Venera_Vlad_EBRD_opportunities_Energy_Efficiency_Investments

advertisement

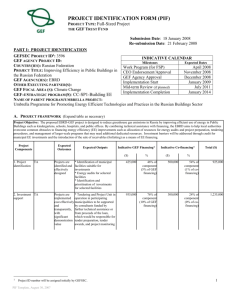

EBRD opportunities – Energy Efficiency Investments Venera Vlad 27 October 2011 Outline EBRD Sustainable Energy Initiative Energy Efficiency Financing Facility Energy Efficiency in Public Buildings 1 Sustainable Energy Initiative The SEI responds to the specific needs of the energy transition in the EBRD region, as well as to the EU call for the IFIs to scale-up climate change mitigation investment. SEI Results 2006- 2010: – EBRD SEI investments of € 6.1 billion for total project value of over €32 billion – EBRD SEI financing account on average for 20% of the Bank’s total investment, (24% in 2010) – Annual emission reduction of 37 million tons of CO2 1. Industrial Energy Efficiency 2. Sustainable Energy Financing Facilities 3. Power Sector Energy Efficiency 4. Renewable Energy Scale-up 5. Municipal Infrastructure Energy Efficiency 6. Carbon Markets Development Barriers to sustainable energy financing – Uncertainties about market demand for EE financing; lack of reliable data – Low awareness about the sustainable energy and energy saving concepts; – Skeptical attitude on the clients’ side about the technical risks and financial benefits of energy efficiency – Legal enforcement in the property and residential sector – Non-supportive procurement rules – Public budgeting rules (”pressure to spend”) – Accounting problems (investment vs. operating costs); lack of ”off-balance sheet” solutions – Lack of specific structures for implementation; limited technical expertise for appraisal and risk assessment 3 EBRD integrated approach Tailor made financing vehicles reflecting country and market specifics: – REECL-type (Bulgaria); – SlovSEFF type (Slovakia case study see next slide for summary) – EEFF, RoSEFF (Romania) SME Sustainable Energy Financing Facility Capacity building: local banks, technical consultants & engineers, local authorities Awareness raising: general public, project stakeholders, authorities Corporate sector: technology and service providers, utilities, project developers; Policy dialogue: assistance on development/upgrade of supportive legal and regulatory framework: legislation; regulations, sustainable energy Action Plans High leverage of national (Donor funded) support programs. 4 Example: SLOVAK SUSTAINABLE ENERGY FINANCING FACILITY EE, RE AND RESIDENTIAL HOUSING ASSOCIATIONS Drivers: high energy intensity, significant potential for energy savings, closure of Bohunice Nuclear Plant. EBRD Credit Line: €60 million Framework of loans to local banks (four to date) for on-lending to enterprises and housing associations to make better use of their energy resources. Grant Support: Bohunice International Decommissioning and Support Fund (BIDSF) of €15 million financing technical assistance (€2.5 M), incentives to sub-borrowers (€ 10 M) and participating local banks (€2.5 M). Results to date – Portfolio of projects €56.4 million with a pipeline for the remaining €3.4 million (under preparation) – 250 residential energy efficiency projects – 41 industrial energy efficiency and/or renewable energy projects Estimated Impact – 1,105,000m2 of floor area refurbished and 46,000 people benefiting from lower energy bills and better thermal comfort; an estimated 14,316 households have been targeted – Estimated energy savings of 32%, twice as much as initially foreseen – 279,197 MWh/a of primary energy savings and 63,120 tCO2 emission reductions per year; – Grant per CO2 12.5 EUR/ton, Investment per CO2 81.1 EUR/ton; – Every EUR of Donor Support received has resulted in energy savings of 355kWH; – One new job created for every EUR 9,000 of investment*, meaning SLOVSEFF has helped in the creation of 8,535 jobs so far. * According to methodology indicated by the Slovakian Authorities. The EU EBRD Energy Efficiency Finance Facility (EEFF) A ‘fast track’ integrated package of Loans - of up to 2.5 million Euros per from participating banks EU-financed free Technical Consultancy from Tractebel Engineering (GDF SUEZ) - Prepared under contract to EBRD - Includes a Rational Energy Utilization Plan and an Energy Performance Certificate 15% EU grants - up to 