The World Bank Project Finance & Guarantees

advertisement

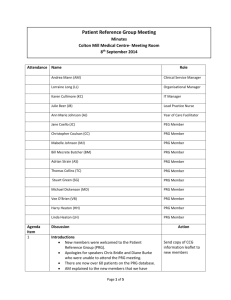

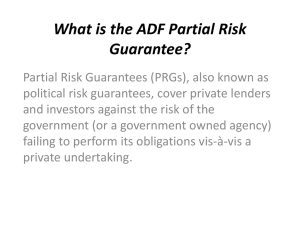

Nigeria Electric Power Transaction & Power Industry Reform Review Conference World Bank PRG in Support of The Nigerian Privatisation Transaction Presidential Villa, Abuja-Nigeria Day 2, November 29, 2011 World Bank Main Messages Nigeria faces a range of challenges implementing the Roadmap for Power Sector Reform and attracting private sector investment into its privatised power market World Bank supports the Government of Nigeria’s reform process and is working with BPE to design a customized risk mitigation solution that supports Nigeria’s power sector reform objectives World Bank guarantees are designed to provide the minimum level of support required to attract private sector participation 2 World Bank FEU – Financial Solutions Key Value Chain Contracting Risks Take-or-Pay Obligation at Receipt (Gas Supplier)/Delivery (Gas Transporter) point of pipeline Gas Supply Gas Supply Risks • Gas E&P • Gas gathering / processing • Gas availability • Gas quality Gas Pipeline Risks • Gas transportation • Gas quality / pressure • Gas availability • Line pack IPP Payment & Credit Risk • Non-payment by DISCOs • Non-performance by GENCO SINGLE BUYER TRANSCO Generation Risks • Construction • Operation & Maintenance • Technology • Financing / interest Rate • Labor availability and disputes • Equipment and spare parts • Non-payment for gas transportation failures • Single Buyer payment risk World Bank FEU – Financial Solutions Transmission Risk • Operation and maintenance of the transmission line • Non-payment by DISCOs of transmission charges DISCO Distribution Risk • O&M of DISCO network • Collection risk • Technical, commercial and non-technical losses • Non-payment by TRANSCO for transmission failures • Tariff/ regulatory risk • Government tariff subsidy payments risk The Partial Risk Guarantee Instrument Nature of Support Political risk mitigation Coverage Cash flow support for investors and lenders Amount Flexible; depends on project needs but limited to minimum required to make transaction bankable Currency Generally, will match the currency of the covered contractual agreements Term Generally, will match relevant term of covered contractual agreement Risk Coverage Triggered by cash flow shortfall caused by a breach of governmental/parastatal contractual undertakings only 4 World Bank FEU – Financial Solutions Benefits of PRG to Private Sector • Mitigates critical perceived political risk • Supports project liquidity throughout project debt term • Facilitates direct access to financial markets • Reduces risk profile of the investment and overall capital costs • Provides comfort on Government governance issues World Bank 5 FEU – Financial Solutions Benefits of PRG to Government • • • • • • • Supports financing through market access, longer tenors and lower financings costs Facilitates privatization by enhancing investor interest Accelerates pace of new investment Sustains relatively more attractive retail tariff regimes by significantly improving the debt profile of financings and by leveraging the investment return of investors Enhances potential “sale” value of existing assets Provides for public sector risk sharing with the private sector Transitional - can be structured to fall away World Bank 6 FEU – Financial Solutions Partial Risk Guarantee Process ✔ Ministry of Finance nominates projects for World Bank PRG support ✔ World Bank undertakes due diligence on environmental and social safeguards, market reform and transaction structures Optimal PRG structure agreed with BPE and Ministry of Finance World Bank conducts due diligence on selected bidder and proposed risk allocations in project agreements World Bank negotiates PRG documentation with L/C Bank and selected bidder; obtains Board approval to issue PRG World Bank and Nigerian Ministry of Finance close PRG Indemnity Agreement; World Bank issues PRG World Bank 7 FEU – Financial Solutions Partial Risk Guarantee using L/C Structure Nigerian Ministry of Finance PPA non-payment: GENCO draws funds directly from L/C Bank’s Standby Facility 4 PRG Indemnity Agreement PPA A World Bank 2 PRG Standby L/Cs 1 3 PPAs NBET PPA B PPA C 5 6 PROJECTS Vesting Contract Vesting Contract Regulatory Event non-payment: DISCO draws funds directly from L/C Bank’s Standby Facility World Bank 8 FEU – Financial Solutions Partial Risk Guarantee using L/C Structure 1. Standby Liquidity Facility: L/C Bank makes Standby Letter of Credit (L/C) available to NBET; NBET enters into L/C Reimbursement Agreement with L/C Bank 2. Partial Risk Guarantee: WB guarantees NBET’s reimbursement to L/C Bank; WB enters into Indemnity Agreement with FGN 3. Power Purchase Agreements: NBET enters into PPAs with GENCOs 4. GENCO Drawing Rights: Under each PPA NBET grants right to access funds directly from L/C Bank if there is an event of non-payment under the relevant PPA. Liquidity: In event of non-payment by NBET, GENCO draws funds directly from L/C 5. Vesting Contracts: NBET enters into Vesting Contracts with DISCOs 6. DISCO Drawing Rights: Under each Vesting Contract, NBET grants right to access funds directly from L/C Bank if there is a Regulatory Event of non-payment. Liquidity: In event of non-payment by NBET, DISCO draws funds directly from L/C World Bank 9 FEU – Financial Solutions Partial Risk Guarantee Fees* *applicable to IDA PRG Fee Type Political Risk Guarantee Guarantee Fee 0.75% per annum on guaranteed amount Initiation Fee 0.15% or US $ 100,000 (whichever is higher) Processing Fee Up to 0.50% (for reimbursable expenses) PRG Fees Payable by the Investor L/C Fees Payable by the Investor 10 World Bank FEU – Financial Solutions Thank You For more information about World Bank Partial Risk Guarantees, please go to: www.worldbank.org/guarantees World Bank 11 FEU – Financial Solutions