Raising Your Technology Market IQ

advertisement

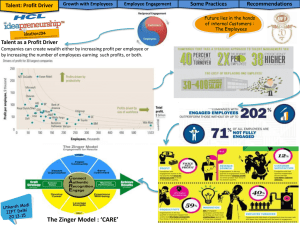

Freddye Silverman, HRIP VP Eastern Region, Jeitosa Group International 1 Source credit is given No recommended products – vendor neutral and not all products or providers in any category may be mentioned Not a case study As always, find the best fit for your requirements, environment and culture 2 HCM Market Mania Overview Core HCM Recruiting Talent Management Time and Attendance Workforce Analytics Enterprise 2.0 3 4 Talent Management – Social Talent Sourcing Consulting Talent Acquisition/Mgmt Talent Suite for Recruiting eLearning Oracle Appirio IBM Technomedia Skillsoft SelectMinds Knowledge Infusion Kenexa Hodes IQ Mindleaders 5 Increase market share…move customers to a new product/platform Eliminate a competitor Enhancement of functionality, e.g. LMS buying another LMS Expansion of functional footprint, e.g. TM Suites Chess game – market perception – Battle of the Gladiators (SAP and Oracle) 6 Kenexa ‘Techmall’ RapidHire – hourly hiring Onboarding Experience Compensation Mgmt CompAnalyst Intersection of HR 2X Assess – multilingual capabilities for users and applicants Social Learning Mgmt Mobile Feedback Survey App Fit Compass – identifies archetypes for company fit And Social Business 7 Complete the suite ◦ ◦ ◦ ◦ ◦ Front-end recruiting – talent acquisition Performance Management Succession Planning Compensation Management Learning and Development 8 New to the HCM market ◦ Strategy: carve out a space where social can thrive in the enterprise ◦ Mining the overlap between CRM (customer relationship management) and talent management ◦ No core HCM…yet Rypple acquisition ◦ Spun it as performance management ◦ In reality it is closer to ‘performance motivation’: corporate goal-setting, feedback, recognition and coaching ◦ Relaunching as ‘SuccessForce’ in a new HCM BU ◦ Led by John Wookey, EVP and SAP/Oracle alum Innovation could drive the market in a new direction 9 Social goal-setting, feedback and performance review system Reviews unrelated to org chart and cost centers Recognizes whom the employees work with and allows them to provide feedback to each other Rebuilt, rebranded and extended version of Rypple 10 Features include: ◦ Private manager-employee coaching workspace ◦ Points-based rewards system that can be tied to Amazon gift cards ◦ iPad-based recruiting app that connects hiring teams to interview schedules, candidate details, resumes and interview notes compiled by participants during the interview process 11 Workday ◦ Still flying high, sales have tripled, successful IPO, evolving to cloud-based ERP ◦ Novelty is wearing off; you either love or hate the UI (where’s the menu?) ◦ A process-driven HCM does not work for all cultures ◦ Intuitive?? ◦ Not making inroads outside the U.S. as quickly as hoped, going back to the lab for some development ◦ Functionality gap: no recruiting, learning or open analytics solutions ◦ Speculation: Social tools may come from integration with Salesforce.com 12 SAP ◦ Strong global product especially for payroll and advanced analytics ◦ SuccessFactors acquisition considered necessary and the only way they could enter the SaaS/cloud market ◦ CW: Integration, if it ever happens, is years away Dayforce ◦ ◦ ◦ ◦ Ceridian’s cloud strategy North American functionality, global in the plan Quick development cycle Very strong time capture (for hourly population) and payroll product included 13 Oracle ◦ PSFT still has a very loyal base and is still being sold but on a small scale ◦ EBS still popular in Europe and selling ◦ FusionBeware is real, has the customers numbers and (on the client small side) Has a way to go to belist considered spin: a robust HCM Does have recruiting, learning, social networking, predictive analytics e.g. Peugeot licensed PSFT Coexists with existingbut PSFThave and Oracle EBS solutions in 2006 never Techstack requirements are monstrous for on-premise installations – very high TCOimplemented it. ◦ Investing heavily in Taleo, integration with Taleo (primarily with Fusion) and analytics ◦ CW: will be a very credible cloud-based vendor 14 SaaS ◦ Frequent releases (Workday every 4 months) ◦ Some clients can’t keep up with that pace On-premise ◦ The sting of de-support ◦ Forced off of a popular release for one less so I.T. ◦ Web services knowledge gap even at the large enterprise level ◦ SOA components needed for enterprise scale delivery – difficult and training is needed 15 Systems of Record ERP-type systems we rely on to run our