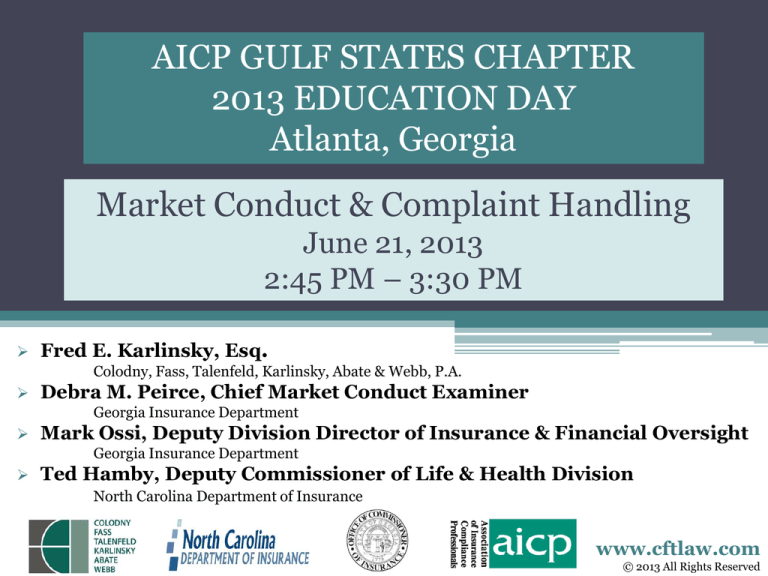

AICP GULF STATES CHAPTER

2013 EDUCATION DAY

Atlanta, Georgia

Market Conduct & Complaint Handling

June 21, 2013

2:45 PM – 3:30 PM

Fred E. Karlinsky, Esq.

Colodny, Fass, Talenfeld, Karlinsky, Abate & Webb, P.A.

Debra M. Peirce, Chief Market Conduct Examiner

Georgia Insurance Department

Mark Ossi, Deputy Division Director of Insurance & Financial Oversight

Georgia Insurance Department

Ted Hamby, Deputy Commissioner of Life & Health Division

North Carolina Department of Insurance

www.cftlaw.com

© 2013 All Rights Reserved

2

DISCLAIMER

The materials in this presentation are intended to provide a

general overview of the issues contained herein and are not

intended nor should they be construed to provide specific

legal or regulatory guidance or advice. If you have any

questions or issues of a specific nature you should consult

with appropriate legal or regulatory counsel to review the

specific circumstances involved. Transmission or

reproduction of any of the information contained herein is

prohibited without the express written consent of Colodny,

Fass, Talenfeld, Karlinsky, Abate & Webb, P.A.

www.cftlaw.com

© 2013 All Rights Reserved

3

AGENDA

Market Conduct Trends

The Market Conduct Annual Statement (MCAS) Update

The Insured Perspective

The Ins and Outs from the Georgia Insurance Department

The Regulator Perspective

Questions

www.cftlaw.com

© 2013 All Rights Reserved

4

Market Conduct Trends

www.cftlaw.com

© 2013 All Rights Reserved

5

MARKET CONDUCT TRENDS

Social Media

According to the Insurance Networking News, in April

2012, ninety-two percent of annuity and insurance providers

use social media of some form; Five P&C companies offer four

or more Facebook pages while the industry average is two per

firm.

Large insurance companies, such as Allstate, Liberty Mutual,

and Hartford Financial, maintain 13 Twitter accounts

according to Insurance Networking News.

www.cftlaw.com

© 2013 All Rights Reserved

6

MARKET CONDUCT TRENDS

Social Media

Significantly decreases marketing costs.

Social media is used as a defensive maneuver.

Insurers listen to what customers say online and respond

to the comments.

Attempt to change public perception.

Used to build trust through ratings and reviews.

A good tool in detecting fraud.

