bulgaria_-_general_presentation_june_2013

advertisement

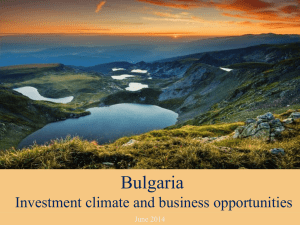

Bulgaria – investment climate and business opportunities June 2013 Macroeconomic indicators show consistent pre-crisis economic growth and quick post-crisis recovery Real GDP Growth 6.4% 6.5% 6.4% Inflation (HICP) Bulgaria 6.2% 0.4% 1.8% EU-27 0.8% Bulgaria 6.0% 7.4% EU-27 12.0% 7.6% 2.5% 3.0% 3.4% 2009 2010 2011 2012 1,151 1,315 1,478 2010 2011 2012 2.4% -5.5% 2005 2006 2007 2008 2009 2010 2011 2012 Bulgaria 9.1% 9.1% 6.9% 2005 2006 2007 2006 2007 2008 FDI Inflow Unemployment 10.7% 2005 9.2% EU-27 10.4% 11.4% 6.3% 2008 € mln. 9,052 6,728 6,222 3,152 2009 Source: Bulgarian National Bank, Eurostat 2010 2011 2012 2005 2,437 2006 2007 2008 2009 FDI in Bulgaria comes mostly from EU countries and is concentrated in four main sectors FDI by host country, 1996-2012 (€ mln.) (1) Netherlands FDI flows by industry, 1996-2012 (€ mln.) 6,601 (2) Austria Real Estate 7,990 5,638 Finance (3) Greece 7,604 3,576 (4) UK 2,606 (5) Germany 2,501 (6) Cyprus 2,317 (7) Russia Manufacturing 6,750 Trade 6,698 Energy 3,522 1,658 Construction (8) Hungary 1,332 (9) Switzerland 1,289 (10) Italy 1,287 Source: Bulgarian National Bank Telecom Other 2,891 2,209 2,915 Why invest in Bulgaria? • • • Political and business stability – EU and NATO member – Currency board – Low budget deficit and government debt Low cost of doing business – 10% corporate tax rate – Lowest cost of labor within EU Access to markets – European Union / EFTA – Russia – Turkey / Middle East • Educated and skilled workforce • Government incentives Bulgaria enjoys one of the most stable political and economic environments in Southeastern Europe • • • Bulgaria is a member of some of the most prestigious political organizations – European Union member since 2007 – NATO member since 2004 – WTO member since 1996 Strong commitment to political reform and transparency has earned praise from leading media and experts worldwide Stable currency – Bulgarian Lev has been pegged to the Euro since the adoption of the currency in 2002 – Currency board backed by IMF „While governments across the eurozone periphery are on the ropes or have been felled by the economic crisis, Prime Minister Boyko Borisov's government has drawn international accolades for cutting spending while maintaining high levels of public support.” September 10, 2011 Standard & Poor's ratings agency raised its short-term foreign and local currency sovereign credit ratings on Bulgaria to 'A-2' from 'A-3' based on its recently adopted methodology. The agency also affirmed our 'BBB' long-term foreign and local currency sovereign credit ratings.The outlook is stable. August 10, 2012 Government financial indicators are remarkable not only in the region, but on a pan-European scale Average government debt (2006-2011) 130% 120% Greece Italy 110% 100% Belgium 90% 80% 70% 60% United Kingdom Portugal France Iceland Ireland Poland 50% Spain 40% Hungary Germany Malta Austria Cyprus Netherlands Turkey Croatia Slovakia Lithuania Slovenia Czech Republic Latvia Romania 30% 20% Finland Sweden Norway Denmark Bulgaria 10% Luxembourg Estonia 0% -11% -10% -6% -5% -4% -3% -2% -1% 0% 1% 15% 16% Average budget deficit/surplus (2006-2011) Source: Eurostat Bulgarian economy maintains its excellent performance despite global challenges Budget deficit for 2012, % of GDP Egypt -10.9% -9.8% Japan United Kingdom -8.3% -8.0% Spain -7.0% Greece -7.0% United States -5.6% India -5.0% Czech Republic -4.5% France -4.1% Netherlands -3.7% Poland -3.6% Denmark -3.3% Euro Area -3.0% Italy -2.8% Hungary -2.6% Austria -2.5% Brazil -2.0% Turkey -1.6% China Sweden Switzerland Germany Bulgaria was the only European country with increased credit rating by Moody’s in 2010 and 2011 BG Estonia Lithuania Bulgaria Spain Ireland Turkey Portugal Cyprus 0.0% 0.0% Greece 0.1% 01/10 07/10 01/11 07/11 01/12 07/12 01/13 Bulgaria has one of the lowest business costs in Europe Lowest corporate income tax rate in Europe Cost of electricity for industrial users is 70% of the EU average Bulgaria Bulgaria 0.078 