Structure, Conduct and Performance of the Rice

Market and the Impact of Technological Changes in

Milling

Institution

Institute of Agribusiness and Development Studies

(IADS) BAU, Mymensingh

Research Team

Professor Dr. Shankar Kumar Raha- PI

Professor Dr. Md. Monjurul Alam – CI

Md. Moniruzzaman – CI

Dr. M. A. Awal - CI

1

Objectives of the Research Project

1. To provide evidence and provide new evidence on rice market

structure, conduct and performance in Bangladesh and

To analyze the impacts of technological changes in the rice

milling sector on employment, financial viability of rice

mills, market concentration, rice quality, and cost of milling

2. To construct detail estimates of costs and margins for key

agents along the rice marketing chain in Bangladesh and

to analyze market integration between domestic and

international markets.

3. To suggest policy implications for improving market structure,

conduct and performance.

2

Methodology

The study will be conducted by adopting the structure,

conduct and performance approach (SCP). This

technique was first formalized by Mason (1939) and his

detailed case study approach was modified by Bain

(1951).

Market structure

3

Market conduct

Market performance

Methodology (Contd.)

Area

District

Faria

Bepari Aratdar

Miller Aratdar Aratdar

cum

wholesal

er

cum

wholesale

r

Paddy

wholesal

er

Wholesal

er cum

retailer

Retailer Importer

Milled rice

Key agents

Dinajpur

Surplus

Rangpur

Naogaon

Bogra

Sherpur

Comilla

Kushtia

Deficit

Sylhet

Khulna

Dhaka

Noakhali

Chittagong

Total

4

15

0

3

2

0

1

16

0

0

0

2

0

39

17

13

27

15

1

3

2

7

2

10

4

5

134

13

16

21

6

32

3

7

0

7

1

5

2

112

20

10

20

8

15

2

25

2

2

2

2

2

110

0

3

1

0

4

0

0

0

6

16

0

0

30

6

7

5

2

0

0

0

0

4

0

0

0

24

5

3

10

15

8

10

17

11

8

10

12

20

129

8

4

0

0

2

14

4

9

9

5

6

5

66

11

13

11

7

8

1

8

5

3

11

10

15

103

2

3

5

Methodology (Contd.)

(a) Estimation of market concentration

4 firm concentration ratio, Entropy index, and Gini coefficient.

(b) Financial viability of the mills was assessed by using NPV, IRR, BCR.

(c) Calculation of marketing costs and margins was done by using

standard formula (Kohls and Uhl, 2005)

(d) Market integration

Market integration was examined by applying co-integration

method developed by Engle and Granger

Data: monthly wholesale price from 1990 to 2011(domestic mkts).

Data: monthly export price of Thailand, Vietnam, and Eastern

India converted into import parity price (1975 to 2011)

5

Overview of the structure, conduct and performance of rice

market in Bangladesh

Researcher Year

Findings

Farruk,

1970 He labeled the markets as oligopolistic as well as

M.O.

oligopsonistic but close observation of the functioning of this

structure in the different markets did not support the

prevalence of unethical market conduct.

Islam et al 1987 The net return to all the functionaries in the channels was

low due to intense competition. Excessive profit of the

functionaries was not found. Capacity utilization of the mills

varied from 40% to 65% at the peak period and 20% to 48%

in low volume months.

Chowdhury 1992 The market was found atomistic on both sides. The aratdar, N.

cum wholesalers were powerful in the rice market as they

handled about 80% -90% of all rice. No excessive

concentration was found in rice milling industry.

6

Overview of the structure, conduct and performance of rice

market in Bangladesh contd.

Rahman, 1998 No collusion among the sellers and buyers were

S.M.S.

observed but the millers complained about aratdars’

collusive activity.

Siddique 2010 He found low level of concentration in the rice milling,

Identified a no. of requirements for the entry.

, M.A.B.

The millers are price taker not price maker.

Performance of the rice milling industry was not

good in terms of capacity utilization.

Maximum mills are running with decades old

machines.

7

Structure, conduct and performance of paddy market in Bangladesh

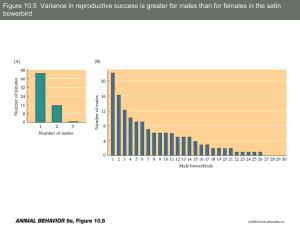

4 firm concentration (%)

90 5.4.1Buyer concentration in paddy markets

80

70

60

50

40

30

20

10

0

8

Markets

5.4.2 Entry barrier

In fact there is no barrier except arrangement of requisite capital

5.4.3 Degree of product differentiation (paddy)

No deliberate effort is made to make the paddy differentiated in the

market.

5.4.4 Distribution of market information

No formal system exist for dissemination of market information.

Paddy traders collect market information through their own effort.

5.5 Conduct at paddy market -3

5.6 Performance of paddy market

Paddy market is operating smoothly throughout the country;

Millers are getting paddy as much they need, though farmers are not

getting reasonable price for their paddy.

Farmers’ perspective, paddy market is not running in favour of them.

