PAGE 1

We Take The Guesswork Out Of

Operating In Mexico

All rights reserved © 2014 Offshore International, Incorporated

For manufacturing operations of any size

Cost Reduction

Pressures

Establishing a Presence

in a

Lower-Cost Country

Maintaining Proximity

To Customers

& Supply-Chain

Operational & Cost

Predictability

PAGE 2

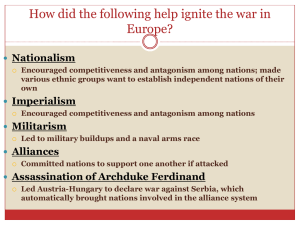

Industry problems are we solving …

PAGE 4

The Offshore Group Today

Helping companies successfully operate since 1986

We Employ

16,223

In Mexico and U.S.

We Manage

We Support

Sqft. of Industrial Space

Manufacturers

4,255,137

affiliate companies & brands

Offshore International, Incorporated

Maquilas Tetakawi S.A. de C.V.

Offshore International, LLC

Manufacturas Zapaliname S.A. de C.V.

57

1.

Employ their own talent without all the risk

2.

Operate in class A manufacturing space that is scalable and secure

3.

Move their factory inputs and outputs seamlessly across the border

4.

Comply with all government regulations without the burdens and distractions

5.

Leverage economies of scale to attain lower operating costs

PAGE 5

Our solutions in Mexico help companies of any size

Client operations range from 12 people to 3,500. Facilities size range from 5,000 sf to 175,000 sf

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

BAE Systems

Benchmark Electronics

Bodycote Thermal Processing

CPP (formerly Esco)

Ducommun Aerostructures

Ellison Surface Technologies

G.S. Precision

GE-Unison Industries

Horst Engineering

Incertec Special Processes

JJ Churchhill

Paradigm Precision (Carlyle.)

Parker Aerospace

Sargent Controls (Dover)

Senior Aerospace

SPS Tech (a PCC company)

Trac Tool (Carlyle)

UTC Aerospace Systems

Vermillion

Williams International

Automotive & Transportation

Electrical, Electronic & Medical

Devices

Aerospace

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Avalon Labs (Am.Cap.)

Blickman

Cardiva Medical

C&M Corporation

CBC Connect (Westcor)

Electronic Evolution

Huber-Suhner

IKOR

Medtronic

Novacap (Dover)

The Phoenix Company

Precision Interconnect (TE)

Turck

Whitepath

Younger Optics

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Cooper Standard Automotive

DCM

Gemini Plastics

Intec Group

Liberty Steel

Mico

Neapco

Powerbrace

Senior Flexonics

St. Clair Technologies

TE Connectivity

TitanX

Unlimited Services

Waukesha Bearings (Dover)

Other Industries

•

•

•

•

•

APSM

Greenheck Fan

Kromet

Minco (Demmer)

Parker (Camfil Farr)

• 40 clients in Guaymas/Empalme

• 16 clients in Saltillo

• 20 clients are publicly traded

• 8 clients also have standalone operations

• 32% of clients between 10 and 20 years

• 45% of clients between 5 and 9 years

• 23% of clients less than 5 years

PAGE 6

Current Clients

PAGE 7

Our Locations

Unique labor & talent characteristics and logistical advantages

Tucson, AZ

Nogales

Hermosillo

Houston, TX

Guaymas /

Empalme

Mission, TX

Saltillo

Distances

•

Port of Los Angeles to Guaymas: 758 Miles

•

Port of Houston to Saltillo: 523 Miles

•

Port of Manzanillo to Guadalajara: 204 Miles

•

Tucson to Guaymas/Empalme: 333 Miles

•

Mission to Saltillo: 205 Miles

Guadalajara

Manzanillo

Queretaro

PAGE 10

Our Services

Solutions for manufacturing operations of any size

Is Mexico Right For You?

How Should You Operate In Mexico?

