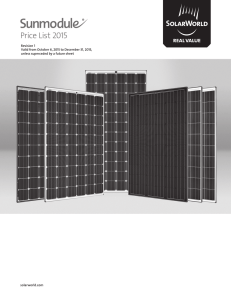

SolarWorld Sunmodule Plus®

advertisement

SolarWorld Sunmodule® Dr. Robert Harmon Portland State University MKTG 464, Summer Term Presented by: Joe Bazeghi Rob Macy Brandon Pitzer Rian Rifkin Mike Tomasovic Agenda Business Overview Technology Assessment Market Analysis Competitor Analysis Net Assessment Marketing Strategy Implementation Conclusion The BIG Idea Why solar? Rising energy prices and increased environmental concerns are driving solar energy adoption. Renewable energies lessen dependence on foreign and fossil fuel sources. Extension of 30% federal ITC until 2016. Installing solar saves money on energy bills, and increases property values. Solar installations have a life-cycle of 25-30 years. Boosts the economy by creating jobs for domestic manufacturers and installers. Business Opportunity The U.S. is currently the fourth largest PV market in the world, and poised for massive growth as the economy recovers, driven by falling prices for solar products and government incentives at both the state and federal level: The PV industry generated $38.5 billion in global revenues in 2009. 34,000+ new solar installations in the U.S. in 2009. Solar is closer than ever to achieving grid-parity. The 30% federal tax credit has been extended through 2016 for both commercial and residential PV installations. Achieving Grid Parity Business Unit Overview SolarWorld USA Hillsboro, OR: Produce monocrystalline silicon ingots, cut wafers, and manufacture of PV cells. Camarillo, CA: Cells assembled into high-quality Sunmodule® solar panels. Vancouver, WA: Recycling and reprocessing of silicon for reuse. Product Description SolarWorld provides customized solar energy solutions for consumers seeking renewable and sustainable sources of power. Objective, Scope & Advantage Objective: To become the quality leader and top-of-mind brand for solar modules within the United States in the next 3 years. Scope: The company's production facility location strategy allows for rapid market response within key geographic segments with the greatest growth potential. Vertical integration throughout the PV value chain allows the company to secure access to raw materials at competitive prices. With more than 30 years experience in the solar market it is a recognized brand name, and has a history of quality production to back it up. Advantage: SolarWorld will provide the highest quality, most efficient solar panels at competitive prices for residential and commercial segments within the United States. Understanding the consumer better than competitors will allow SolarWorld to create value through superior design, efficiency, functionality, support and services, and effective marketing communications. Brand Identity Pioneering Spirit Social Responsibility Innovation Durability Safety Sustainability Economic Success Strengths/Weaknesses to Address Strengths: Proven Technology Best Value Industry Experience Brand Equity (Germany) Weaknesses: Focus on Existing Technology Low-cost Competition Lack of Brand Equity (USA) Product Description Sunmodule Plus® and Sunkit® Customized Solar Solutions Max Power: 240 W 17% STC Efficiency 60 Monocrystalline Cells 66” x 40” 48.5 lbs. 4 mm Tempered Glass Aluminum Frame 25-year Linear Performance Guaranty ISO 9001:2000 Certified Facilities Product Technology Solar Installation: PV module array, interconnective wiring, inverter, and batteries (optional). Solar Modules: Solar cells encased in glass and framing for durability and protection from elements. Solar Cells: Cut from monocrystalline (USA) and polycrystalline (Germany) silicon wafers. Photons from the sun are captured by solar cells, dislodging electrons in the silicon wafer, and producing energy. Direct current (DC) power runs through the inverter, and is converted to alternating current (AC). The Solar Value Chain 1. Silicon 2. Wafers 3. Cells 7. Recycling 6. Systems 5. Kits 4. Modules Competing Technologies Thin Film: Primarily uses cadmium telluride (CdTe) as semiconductor material 18% of PV product market in 2009 First Solar (China) module was #1 PV product in 2009. 