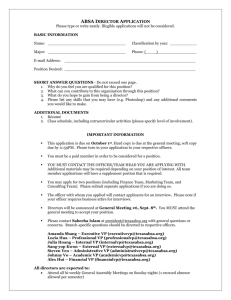

Buzz Distribution Tracy version

Distribution

Video

PA

Veronica

Viljoen

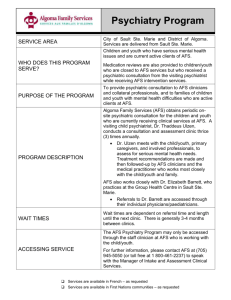

Distribution Structure

ME

Izak Smit

EA

Kwena Isadore

Moabelo

GM Finance

Werner Bosman

GM

Operations

Marletha Hardy

Head Sales

Enablement

Telephony

Bill Lynch

Head

Keystone

Retail

Steve Lyvt

Head AIFA

Sibusiso Ntonga

Head

Corporate

John Fiser

Head

Business

School

Pieter Louw

Our distribution model ensures customers can interact with us using their choice of channel

Lead

Generation

Distribution Channels

How this will bring growth:

• ATOM for profitability and better customer experiences – Absa

Planners;

• Additional call centre capacity;

• Digital channel;

• Keystone focus on the branches .

Digital

(e.g. AOL)

Call centres

Absa advisors

Branches

We developed an ambitious plan to change the way things were done

VISION

By 2015 we will be a world class financial services distribution house...

a business school case study

A win-win partnership model with external product suppliers

Solid systems to enable straight through processing

Market leading solutions drive all advice

Competitive advisor communication model

Fee income business model (from commission only model)

State of the art leads flow – a competitive advantage in the industry

Integrated channels to deliver a single view of the client

Respected business school to socialise and upskill our people

Our digital channel will provide an end-to-end online experience...

Targeting our retail Absa Online base product selection is based on local and global market trends Customer benefits include:

Easy Accessibility

Online sales, service and claims management

Quick and Easy

Limited steps to ensure a rapid process

Caters for all Needs

Complex needs directed to a broker

Convenience

An end-to-end customer experience

Customised

Customers are recognised by the system

A Tailor-Made

Experience

Selected products prove to be feasible

To reach these customers, trigger event marketing provides focus

Simplicity

No clutter

Easy Steps

We are developing a best practise telephony model to support our integrated sales and service approach

Good results over the past year

Significant increase in efficiency and sales

Current performance strike rates are above market for cold outbound telesales campaigns

Previously outsourced our telephony to service providers

Difficult with the consumer protection act

Resource intensive

Compensate third parties

Building our own capacity through

Best practice telephony implementation

Embedding this core competence in four phases

Investing in good people, technology and sales culture

60 agents (target 200 in 2013)

Our branch network is extensive and ensures easy access to our products and services

Simple, non-advice products

(branch consultants)

Convenience – an end-to-end customer experience

Six stand-alone products (Law for You, Extreme, Classic

Life, Funeral, Wills, investment)

One embedded product

Shared revenue model with branches on bank scorecards

Sales support in place to enable branch consultants

New client conversation tool (CNAT) to drive leads and product sales appropriately to suit customer needs

Significant replatforming of our systems experience...

Replatforming focused on the system and process integration of AFS and Absa systems to support our future operating model

Back office centralisation for greater efficiencies. Focus on:

Customer Relationship

Management

Financial Planning

Leads and Activity

Management

Compliance

Fulfilment Servicing Quoting

...Our vision is an institution where bankers can also be socialised, cross and up-skilled bridging the cultural divide between the adviser and banker supporting a one stop, holistic customer value proposition...

Business School Vision

“GLO”

…to become a

Global Learning Organisation that: place a high premium on the acquisition, creation, transfer & retention of knowledge and skills delivered through the Business School

We are transforming our academy into a bancassurance business school

for people excellence and leadership

... ultimately it will cater

For the development needs of existing advisers and other

AFS staff......

More than just a training institute

Socialising novices. Socialising all AFS distribution employees

Upskilling advisors / planners CPD points – sharpening the saw

Development of all AFS employees

Development and upskilling of Absa bankers

Our academy is developing into an institution where all new advisers (green fields and experienced) will be socialised,

...our vision is an institution where bankers can also be socialised, cross and upskilled, bridging the cultural divide between the adviser and banker

The operating model

Personal mastery: leadership; mentoring and ubuntu

Personal development: soft skills, practise management and selling and building trust

Core technical skills: novice, intermediate and professional

Business School Structure

Academies

Cognitive

Behavioral

Performance improvement

Leadership

Cognitive

Behavioral

Performance improvement

Culture and

Socialisation

Cognitive

Behavioral

Performance improvement

Sales and

Innovation

Cognitive

Behavioral

Performance improvement

Core Technical

Cognitive

Behavioral

Performance improvement

Learning and Development HR Technology

Employee

Levels

1 2 3 4

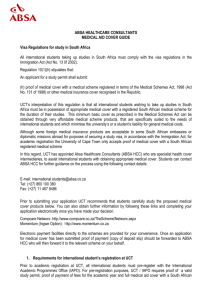

Keystone drives collaboration and better cross-sell between AFS and the bank to deepen penetration in the base

Life Insurance

Short term insurance

Investment

Keystone

Employee benefits

Fiduciary

One customer

Seamless integration with the segmentation of the bank

Single view of

CVP

Get the bank to benefit from the

Use the bank brand

Protect the brand as a major competitive edge

Integrate marketing

Products should look and feel like bank products

Maximise the channels

Blended channels that benefit the customer

Loyalty for all

Customers to get the full value of using the bank for all their services

Key Competencies

Customer Growth Segments Customer Segment

Enablers

Consumer Banking

HNW & Lending Leads Management

Customer Solutions

Business Markets Africa Digital Innovation Mission Control

Operation

Connecting the

Customer’s Universe

Leads Management

Consumer

Banking

Customer

Analytics

Africa

High Net Worth

Digital Innovations

Business Banking

Customer

Solutions

Big 10

Customer

Intimacy

Councils, Rolling stone

Alignment

Advisor Alignment

Product / Segment /

Channel / CVP Alignment

Top 500

Training

Identification of target executives

Execute and Optimise

Brand Ambassadors

Conquer

Business

Markets

Commission Share

VAPM

Leads optimisation

Agribank

Unlock Value in Retail

Branches

Leads optimisation

Supersize non-advice

CDD / iCAPs

Discover

Africa

Due Diligence

Job cards

Strategy / Relationships

Bancassurance best practice

Digital

Innovation

WIM

AOL

Strategy

Feature store

Sexy

Customer

Solutions

Marketing Insights

Communication

CVPs

Predictive Modelling

Loyalty

Customer Onboarding

Leads &

Sales

Planning

Framework/ Reporting/

Activity

Technology

Dashboard

Retail/BB/PB Campaigns

Maximise

Secured

Lending

AHL & CPF

AVAF & AVCAF

Joint Ventures

Edcon/Retail

Map up JVs

New Opportunities