eBanking 2

© 2010 Saga d.o.o. Beograd • May 2010

eBanking

2

THE DRIVERS…

What are 10 key business issues in financial services?

1.Regulators will require financial services firms to concentrate on transparency and risk management.

2.Transaction banking will have a strong resurgence and will need to offer product and delivery innovation, including social media, new interactive strategies, and mobile banking.

3.Lending Activity will continue to recover and increase.

4.The handful of global banks likely to be flourishing in the future will owe much of their success to having significantly scaled back the complexity of their operations.

5.Globalization and emerging markets will represent growth opportunities.

6.Traditional fee sources will end / change.

7.Wealth management will remain strategic, but with some shifts.

8.Prioritizing Investments will remain critical as hard times hinder innovation.

9.Security will remain a primary consumer concern.

10.Non bank banking ecosystems will begin to develop.

© 2010 Saga d.o.o. Beograd • May 2010

THE TECHNOLOGIES…

What technologies are needed to support the business?

• Increased emphasis on Interactive related technologies: Mobile, enhanced Web, and

Social Networking.

• Improvements in data consolidation and rationalization; Information analytics and realtime information.

• Evolution of core financial services software platforms.

• Increased IT Governance.

• Emphasis on improved “non-invasive” security processes and systems

• Continued Efficiency improvements in infrastructure

© 2010 Saga d.o.o. Beograd • May 2010

THE TRENDS ...

What are leading trends in interactive banking?

• Dynamic online help / chat

• Interactive portal/ widgets based

• More video / audio usage

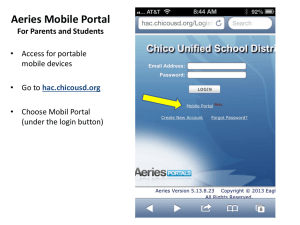

• Explosion of mobile banking, more useful applications

• Creative uses of social networking

• Increased use of targeted marketing for Cross Sell; subtle/overt and life events.

• Better business analytics – web analytics integrated with bank CRM data

• Improved online PFM; Personalized Portals

© 2010 Saga d.o.o. Beograd • May 2010

TRENDS IN INTERACTIVE

BANKING

Improved online; Personalized Portals

• Should allow client personalization, customization, and aggregation

• What does your online banking offering offer? Does it look like this?

© 2010 Saga d.o.o. Beograd • May 2010

THE ENABLERS

What architectures are needed to support the new trends?

• Two Key Components are needed:

• Data Integration – Financial Messaging Service BUS

• Provides consolidated view of a customer’s relationships

• Provides integration of internal and external customer data

• Provides for personalization and targeted offers

• Presentation Integration - A flexible Portal system – “HOLOS”

• Provides client and bank customization and personalization

• Provides easy integration with bank systems, data, and external content / applications

• What might that look like?

© 2010 Saga d.o.o. Beograd • May 2010

© 2010 Saga d.o.o. Beograd • May 2010

„Old Systems“ – Hierarchical windows, waiting time

© 2010 Saga d.o.o. Beograd • May 2010

NEW !!

MashUp Portal - Widgets

eBanking widgets

© 2010 Saga d.o.o. Beograd • May 2010

Financial Mashup portal

YouTube service

CRM

API

Public

API services

Bank’s

Marketing

API

Business Mashup*

eBanking 2

Images

Sounds

Videos

Backend

Data

Services

Existing

Enterprise

Services

Public

Internet

Mashup APIs

In Web development, a mashup is a Web page or application that uses and combines data, presentation or functionality from two or more sources to create new services. The term implies

easy, fast integration, frequently using open APIs and data sources to produce enriched results that were not necessarily the original reason for producing the raw source data. - Wikipedia

© 2010 Saga d.o.o. Beograd • May 2010

RSS/Atom

Feeds

ODATA

SOAP

Financial Portal Architecture

Public

API services

SOA

CRM eBanking

Portal engine

Re-usable generic

Financial Mashup portal

Widgets

SaaS eBanking suite

Notification ...

Ebanking services

Personal finance

Mailbox

Analytics

Core banking

Administration

Monitoring

SCOM

SOA

Banking services

© 2010 Saga d.o.o. Beograd • May 2010

MashUp Portal - Widgets

eBanking widgets

© 2010 Saga d.o.o. Beograd • May 2010

Financial Mashup portal

CRM

API

Bank’s

Marketing

API

Public

API services

Video service

Saga eBanking

2

- Widget-based

- Asynchronous

- Concurrent

- Inter-Communication

- Fully Open for

Integration: system wide and widget wide

- Internet, mobile, contact center, IVR,

SMS, e-Mail

© 2010 Saga d.o.o. Beograd • May 2010

WebKit browser compatible

© 2010 Saga d.o.o. Beograd • May 2010

„Touch“ Supported ...

© 2010 Saga d.o.o. Beograd • May 2010

Product Roadmap

1.10.’11 1.4.’11 1.4.’12 1.5.’13 1.5.’14 v 2.0

v 2.0

v 2.1

v 2.1

v 2.2

v 2.2

v 3.0

v 3.1

1.7.’11

© 2010 Saga d.o.o. Beograd • May 2010

1.1.’12 1.9.’12