Regional Trade Agreements in the Pacific

advertisement

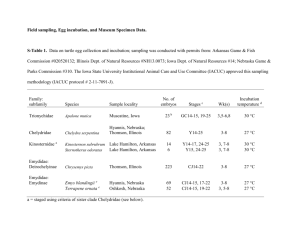

Regional Trade Agreements in the Pacific Dr Chris Noonan, Chief Trade Adviser Office of the Chief Trade Adviser for Forum Island Countries Commonwealth Parliamentary Association, Regional Workshop on Trade Policy for Pacific Parliamentarians, Aggie Greys Hotel, Apia, Samoa, 3-4 June 2010 WTO and Regional Trading Arrangements The WTO regulates the regional trading arrangements entered by WTO Members The rules will apply even if not all of the parties to a regional trading arrangement are WTO Members Key WTO provisions: GATT Article XXIV – free trade areas and customs unions for goods GATS Article V – economic integration agreements for services Enabling Clause (GATT Contracting Parties Decision on Differential and More Favourable Treatment, Reciprocity and Fuller Participation of Development Countries, 20 November 1979) – Generalized System of Preferences Enabling Clause – trade in goods liberalisation among developing countries GATT Article XXIV If a regional trade agreement does not meet the requirements of Article XXIV, it will breach one of the fundamental principles of the GATT – MFN treatment The Pacific has pursued free trade agreements rather than customs unions Key requirement that tariffs and quotas are eliminated on substantially all trade between the parties within a reasonable period of time Same rules apply to developed and developing countries EU-ACP EPAs: 90 percent of trade, by volume and by tariff lines; almost 100 percent by EU; at least 80 percent by ACP States GATS Article V Applies to trade in services (cross-border supply; foreign investment; and temporary movement of people) Substantial sectoral coverage required Uncertain how many sectors must be covered – significant commitments have been extracted from countries acceding to the WTO Simple counting of sectors and subsectors may not provide an accurate view of the level of liberalisation – especially new liberalisation More flexibility may be possible when agreement part of a wider economic integration arrangement and when some of the participants are developing countries Enabling Clause Preferential tariffs for developing countries Grantor unilaterally determines product coverage, level of preference, rules of origin and procedures Preferences may be conditional on respect for human rights, environmental and labour standards, intellectual property, and so forth WTO Appellate Body EC – Conditions for Granting Tariff Preferences to Developing Countries, 2003: treat like developing countries alike Permissible conditions and when developing countries need not be treated alike is uncertain Graduation from developing country status determined by grantor Special treatment for LDCs permitted Hong Kong Ministerial Decision – duty free access EU EBA (Everything But Arms); Australia and New Zealand Economic Integration Initiatives involving the Forum Island Countries SPARTECA – South Pacific Regional Trade and Economic Cooperation Agreement PICTA – Pacific Island Countries Trade Agreement PACER – Pacific Agreement on Closer Economic Relations MSGTA – Melanesian Spearhead Group Trade Agreement EPA – Economic Partnership Agreement between the EU and the PACPS PICTA TIS – Trade in Services (and Temporary Movement of Natural Persons) PACER Plus PICTA Free trade agreement among the FICs Not all FICs are a party to PICTA Reciprocal commitments to reduce and eventually eliminate tariffs on most goods Basic trade agreement that does not address services or any traderelated issues and has an undeveloped institutional structure Relatively little trade takes place under PICTA PICTA TIS Currently under negotiation Trade in services liberalisation – based on GATS model Approach driven by GATS Article V and expectation that FICs would at some point negotiate trade on services agreements with developed countries Several rounds of negotiations to develop a draft text and commitments of FICs – the schedules of commitments are very important Included provisions on Temporary Movement of Natural Persons – but not currently being pursued Selected Indicators of Global Integration for Pacific Countries (2007) Country Trade (% GDP) Foreign Direct Investment (% GDP) Tourism Receipts (% GDP) Remittances (% GDP) Pacific 78.9 6.5 16.5 11.8 Developing Countries 64.3 3.7 2.1 2 World 56..9 4 1.9 0.7 Trade as a percentage of GDP – US 23%; Japan 30%; Australia 37%; UK 39%; New Zealand 45%; Portugal 58%; Denmark 66%; Sweden 72% Cf. Interim EPA “Promoting the gradual integration of the Pacific States into the world economy” and PACER Article 2 ODA (% GDP 2007) Imports (% GDP 2005) Exports (% GDP 2006) Tourism (% of exports 2005) FDI inflow (% GDP 2007) Remittance (% GDP 2007) Trade Taxes (% government revenue) Fiji 2 67 49 44.8 8 5 26 Kiribati 20 70 6 - - 9 20 Papua New Guinea 5 55 83 0.1 2 0 7 Samoa 7 56 26 63.6 1 23 13 Solomon Islands 46 59 36 4.8 11 5 24 Tonga 12 70 16 27 11 39 54 Vanuatu 11 55 44 58.8 8 1 37 Challenges for Intra-FIC Integration Small widely dispersed populations with generally poor direct transport links