43% of U.S. production was in thin cell technology in 2007 (Jager-Waldau, 2008) Cheap to produce (>$1/W), but CdTe is highly toxic and banned in the EU. Ribbon: Silicon is grown in thin two-dimensional strips between two ribbons to overcome inefficiency of crystalline ingot production. Evergreen is primary competitor using ribbon technology, but are not yet able to achieve power or efficiencies of SolarWorld modules. Disruptive Technologies Concentrating Solar Power (CSP): Uses mirrors and lenses to improve power generation efficiency. Axis-tracking Systems: Rotates panels on vertical and/or horizontal axis to increase degree of insolation (i.e. sun exposure). Electrochemical PV Cells: Possibly cheaper to manufacture than silicon-based technology, but efficiency and durability not yet proven. Potential Market Segments Residential customers are those living in space that has been designated by local authorities as an area primarily used for housing. The average residential installation consists of fewer than thirty individual modules; however, in 2008 almost 90% of total installations were at residential locations. (Sherwood, 2009) Commercial facilities are those that are designated for commerce. They include retail, event, office space, and public buildings (including universities and other government facilities), as well as multi-family residential facilities such as apartment buildings, condos and duplexes; which are included because a decision to install a solar system will be based, at least in part, on increased sales of units. Industrial includes all utility scale developments, which may include a thousand or more individual modules per installation, as well as factory and production based systems. These are very large systems; in 2008 “a total of 84 systems larger than 500 kW accounted for more than 30% of the total PV capacity installed.” (Sherwood, 2009) Aggressive growth rates expected due to the introduction of statutory minimum shares of renewable energies in the energy mix as well as Cash Grant programs available for the utilities providers. Segmentation Forecast U.S. - New Capacity Forecast (MW) 2010e 2011e 2012e 600 1,200 1,500 1,000 2,000 3,000 Number of Solar Modules Needed to Achieve Capacity Forecast - Moderate Scenario (210 W Average) 2,857,143 5,714,286 7,142,857 Number of Solar Modules Needed to Achieve Capacity Forecast - Policy-Driven Scenario (210 W Average) 4,7691,905 9,523,810 14.285.714 Moderate Scenario (MW) Policy-Driven Scenario (MW) Source: EPIA. (2010). Global market outlook for photovoltaics until 2014. TAM by Segment TAM by Segment - New Capacity Installed, 2009 Index New Installation Capacity 2009 (kW) Number of Installations USA Residential 100% 228,960 76,320 34,000 12,240 16,320 5,440 817,714 1,090,286 363,429 Solar Panels per Installation (210 W) 67 Avg Expenditure per Installation Total Solar Panel Market Potential 16.0% 171,720 14 Avg Expenditure per Panel 48.0% Industrial 477,000 Avg Capacity per Installation (kW) Total Solar Panels Sold 36.0% Commercial 2,271,429 $600 $600 $600 $600 $40,084 $1,362,857,143 $ 490,628,571 $ 654,171,429 $ 218,057,143 TAM by State: Chain Ratio Model TAM by Top-10 States - New Capacity Installed, 2009 USA CA 100% Index New Installation Capacity 2009 (kW) Number of Installations 13.0% 8.0% 5.0% 62,010 38,160 23,850 34,000 16,660 4,420 2,720 1,700 1,113,000 295,286 181,714 113,571 $ 667,800,000 $ 177,171,429 $ 109,028,571 Connecticut North Carolina Solar Panels per Installation (210 W) 67 2,271,429 Avg Expenditure per Panel $600 Avg Expenditure per Installation $40,084 Total Solar Panel Market Potential $1,362,857,143 Hawaii 5.0% $ Arizona 233,730 14 Colorado 49.0% Florida 477,000 Avg Capacity per Installation (kW) Total Solar Panels Sold New Jersey New York 3% Massachusetts 