Estonia 0.082 Romania 0.083 10% Romania Hungary Slovakia Czech Rep Croatia Turkey Source: Eurostat; Savills €/kWh, 2012 Lowest cost of agricultural land in the European Union Romania 1,616 Bulgaria 1,671 € / ha, 2011 16% 19% 19% 19% Turkey Czech Rep Hungary 3,343 Czech Rep. 3,621 Poland 3,671 Greece 4,000 0.096 0.103 0.108 France 6,909 EU average 0.124 Slovakia 0.127 Germany 9,193 Germany 0.130 Netherlands 9,472 20% 20% Slovakia Belguim 8,079 Bulgaria is only 3 hours flight from all major destinations in Europe, Russia and the Mediterranean region Strategic geographic location Major transport corridors passing through Bulgaria Educated and skilled workforce is among the main advantages of Bulgaria Almost 60,000 students graduate every year from over 50 universities Business 19,480 Social sciences Health Architecture Agriculture 14.2% 10.2% 8.3% Bulgaria 3,677 5.8% Greece 3,166 Austria Law 17.8% Slovakia 7,178 Education Iceland Ireland 8,372 Engineering Bulgaria has one of the highest proportions of students abroad from all European countries 4.7% 1,553 Germany 3.1% EU-27 average 2.8% 833 860 Other Source: National Institute of Statistics, Bulgaria Romania 2.2% Czech Republic 2.1% 12,684 Students in another EU / EEA country, % of all The government supports specific industries under the Investment Promotion Act (IPA) • • Investments must be related to the following sectors: – Manufacturing – Research & development – Education – Healthcare – High-tech services – Warehousing and logistics Minimum investment amounts must exceed €2.5m – • €1m in regions with high unemployment and €0.5m for investment projects in high-tech services Benefits for certified investors include: – Shortened administrative procedures – Preferential acquisition of state or municipal land – Financial support for professional training / education – Infrastructure subsidies – Labor cost subsidies – Individual administrative services Biggest investors are supported through a priority investment scheme • Priority projects can be related to all sectors of the economy, which do not contradict regulation 800/2008 of the European Commission – • • Subsidies not allowed in mining, primary agriculture production, and shipbuilding Priority projects should exceed €50m and create at least 200 new working places for a 3-year period – €25m + 100 working places for certain manufacturing projects – €10m + 50 working places for high-tech services and R&D Priority projects receive all benefits for certified investors, as well as the following: – Lowest possible costs for the acquisition of government and municipal land + waived taxes for land status changes – Working group for project support is assigned by the Council of Ministers – Financial grant scheme for up to 10% of the investment project cost (50% for R&D) Attractive FDI sectors • • • Services: – Transport and Logistics – Information technologies – Outsourcing of business processes – Health and tourism related to healthy lifestyle Industry: – Transport equipment and machine building – Electronics and Electrical engineering – Chemical industry – Food and Agriculture Resources: – Mining – Oil – Alternative energy Leading global investors have chosen Bulgaria as an FDI destination IT development Back office operations Chemical and metal Industry Engineering Food Page 14 InvestBulgaria Agency InvestBulgaria Agency is a Government investment promotion arm, part of the Ministry of Economy, Energy and Tourism IBA services: • Macroeconomic data on Bulgaria • Legal advice • Data on operational costs • Regional information: industrial zones and infrastructure, data on unemployment, skilled labour force and level of education • Recommendation of investment project sites • Identification of potential suppliers, contract manufacturers and joint-venture partners • Personalized administrative servicing • Liaison with central and local governments • Liaison with branch chambers and NGOs InvestBulgaria Agency Sofia 1000, 31 Aksakov Str. Phone: (+359 2) 985 5500 Fax: (+359 2) 980 1320 E-mail: iba@investbg.government.bg Web: www.investbg.government.bg