Reducing Default in Contract Farming Arrangements

advertisement

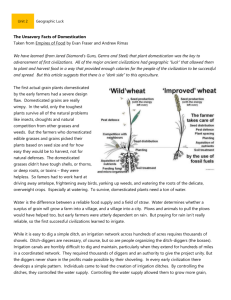

Reducing Default in Contract Farming Arrangements June 25, 2013 Bronwyn Irwin Senior Technical Director Enterprise Development Objectives of this Session Desired Outcomes: 1. Better understand how incentives can drive side-selling 2. Have practical tools to strengthen the design of contract farming programs Contract farming is not always best Contract Farming is… any agricultural production that takes place under an agreement (written or verbal) between a buyer and seller that provides conditions for the production and sale of the commodity. When Does Contract Farming Make Sense? • Better fit when: » Strong vertical coordination is needed » Higher value crop » Barriers to entry Benefits of Contract Farming Firms • • • • • • Farmers Risk decreases Benefits Consistent quality and volume of supply Reduced transaction costs Don't have to invest in land or fixed labor for own production • • • Risks Production failure Inefficient management that results in lost sales Corruption from the firm • • • Returns increase Benefits Consistent market with a known floor price Embedded services (information, training, finance) Risks Insecure tenure of contracted farmers Dispute with farmers Side-marketing Input diversion Benefits of Contract Farming Firms • • • • Farmers Risk decreases Benefits Consistent quality and volume of supply Reduced transaction costs Don't have to invest in land or fixed labor for own production • • • Risks Production failure • • Inefficient management that Benefits Consistent market with a known floor price Embedded services (information, training, finance) Risks Insecure tenure of contracted farmers Dispute with farmers • Side-marketing • Input diversion results in lost sales • Corruption from the firm Returns increase Contract Default Farmer Default Firm Default Side selling Late Supply of Inputs Side harvesting Input shortage Input diversion/ selling Collection delay/failure Price terms Side-Selling Low Yields Payment Delay Transport issues Collection delay Greed Low Prices Inventory of Smallholder Contract Farming Practices: Revised Final Report, December 2009. SNV Netherlands Development Organisation. Side-Selling Low Yields Payment Delay Transport issues Collection delay Greed Low Prices Inventory of Smallholder Contract Farming Practices: Revised Final Report, December 2009. SNV Netherlands Development Organisation. Impact of Contract Default Impact of Farmer Default Impact of Firm Default Failure to Repay Loans Reduced yields Lower prices Reduced yields Reduced firms’ trust Reduced quality of crop Reduced farmers’ trust Video Perspectives on Contract Farming From Farmers and Firms in Zimbabwe http://www.youtube.com/watch?v=x4JIZjzbUWI Case Study Discussion Questions: • What are the clauses that could create issues and lead to contract default? • What are the underlying causes of that potential contract default? • What are potential strategies to mitigate side-selling in this particular case? Strategies to Mitigate Default: Carrot • Build Trust (Good Management by Firm) • Payment Terms • Incentive Payment Structures • Preferred Supplier Program Strategies to Mitigate Default: Stick • • • • • Farmer Selection Firm Coordination Joint Liability Suing Farmers in Court Debt Collection REALIZ Contract Farming Data Crop Contracted Farmers Repayment Rate Actual vs. Budgeted Inputs Actual Delivery vs. Budgeted Yield Gooseberry 34 64% 48% 18% Cosmos seed 296 55% 96% 27% Paprika 424 43% 53% 15% Cowpea 700 72% 100% 41% Emerging Strategies to Mitigate Default • Improve efficiency and relationships with technology (SMS, direct deposits, barcodes, management systems) • Biometrics Results of Good Contract Farming Northern Tobacco Smallholder Farmers’ Yield Northern Tobacco Smallholder Production Share Results of Good Contract Farming Zimbabwe Cotton Yields Cotton Sector Repayment Rates Closing the Yield Gap Actual Yield (kg) Tobacco Potential Yield Gap Yield (kg) Current Profit 1,200 3,000 150% 3,401 Cotton 580 1,500 159% (2) Coffee 500 2,000 300% 420 Sugarcane 7,430 14,160 91% 481 Paprika 1,150 5,000 335% 556 690 8,000 1,059% 24 Maize Source: 2010 data from AMA; potential yield from FAO Handbook; calculations use budgets in Annex III. Since 1963 and in 146 countries, ACDI/VOCA has empowered people to succeed in the global economy.