3.0% 2.0% 2.0% $ 68,142,857 Others 2.0% 7.0% 23,850 14,310 14,310 9,540 9,540 9,540 33,390 1,700 1,020 1,020 680 680 680 2,380 113,571 68,143 68,143 45,429 45,429 45,429 159,000 68,142,857 $ 40,885,714 $ 40,885,714 $ 27,257,143 $ 27,257,143 $ 27,257,143 $ 95,400,000 Segment Profiles Residential Industrial Commercial Demographics Age: 25-50 Gender: Male and Female Income: Moderate - High Marital: Married Education: Bachelor’s Degree or MBA Race, ethnicity, nationality: Caucasian, Asian Social class: Upper/Middle Geographic: Southwest US Age: 40-60 Gender: Male Income: High Marital: Married Education: MBA Race, ethnicity, nationality: Caucasian, Asian Social class: Upper Geographic: Southwest US Age: 25-60 Gender: Male Income: High Marital: Married Education: MBA Race, ethnicity, nationality: Caucasian, Asian Social class: Upper Geographic: Southwest US Psychographics Personality: Identity driven Perceptions, attitudes: Liberally minded individual who is heavily influenced by trends of sustainable living and green marketing. Values: Reduce energy dependence and lower carbon foot print. Personality: Incentive driven Perceptions, attitudes: Slightly skeptical of green marketing. Motivated to utilize sustainable practices because of financial incentives and environmental regulations. Values: Success of business, capitalize on green trends. Personality: Identity/Incentive driven Perceptions, attitudes: Concerned about environmental sustainability but is motivated into action by sales/profit opportunities driven by green marketing trends. Values: Develop into a green business, improve value of business and increase profits. Behavioral Purchase behavior: One time purchase Preferred POP: Retail Outlets / Customized Business Solutions Loyalty: Low End user: Home owner Purchase behavior: Multiple purchases as solar operations continue to grow. Preferred POP: Customized Business Solutions Loyalty: Low End user: Employees Purchase behavior: One – Three purchases, possibly more. Preferred POP: Customized Business Solutions Loyalty: Medium End User: Local consumers, customers, residents, Customer-Value Drivers Cost of Ownership ROI/Profitability Best Quality/Reliability/Durability Outperforms Competition Superior Service & Support Shared Values Credibility (Trust, Expertise, Similarity) Visibility, Recognition, Self-Esteem Desire to Be Viewed as a Problem Solver Buyer’s Task Requirements Segment Weighted Average Residential 7.84 Commercial 7.95 Industrial 7.01 fO wn er RO it y sh I/P ,R ip r el of ia i ta bi O bi lit ut lity y, pe D Su rfo ur ab rm pe ilit r io s y Co rS m er Cr p vic et ed itio e ib an ilit n y d (T Su Vi ru pp Sh sib st or ,E ar ilit De t ed y, x p sir R er Va ec e t ise lu to og es ,S Be ni t im io Vi n ila ew & rit ed Se y) lfas E Bu a st ee Pr ye ob m r's l em Ta -S sk ol R ve eq r ui re m en Se ts gm en tS iz e G ro wt h Be st Q ua l Co st o Rank Segment Attractiveness Analysis: Customer-Value Drivers Segment Attractiveness Factors 10 9 8 7 6 5 4 3 2 1 0 Grid-Connected Residential Industrial Commercial Customer-Value Drivers Features, Advantages, & Benefits Price Cell Technology Power Output Power Tolerance Design Warranty Durability Performance Recycling Program Safety Increases Property Value Sustainability Green Self-Image Support Economy Reduces Risk Segment Weighted Average Residential 7.71 Commercial 7.93 Industrial 6.93 C Po ell we Te Pri r O ch ce n P o ut p ol o Li ne we ut gy ar r T (kW Pe ol rfo er h) an rm an D ce es ce W i gn ar r D ant u R Pe r a y ec b yc rfor ility lin m In g an cr Pr ce ea og se ra s m P Su r o Sa st pe ai rty fety n R Su Gr ab Va ed pp e le lu uc or en E n e es tin Se er Ri g U lf-I gy sk m S (E Ec age n e on rg om y Pr y ic es ) Rank Segment Attractiveness Analysis: Features, Advantages, & Benefits Segment Attractiveness Factors 10 9 Grid-Connected Residential 8 7 Industrial 6 5 4 Commercial 3 2 1 0 Features, Advantages & Benefits Perceptual Map of Segments/Drivers