Limited manufacturing capacity in most FICs – high level of subsistence living Limited demand for economic integration by most economic operators, cf. some goods, possible benefits from trade in some services, some demand for labour mobility Stronger ties to developed countries – exports and imports, labour mobility and remittances, development aid, cultural and sporting ties, etc Inadequate financial, human and technical resources to negotiate – especially for smaller FICs – uncertainty about detailed objectives in negotiations Challenges for Intra-FIC Integration (2) Inadequate institutional basis – decision to incorporate PICTA goods and services into one agreement together with better institutional procedures not acted upon Different views of developed country partners, e.g. the origin of of PICTA and PACER The ‘vision’ for the region – Pacific Island regional entity – perception of outside world – influence on world stage – cf. CARICOM PACER may displace PICTA – especially if little progress can be made in PICTA TIS and TMNP – cf. MSGTA which has a stronger political purpose Benefits from regional cooperation may be greater from sharing resources and building common institutions PACER Endorsed by Forum Leaders on 18 August 2001 – almost all Forum Members have signed and ratified – controversial origins The Parties wish to establish a framework for the gradual trade and economic integration of the economies of the Forum members in a way that is fully supportive of sustainable development of the Forum Island Countries and to contribute to their gradual and progressive integration into the international economy. Article 2(1) More specifically, to provide a framework for cooperation leading over time to the development of a single regional market. Article 2(2)(a). A single market includes trade in goods and services as well as movement in capital and labour. No trade liberalisation commitments, but obligations to enter into negotiations on a trade agreement under certain circumstances – 8 years after PICTA enters into force (Article 5); commencing or concluding free trade negotiations with third parties (Article 6) Part 2 Commitments to cooperate on trade facilitation and the provision of assistance – PACER Part 3 2 May 2009 Fiji suspended from participating in Forum activities and not invited to participate in PACER Plus meetings Legal and practical questions about the exclusion of Fiji from PACER Plus negotiations Fiji requested consultation under PACER Article 15 and latter suspended Part 2 of PACER PACER Plus Commencement of negotiations endorsed by Leaders in Cairns in August 2009; formally commenced by Forum Trade Ministers in October 2009 Ministers identified a number of priority subjects for negotiation Fiji: Effectively views the current process as illegal Australia: It is not linked to PACER Role of guiding principles in PACER? Not clear what issues will be included in PACER Plus or the shape of the final package First formal PACER Plus negotiation in April 2010 Forum Trade Ministers’ Meeting, 29 April 2010, Pohnpei Workshop on ROO and customs procedures in late August in Tonga Second PACER Plus negotiating meeting in October in Solomon Islands Third PACER Plus negotiating meeting in 2010? Air and sea transport, telecommunications, and water supply infrastrcuture next items on the agenda Echoing comments made by Ministers Homae and McCully at the FTMM, Minister Crean has subsequently written of the need for flexibility in the press FIC-ANZ Negotiations Significant economic interests for almost all FICs and ANZ in PACER Plus Cf. EPA where few FICs had significant economic interests in concluding a traditional goods and services trade agreement ANZ – greater knowledge of FIC economies; greater engagement with FIC political actors; and greater commercial interests – compared to EU Perception that ANZ will take PICTA and EPA liberalisation as a starting point – then ask for more – sectors where they have a trade interest; WTO positions; and/or ideological commitment to liberalisation Failure to set many useful precedents with PACP EPA or PICTA TMNP negotiations FIC-ANZ Negotiations (2) Limited analytical and negotiating capacity in most FICs Establishment of the OCTA – precondition to PACER Plus Difficulty of most FICs to effectively engage with two major trade negotiations at a time For some FICs negotiations will trigger further processes – e.g. with the US under the Compacts of Free Association Regional assistance is not sufficient – need national engagement with process, consultations with national stakeholders, data collection and analysis, etc. While many FICs will often have common interests, there are important differences in the relationship between each FIC and ANZ – difficult for FICs to credible commit to negotiate as a region FIC-ANZ Negotiations (3) Key issues may be discussed outside of PACER Plus, e.g. competition, intellectual property – crating an incentive for a forum-shifting strategies – cf. comprehensive EPA Economic ties and contact at Ministerial and Prime Ministerial levels – difficulties of credibly committing to negotiate