North Country Auto, Inc (compilation)

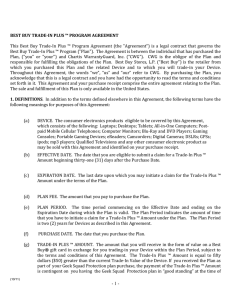

advertisement

NORTH COUNTRY AUTO, INC. Group IV: Galing Priyatna Gradithasari Helmi Indra BACKGROUND Company information : Franchised dealer and factory authorized service center for Ford, Saab and Volkswagen. Each of three manufacturers used a different computer systems for tracking inventory and placing new orders and required dealers to maintain an adequate service facility with a crew of trained technicians and spare parts inventory, level of investment for each product line. BACKGROUND Company information : The dealership was situated in an upstate New York Town with a population of about 20000, served two nearby towns of 4000 people as well as rural areas covering a 20-mile radius. North Country began operations in 1968,. Owned as a corporation by George Liddy and Andrew Jones. Mr Liddy focused on new and used car sales. BACKGROUND Company information : Mr Jones concentrated on managing the parts, service, and body shop departments. George Liddy was feeling pretty good about the new control systems recently put in place for his five department managers (new and used car sales, service, body, and parts departments). He strongly believed in the concept of evaluating each department individually as a profit center. BACKGROUND Industry Information • Aggressive discounting • High inventories (exhibit 1) • More educated customer • Proliferation of new entrants BACKGROUND Industry Information • Industry analysts estimated that fewer than 50% of dealers in the US would make a profit on new car sales in 1990 • Overall net profit margins were expected to fall below 1% of sales (the wall street journal. Dec 11, 1989) DEPARTMENTAL STRUCTURE North Country Auto, Inc. New Car Sales Used Car Sales Service Parts Body Shop IMPORTANCE ISSUES Before George Liddy • All five departments operated as a part of one business. • Department managers were paid salaries and a year end bonus determined at the owner’s discreation based on overall results for the year and subjective appraisal of each managers. • This system did not provide proper motivation for the managers. George Liddy “The New Control Systems” • All five departments were operated as profits centers. • Mr. Liddy believed in decentralized profits centers and performance-based compensation as superior models of control. • He instructed each of his departmental managers (new, used, service, body, and parts) to run his/her department as if it were an independent business. • The management of each department were awarded bonuses based on departmental Gross Profit. The Potential Problems • In addition to finding a way to effectively track departmental performance, George Liddy had to devise a sensible system for transfer pricing. • Mr. Liddy acknowledge that a complex interrelationship existed among the profits centers in the course of normal business transactions. QUESTIONS ① Using the data in the transaction, compute the profitability of this one transaction to the new, used, parts, and service departments. Assume a sales commission of $250 for the trade-in on a selling price of $5,000. (Note: Use the following allocations [new, $835; used, $665; parts, $32; service, $114] for overhead expenses while computing the profitability of this one transaction. These overhead allocations are also shown as Note 13 in Exhibit 3.) QUESTIONS ② How should the transfer-pricing system operate for each department (market price, full retail, full cost, variable cost)? ③ If it were found one week later that trade-in could be wholesaled for only $3,000, which manager should take the loss? QUESTIONS ④ North Country incurred a year-to-date loss of about $59,000 before allocation of fixed costs on the wholesaling of used cars (see Note 2 in Exhibit3.) Wholesaling of used cars in theoretically supposed to be a break-even operation. Where do you think the problem lies? ⑤ Should profits centers be evaluated on gross profit or “full cost” profit? ⑥ What advice do you have for the owners? ANSWER (1) New Revenue DP Trade in Loan Total Cost $2,000 $4,800 $7,350 Used Sales $14,150 COGS OH $11,420 $835 Part $5,000 Brakes Lock Full Tune Up $5,000 Trade-in cost Repair & Tuneup Sales Commission Overhead $4,800 $705 $250 $665 Service $125 $30 $80 Brakes Lock Cleaning Full Tune Up $235 1/1.4 from rev Overhead $167.86 $32 $175 $45 $75 $175 $470 1/3.5 from rev Overhead $134.29 $114 Total $12,255 $6,420 $199.86 $248.29 Profit $1,895 ($1,420) $35.14 $221.71 Total Profit : $731.85 ANSWER (1) - ALTERNATIVE New Revenue DP Trade in Loan Total Cost $2,000 $3,500 $7,350 Used Sales $12,850 COGS OH $11,420 $835 Part $5,000 Brakes Lock Full Tune Up $5,000 Trade-in cost Repair & Tuneup Sales Commission Overhead $3,500 $705 $250 $665 Service $125 $30 $80 Brakes Lock Cleaning Full Tune Up $235 1/1.4 from rev Overhead $167.86 $32 $175 $45 $75 $175 $470 1/3.5 from rev Overhead $134.29 $114 Total $12,255 $5,120 $199.86 $248.29 Profit $595 ($120) $35.14 $221.71 Total Profit : $731.85 ANSWER (2) How should the transfer-pricing system operate for each department (market price, full retail, full cost, variable cost)? a. New Car Dept – Used Car Dept : Market Price b. Used Car Dept – Service & Part : Full Cost + Markup ANSWER (3) If it were found one week later that trade-in could be wholesaled for only $3,000, which manager should take the loss? Used Car Department Manager ANSWER (4) North Country incurred a year-to-date loss of about $59,000 before allocation of fixed costs on the wholesaling of used cars. Wholesaling of used cars in theoretically supposed to be a break-even operation. Where do you think the problem lies? It is possible that this loss occurred because new car managers were giving trade-in allowance above the market valuations. ANSWER (5) Should profits centers be evaluated on gross profit or “full cost” profit? Gross Profit 6. ADVICE FOR THE OWNERS 1. BETTER STRUCTURE New Car Sales, Used Car Sales and Service Departments remain as profit centers. Parts and body shop departments changed to cost centers because the division managers did not have direct or influential control on the division’s profit. 2. TRANSFER PRICING Use book values for the trade-in value for new car division and use that as the cost to the used car division. Allow for higher trade-in values with clear responsibility among departments Full cost plus mark-up to be used from parts and body shop to other departments. 3. REVISE BONUS SYSTEM The company should revise managers bonus system, so they can be measured not just by their own departments profits, but the companys profit as whole. Q&A