Customer-Referent Value Drivers (Emotional) Residential Commercial Product-Referent Value Drivers (Rational) Industrial The Strategic Sweet Spot Customers’ Needs Information ROI Performance/Efficiency Self-Image Competitors’ Offerings Lowest Price New Technologies Ad-Hoc Systems SolarWorld-Customer Alignment Experience → Information Best Quality → Performance/Efficiency Brand Identity → Self-Image SolarWorld Capabilities Best Quality Competitive Pricing Brand Identity Experience Solar Solutions Target Market Selection Primary Market: “Green Money” Secondary Market “Joe Greenthumb” RATIONALE: The Commercial segment is our most attractive market via our Segment Attractiveness model. Additionally, growth rates for this segment are also very optimistic and provide strong motivations for SolarWorld. However, the Residential market also appears attractive and so we hope to expand our efforts into that market in the near future (3-5 years). Porter Model: Competitive Forces Supplier Power: Low – Market spot prices for silicon have plummeted recently, and long-term procurement contracts mitigate risk. Evergreen BP Solar Sharp Kyocera & more…. Substitution Supplier Power New Entrants Threat of New Entry: High – The number of solar manufacturers in the U.S. has more than doubled since 2005, and Chinese production has surged. Buyer Power: High – There are a number of solar products available for buyers to choose from. Buyer Power Threat of Substitution: High – Until solar power can achieve grid parity, many consumers will continue to obtain power from non-renewable and alternative energies. Competitor Analysis Sales Revenue (2009) No. of Employees Market Position (Cell/Module Production 2009) Technology SolarWorld $1.4 billion >2,700 worldwide 14.8% Monocrystalline and Polycrystalline Solar Cells Evergreen $267 million 729 6.4% String Ribbon® Technology BP Solar $5 billion 2,200 6.7% Monocrystalline and Polycrystalline Solar Cells Sharp $2.24 billion 64,500 6.8% Crystalline and Thin Film Solar Cells Kyocera $1.77 billion 6,783 (Applied Ceramics Parts Group) 4.2% Polycrystalline Solar Cells Be st Q ua l fO wn er sh RO ip it y I/P ,R ro f it el ab ia bi ilit l i y ty O ,D ut pe ur rfo ab Su rm ilit pe y s r io Co rS m pe er tit vic io Cr e n ed an ib d ilit Su y pp (T Sh or ru t st ar Vi ,E ed sib xp Va ilit De er y, lu t ise sir es R ec e , Si to og m Be ni ila tio Vi rit n y) ew ,S ed el f -E as st a ee Bu Pr m ob ye le r's m Ta -S sk ol ve R r eq ui re m en ts Co st o Rank Competitive Factors Mapping Competitive Factors Analysis 10 9 8 7 SolarWorld Evergreen Kyocera Sharp 6 BP Solar 5 4 3 2 1 0 Customer-Value Drivers Competitive Factors Analysis Cost of Ownership ROI/Profitability Best Quality/Reliability/Durability Outperforms Competition Superior Service & Support Shared Values Credibility (Trust, Expertise, Similarity) Visibility, Recognition, Self-Esteem Desire to Be Viewed as a Problem Solver Buyer’s Task Requirements Manufacturer Weighted Average SolarWorld 7.96 Evergreen 5.93 Kyocera 6.40 Sharp 6.99 BP Solar 5.86 SWOT Analysis STRENGTHS WEAKNESSES SolarWorld is the largest PV panel manufacturer in U.S. with 30-years experience and a strong quality reputation. Vertically integrated from silicon to solar module. Solid financial position and growth. Location strategy puts manufacturing near regions where high-growth is anticipated. Sunmodule panels independently tested and shown to be one of the most efficient available. Price Competitive: based on multiple quotes average price for SolarWorld modules are $2.25$3.00 per watt, versus industry average of $4.18 per watt as of July, 2010. Unique linear performance guaranty. Focus OPPORTUNITIES THREATS Increasing Cost U.S. production capacity will allow for rapid market response to anticipated growth. Continuous process and design improvements are leading to more efficient solar modules without increased costs. Price of silicon is expected to remain low or