The Revenue Cycle: Sales to Cash Collections

advertisement

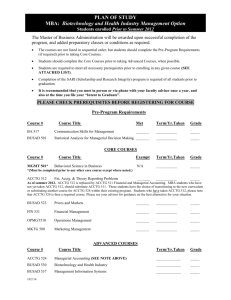

The Revenue Cycle: Sales to Cash Collections Chapter 10 FOSTER School of Business Acctg.320 1 Questions Addressed What are the basic business activities and data processing operations that are performed in the revenue cycle? What decisions need to be made in the revenue cycle, and what information is needed to make these decisions? What are the major threats in the revenue cycle and the controls related to those threats? FOSTER School of Business Acctg.320 2 Introduction The revenue cycle is a recurring set of business activities and related information processing operations associated with providing goods and services to customers and collecting cash in payment for those sales. Primary external exchange of information is with customers. FOSTER School of Business Acctg.320 3 Revenue Cycle Objective The revenue cycle’s primary objective is to provide the right product in the right place at the right time for the right price. (no lefts here!) To accomplish that objective, management must make many key decisions: FOSTER School of Business Acctg.320 4 Key Decisions: Revenue Cycle To what extent can and should products be customized to individual customers’ needs and desires? How much inventory should be carried, and where should that inventory be located? How should merchandise be delivered to customers? Should the company perform the shipping function itself or outsource it to a third party that specializes in logistics? What are the optimal prices for each product or service? Should credit be extended to customers? How much credit should be given to individual customers? What credit terms should be offered? How can customer payments be processed to maximize cash flow? FOSTER School of Business Acctg.320 5 AIS basic functions There are 3 basic functions of the AIS in the revenue cycle: (1) capturing and processing data about business activities, (2) storing and organizing that data to support decision making, (3) providing controls: ensure reliability of data & safeguard resources. FOSTER School of Business Acctg.320 6 Revenue Cycle Business Activities Four basic business activities performed in the revenue cycle: Sales order entry Shipping Billing Cash collections FOSTER School of Business Acctg.320 7 Sales Order Entry Sales order entry process entails four steps: 1. taking the customer’s order, 2. checking and approving customer credit, 3. checking inventory availability, and 4. Responding to Customer Inquiries FOSTER School of Business Acctg.320 8 Taking Customer Orders Many different ways: phone, store, field rep., mail, web…etc. Optical scanners can convert hardcopy to electronic data or customers enter data. Choiceboards allow customers to customize products to their needs (e.g., Dell). Use EDI (EDINT) for orders or to allow vendors to manage inventory (vendor managed inventory (VMI). Software can be used to optimize selling prices! FOSTER School of Business Acctg.320 9 Credit Approval Most business-to-business sales are made on credit. Credit sales should be approved before they are processed. Each customer will have a credit limit. Credit limit is the maximum allowable account balance for each customer based on the customer’s past credit history and ability to pay. Figure 10-7 on Page 376 shows the information typically available for this purpose: the customer’s credit limit, current balance and age of any outstanding unpaid invoices. FOSTER School of Business Acctg.320 10 Checking Inventory Availability The next step is to determine if there is sufficient inventory available to fill the order. When there are not sufficient items on hand to fill the customer’s order, a back order is created. Once the item(s) become available, a picking ticket is created. The picking ticket authorizes the inventory control function to release merchandise to the shipping department. The accuracy of inventory records is important because customer may become justifiably upset when unexpected delays occur in filling their orders. FOSTER School of Business Acctg.320 11 Responding to Customer Inquiries Customer services is so important that many companies use special software packages, called Customer Relationship Management (CRM) systems, to support this vital process. The goal of customer relationship management is to retain customers. This is important because a general marketing rule of thumb is that it costs at least five times as much to attract and make a sale to a new customer as it does to make a repeat sale to an existing customer. FOSTER School of Business Acctg.320 12 Responding to Customer Inquiries Transaction processing technology can also be used to improve customer relationships. For example, many commercial POS systems can link not only with the inventory file but also with the customer master file. This not only automatically updates accounts receivable balances but provides an opportunity to print customized coupons and personal messages on each sales receipt, such as “Thank you.” Web sites provide a cost-effective alternative to traditional toll-free telephone customer support, automating that process with a list of frequently asked questions (FAQs). FOSTER School of Business Acctg.320 13 Shipping The second basic activity in the revenue cycle is filling customer orders and shipping the desired merchandise. Figure 10-9 on Page 379 provides a data flow diagram for shipping. Shipping consists of the following two steps: (1) picking and packing the order and (2) shipping the order FOSTER School of Business Acctg.320 14 Pick and Pack the Order The picking ticket printed by sales order entry triggers