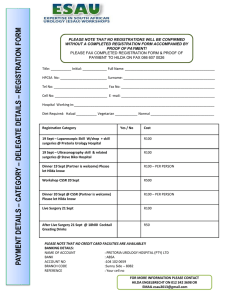

Sept 2013 - Ace Analyser

advertisement

Beach picture photo STATE BANK OF TRAVANCORE HEAD OFFICE THIRUVANANTHAPURAM ANALYST MEET AT MUMBAI 06th Nov 2013 2 BRIEF HISTORY OF STATE BANK OF TRAVANCORE Established as The Travancore Bank Ltd. on 12th September 1945 Founder: Maharaja Chithira Thirunal Balarama Varma of the erstwhile princely State of Travancore Initial paid up capital of Rs one crore 30 percent by the then Government of Travancore Became a Scheduled Commercial Bank in 1946 In 1960, became a subsidiary of the State Bank of India Renamed State Bank of Travancore 3 3 ORGANISATIONAL STRUCTURE Head Office & Registered Office at Thiruvananthapuram Central Data Centre at Belapur, Integrated Treasury at BKC Mumbai 3 Network GMs at Thiruvananthapuram, Ernakulam & Chennai 9 Modules and 27 Regional Offices 9 Specialised NRI branches 7 Commercial Branches for Corporate Credit 13 Mid Corporate Branches 4 Bank at a Glance As on Sept 2013 5 Performance Highlights – Sept 2013 Operating Net Profit Rs. 241 crore Book value Per Share Rs. 868.42 Earning Net profit : Rs. 729 crore [Rs 10 face value] Per Share Rs. 96.40 [Annualised] Interest income Rs. 1182 crore – Up by Rs.153 crore (YoY) 6 6 BUSINESS HIGHLIGHTS– Sept 2013 Advances Growth (YoY%) Advances (ASCB market share) Deposits Growth (YoY%) Deposits (ASCB market share) Sept 12 Sept 13 21 17 1.19 1.21 21 21 1.16 1.27 7 7 Highlights – Profitability Parameters Sept 12 Net Interest Income Sept 13 YOY(In%%) 1029 1182 15 272 398 46 1301 1580 21 Operating Cost 660 850 29 Operating Profit 641 729 14 Provision (other than tax) 221 433 96 Net Profit 317 241 -24 Other Income Operating Income 8 Efficiency Parameters (In %) Efficiency Parameters Net Interest Margin Cost to Income Ratio CAR (BASEL III) EPS (Annualised) CoD YoA RoA RoE PCR Sept 12 2.54 Sept 13 2.44 50.69 53.83 NA 126.82 7.55 11.11 0.73 16.28 60.02 10.13 96.40 7.38 10.76 0.46 11.33 57.31 9 9 PERFORMANCE COMPARISION - JUNE 2013 Parameters SBT All Banks Peer 4.86 1.08 1.29 % Growth in Gross Advances -1.09 -0.32 -1.05 C.R.A.R. (Basel III) 10.48 13.48 11.79 3.09 1.74 4.00 2.13 3.54 2.00 6.87 11.87 -- 76.23 75.42 75.51 3.16 3.12 4.37 0.18 0.26 0.18 9.66 13.34 10.32 % Growth in Total Deposits Gross NPA % Net NPA % Gross NPA + Std Restructured A/cs Ratio Credit Deposit Ratio Return on Equity % Return on Total Assets % Non Interest Income to Total income % 10 10 Shareholding Pattern - Sept 2013 0.05 0.01 2.27 0.03 Body corporate(2.27) 13.46 SFC(0.03) 1.03 0.17 SBI(75) 2.93 0.9 FOREIGN INSTITUTION(3.10) 1.05 GOVERNOR OF KERALA(1.05) 3.1 INSURANCE CO(0.90) BANKS(0.17) MUTUAL FUND(1.03) NRI(2.93) RESIDENT INDIAN(13.46) 75.00 CLEARING MEMBER(0.05) FINANCIAL INSTITUTIONS(0.01) 11 Dividend History 250 DIVIDEND % 200 200 180 180 160 150 100 130 100 100 100 75 50 0 12 SHARE PRICE MOVEMENT HIGH DATE LOW DATE (In Rupees) July-13 512.00 01.07.13 444.60 31.07.13 Aug-13 469.95 01.08.13 405.10 28.08.13 Sept-13 478.80 19.09.13 401.55 04.09.13 13 13 Market