continue to decrease. Incorporating new technologies such as CSP or axis-tracking systems could improve installation efficiencies. State-by-state incentives and emerging FiT models will continue to drive growth in the U.S. on existing silicon-based technology. company lacks a diverse portfolio of products in contrast to some competitors. Until solar power achieves grid parity, business is reliant on government incentives to drive growth. Manufacturing in Germany, South Korea, and the U.S. may result in labor costs that prevent competitive pricing with solar products from China. Inability to rapidly scale-down production if anticipated demand declines. The of power from other renewable energy sources such as hydro and wind is less than current cost of solar energy. In 2009 PV supply exceeded demand, yet highgrowth potential continues to lure new entrants to the market. Emerging technologies such as thin film and electrochemical cells are cheaper to produce than crystalline cells. Global economic instability may continue, leading to poor capitol market performance, and decreased demand for solar. Critical Risk Factors Critical Risk Factor Description Mitigate Metrics PV modules are commoditized Differentiation between SolarWorld’s PV modules and their competitors is not clearly defined to consumers. Provide value innovations to consumers through unique features and designs. Sales Growth, Customer Satisfaction Self-limited distribution While the company has a long history of producing PV technology, the company has limited their distribution through partnered wholesalers and retailers who then sell to installers. Include retail stores like Home Depot, who have their own contractors and installers, in their distribution chain. Addition of Retail Channels Sales reliant on continued government incentives and support The cost of installing a PV solution becomes much less attractive when consumers have less financial incentive to do so. Improve panel efficiency and cost reductions to make PV systems more equitable with conventional energy prices. Parity Comparisons with Other Energy Sources Manufacturing capacity SolarWorld has only three manufacturing facilities in North America. Continue to increase manufacturing operations domestically in other key market areas. Production Capacity in MW Critical Success Factors Critical Success Factor Description Leverage Metrics Improve brand management SolarWorld must continue to build on the equity of their brand name in order to differentiate from competitors. Turn SolarWorld’s stance on supporting domestic manufacturing into a unique brand factor. Focus Group Studies on Brand Recognition, Installer Brand/Quality Scorecards Technology innovations and panel efficiencies Due to the lowered costs of materials, SolarWorld has room to improve efficiencies of their products and create new value drivers. Refocus company resources towards product improvement and increased panel efficiencies. Installer Brand/Quality Scorecards, % of Budget Allocated to R&D Build # of business relationships SolarWorld’s key product offerings could better benefit from external support (product design, distribution, product support) in domestic and foreign markets. SolarWorld should forge new relationships with additional distributors, retailers, government agencies, and drivers of sustainable energy. Addition/Acquisition of Suppliers, Addition of Contract w/Government Business Reduce manufacturing costs SolarWorld must continue to cut costs in different stages of the manufacturing process. Improve logistical systems and internal communications to reduce excess materials and overproduction. Reduction in Materials, WIP Goods, and Finished Goods Marketing Strategy Strategy Platform - Dashboard Market Share Growth in Sales for SunModule panels between 2011-2013 $25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 Sales 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Market Share 20 11 :Q 20 1 