the pick and pack process. Some of the investments companies have an automated warehouse system which include: computers, bar-code scanners, conveyer belts and communications technology. Some warehouses have no people—use robots. Radio-Frequency Identification (RFID) is replacing bar codes. The RFID tag eliminates the need to align items with scanners; instead, the tags can be read as the inventory moves throughout the warehouse. FOSTER School of Business Acctg.320 15 Ship the Order The shipping department compares the physical count of inventory with the quantities indicated on the picking ticket and with the quantities indicated on the copy of the sales order that was sent directly to shipping from sales order entry. The packing slip lists the quantity and description of each item included in the shipment. The bill of lading is a legal contract that defines responsibility for the goods in transit. FOSTER School of Business Acctg.320 16 Ship the Order If the customer is to pay the shipping charges, the copy of the bill of lading may serve as a freight bill, to indicate the amount the customer should pay to the carrier. One major decision that needs to be made when filling and shipping customer orders concerns the choice of delivery method. Another important decision concerns the location of distribution centers. RFID systems can provide real-time information on shipping status and thus provide additional value to customers. FOSTER School of Business Acctg.320 17 Billing Involves two separate but related tasks: (1) invoicing: The document created in the billing process is the sales invoice, which notifies customers of the amount to be paid and where to send payment. (2) updating A/R: The accounts receivable function uses the information on the invoice to debit the customers’ accounts for credit purchases and credit the customers’ accounts when payment is received. FOSTER School of Business Acctg.320 18 Billing Under the open-invoice method, customers normally pay according to each invoice. The customer is asked to return a copy of the invoice when mailing in their payment. This return copy is referred to as the remittance advice. Under the balance-forward method, customers typically pay according to the amount shown on a monthly statement. A monthly statement lists all transactions, including both sales and payments. FOSTER School of Business Acctg.320 19 Billing One advantage of the open-invoice method is that it is conducive to offering discounts for prompt payment, as invoices are individually tracked and aged. A disadvantage of the open-invoice method is the added complexity required to maintain information about the status of each individual invoice for each customers. Under cycle billing, monthly statements are prepared for subsets of customers at different times. For example, the customer master file might be divided into four parts, and each week monthly statements would be prepared for one-fourth of the customers. FOSTER School of Business Acctg.320 20 Exceptions: Account Adjustments and Write-offs This involves either the return of merchandise by customers for credit or the write-off of customers who do no pay their bill. After repeated attempts (at least three attempts in a three month period) to collect payment have failed, it may be necessary to write off a customer’s account. In such cases, the credit manager issues a credit memo to authorize the write-off. FOSTER School of Business Acctg.320 21 Cash Collections The final step in the revenue cycle is cash collections. The cashier handles customer remittances and deposits them in the bank. A remittance list provides the names and amounts of all customer remittances, and sends it to accounts receivable. Imaging technology can be used to improve the efficiency of processing customer payments. FOSTER School of Business Acctg.320 22 Cash Collections A lockbox is a postal address to which customers send their remittances. The participating bank picks up the checks from the post office box and deposits them to the company’s account. Under an electronic lockbox arrangement, the bank electronically sends the company information about the customer account number and the amount remitted as soon as it receives and scans those checks. With electronic funds transfer (EFT), customers send their remittances electronically to the company’s bank and thus eliminate the delay associated with the time the remittance is in the mail system. EFT is usually accomplished through the banking system’s Automated Clearing House (ACH) network. FOSTER School of Business Acctg.320 23 Cash Collections Electronic date interchange (EDI) is the use of computerized communication to exchange business data electronically in order to process transactions. EFT only involves the transfer of funds. Although every bank can do EFT through the ACH system, not every bank possesses the EDI capabilities necessary to process the related remittance data. Many companies have to separate the EFT and EDI components of processing customer payments. Financial electronic data interchange (FEDI) integrated the exchange of electronic funds transfer (EFT) with the exchange of the remittance data; electronic data interchange (EDI). FOSTER School of Business Acctg.320 24 Information Processing Procedures Many organizations have replaced their accounting information systems with an integrated Enterprise Resource Planning (ERP) system. ERP key improvements are as follows: Real-time order entry detects errors, such as missing data, as the order is being entered, and when it is easiest to correct those errors. Credit approval decisions can be made at the time the customer places the order. If special