business (financial, manufacturing, CRM, HR) Must be ‘correct’ and ‘integrated’ so all data is consistent Designed for people that have no choice but to use them Systems of Engagement Systems used directly by employees for employees (email, collaboration, social networking and learning) They engage employees Organize, shape and drive the business, people and process Complement systems of record, don’t replace them 16 SOR – biggest problem with LMS, performance management or talent system is that employees don’t use it. Adoption factor is very low, leads to inconsistent data and suboptimized promises Transition from SOR to SOE – newer apps like Fusion, Silk Road, Workday look and act very different Towers Watson survey of 628 HR Orgs – why consider Workday? ◦ 58% said because of its user interface (the engagement factor) Source: Josh Bersin, Bersin blog 17 Systems of Record were designed in the last century, largely defined by ‘time and motion’ principles Employees were asked to bring their bodies to work and leave their brains at home Three primary factors of innovation and competition are time, process and collaboration “Technologize Process, – addressed by Systems the of Engagement Experience.” New era Humanize of internet,the mobile, Cloud, etc asks employees to bring their brains to work and leave their bodies at home. Sue Marks, CEO, Pinstripe, Inc. Source: Josh Bersin, Bersin blog 18 Of 250 vendors, a high percentage were related to recruiting Recorded video interviews are the latest add-on as well as ‘super-parsing’ powers Differentiators were not obvious, so how do products stand out? 19 Broadbean getTalent GooodJob HireAbility.com Hire-Intelligence HireIQ Hireology HireVue HR Smart Innovate CV JIBE JobApp Jobvite Montage nowHIRE Recruitics SelectMinds sparkHire Talemetry TalentBin TalentCircles TalentWise Terefic TweetMyJobs.com willbeHired Work4labs.com (thru Facebook) Wowzer 20 Search Engine Optimization Online Assessments Resume parsing Video - recordable Mobile Applications Social Media 21 MySammy - productivity measurement software which measures the computer activity of employees. ◦ Designed to help companies determine how employees are spending their time and assist in setting up individual goals for employees to improve their productivity. ◦ Works with company’s internet security. RoundPegg - –quantifiably track company culture to make better hires and keep employees engaged ◦ ◦ ◦ ◦ CulturePegg – track culture, alignment and ROI HirePegg – custom interview guides to hire for culture fit TeamPegg – leadership guides based on team sub-culture EngagePegg – Track engagement and get custom reports to re-engage based on culture 22 Talent Acquisition Onboarding Performance Management Learning Management Compensation Management Career Development Workforce Planning Ancillary Software, e.g. HR TMS Jobs SkillSurvey –Prehire 360 Succession Planning 23 Silk Road Life Suite Kene Saba Xa 24 SuccessFactors - building out Employee Central SumTotal – bought Softscape Taleo – inherited via Oracle SilkRoad – now building out Heartbeat (bought from Emportal in 2009) 25 No competitors left for Kronos – all had been acquired New generation of products ePay Systems ReportTime 26 SHRM is trying to develop investor metric standards to help investment industry determine the value of human capital and report on it easily a la FASB Companies would disclose all costs re hiring, retention and training of employees and contingents plus detailed info re company organization and staffing Create a formula for spending on human capital plus data metrics for talent retention, leadership depth, leadership quality and employee engagement. 27 HR community has pushed back – SHRM should drop the effort. Concern: ◦ no use to investors ◦ data could be used by companies seeking to acquire, raid talent or apply competitive pressure Open to second comment period; if support is lacking, SHRM will discontinue the initiative 28 •Founded in 2010 by BI experts including John Schwarz, former CEO of Business Objects •Based in Vancouver and San Francisco •Cloud-based application •Core workforce metrics •Predictive analytics •Access/Measure/Predict/Share 29 30 “Remove the HR data smog” Cloud-based analytical platform Multiple sources ◦ Internal (ERP, CRM, Talent Mgmt, eLearning…) ◦ External (benchmarking data, regional UI rates...) Pre-built connectors to some leading HCMs Proprietary Mercer content from surveys & research Pre-defined metrics Bundled with consulting services (a la Doublestar) 31 cFactor