as a region – effective developed country strategy Need for a whole of government approach to negotiations – national level action required Establishment of the Office of the Chief Trade Adviser Pre-condition for PACER Plus negotiations commencing Intended to provide FICs with independent advice and support; representation in negotiations; coordination of negotiating positions; and build negotiating capacity Only started setting up OCTA; it is not established Legal and organisational structure not finalised and role still contested OCTA operating under an interim arrangement with PIFS intended to permit contracts with donors and engage staff Some funding from Australia and New Zealand, further funding absolutely necessary, some funding from the European Development Fund possible Approaching PACER Plus The perception among many in the FICs is that PACER Plus is something that is being done to the FICs ANZ are the demandeurs Leaders have agreed to negotiate – the issue is not whether there will be a PACER Plus negotiation but what will it look like – minimise costs and maximise benefits There are opportunities for the FICs FICs need to shape the agenda if the FICs are to benefit Recent talk by Ministers of need for flexibility Priority Issues Rules of origin (ROO) Customs procedures Sanitary and phytosanitary measures (SPS) Technical barriers to trade (TBT) Labour mobility Development assistance Shipping, aviation, telecommunications and water infrastructure ROO Need industry input Reform SPARTECA – an early harvest? Change of tariff heading favoured by Australia and New Zealand, and previously favoured by FICs in EPA negotiations Forward looking and easy to administer – should assist FIC exporters The dark side – hundreds of pages of product specific exceptions Value added – alternative or additional rule SPARTECA – 50% value added Much lower levels would promote development in FICs Cumulation becomes important Customs Procedures Australia has suggested an approach similar to that contained in the ANZ-ASEAN FTA NZ appears less convinced that all those rules should be adopted by all FICs Would benefit foreign exporters (and local consumers and businesses) Matching specific commitments to additional development assistance Assistance provided by several donors in this area SPS and TBT Australia has suggested an approach similar to that contained in the ANZ-ASEAN FTA – would require all FICs to adopt WTO rules FICs are likely to want to resolve some product-specific issues restricting exports into Australia and New Zealand – and a practical method of resolve disputes Development assistance may be requested to assist exporters meet foreign standards, and to improve the capacity of FIC institutions FICs generally lack regulation on food safety and the alike rather than having protectionist standard SPS and TBT issues are being addressed both in PACER Plus negotiations and by PIFS and SPC Labour Mobility Limited benefits likely from GATS mode 4 liberalisation for FICs Many studies indicate there would be major benefits to the FICs Interest in both unskilled and skilled workers – but differences between FICs Any proposals need to take into account political sensitivities in ANZ Need support for education and training in the FICs and recognition of qualifications Need to understand FIC and global markets Development Assistance and Cooperation Only significant benefit for some FICs likely from PACER Plus Issues: Additional resources Binding commitment to provide resources Modalities for delivery of assistance Relationship with existing bilateral and regional programmes Link between development assistance and commitments made under PACER Plus Non-financial assistance forms of development cooperation Some Possible Areas of Interest Trade policy and regulation Formulation of trade policy; stakeholder consultations; customs law and administration; recognition of standards and qualifications; … Trade-related infrastructure Transport, telecommunications, energy; regulatory reform and institutional building, including services and SPS and standards and conformance; … Productive capacity building Investment in education and training; increasing productivity of agriculture; meeting foreign quarantine standards; assistance with marketing and distribution; … Trade-related adjustment Mitigation of the impact of loss of government revenue; mitigation of the impact of the phasing out of uncompetitive firms including retraining of workers; measures to stabilise income of farmers; … Services and Investment FTMM noted importance of shipping, aviation, telecommunications and water infrastructure to trade in goods and services and agreed that they were priority negotiating issue for PACER Plus Significant investment in infrastructure in FICs is needed Important questions on how to increase investment, provide relevant services, and regulate service providers Some Ministers may have seen this as involving little more than liberalisation; other Ministers may have seen it as involving greater assistance to the region As a result of GATS Article V negotiations may extend to all services