UNCTAD/ITCD/TAB/11

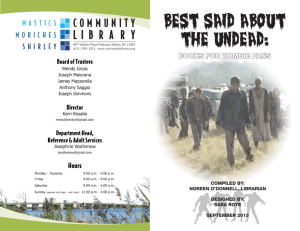

advertisement