11 :Q 20 2 11 :Q 20 3 11 :Q 20 4 12 :Q 20 1 12 :Q 20 2 12 :Q 20 3 12 :Q 20 4 13 :Q 20 1 13 :Q 20 2 13 :Q 20 3 13 :Q 4 1 2 3 4 1 2 3 4 1 2 3 4 :Q :Q :Q :Q :Q :Q :Q :Q :Q :Q :Q :Q 11 11 11 11 12 12 12 12 13 13 13 13 20 20 20 20 20 20 20 20 20 20 20 20 70,000,000.00 60,000,000.00 ROM 50,000,000.00 40,000,000.00 Investment in Marketing ($) 30,000,000.00 20,000,000.00 Return on Marketing (Revenues) 10,000,000.00 2011: Q1 2011: Q2 2011: Q3 2011: Q4 2012: Q1 2012: Q2 2012: Q3 2012: Q4 2013: Q1 2013: Q2 2013: Q3 2013: Q4 0.00 Profit Unaided Recall per hudered respondents $2,500,000.00 2013: Q4 2013: Q3 2013: Q2 2013: Q1 2012: Q4 2012: Q3 2012: Q2 Unaided Recall per hudered respondents 2012: Q1 20 11 : 20 Q1 11 20 : Q2 11 20 : Q3 11 : 20 Q4 12 20 : Q1 12 : 20 Q2 12 20 : Q3 12 : 20 Q4 13 20 : Q1 13 20 : Q2 13 : 20 Q3 13 :Q 4 $0.00 Profit 2011: Q4 $500,000.00 2011: Q3 $1,000,000.00 100 80 60 40 20 0 2011: Q2 $1,500,000.00 2011: Q1 $2,000,000.00 Ansoff Growth Matrix Existing Products Existing Markets Market Penetration • • • New Markets • Product Development • Target competitors customers Additional promotions focusing on SolarWorld quality & performance Increase promotions in spring and summer when weather is best for solar efficiency and construction/remodeling project investments. Market Development • New Products As prices for solar decline it will become more reasonable for lower income customers to acquire. Partner with existing retail and commercial establishments to retro-fit buildings with solar. • Further innovation of current solar modules to increase nameplate watt capacity Develop integrated online solar installation tracking system Diversification (The “Blue Ocean”) • • • • Creating a “put it together yourself” solar module Development of a plug in solar module Create solar module financing Incorporate axis-tracking systems into Sunkit solar solutions Positioning as Quality Leader Tangible and Intangible Tangible quality refers to gaps, or surpassed achievement, between expected and perceived performance of physical elements of the value proposition. Associated value drivers: Outperforms the competition, reduces environmental costs KPI’s: Customer retention rate, customer complaints, total life performance, delivered watts, freedom from defects Intangible quality extends to encompass all aspects of customer and product imbedded services. Benefits can be broken into two basic categories: •Functional benefits = ƒ(operational excellence, knowledge, time, innovation) Associated value drivers: reduced environmental costs, best customer service KPI’s: Product platform, design metrics, usability, technology •Social benefits = ƒ(customer intimacy) Associated value drivers: Shared values, self/brand image congruency KPI’s: Internet buzz, customer satisfaction, adoption rate Positioning - continued We choose to position on intangible benefits. Solar panels are quickly becoming commoditized Service as differentiating factor Knowledge, skills, techniques, and customer relations are not commodities They are not easily copied by competitors Market Leadership Strategies Value Discipline Radar Chart Knowledge 3 2 Time 1 Innovation 0 Customer Intimacy Operational Excellence Value Proposition SolarWorld does not tell us what we want; they develop relationships and listen to the customer in creating value. Every step of the way and throughout the lifetime of the system, SolarWorld collaborates with the customer and provides customized solutions to meet our energy needs. The systems consistently outperform the competition, and their customer service is unmatched in the category. The individuals and companies that purchase SolarWorld solutions care about our environment, our nation and their relationships with others and society. That is only one reason that SolarWorld owners are the type of people that you want to be associated with; because they care, and they care enough to change the broken paradigm that is our nation’s