As a Standalone

With Support

Advisory

Services

Startup

Implementation

Shelter Framework & Administrative Services

Obtain reliable and useful

information to determine if

and/or how a business case

exists for establishing a

manufacturing presence in

Mexico.

Receive expert hands-on

support to plan and execute

the key elements needed to

successfully setup a

manufacturing presence in

Mexico.

Costing, Site Selection, Workforce

Evaluation, Logistics, Regulatory

Compliance

Legal Structure, Staffing, Facilities

Setup, & Regulatory Compliance

Immediately leverage a world-class infrastructure built specifically for

manufacturers to achieve a globally competitive advantage in a

predictable lower cost environment.

Legal Structure, Staffing, Facilities Setup, & Regulatory Compliance

Shared Service

For users requiring smaller

spaces and are willing to share

infrastructure.

Full Service

Provided in our integrated and

secure manufacturing

communities located in

Guaymas / Empalme, Sonora

and Saltillo, Coahuila.

Flex Service

For users operating outside

our manufacturing

communities with potential

transition to standalone. Flex

Services are available in

Guadalajara, Queretaro,

Hermosillo, and Saltillo.

PAGE 11

Our Business Model

You in Mexico

Leverage

economies of scale

Mitigate

risk and exposure

Manufacturing

Communities

Legal

Framework

Support

Services

Focus

on production

Minimize

taxes

La Angostura – Manufacturing Community in Saltillo, Coahuila Mexico

PAGE 12

Client

A U.S. or other foreign country

legal entity.

U.S. Contract

Offshore International

Benefits:

First 4 Years:

• No Permanent Establishment

• No Income Taxes

A U.S. Corporation

Related Parties

U.S.

Mexico

MTK or ZAPA

Mexico affiliates of Offshore

International

IMMEX - Shelter

Client

Operation

Various Client

Operations

Reference Articles 181 and 183 of Mexico’s New Income Tax Law

published in Mexico’s Official Federation Daily Register dated

December 11, 2013.

PAGE 13

Shelter Legal Framework

PAGE 14

Labor Management

A proven process built around manufacturer’s needs

You

Staffing

Plan

Job

Descriptions

Us

Skills

Development

Coordination

Recruiting &

Prequalification

Schools &

Government

Selection

Hiring &

Induction,

Employer

Of Record

Job

Training

Busing

Coordination

•

•

•

•

•

•

•

•

Manage Employee Activities

Organizational Development

Problem Resolution & Corrective Actions

Turnover & Absenteeism Monitoring

Labor Union Relations

Employee Event Coordination

Employment Termination

Labor Arbitration & Legal

Administrative and support services delivered by experts and state-of-the-art systems through economies of scale

f e a t u r e s

•

•

•

•

•

•

•

•

First-hand labor market knowledge

Recruiting of labor, technical, and leadership

positions

Employer of record and compliance with labor law

Labor union relations & negotiations

Skills development facilitation

Employee and employment problem resolution

Employee busing coordination

Medical care provision and employee amenities

b e n e f i t s

•

•

•

•

•

•

Hiring best-practices

Employee retention

Reduced absenteeism and turnover

Personnel cost predictability and containment

Reduced labor-related legal compliance risk

Employment flexibility

PAGE 15

Labor Management

Cross Dock

Freight Consolidation in the U.S.

Import & Export

•

•

•

•

•

•

•

•

•

•

•

Pre-border crossing inspection

Documentation

Classification and valuation

NAFTA, Prosec, & import duties

Border crossing coordination

Customs broker relations

Mexico importer/exporter of record

Mexican Customs compliance

Compliance & operations systems

U.S. Customs assistance

Regulatory audit management

PAGE 16

Import & Export Management

Administrative and support services delivered by experts and state-of-the-art systems through economies of scale

f e a t u r e s

•

•

•

•

•

•

•

•

•

Startup training and logistics resource alignment

Determination and mitigation of import duties

U.S. based cross docking facilities and infrastructure

Importer and exporter of record in Mexico

Mexican Customs regulatory compliance

Trade agreement compliance (NAFTA, EFTA, etc.)

