asset. Consideration of Fixed Assets: Guidelines Capital Expenditure Items Eg. Expenditure incurred for Installations Commissioned Land and Buildings Vehicles Standby equipments Addition and Alterations Revenue Expenditure Eg. Expenditure incurred for Shifting and re-installation of existing assets Consideration of Fixed Assets: Guidelines Capital Expenditure Items Expenditure on replacement of assets, equipments, instruments and rehabilitation works can also be capitalized, if in the opinion of the management, it results enhancing the revenue earning capacity. For this Management Certificate is required for record. Treatment of Work in Progress as Fixed Assets: For capitalizing & taking into accounts as fixed assets, “Management Certificate” will be issued by the Management Depreciation: Depreciation means a fall in the quality, quantity or value of an asset Causes of depreciation Wear and tear due to actual use b) Efflux of time- mere passage of time will cause a fall in the value of an asset even if it is not used. c) Obsolescence- a new invention or a permanent change in demand may render the asset useless; d) Accident; and e) Fall in market price. Depreciation: The fact to remember is that except in a few cases ( e.g. land and old paintings) all assets depreciate Full depreciation is charged on Capital expenditure up to Rs.5, 000/Income Tax Act, 1961 provides for 100 % depreciation on those items of plant and machinery whose actual cost does not exceed Rs. 5,000 each MSTC (Metals and Scrap Trading Corporation). Methods for Providing Depreciation In BSNL depreciation is provided on written down value method. Under this method, the rate or percentage of depreciation is fixed, but the first year, depreciation is written off proportionate to the actual period in use. The Depreciation on the Rs. 20,000the cost of the asset- at the rate of 10% will be Rs. 2000 in the first year. This will reduce the book value of the asset to Rs. 18,000. Depreciation in the second year will be Rs. 1800 i.e. 10% of Rs. 18000/-. Rate of Depreciation in BSNL 5% 13.91% 15.33% 18.10% 25.89% 40% 45.8% Building Lines & Wires, Installation Test Equipments, Masts & Aerials, Office Machinery & Equipment , Electrical Fitting & Appliances Apparatus & Plants, Cable Furniture & Fixtures Motor Vehicle & Launches Computer Subscriber Installations Terminologies Associated with Assets Non Performing Assets: An asset which is producing no income. Obsolete Assets: The Asset which has outlived its economic life, or due to change of technology it is not useful to generate revenue Unserviceable Assets: The asset which is not useful for the department being beyond economic repairs and as such is not useful for generating revenue. Surplus Assets: An asset may be treated as surplus when the same is in excess of requirement for a specified period. Inventory Non Moving Inventory: If an item is lying in stock/depots continuously for more than three years without any issue. Slow Moving Inventory: when only 10% to 15% of the said items in stock are issued each year for a period of 2 to 3 years continuously. Questions ? Thank You