energy crisis. These people are compassionate innovators, consummate patriots and problem solvers; members of a club that you want to be associated with. “Together with SolarWorld making a better world, one solar solution at a time.” Brand Strategy Together with SolarWorld creating a better world, one solar solution at a time. We’re going on the OFFENSE! Invest to grow IS and marketing communications New production capacity Improve position Marketing communications Increase customer intimacy New market entry Existing offerings to new markets. Community purchasing agreements – lowmoderate income levels. Linking Strategy to Value Knowledge • Source credibility • Best technical solution • Best feature set Innovation • Innovative solution • Further decrease of environmental costs Operational Excellence • Delivered initial cost • Best quality/reliability/durability • Meets/exceeds expectations Customer Intimacy • Shared values • Self/brand image congruency • Best customer service/support Time • Best customer service/support Transition to the 4 P’s Associated Value Drivers Product – Outperforms the competition, customer service, reduced environmental costs Promotion – Shared values, self/brand image congruency Product Launch Timeline 2011- Release of Axis Tracking System to customers in Q1 2012- Smartphone application released in Q1 2013- Product launch at retail outlets of the home Sunkit in Q1 2013- In house financing offered to all segments in Q3 SolarWorld Product Platform Residential Segment Monocrystalline Modules Polycrystalline Modules Sunkit® w/ Axis-Tracking for Residential SunModule Plus® 240 W Sunkit® App for Residential Sunkit® w/ Axis-Tracking for Commercial Commercial Segment Wafers & Cells SolarWorld DIY Home Kit In-House Financing Sunkit® App for Commercial Solar Farm Installations >1MW Industrial Segment Solar Modules and Customized Solutions Cell Technology (c-Si) Unique Product Elements Common Platform Elements Silicon Ingots, Wafers, and Cells Time Adapted From Source: McGrath, Michael (2001), Product Strategy for High Technology Companies, New York: McGraw-Hill Sales & Distribution Plan Promotion Plan “Working together to make a better world, one solar solution at a time.” Advertising (CA, NJ, FL, CO, & AZ spot markets) Public Relations Regular news center updates and press releases to generate awareness. Make marketing personnel available for interviews. Corporate Social Responsibility: Expand Solar2World program into lower income neighborhoods within the U.S. Sales Promotion Television: 3-month rollout 2011, then transition to flighting schedule. High reach medium to build awareness rapidly. Radio: Coverage in select geographic locations. Outdoor: Geographic flexibility and buzz factor. Magazines: Regionally-based commercial development and business magazines with distribution in key markets. Brochures: Distribution to installation partners and in response to individual requests for information. POP: Necessary for year 3 rollout to retail chain (Lowes). Internet: Key medium for consumers as solar is high-involvement product. Trade Shows: Key trade show events centered in CA. Direct Marketing Social Media:Active participation in social media vehicles (Facebook & Twittter). Customer Relationship Management: Develop robust CRM program; Make customers know that with purchasing system they have become part of the SolarWorld family. Pricing Plan Hybrid pricing strategy over the next three years that includes both skimming and penetration pricing. During the launch of the each new SunModule refresh, SolarWorld will want to price skim and leverage the value of their brand and emphasize high quality with premium prices. This will also allow SolarWorld to skim the inelastic demand with brand image pricing. Overtime, it will be important to reduce prices over the product life cycle to attract those price sensitive buyers and sustain their market share. The initial launch price (Q1 2011) for the