Customs brokerage relationship management

Inbound and outbound operations

Regulatory audit management

b e n e f i t s

•

•

•

Customs cost predictability and containment

Reduced financial and operating risk through 100% compliance

Reduction in delays at border crossing ports

PAGE 17

Import & Export Management

PAGE 18

Park & Facilities Management

Administrative and support services delivered by experts and state-of-the-art systems through economies of scale

f e a t u r e s

•

•

•

•

•

24/7 park security, surveillance, and controlled

access

Utilities provision monitoring and corrective actions

Infrastructure preventive maintenance

Building repairs and maintenance

Tenant improvement management

b e n e f i t s

•

•

•

•

Achieve maximum operational continuity

Lower costs through preventative maintenance

Operate in safe and secure park environments

Complete building improvement projects on time

and on budget

PAGE 19

Park & Facilities Management

U.S. Standards

Mexico Standards

PAGE 20

Environmental and Occupational Health & Safety

Our Role

•

Stay current on

regulatory

requirements

•

Advise on best

practices

•

Conduct internal

audits

•

Recommend

preventive actions

Your Role

•

Implement best

practices

•

Cooperate with

internal and

external audits

Over 14,000 paid each

week through direct

deposit with onsite

ATM’s

Managing benefits required by

law, from labor union contract,

and employer provided fringes

including social security,

housing, and retirement

System to access regional

suppliers and service

providers, and process

In-Mexico indirect spend

•

•

•

•

Corporate income taxes

Payroll taxes

Value added tax

State & local taxes

PAGE 21

Payroll & Benefits, Indirect Spend & Local Vendors, A/P,

Accounting, and Taxes

Administrative and support services delivered by experts and state-of-the-art systems through economies of scale

f e a t u r e s

•

•

•

•

•

•

Electronic and networked time and attendance

systems

Direct deposit and in-park ATM machines.

Federal, regional, labor union, and employerprovided benefits management.

Mexico indirect-spend order processing systems and

controls.

Value added tax tracking and reimbursement

processing

Federal, state, and municipal tax and fiscal reporting

b e n e f i t s

•

•

•

Employee retention

Indirect spend cost predictability

Income tax haven through shelter legal framework

PAGE 22

Payroll & Benefits, Indirect Spend & Local Vendors, A/P,

Accounting, and Taxes

PAGE 23

Mexico Operating Costs

Based on a compilation of 2013 costs in USD of 57 operations manufacturing in various regions of Mexico

Direct Labor Cost

Overhead Cost

(fully fringed cost per hour including overtime

and bonuses)

Total (Labor + Overhead)

(cost per direct labor hour including indirect

and salaried positions, facilities, utilities, inMexico indirect spend, administrative costs

and taxes)

(Mexico-incurred cost per direct labor hour)

Manufacturing Process

Min.

Avg.

Max.

Min.

Avg.

Max.

Min.

Avg.

Max.

Electromechanical &

Electronics

$2.35

$3.20

$4.42

$4.60

$9.32

$23.13

$6.95

$12.81

$28.20

Machining &

Metalworking

$3.01

$4.62

$7.04

$10.18

$18.67

$32.34

$14.11

$23.78

$35.62

Molding, casting,

materials processing

$2.42

$2.99

$4.19

$6.84

$15.30

$26.52

$9.72

$19.49

$29.35

Variations are due to employee qualification

levels, overtime, and locations.

Variations are due to space utilizations, ratio

of indirect to direct positions, utilities usage,

and logistics efficiencies.

Not included are allocated burdens from

foreign company support or asset depreciation.

PAGE 24

{

For more information:

Eduardo Saavedra

EVP, Business Development

Eduardo.Saavedra@OffshoreGroup.com

Ofc: 520-574-6209

www.OffshoreGroup.com