Insurance companies are collecting information about

their customers to determine if their claims are legitimate.

www.cftlaw.com

© 2013 All Rights Reserved

7

MARKET CONDUCT TRENDS

Social Media

Social media enables underwriters to learn more about their

policyholders, which leads to better pricing and claims

handling.

Underwriters can learn more about their potential customers

through social media.

Can be used to help solve problems associated with risk

assessment.

www.cftlaw.com

© 2013 All Rights Reserved

8

MARKET CONDUCT TRENDS

Social Media

NAIC has developed two smartphone insurance apps:

myHome Inventory app lets users quickly photograph and

capture images, descriptions, bar codes and serial

numbers, and then stores them.

The app organizes information by room, and even creates

a back-up file for email sharing.

www.cftlaw.com

© 2013 All Rights Reserved

9

MARKET CONDUCT TRENDS

Social Media

WreckCheck mobile application outlines what to do

immediately after an auto accident and helps users create

their own report.

The app makes it easy to capture photos and document

the necessary information to file an insurance claim.

Lets users email a completed report directly to themselves

and their insurance agents.

www.cftlaw.com

© 2013 All Rights Reserved

10

MARKET CONDUCT TRENDS

Social Media

NAIC created a social media working group to develop a white

paper on how insurance companies and producers use social

media, identify regulatory compliance issues and provide

guidance on how to address these issues.

The draft was released December 2011:

An insurer must develop policies and procedures that

comport with existing laws and regulations;

An insurer is responsible for the content of its producers’

posts;

www.cftlaw.com

© 2013 All Rights Reserved

11

MARKET CONDUCT TRENDS

Social Media

Outline clear delineation between static and interactive

social media in order to properly apply regulatory

guidelines;

Insurers should train their employees/agents on the

company’s social media policies;

They should set up a procedure to monitor, supervise, and

enforce; and

The insurer or producer is responsible for complying with

the state recordkeeping laws.

www.cftlaw.com

© 2013 All Rights Reserved

12

MARKET CONDUCT TRENDS

IT in Claims Handling

In a new era of visibility, the claims process is under intense

public scrutiny and must continue to evolve.

Companies are investing in their IT infrastructure and

software to help streamline the claims process.

Information can be gathered quickly which will enable

companies to investigate and respond faster resulting in

better customer support and satisfaction.

www.cftlaw.com

© 2013 All Rights Reserved

13

MARKET CONDUCT TRENDS

IT in Claims Handling

Mobile technology solutions are allowing customers and

adjusters to share information more efficiently.

Insureds prefer to receive a text from the adjustor instead of a

phone call; will require more training to ensure adjusters are

effectively utilizing their smart phones.

Mobile technology enables field adjusters to have access to

more information while they are onsite.

Companies can utilize digital photography to write estimates

of damages without the need for an on-inspection.

www.cftlaw.com

© 2013 All Rights Reserved

14

The Market Conduct Annual

Statement (MCAS) Update

www.cftlaw.com

© 2013 All Rights Reserved

15

MCAS UPDATE

The Market Conduct Annual Statement (MCAS) was first

developed with the input of state regulators and

representatives from the industry to develop a tool to analyze

the market.

By using common data and analysis, states have a uniform

method of comparing the performance of companies.

MCAS was initially a pilot program among 9 jurisdictions and

now has expanded to 46 states.

www.cftlaw.com

© 2013 All Rights Reserved

16

MCAS UPDATE

The data collected consists of:

Claims handling – claim denials, processing times, and

lawsuit activity.

Underwriting – new issues, policies in force, nonrenewals and cancellations.

On April 15, 2011 the NAIC launched a newly redesigned

collection system to simplify the MCAS process.

The new process will help improve state regulation by

allowing all participating states to analyze the industry on a

national and state level.

www.cftlaw.com

© 2013 All Rights Reserved

17

MCAS UPDATE

In the next few years, MCAS will continue to expand by

adding new states and new lines of business.

Currently, MCAS data is only collected for private passenger

automobile, homeowners and individual life and annuity

products.