375,000 Euros per company - Paid by EBRD when the investment is verified to be complete and operational New EU EBRD Energy Efficiency Finance Facility (RoSEFF) 60 mil. Euro framework Loans - of up to 1 million Euro EU-financed free Technical Consultancy Eligible areas: • Commercial EE investments • Stand-alone small scale RE investments • Buildings sector EE and RE investments • Investment loans for eligible manufacturers, suppliers of EE and RE technology, equipmen and materials EEFF to finance energy efficiency in buildings Eligible investment categories are: 1. Industry and agriculture: investments that bring >20% energy savings • Boiler replacement or improvements (automation, economisers, burners, insulation) • Production line or process improvements (that save energy) • Steam distribution improvements (steam traps, condensate recovery) • Automation and control systems, Energy Management Systems • New machines, new equipment, new motors, new pumps… 2. Any company: investments in buildings that bring >30% energy savings • Improving energy efficiency in industrial buildings, offices, farm buildings, hotels etc • Insulation of walls and roofs, new windows, doors, lighting systems, boilers, .... 3. Any company: cogeneration to meet own power and heat needs* • (Or tri-generation to meet own power, heat and cooling needs) • So large buildings such as hotels and shopping centres may finance CHP with the EEFFCo-gen/tri-gen investments are subject to case-by-case approval by EBRD 46 investments with a combined value of 34 million Euro are under-way or complete... Autumn 2010 10 Four examples of energy efficiency investments financed using the EEFF... (Selected as being those most relevant to buildings) 1.Simple building rehabilitation 2.Relocation as an opportunity to become more energy-efficient 3.Self-generation of heat and power 4.Energy efficient lighting Energy Efficiency in Public Buidlings Aim to support development of public EPC market in CEE and CIS, initially: Romania, Bulgaria,Russia and Ukraine Developing a suitable EPC-model for the Romanian market Use initial TA to assess market and identify main obstacles Implement capacity building programme to support cities, ESCOs and banks Provide initial financing through ESCO financing, commercial banks or dedicated funds Saving energy, reducing public spending and GHG-emmissions EPC and the Romanian legal framework EPC is included in the Romanian National Energy Policy – Government Ordinance (GO) 22/2008 (transposed from 2006/32/EC) Defines the National Energy Policy Defines ESCOs and energy services Defines EPC Defines financing instruments for EPC-projects – Government Decision (GD) 163/2004 defines the National Energy Efficiency Strategy (targets) – GD 1661/2008 identifies efficiency measures (incl. EPC) – National Strategy for Energy Efficiency – under revision Energy Performance Contracting (EPC) – simpliest form Public Authority/ Building owner remuneration ESCO saving guarantee Facilities /sites remuneration natural gas district heat electricity oil Utilities Gas, electricity and/or fuel supply companies Co-ordination Supply Technical issues Energy Efficiency Services – Criteria and Conditions for Success Driving force: • Decision makers who take on the responsibility Reliable legal framework: • Procurement: EPC allowed, tender procedure formally approved (guideline by ANRMAP) Standardized procedures and contracts approved by ANRMAP: • Reliability, transparency, time and cost effectiveness for implementation • Need to ensure obligations under EPC do not count as municipal debt • Need to ensure energy savings can be re-allocated to payments under EPC over life of contract • Need to ensure ESCOs are free to assign payments under EPC as basis for financing EE in Public Buidlings - Next Steps Prepare basic financing proposal for funding mechanism Approval for EBRD framework financing – Direct financing of ESCOs (€5m to €10m) – Dedicated vehicle for financing EPC contracts Design full technical assistance programme to help municipalities develop, launch and implement EPC programmes Select and engage consultants for project support teams Begin operations and working with municipalities 2012 Thank you! 19