SolarWorld SunModule Plus 240 will be $699.99 per module as we believe it is sufficiently higher than most competitors to signal a premium quality message. With increased watt performances in each product refresh, we plan to lower the price to $639 (by Q4 of 2011) to get rid of outdated wattage modules as well as penetrate the market. Annually, the price of SunModule is expected to decrease at an average rate of 8%. Implementation: Marketing Budget Marketing Objectives Sales: $59 million (Y3) Market Share: 7.5% (Y3) Sunmodule Plus® 3-Year Sales Potential $70,000,000 $59,091,293 $60,000,000 Revenue $50,000,000 $40,000,000 $30,231,624 $30,000,000 $20,000,000 $11,049,743 $10,000,000 $1 2 Year 3 Organizational Requirements CEO VP Marketing Sales Director Marketing Director Dir. Product Development Sales Department Marketing Department R&D Department Marketing Budget SolarWorld Marketing Budget 2011 2012 2013 Marketing Management $169,686.60 $464,255.10 $907,441.65 Sales Management $124,436.84 $340,453.74 $665,457.21 Planning & Market Development $124,436.84 $340,453.74 $665,457.21 Account Managers $45,249.76 $123,801.36 $241,984.44 Technical Support $33,937.32 $92,851.02 $181,488.33 Installer Training $11,312.44 $30,950.34 $60,496.11 Marketing Communications $113,124.40 $309,503.40 $604,961.10 Advertising $169,686.60 $464,255.10 $907,441.65 Public Relations $113,124.40 $309,503.40 $604,961.10 Sales Promotions $90,499.52 $247,602.72 $483,968.88 Direct Marketing $79,187.08 $216,652.38 $423,472.77 Other Miscellaneous $56,562.20 $154,751.70 $302,480.55 $1,131,244.00 $3,095,034.00 $6,049,611.00 Total Marketing Budget Marketing Communications Budget % of Budget 3-Yr Budget 53% $ 2,723,110 $ 299,780 $ 820,184 $ 1,603,147 Television (Cable) 50% $ 1,361,555 $ 149,890 $ 410,092 $ 801,573 Radio 15% $ 408,467 $ 44,967 $ 123,028 $ 240,472 Outdoor 10% $ 272,311 $ 29,978 $ 82,018 $ 160,315 Magazines 15% $ 408,467 $ 44,967 $ 123,028 $ 240,472 Brochures 3% $ 81,693 $ 8,993 $ 24,606 $ 48,094 POP 5% $ 136,156 $ 14,989 $ 41,009 $ 80,157 Internet (Tiles) 2% $ 54,462 $ 5,996 $ 16,404 $ 32,063 20% $ 1,027,589 $ 113,124 $ 309,503 $ 604,961 100% $ 1,027,589 $ 113,124 $ 309,503 $ 604,961 15% $ 770,692 $ 84,843 $ 232,128 $ 453,721 Exibits 40% $ 308,277 $ 33,937 $ 92,851 $ 181,488 Trade Shows 60% $ 462,415 $ 50,906 $ 139,277 $ 272,232 7% $ 359,656 $ 39,594 $ 108,326 $ 211,736 Social Media 30% $ 107,897 $ 11,878 $ 32,498 $ 63,521 CRM 70% $ 251,759 $ 27,715 $ 75,828 $ 148,215 5% $ 256,897 $ 28,281 $ 77,376 $ 151,240 SEO/SEM 75% $ 192,673 $ 21,211 $ 58,032 $ 113,430 Solarworld App 25% $ 64,224 $ 7,070 $ 19,344 $ 37,810 $ 5,137,944 $ 565,622 $ 1,547,517 $ 3,024,805 SolarWorld MarCom Budget ADVERTISING PUBLIC RELATIONS CSR Initiatives SALES PROMOTION DIRECT MARKETING Internet/Web TOTAL 2011 2012 2013 3-Year Profit & Loss Statement SolarWorld 3-Year P&L Statement 2011 2012 2013 $ 11,312,435 $ 30,950,339 $ 60,496,105 $ 6,787,461 $ 15,475,170 $ 27,223,247 $ 4,524,974 $ 15,475,170 $ 33,272,858 R&D $ 113,124 $ 309,503 $ 604,961 SG&A $ 1,696,865 $ 4,642,551 $ 9,074,416 Mktg Personnel $ 1,131,244 $ 3,095,034 $ 6,049,611 Mktg Expense $ 565,622 $ 1,547,517 $ 3,024,805 TOTAL Operating Expenses $ 3,506,855 $ 9,594,605 $ 18,753,793 Earnings Before Taxes $ 1,018,119 $ 5,880,564 $ 14,519,065 Taxes (35%) $ (356,342) $ (2,058,198) $ (5,081,673) Net Income $ 661,777 $ 3,822,367 $ 9,437,392 Gross Sales COGS Gross Income Operating Expenses Conclusion The Commercial market for solar panels in the United States is very attractive due to high growth and high brand identity alignment with customer value drivers. SolarWorld is unique from other PV competitors due to their vocal support of domestic manufacturing and strong reputation for quality panels at affordable prices. In order to be successful reaching the Commercial (and eventually Residential) segments SolarWorld will need to emphasize their accessibility and ease of purchase in all future marketing efforts.