Workforce: global workforce management solutions w/ embedded social media, real-time collaboration tools, HR metrics cFactor Communications: unified platform to reach entire org, common brand and message in multiple languages and across multiple jurisdictions, advanced analytics to measure impact Regardless cFactor Communities: enterprise-grade of the chosenflexible, tool, it must be used by a social toorder fit various environments and skilled solutions craftsman in to extract true value and cultures to supportmeaning corporate initiatives 32 Avalanche of data from disparate sources Need to harness this data and use it to produce more meaningful results Problems in all functional areas ◦ Recruiting: measure time to hire but not quality of hire ◦ Benefits: measure what employees choose but not whether the choices are understood or if plans are well-utilized ◦ Learning/training – inadequate measures of competency, mastery and subsequent usage in the workplace Source: Lowell Williams, HR Executive 33 435 business and I.T. execs surveyed – only 37% familiar with concept Need for ‘data scientists’/ specialized Hadoop Distributed File System (HDFS) Typical uses ◦ ◦ ◦ ◦ Retail – buying trends of customers Healthcare – plan and claim data Ancestry.com Military Not every company can or should use Big Data 34 35 23% - percent of recent college graduates who wouldn’t take a job if they weren’t allowed to make or receive personal telephone calls (Adecco Group NA) 30% - percent of people born after 1980 who feel anxious if they can’t check Facebook every few minutes (Larry Rosen, iDisorder: Understanding Our Obsession with Technology and Overcoming its Hold on Us.) 46% - percent of people 18-24 who would rather have access to the Internet than access to their own car (The Gartner Group) 36 Consumerization of software a la Facebook LMS software is almost as mobile as recruiting apps UpMo – social talent management provider ◦ Talent Marketplace – designed to accelerate pace of filling open roles with internal talent ◦ Uses algorithms to match current employees to open opportunities, gain visibility into skills and talents of existing workforce ◦ Patent-pending algorithms use social feedback and employee-provided career goals and interests 37 Peoplefluent: Workforce Explorer app for iPad ◦ Designed to leverage use of gamification for training and self-learning ◦ Generates custom questions for line managers based on specific data in categories like performance, compensation, flight risk, employment history ◦ If they don’t know the answer, can receive a tip and search for answer ◦ Free 38 On its way to becoming a standard Workday has legitimized the use of the cloud for ERP applications. Created an upsurge of replacement discussions globally Almost all talent management vendors are in the cloud now Typically large companies replace core systems every 7-10 years, sometimes sooner if new technology architectures are developed Changing vendors/technology strategies is expensive – question ROI of making switch 39 Capterra.com Filter by platform, number of users, features, number of employees, location, budget List produced displays paid advertisers first, followed by complete list of all vendors in smaller print Comparehris.com Complete tool, view scored list of products closely matching listed needs Learn the capabilities of listed systems Determine needs by weighting importance of each feature or option View Detailed Comparison Screens View pre-recorded Demos Vendors pay to be included – not full market discovery Technology Evaluation Center Respond to series of questions to determine requirements Can do functionality only or also include technology requirements Must do your homework before using the tool in order to get a valid answer – incorrect requirement responses lead to incorrect conclusions Research and advisory firms Gartner ‘magic quadrant’ Forrester Aberdeen IDC Ventana Vendor websites Interactive product demos Can get a good sense of design and navigation 40 The HR Technologist (Bryon Abramowitz, KI) The Human Capitalist (Jason Corsello – Cornerstone on Demand) Naomi Bloom – ‘In Full Bloom’ Steve Boese on HR Technology – RIT professor (steveboese.squarespace.com) Ahmed’s Universe (Ahmed Limam, Independent global HR technologist) Analyst blogs (Bersin, Gartner, Forrester) Use RSS feeds for easy access LinkedIn – HR Technology groups Twitter Filter the facts from the buzz 41 Beware the anorexic organization… 42 Questions or Comments? freddye.silverman@jeitosa.com 443-956-0656 43