EU - Liberia - Forest Governance Forum

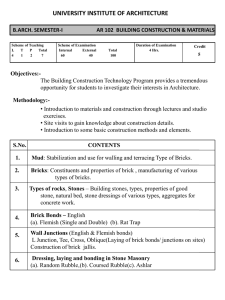

advertisement

How European Wood Businesses are Coping with Legislation An Importing Trade Association View Rachel Butler Head of Sustainability UK Timber Trade Federation (TTF) representing the European Timber Trade Federation (ETTF) European Timber Trade Federation • Established in 2009 and brought together organisations representing hardwood (UCBD), softwood (UCBR) & panels (UCIP); – Also FEBO, which represent timber distributors & merchants • Membership represents 12 key European importing countries; – Netherlands, UK, Spain, Sweden, Belgium, France, Germany, Greece, Italy, Portugal, Denmark & Norway • Strengthen the voice and representation of the European timber importers. European Trade Facts • Less than 10% EU timber consumption is imported from; – China, US, Russia, Brazil, Malaysia, Indonesia, Chile, Vietnam, Cameroon, Gabon & Thailand • European forestry reserves are growing annually – Estimated as the size of Cyprus every year • Global joint efforts to curb illegal by Governments, NGOs and the trade are perceived to be working – Recent Chatham House Report Current EU Market Demand for Legal & Sustainable Timber • Market for certified timber is still a push-market • Enough supply but very often lacking demand – UK is strongest market has risen significantly in recent years but still perceived as low • With some exceptions: limited data available! – ETTF has just commissioned a market report to collate data across all member TTFs • Dutch Market 2009 65% certified • UK Market 2010 85% certified ETTF & EU Timber Regulation • Shares the commitment of the EU to eliminate illegal timber from supply chains; – Creates a level playing field – Supported the prohibition • Some member TTFs are already implementing due diligence and supporting their trade; – E.g. Netherlands, UK & France • Some member TTFs are planning and developing due diligence systems; – E.g Germany, Italy Facilitating Due Diligence: UK RPP Case Study • UK developed Responsible Purchasing Policy (RPP); about 7 years ago – Voted to make Due Diligence mandatory in 2008 under Code of Conduct – All members obligated in 2010; 6 out of approx 150 are now suspended – TTF provides standard forms, guidance & technical assistance – Sufficient to meet the new future EU Timber Regulation as it facilitates due diligence? UK RPP Case Study: Due Diligence Core Elements • • • • • • • • • • Public commitment to legal and sustainable timber Complete supplier product screening Objective assessment system & credible evidence Continuous improvement & target setting Supplier feedback Independent auditing Annual reporting Communications Protocol Governance & Sanctions Training for auditors & members UK RPP Case Study: Process • Recognises that only FLEGT is an automatic passport! • Evaluates risk of uncertified/unverified timber products, using a standard format and guidance • Records products where risk mitigation is in hand & provides guidance on these risk mitigation schemes; – negligible risk (certified & FLEGT) – managed risk (legality verification, TTAP, TFT, GFTN etc) • Members set targets & are independently audited annually; • Independent Body collates annual submissions UK RPP Case Study: Product Risk Rating • Classify the country using the Transparency International Risk Index. • Use the appropriate decision tree to risk rate products as high, medium or low • Risk rating process linked to TTF’s country guidance to make decision more objective rather than subjective. UK Case Study: RPP Overview • • • • • • Cost effective in delivering due diligence Risk evaluation is separate to risk mitigation Guidance & standard forms Communications & Governance Independent audit Training for members & auditors • • • • RPP is still paper based & not “real” time Does not guarantee products are legal Small members have resource issues Audit costs can be high Implications & Consequences of TR for ETTF Members • Many not prepared, but the importing trade/retailers are waking up! – Many rely on their suppliers • Changes in timber flows & switching to lower risk producer countries • Increase in misleading & false claims • Is it a driver for sustainable timber? ETTF’s Future Development on TR • Need to support EU TR at EU Level, to support buyers and producers therefore ETTF are considering; – One Responsible Purchasing Policy – One set of guidance on countries of origin, certification, verification etc – Possibly becoming an EU Monitoring Organisation for smaller TTFs Future Challenges for Suppliers • All buyer’s need it to be simple; – Certified – FLEGT licensed – Verified legal • Boycott of Tropical Timber? • Will demand go away? – Other markets e.g. China, Australia – REDD+, links to FLEGT 13 Timber Industry: The future for us all • • • • More timber used No illegal logging Forests protected, SFM implemented Higher prices for products – Value added? • Buyers in EU & US – Due care or due diligence, difference in reality? • Suppliers to EU & US – Same information/evidence? 14 Concluding remarks: • Illegal timber is damaging the image of all timber products > ETTF welcomes TR • Links to US Lacey Act • Legal proof is the basic requirement, but the current demand where it exists & trade preference is for sustainably produced timber. • Key market drivers are increasing demand for timber (Public Procurement, Green Building Initiatives, RPPs, etc.) • There is no premium for legal, but still a premium for SFM certified tropical timber products • Demand is still lacking but legislation will increase demand within our markets. • FLEGT timber, we do need it! • Need for European wide guidance & standard RPP Thank you for your attention! Rachel Butler rbutler@ttf.co.uk European Timber Trade Federation