approval is required, the credit manager is notified by e-mail or IM and can immediately make that decision. Inventory records are more accurate and timely, enabling sales order entry staff to provide customers accurate information about expected delivery dates. FOSTER School of Business Acctg.320 25 ERP key improvements (cont.) The warehouse and shipping departments can better plan activities to minimize the time required to fill customer orders. The system compares data that the shipping department entered with the sales order file, thereby detecting and facilitating correction of any errors prior to shipment. Cash receipts are processed more quickly, improving cash flow. Reports and performance measures are timelier, enhancing management’s ability to monitor and improve efficiency and effectiveness. FOSTER School of Business Acctg.320 26 Control Objectives, Threats and Procedures In the revenue cycle, a well-designed accounting information system should provide adequate controls to ensure that the following objectives are met: All transaction are properly authorized. All recorded transactions are valid (actually occurred). All valid, authorized transactions are recorded. All transactions are recorded accurately. Assets, (cash, inventory and data) are safeguarded from loss or theft. Business activities are performed efficiently and effectively. FOSTER School of Business Acctg.320 27 Control Objectives, Threats and Procedures Table 10-1 on Page 392 lists the major threats in the revenue cycle and the appropriate control procedures that should be in place to mitigate them. FOSTER School of Business Acctg.320 28 Control Objectives, Threats and Procedures Sales Order Entry Threats The primary objectives of the sales order entry process are to accurately and efficiently process customer orders, ensure that the company gets paid for all credit sales and that all sales are legitimate, and to minimize the loss of revenue arising from poor inventory management. FOSTER School of Business Acctg.320 29 Sales Order Entry Threats: Threat 1: Incomplete or Inaccurate customers Orderhave to call customer to get correct info. Threat 2: Credit Sales to Customers with Poor Credit Threat 3: Legitimacy of Orders Threat 4: Stockouts, Carrying Costs and Markdowns-lost sales, excess inventory = carrying costs & markdowns. FOSTER School of Business Acctg.320 30 Shipping Threats The primary objective of the shipping function is to fill customer orders efficiently and accurately, and to safeguard inventory. Threat 5: Shipping Errors Threat 6: Theft of Inventory: by employees or in shipment. Inventory "shrinkage," a combination of employee theft, shoplifting, vendor fraud and administrative error, cost the nation's retailers $31.3 billion last year, according to the just released National Retail Security Survey, which analyzed theft incidents from 118 of the largest U.S. retail chains. FOSTER School of Business Acctg.320 31 Billing & A/R Threats The primary objectives of the billing and accounts receivable functions are to ensure that customers are billed for all sales that invoices are accurate and that customer accounts are accurately maintained. Threat 7: Failure to Bill Customers Threat 8: Billing Errors Threat 9: Error in Maintaining Customer Accounts-validity checks, closed-loop verification, field checks. FOSTER School of Business Acctg.320 32 Cash Collections Threats The primary objective of the cash collections function is to safeguard customer remittances. Threat 10: Theft of Cash The following segregation of duties should be used to reduce this risk: Handling cash or checks and posting remittances to customer accounts. Handling cash or checks and authorizing credit memos. Issuing credit memos and maintaining customer accounts. FOSTER School of Business Acctg.320 33 General Control Issues Two general objectives pertaining to all revenue cycle activities are: (1) that accurate data be available when needed and (2) that all activities be performed efficiently and effectively. Threat 11: Loss, Alteration or Unauthorized Disclosure of Data. Threat 12: Poor Performance In addition to ensuring accuracy and safeguarding assets, another objective of internal controls is to encourage efficient and effective performance of duties. FOSTER School of Business Acctg.320 34 Revenue Cycle Information Needs Effective management of revenue cycle activities requires timely access to accurate information Operational data are needed to monitor performance and to perform recurring tasks. In addition, current and historical information is needed to enable management to make strategic decisions. The accounting information system must also supply the information needed to evaluate performance of critical processes. FOSTER School of Business Acctg.320 35 New Metric: Revenue Margin One example of a new type of metric designed specifically to provide a leading indicator of revenue cycle performance. Revenue Margin equals gross margin* minus all selling costs: Payroll Commissions Salesforce travel expense reimbursements Customer service and support costs Warranty expenses Marketing and advertising expenses Distribution and delivery expenses * Net sales minus cost of goods sold = gross margin The value of revenue margin as a metric/measurement is that it integrates the effects of changes in sales, pricing and the costs associated with generating sales on overall company operating profits. FOSTER School of Business Acctg.320 36 Conclusion Accountants have to continually refine and improve performance measures/reports. In order to do this, accountants must develop a better understanding of business processes. FOSTER School of Business Acctg.320 37