Belden, Inc.

advertisement

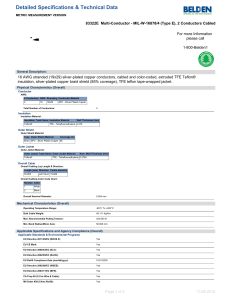

SECTOR: INDUSTRIALS COMPANY: BELDEN, INC. SR. ANALYSTS: HELENE SAJER JR. ANALYSTS: MALCOLM ANGUS, RAYMOND CHEN, TYRONE CHEUNG, SHIRIN KRALL, DEREK LOREN, JOHN SAAD, XIAO YANG Investment Recommendation 1 2 3 2 Company Belden, Inc. Recommendation BUY Current Price $36.70 1yr Target Price $46.17 % Upside 25.8% • Infrastructure investments in emerging markets • Raw materials cost management and industry demand • Growing market share through acquisitions The Communications Equipment Industry Consists of small cap companies who manufacture copper and fiber optic cable, networking, and connectivity products. Customers include OEM’s and Distributors, and their products are used in Industrial automation, transportation, infrastructure, consumer electronics, and enterprises. 3 Industry Snapshot $6.1 billion in industry revenue in 2010 Market Share by Revenue 314 MM, 5% BDC Belden, Inc. BGC General Cable Corp. 1.6 B, 24% 4.8 B, 71% PLPC Preformed Line Products Co. Ticker Company Name BDC Belden, Inc. General Cable Corp. BGC PLPC 4/13/2015 Preformed Line Products Co. Market Cap ($M) Revenue ($M) Sales Growth EPS ($) 1700 4800 14% 2.32 2200 1600 11% 1.33 362 314 22% 5.31 BU Finance & Investment Club 4 Company Definition • Belden manufactures cable, networking, and connectivity solutions for a variety of markets including enterprise, industrial, and broadband • Belden offers thousands of wire and cable products such as multiconductor, paired, coaxial, flat and optical fiber cables, plus portable cordage, molded cable assemblies, hook-up and lead wire Product offerings also includes a complete selection of data network connectivity products and structured cabling systems and services, enclosures and racks, surface raceway systems, and cable management accessories • 4/13/2015 BU Finance & Investment Club 5 Belden, Inc. Revenue Revenue ($ millions) 2500 2000 CAGR 5.3% 1500 1000 500 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Revenue by Product Networking 12% Connectivity 12% Cable 76% 6 Revenue Breakdown: by Segment & Product 2010 2009 2008 0% 20% Cable 40% Networking 60% 80% Connectivity 100% Supply Chain 4/13/2015 BU Finance & Investment Club 8 Products and Applications Product Platforms Networking Connectivity Cable Customer Industries by Revenue Broadcast 12% Consumer Electronics 11% Applications Data Sound Video Industrials 50% Enterprise 27% Vertical Markets Industrial 4/13/2015 Enterprise Broadcast Consumer Electronics BU Finance & Investment Club 9 Trend: Developing Infrastructure in Asia • Currently 23% of families have internet access in China • China Telecom plans to increase number of optical fiber broadband from 30 million to 100 million in five years • China plans to invest $300 billion over 5 years in infrastructure, 80% will be in broadband • Indian government plans to spend 150 billion rupees ($3.3 Billion) on infrastructure over the next few years Belden Acquired LTK Wiring Based in Hong Kong 4/13/2015 BU Finance & Investment Club 10 Belden in Emerging Markets • 25% of Belden’s portfolio benefits from E.M • Rev from Brazil, India, China have 6-10% growth rates over 2010 • On 4 April 2011 Belden Acquired Poliron Cabos Electricos Especiais Ltda in Brazil for $30 mil. • "This acquisition allows us to be a legitimate player in one of the more attractive emerging markets” Belden in Asia Pacific • 16% growth Year over Year, 6% of this is organic growth • Asia has grown from 5% of Belden’s business to 21%, and is expected to increase another 1% by 2013 • The Networking Segment in Asia has grown 34% organically