The NAIC Market Analysis Procedures (D) Working Group

was tasked in 2013 to review MCAS data elements and the

"Data Call and Definitions" for all lines of business collected

and to update them where necessary.

In addition, the Working Group approved the addition of

Long Term Care data to be collected.

www.cftlaw.com

© 2013 All Rights Reserved

18

The Insured Perspective

www.cftlaw.com

© 2013 All Rights Reserved

19

THE INSURED PERSPECTIVE

Claims handling continues to be pivotal in the heated battle

for market share.

Market leaders view the quality of the customer experience as

the means to demonstrate true customer centricity and

differentiate their strength and stability of their brands.

The customer experience has moved up the strategic agenda

throughout the insurance industry.

Policyholder expectations regarding the service and

communication provided by their carriers has increased

drastically.

www.cftlaw.com

© 2013 All Rights Reserved

20

THE INSURED PERSPECTIVE

Today’s consumers expect everyone at the company to share

information and recognize the customer’s identity and

history.

They don’t want to be asked the same question multiple

times or have to call multiple numbers or visit multiple

sites to find their answers.

Younger, more digitally- oriented consumers will not tolerate

companies that don’t have integrated systems where they can

view date and claims status.

A positive experience in claims helps eliminate reasons for

policyholders to consider making a switch.

www.cftlaw.com

© 2013 All Rights Reserved

21

THE INSURED PERSPECTIVE

Changes to the customer experience, should be tailored to an

enterprise strategy.

Insurers that gain insight into and reach a consensus on the

types of customers they want to attract will be ahead of the

curve on developing the optimal experience.

The key is to identify changes that can deliver immediateterm value.

Customer centricity will create a competitive advantage and

market leadership.

www.cftlaw.com

© 2013 All Rights Reserved

22

The Ins & Outs from the Georgia

Insurance Department

Debra M. Peirce,

Chief Market Conduct Examiner

Mark Ossi,

Deputy Division Director of

Insurance & Financial Oversight

www.cftlaw.com

© 2013 All Rights Reserved

23

THE INS & OUTS FROM GEORGIA

http://www.oci.ga.gov/

www.cftlaw.com

© 2013 All Rights Reserved

24

THE INS & OUTS FROM GEORGIA

www.cftlaw.com

© 2013 All Rights Reserved

25

THE INS & OUTS FROM GEORGIA

www.cftlaw.com

© 2013 All Rights Reserved

26

THE INS & OUTS FROM GEORGIA

www.cftlaw.com

© 2013 All Rights Reserved

27

THE INS & OUTS FROM GEORGIA

www.cftlaw.com

© 2013 All Rights Reserved

28

THE INS & OUTS FROM GEORGIA

www.cftlaw.com

© 2013 All Rights Reserved

29

The Regulator Perspective

Ted Hamby,

Deputy Commissioner of the

Life & Health Division

www.cftlaw.com

© 2013 All Rights Reserved

30

QUESTIONS

www.cftlaw.com

© 2013 All Rights Reserved

31

CONTACT INFORMATION

Fred Karlinsky

Debra Peirce

Mark Ossi

Ted Hamby

fkarlinsky@cftlaw.com

Direct: (954) 332-1749

Main: (954) 492-4010

dpeirce@oci.ga.gov

(404) 657-7277

mossi@oci.ga.gov

(404) 656-0718

Ted.hamby@ncdoi.gov

(919) 733-5060

South Florida Office

One Financial Plaza

23rd Floor

100 SE 3rd Avenue

Ft. Lauderdale, FL 33394

Georgia Department of

Insurance

Two Martin Luther King

Jr. Drive

Atlanta, GA 30334

Georgia Department of

Insurance

Two Martin Luther King

Jr. Drive

Atlanta, GA 30334

North Carolina

Department of Insurance

P.O. Box 26387

Raleigh, NC 27611

Tallahassee Office

215 S. Monroe Street

Suite 701

Tallahassee, FL 32301

www.cftlaw.com

© 2013 All Rights Reserved