Scientific Research & Experimental Development

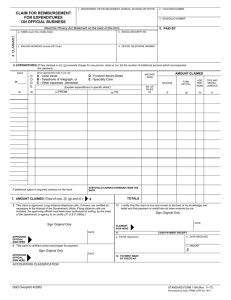

advertisement

Scientific Research & Experimental Development Investment Tax Credit Program Yukon Research, Innovation and Commercial Conference Thomas Hu (604) 691- 3832 SR&ED Tax Incentive Program a tax incentive program to encourage Canadian businesses of all sizes to conduct R&D that will lead to new or improved technologically advanced products or processes largest single source of federal government support for industrial research and development Used by over 21,000 publicly or privately owned Canadian companies, Partnerships, individuals annually Provides ~ $3.3 billion/year in tax credits/cash CRA is responsible for administering the SR&ED program (by HQ + 10 regional offices), while the Department of Finance is responsible for the legislation What the Program Offers • Investment Tax Credits (ITCs) can be: • offset against federal taxes otherwise payable and/or refunded • ITCs of 20% or 35% • Allowable SR&ED expenditures incurred (including capital) qualify for immediate write off, or indefinite carry forward • Pooling concept for both SR&ED expenditures and ITC Requirements • Claimant must operate a business in Canada in the taxation year • Expenditures must be incurred • SR&ED must be carried out in Canada directly by the claimant or on his/her behalf • Certain expenditures for SR&ED performed outside Canada are now permitted • The SR&ED must be related to the claimant’s business • You have to file your complete claim by your Reporting deadline: the day that is 12 months after the filing due date of the return of income for the year What Work Qualifies? Work must meet the legislative definition of SR&ED: a systematic investigation or search that is carried out in a field of science or technology by means of experiment or analysis Categories: a. Basic research b. Applied research c. Experimental development d. Work in support a. Basic Research work undertaken for the advancement of Scientific knowledge without a specific practical application in view How did the universe begin? What are protons, neutrons, and electrons composed of? What is the specific genetic code of the fruit fly? b. Applied Research work undertaken for the advancement of scientific knowledge with a specific practical application in view improve agricultural crop production treat or cure a specific disease improve the energy efficiency of homes, offices, or modes of transportation c. Experimental Development work undertaken for the purpose of achieving technological advancement for the purpose of creating new, or improving existing, materials, devices, products or processes, including incremental improvements d. Support Activities work which is commensurate with the needs, and directly in support of the work described above including: engineering design data collection testing mathematical analysis computer programming operations research psychological research Example - Thermodynamics • Basic Research: D U = Q-W • Applied Research: • Experimental Development: • Support Activity e. – k. Excluded Work Social Sciences or humanities Market research or sales promotion Quality control or routine testing Routine data collection, engineering or design Style changes Commercial production or use Prospecting, exploring or drilling for, or producing, minerals, petroleum or natural gas Eligibility Requirements For any research and development work to be “Eligible”: The work must be a systematic investigation or search, The work must be carried out in a field of science or technology that is not excluded by this legislation, The work must be carried out by means of experiment or analysis, and The work must be undertaken either: • • for the purpose of achieving technological advancement, or for advancing scientific knowledge. These requirements must be met for any work to be eligible SR&ED. Use self-assessment tool @ http://www.cra-arc.gc.ca/txcrdt/sred-rsde/ssssmnt/menu-eng.html Project Information A. Field of Science or Technology, date B. For Experimental Development • Technological advancements achieved • Technical Obstacles overcome • Work performed C. For Basic or Applied Research • Scientific knowledge advanced • Work performed D. Additional Information, evidence E. Project Cost Evidence Project planning documents Records of resources allocated to the project, time sheets Design of experiments Project records, laboratory notebooks Design, system architecture and source code Records of trial runs Progress reports, minutes of project meetings Test protocols, test data, analysis of test results, conclusions Photographs and videos Samples, prototypes, scrap or other artefacts Contracts Others Project Model Motivation Business objectives – Market Research - Constraints SR&ED Objective (Hypothesis) Eligibility Requirements Experimentation Advanced Technology/ Process Product/System Commercial use Support Work Strategic Game Software Development Initial Planning Technical Review Initial Themes & Concept Mathematics Art & Animation Build Delivery Eligibility components? Continuous Manufacturing Process Eligible or not? Free Science Access Information Packages, Seminars and Presentations First Time Claimant Service Pre-Claim Project Review (PCPR) Account Executive Service CRA cannot: Provide advanced rulings on projects Prepare your claim Completeness of Forms T661E - expenditure T2 SCH31 - federal credit corporation T2038 (IND) - federal credit individual T666 E - BC credit corporation T2 SCH442 - Yukon credit corporation T1232 - Yukon credit individual File a complete claim ASAP use the latest forms To speed-up the processing of your claim, place the T661, Schedule 31 and project description on top of your tax return. You have to file your complete claim by your Reporting deadline: the day that is 12 months after the filing due date of the income tax return for the year (don’t miss) Different types of claims have different service standards The SR&ED program is committed to meeting these service standards at least 90% of the time. CRA Claim Processing Claim received at the Tax Centre Completeness Check and Initial Risk Assessment Claim sent to Tax Services Office Desk Risk Assessment Review of Projects (RTA) Expenditures (FR) Notice of Assessment sent to the Claimant Confidentiality www.cca-arc.gc.ca/sred 1-866-317-0473