Practical Flowcharting for Auditors

advertisement

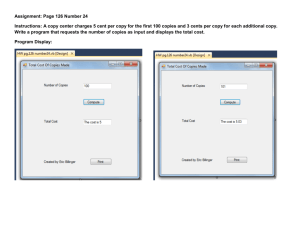

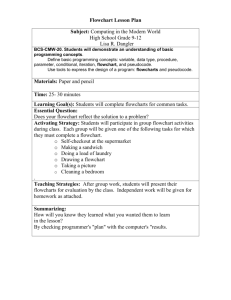

About the speaker Matthew Clohessy, CPA, CIA, has six and a half years of experience as an internal auditor at mid-sized commercial banking institutions where he specializes in evaluating internal controls over electronic banking delivery channels, retail and commercial banking operations, loss prevention and consumer banking regulatory compliance. Prior to his career in internal auditing, Mr. Clohessy was a network administrator for a small company in the office design industry for four years, where he was responsible for the operation, security and maintenance of the company’s IT infrastructure. Discussion Topics Flowchart types Benefits of using flowcharts Recommended methodologies / application examples Flowchart Types Basic flowchart: Swimlane / Cross-functional flowchart: Benefits to flowcharts Single document that can be used to facilitate discussion with different levels of management, both with our auditees and within the audit function: Granular process operation discussions with line management; Strategic and process design discussions with mid and upper management; and Operational reliance discussions between multiple lines of business. Efficient way of describing highly complex processes. Knowledge gaps in the process are easier to identify. Flowchart Balancing Act Robust documentation that stands on its own Easy to read presentation of the facts Recommended Methodologies Symbol Simplification Breakout into action statements Swimlanes - Breakout stakeholders Layering Notes “Table of Contents” Design Nesting Time Breaks Color Coding How are these symbols used? Symbol Simplification Action Decision Point Scenario – Accounts Payable Process Various departments complete purchase order request forms in [AP System] for new equipment, office supplies, etc. Accounts Payable is notified via e-mail of new entries in [AP System]. New entries are reviewed to ensure they are fully completed and that the requestor has adequate purchasing authority per the [approval list]. Orders over $5k require approval from the Accounts Payable Supervisor before they can be processed. [AP System] systemically notifies the requestor when an item has been approved or denied. Treasurer is notified by [AP System] of fully approved requests and makes the corresponding General Ledger entries. Starting off: Avoid having “busy” steps Break out into action statements Action Statement Breakout Updated Flowchart Which stakeholder is most important? Breaking out stakeholders Integrating Notes “Table of Contents” Design Nesting Workpaper reference made to another process document or flowchart. Time breaks and color coding Time break Color coding to designate audit coverage Questions?