Key Figures & Trends, Erik Timmermans, rep. Secretary - g

advertisement

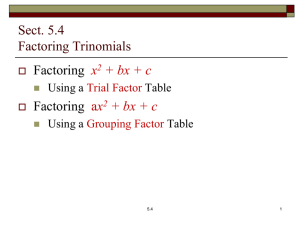

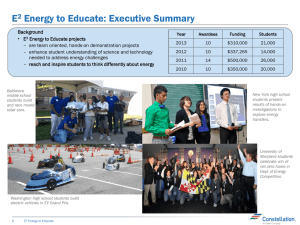

Factoring Key Figures & Trends Erik Timmermans, rep. Secretary General IFG G-Nexid Workshop, Geneva 28 March 2014 CONNECT. EDUCATE. INFLUENCE. What is Factoring / Commercial Finance? • General definition: A range of working capital solutions designed to provide day to day operating business finance for commercial organisations • Basic definition: Provides cash against customer invoices • Descriptive definition: Factoring may include: Sales Ledger Administration Collection Credit Insurance CONNECT. EDUCATE. INFLUENCE. Why is this industry important? • Support for (in particular SME) business to develop and grow • Support for export development • Creating and supporting employment • Efficient economic growth CONNECT. EDUCATE. INFLUENCE. Average Client Turnover, Europe CONNECT. EDUCATE. INFLUENCE. Evolution of World Factoring Turnover 1980 : +/- 50 billion € 1990 : +/- 200 billion € 2000 : +/- 600 billion € 2012 : +/- 2.120 billion € The industry has grown 4 over the last 30 years… CONNECT. EDUCATE. INFLUENCE. times faster than the World economy Factoring in the World 2012 Europe North America 1.257 (59%) 91 (4%) (1.173 EU) South America Total World: €2.119 billion (+8%) 93 (4%) Source: IFG GIAR 2012 CONNECT. EDUCATE. INFLUENCE. Asia 581 (28%) Africa & Middle East 32 (2%) Australia & NZ 64 (3%) Key Industry Figures • Turnover 2012 : 2.119 billion € • + 8 % compared to 2011 • Approximately 2.700 factoring companies But 1.200 in USA and over 500 in Brazil… • Financed amount at year end : 309 billion € • Factoring Clients : 496.000 • Factoring Debtors : 13.500.000 (rough estimate) • Employees : 46.000 CONNECT. EDUCATE. INFLUENCE. Market Shares 2012 (GIAR IFG) China UK and Ireland France Italy Germany Spain Japan USA Taiwan Australia CONNECT. EDUCATE. INFLUENCE. Total in Mio € Market Share 343.759 311.156 186.494 181.878 157.424 124.036 98.100 80.000 70.000 63.291 16,2 % 14,7 % 8,8 % 8.6 % 7,4 % 5,9 % 4,6 % 3,8 % 3,3 % 3,0 % Market Structure Concentration : Bank dominated: Combined market share of 5 biggest factoring companies in each country • On average 84% Combined market share of Top 5 in each country 49 % : bank subsidiaries 44 % : bank divisions CONNECT. EDUCATE. INFLUENCE. International Factoring Support of SME’s in open account trade CONNECT. EDUCATE. INFLUENCE. International Factoring • • • • 62% of World Factoring turnover is reported as Domestic Factoring Cross-border factoring continues to grow more rapidly than domestic factoring Either Direct Export Factoring (Factoring Company deals itself with foreign buyers) Or Two-Factor system (Export Factor uses services of Import Factor in buyer’s country) CONNECT. EDUCATE. INFLUENCE. The Two-Factor System Export Factor IF exchange: Electronic exchange between factors Credit protection & Collection by Import Factor Factoring agreement: Prepayment of invoices/ credit management Supplier CONNECT. EDUCATE. INFLUENCE. Import Factor Invoice collection and debtor credit approvals Delivery of goods & services Debtor Benefits of the two-factor system for the Exporter 100% protection against the buyer’s inability to pay on 90 days past due. Increased sales in foreign markets by offering competitive terms and conditions of payment. Credit lines are in place for buyers, which speed up response time for orders and reorders. CONNECT. EDUCATE. INFLUENCE. Accelerated cash flow through faster collections. Elimination of time-consuming administrative burden or delays linked with the negotiation of Letters of Credit. Benefits to the Buyer Purchase on convenient “Open Account” terms. Expanded purchasing power without using existing credit lines. CONNECT. EDUCATE. INFLUENCE. Orders can be placed swiftly without incurring the delays, complications and cost of opening Letters of Credit. No additional commission for buyers. Role of IFG CONNECT. EDUCATE. INFLUENCE. IFG • Started in 1963 • Members in more than 60 countries • Representing the Commercial Finance Industry worldwide (Factoring, Invoice Finance, Asset Based Lending) CONNECT. EDUCATE. INFLUENCE. Connect • Creating Business Opportunities for Members through TwoFactor platform and other cross-border business solutions. • Global association but regional approach through Chapters (Asia, Latin America, Africa, Central East Europe) • Partnering with like-minded associations (CFA USA, ADFIAP, national associations…) and international organizations (EBRD, EIF, CFEC, …) • Connect members with specialized service providers (IT, Legal, Risk, Consulting…) CONNECT. EDUCATE. INFLUENCE. Educate • Developing Talent in Factoring Industry • E-learning in different languages • University certificated Course on Finance International Trade & Commercial Finance • Leadership Business game • Mentoring and Consulting CONNECT. EDUCATE. INFLUENCE. Influence • Research and Statistics Center • Access to networking & Learning • Defending the industry with policy makers : • EU Federation for Factoring & Commercial Finance • Co-operation with CFA for harmonization • Draft Model Law on Factoring CONNECT. EDUCATE. INFLUENCE. Thank you for your attention! Questions? More info on www.ifgroup.com CONNECT. EDUCATE. INFLUENCE.