in 2010 • In 2007 Belden Acquires Hirschmann Automation And Control with three manufacturing joint ventures in China Belden In Asia Pacific 4/13/2015 BU Finance & Investment Club 13 Trend / Opportunities: Raw Materials Costs • The cost of copper, BDC’s principal raw material grew by 129% in 2010 • Copper demand expected to increase by 6.4% • China to increase copper imports by 17% • Belden has historically shown its ability to pass on rising costs of raw materials to their consumers Copper Prices vs. Revenue and Gross Margin 1 0.8 % Change 0.6 Copper Prices 0.4 Revenue 0.2 Gross Margin 0 2005 -0.2 -0.4 14 2006 2007 2008 2009 2010 100% 80% 60% 40% 20% 0% Korea (*) Iceland Sweden Norway (*) Netherlands Denmark Finland Luxembourg (*) United Kingdom Canada (2008)(*) Germany United States Belgium Switzerland (2007) New Zealand (*) Australia (2008) (*) Estonia Japan (*) Austria France Slovenia EU27 Ireland Spain Poland Hungary Czech Republic (*) Portugal Slovak Republic Italy Greece Turkey (2007) Chile (2006) Mexico (*) Trend: Fiber Optics Percentage of Homes with Broadband Access 4/13/2015 BU Finance & Investment Club 15 Belden: Signal Transmission • Positioned as the technology leader in signal transmission, with the capability of solving customers’ end-to-end requirements for high-bandwidth solutions • Broad casting: 25% growth last quarter Coax Connectivity Solutions acquisition • Brand most trusted and used for all Olympics and major sporting events Belden: Increasing Market Share through Acquisitions • Feb 2007: Acquired Hong Kong Based LTK Wiring for $195 million (revenue of $220 Million) • March 2007: Acquired Hirschmann Automation and control for $260 Million • April 2007: Acquired Lumberg Automation Components in Germany for $75 million • June 2008: Acquired Trapeze Networks for 133 million, and sold Trapeze in 2010 for a $20 million profit • November 2010: Acquired GarretCom for $52 million and Tomas & Betts for $78 Million • April 2011: Acquired Poliron Cabos Electricos Especiais in Brazil for $30 million, and expects the acquisition to break even in 2011 4/13/2015 BU Finance & Investment Club 17 Financials & Stock Performance Company M. Cap ($m) Revenue ($m) Sales Growth EBITDA ($m) EPS ($) Inventory Turnover Belden Inc. 1700 4800 14% 200 2.32 7.1x Belden, Inc. Total Debt ($m) 551 Debt / Equity 0.86x Current Ratio 2.4x Quick Ratio 1.8x 4/13/2015 BU Finance & Investment Club 18 Valuation Year FCF ($MM) 2011-e 2012-e 2013-e 2014-e 2015-e $ 191.48 $ 236.31 $ 280.45 $ 298.71 $ 313.65 Comps – TEV/EBITDA 30% P/S 20% DCF – 50% WACC 10.84% TEV/EBITDA 9.5x Growth Rate 2% 1yr Target Price $ 40.49 DCF EV $ 2,369.58 1yr Target Price $ 51.01 P/S 1.1x 1yr Target Price $42.58 1yr Target Price $46.17 +25.8% Risks & Sensitivities Forecasted Current Future Acquisitions Economic Downturn $29.50 $16.30 Restructuring Costs $33.05 Currency Exchange $34.50 Weighted Risks $10.00 $31.72 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 Price per Share 4/13/2015 BU Finance & Investment Club 20 Company Analysis Increasing market share through two new acquisitions in 2010 and one in April 2011 Increasing revenue by developing manufacturing facilities abroad, focusing on growth in Asia segment and emerging markets Managing the cost of raw materials as copper prices reach all time highs Investment Recommendation Company Recommendation 21 Belden, Inc. BUY Current Price $36.70 1yr Target Price $46.17 % Upside 25.8% Questions? 4/13/2015 BU Finance & Investment Club 22 Backup Slides 4/13/2015 BU Finance & Investment Club 23 Time Series 1 Yr Revenue Growth vs. P/S 4/13/2015 BU Finance & Investment Club 24