What is new on the business climate in Russia

advertisement

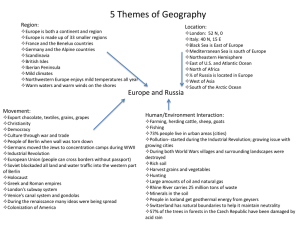

Vienna Process 6th Meeting What is new on the business climate in Russia Mikhail Dmitriev President of the Center for Strategic Research Vienna 27 February 2013 1 Like the rest of the world economy, Russian faces high macroeconomic uncertainty in the longer run Long-term growth scenarios by the Ministry of Economy 2 Source: MED In 1H 2012 Russia’s growth rates were above average for developing economies Russia OECD developing Europe Other developing 3 Source: the World Bank 3 But output recovery is uneven Manufacturing Industrial production Mining Water, gas and power generation 4 Sources: Rosstat, Gaidar Institute 4 With adjustments to crops fluctuations Russian economy was slowing down just as the rest of the world World Russia actual Стандартный Source: HSBC, World Bank Russia, crops’ adjusted С поправкой на урожай 5 5 HSBC forecast comes true: slowdown continues HSBC GDP growth forecast for 2013: 2,5% 6 Изменение ВВП в % к аналогичному GDP growth, yoy кварталу предыдущего года 5 4 3 2 1 0 I кв. 2012 II кв. 2012 III кв. 2012 IV кв. 2012 I кв. 2013 II кв. 2012 III кв. 2012 IV кв. 2012 6 Source: HSBC 6 Растет в основном сфера услуг 7 Источник: Всемирный банк 7 • • • • Consumer demand –the key driver of growth Since 2004 domestic consumption contributed 80% of GDP growth By 2020 Russia may become the largest consumer market in Europe By 2025 Russia’s consumer market may reach $3 trln Equity of Russia’s consumer sector companies are discounted by 25-50% to the peers in BRICS and Turkey Aggregate demand Statistical deviation Change of inventories External demand Domestic demand GDP growth 8 But consumer confidence is still in the negative zone CENTER FOR STRATEGIC RESEARCH Source: Rosstat 9 Procyclicality of growth: potential for new bubbles Jan-June 2011 Jan-June 2012 Agriculture and forestry Mining Manufacturing Jan-June 2011 Industrial services Trade Finance Jan-June 2012 Construction Transportation and telecommunications Real estate 10 Source: the World Bank 10 Labor market is overheated • Unemployment has fallen to the lowest levels for the last 20 years • Wages grow ahead of productivity Unemployment Seasonally adjusted General Real wages (%) Tradable sector Non-tradable sector Non-market sector Source: Rosstat, the World Bank 11 Problems for new investments: Labor supply declines Annual average growth projections for working age population USA EU-15 Japan Russia 12 Source: The Economist, CSR 12 Two generations of baby-boomers 10-year cohorts From to Year 100 and above Total Source: CSR 13 Consumption boom is heavily reliant on banking loans Share of bank loans in household consumption (%) Source: Gaidar Institute 14 Consumer confidence remains in the negative CENTER FOR STRATEGIC RESEARCH Consumer confidence index Source: Rosstat 15 Russia and many of its regions was successful in improvements of its business environment Russia is among 30 of the most successful among 167 countries, which were improving doing business during the last 7 years Ownership registration Registration Of firms Enforcement Taxation of contracts Insolvency resolution Source: the World Bank Investor’s protection International Access to Construction trade credit permists 16 16 Doing Bisiness-2012: Russia is the only BRIC which made progress Россия входит в число 30 наиболее успешных стран из 167 государств, добившихся улучшения условий ведения бизнеса за последние 7 лет China Russia Brazil India 17 Источник:Всемирный банк. 17 Regional variatioты in business climate (BEEPS survey) CENTER FOR STRATEGIC RESEARCH Source: EBRD 18 Historically Russia was rather successful in attracting FDI 19 Source: KPMG 19 FDI spread unevenly across the regions Source: KPMG 20 20 Net capital outflow: 363 bln $ US in 5 years • Net outflow has been typical even for the FDI • Share of foreigners on domestic equity market has declined from 70% in 2007 to little more than 50% in 3Q2012 • Structure of capital outflows and inflows is asymmetrical • Inflows – loans and bonds • Outflows – equity investments • Russia has the 4th largest and fastest growing venture market in Europe Portfolio investments Net capital outflow FDI Other Source: the World Bank. 21 21 Corporate external debt is increasing Bln $ US 22 Source: the World Bank 22 Since 2009 Global equity markets are closely linked to FRS assets… MSCI Global (lhs) FRS assets, bln $US 23 Source: Institute of Energy and Finance 23 … but Russian equity market has delinked from that of the US: the gap is now 60% 24 Source: Development Center, HSE. 24 Investments stagnate CENTER FOR STRATEGIC RESEARCH Investments mom (rhs) Investments, 2008=100% Source: Development Center HSE 25 Long term trends: will the official goals be achieved? Capex in % of GDP Share of high-tech industries(%) Actual trend Labor Productivity Official goal Rank in «Doing Business” 26 Source: the World Bank Thank you for attention! 27