Share & CD Ratio DEPOSITS ADVANCES 1.28 1.22 1.16 1.18 1.24 1.25 1.27 1.27 1.16 1.18 1.19 1.24 1.21 1.19 1.16 1.10 Mar 11 Mar 12 Jun12 Sep 12 Dec 12 Mar 13 Jun 13 Sep 13 Mar 11 Mar 12 Jun12 Sep 12 Dec 12 Mar 13 Jun 13 Sep 13 CD RATIO 79.24 75.67 Mar 11 80.8 77.75 76.97 Mar 12 76.58 76.42 Jun12 80.01 77.32 76.37 77.61 77.95 75.14 Sep 12 Dec 12 78.27 Mar 13 ASCB SBT 75.64 74.62 Jun 13 Sep 13 14 Advances - Exposure across Segments Rs.58667 Crores Rs. 68389 Crores Rs. 68552 Crores % C&I PER AGRI SME Sep-12 48.71 27.43 16.77 7.09 C&I PER AGRI SME Mar-13 51.49 26.20 15.10 7.20 C&I PER AGRI SME 51.33 26.96 14.37 7.33 Sep-13 15 Major Industry-wise Restructured Assets (In Rs crores) Industry Mar 13 Sept 13 Iron & Steel 409.39 688.78 Textiles 229.38 483.04 Infrastructure 529.62 572.05 Pharma Shipping & Transport Non-ferrous Metals Engineering 16.30 309.43 49.98 169.25 234.94 260.42 163.34 178.65 16 16 Major sector-wise NPA (In Rs crores) Industry Iron & Steel Textiles Infrastructure Food Processing Metals Engineering Mar 13 Sept 13 167.40 167.75 82.87 46.37 142.05 4.64 10.19 26.04 221.66 33.10 11.21 46.37 17 17 Direct Benefit Transfer DIRECT BENEFIT TRANSFER (DBT) : As part of DBT, Wayanad and Pathanamthitta Districts of Kerala were selected for AADHAR LINKING. We have opened 11.99 lac accounts, linked with AADHAR for direct transfer for benefits under LPG and other Govt. Schemes as on 30-09-2013 FINANCIAL INCLUSION (FI): 29 FI villages in Kerala and 6 FI villages in Tamilnadu allotted to our Bank. In Kerala we have opened new branches and in other areas basic banking services provided through Business Correspondents. As part of FI, 23.83 lacs Basic Savings Accounts opened (of which 37658 in FI villages) 18 Expanding Footprint Sept 12 Mar 13 Sept 13 Branches ATMs YoY Incr. No. of Branches 925 1013 1022 97 No. of ATMs 949 965 1034 85 Hits per day 212 227 225 13 Debit Cards (in lac) No. of Debit Cards 59.74 66.31 75.96 16.22 Internet Banking No. of customers 5.06 5.61 6.46 1.40 32.41 68.12 49.45 17.03 Registered mobile users 1.04 1.45 1.53 0.49 No. of transactions 2.11 4.60 3.10 0.99 40.87 55.77 60.77 19.90 (in lac) Mobile Banking (in lac) Alternate Channels No. of transactions % of total transactions 19 CORPORATE SOCIAL RESPONSIBILITY • Social Circle is a “Unique activity of SBT” • Ambulance Van donated to Deena Daya Seva Trust, Thodupuzha at a cost of Rs.7 lac • Rs.11.65 lac distributed among 400 cancer patients of Regional Cancer Centre, Thiruvananthapuram. • EEG Machine to Swami Vivekananda Medical Mission, Attappady • Distributed water purifiers to schools through our entire network. • Donated 10 ceiling fans each to deserving schools by all our offices. • Ambulance costing Rs 8.05 lacs to St.John’s Health Service Pirappancode • Akshaya Noon Meal Programme for school children was assisted by donating Rs. 3 lacs • Donated Rs.5.40 lacs to Kozhikode Higher Secondary School for Handicapped to set up audiology lab • Donated Rs.10 lacs to M/s.Santhi Bhavan Trust Hosur for Solar Panel 20 21