9

Market structure, conduct and performance of rice

milling industry

5.7 Dimensions of market structure (4)

5.7.1 Seller concentration in rice mill industry

Measure

CR4

Entropy Index , (E)

Gini –Coefficient

Seller concentration in rice mills

0.69 %

3.60 ,Log n =3.66

0.2436

5.7.2 Degree of product differentiation

5.7.3 Entry barrier

Lack of utilities

Skilled manpower

Tough competition

10

Sufficient capital

Suitable site

5.8 Market conduct

5.8.1 Price Policies

Selling price of rice is set independently

Automatic rice mill owners are in better position in negotiation

for setting price.

In the case of husking and semi-automatic mills buyers are

more powerful.

5.8.2 Product Policy

With the changing of milling technology, millers are capable to process rice

according their own choice and also to buyer’s choice

Sometimes the millers supply rice with labeling as per direction of traderbuyers.

11

5.8.3 Policies aimed at coercing rivals

No evidence of predatory and/or exclusionary tactics adopted

by the established firms in rice market.

5.9 Performance-Dimensions

Capacity utilization (%)

Capacity utilization of rice mills

58

56

54

56.24

54.45

52

51.78

50

48

Automatic

Semi-automatic

Rice mill

Size of selling cost

Product quality

Progressiveness of the industry

Employment position

Discrimination by sex

12

Husking

Impact of technological changes in rice milling

Paddy Separator

Rice shifter

13

De-stoner

Silky polisher

Cone Polisher

Colour sorter

Modern Rice mill Equipment

Impact of technological changes in rice milling

Table 6.1: Milling cost and profit by different types of rice mill

Type of rice

mill

Husking

SemiAuto*

SemiAuto**

Auto rice

mill*

Auto rice

mill**

14

cost of

paddy

(Tk.)

Milling

cost

(Tk./ton

of rice)

Total

cost

(Tk.)

Byproduct

Total

return

(Tk.)

Profit

(Tk.)

Whole

rice

recovery

%

Rice

24300

2601

26901

27000

2230

29230

2329

65

25427

2943

28370

28500

2414

30914

2544

66.25

26016

3452

29468

30000

3448

33448

3980

64.75

25177

2563

27740

30000

3478

33478

5738

67.5

26361

3070

29431

32000

3712

35712

6281

66

*Without modern equipment

**With modern equipment

Return (Tk.)

Table 6.2. Employment in different rice mills

Type of rice

mill

Husking

Semi-Auto

Semi-Auto

Auto rice

mill

Auto rice

mill (with

modern

equipment)

15

Labour,

Tk/ton of

paddy

Staff cost,

Tk/ton of

paddy

403

403

483

147

168

216

100

116

173

101

Employment

Labour,

Labour,

man-hr/

manton of

days/yr

paddy

14.17

2232

14.17

2274

15.67

3015

3.20

3120

3.95

5925

Staff,

manhr/ton of

paddy

6.95

9.13

4.50

5.99

Staff,

mandays/yr

4.14

6205

1095

1095

1460

5840

Financial viability of the rice mills

Type of mill

IRR

NPV(‘000Tk.)

at 10%

BCR

(at 10%)

Husking rice

mill

18.45%

Semi-auto rice

mill

25.23%

418

1.002

10325

1.046

Auto-rice mill

117471

1.063

16

32.54%

Farmer

Faria

Aratdar-cum-wholesaler

Bepari

Procurement

centre

Rice miller

Aratdar

Aratdar-cum-wholesaler

Paddy processor

Wholesaler

Wholesaler-cum-retailer

Retailer

Government

procurement

Consumer

Figure 5.1: Typical Marketing Channels of Paddy/ Rice in Bangladesh

17

Marketing margins of paddy/rice for different actors

(for 1 quintal of rice /and equivalent amount of paddy)

2000

1800

1600

Retailer

196.51

Wholesaler cum

retailer

Wholesaler

261.53

1400

216.02

1200

27.81

1000

800

31.9

144.91

849.98

600

145.16

7.81

400

430.38

200

0

18

Aratdar(Rice)

93.67

111

114.91

56.17

70.5

66.17

Gross marketing margin Marketing cost

164.61

Rice mill

116.62

70.86

20

Aratdar

419.6

Bepari

37.5

40.5

48.74

Faria

Net margin

Share of different actors in gross marketing margin, marketing cost and net margin

100%

90%

80%

70%

60%

10.5

3.35

15.2

17.92

14

11.5

1.49

15.2

12.7

0.82

7.71

2.18

45.4

45.2

45.7

30%

0%

19

Wholesaler

Rice mill

Aratdar

20%

10%

Wholesaler cum

retailer

Aratdar(Rice)

50%

40%

Retailer

5.01

5.93

6.14

Gross marketing

margin

5.89

7.4

6.94

4.08

4.41

5.3

Marketing cost

Net margin

Bepari

Faria

in 2010

20

Map 6.1: Extent of rice surplus and deficit at district level in 2010

Integration of Rice market

All the 12 districts rice markets found integrated

This study strongly supports marketing efficiency in the selected

21

rice markets.

The results of the strong forms of market integration indicate

strong form of market integration in all the rice markets

Govt. price policy of rice will be effective in rice market.

Rice market of Bangladesh , Eastern India, Vietnam and Thailand

found integrated

The strong form of market integration does not support Eastern

India-Thailand, Vietnam-Eastern India, Eastern India-Bangladesh

and rest of markets support strong form of market integration.

Policy options

Formation of farmers’ marketing cooperative / group

Dissemination of paddy prices of different important

markets (by cell phone, display board at market places).

Provision of credit facilities for the farmers and paddy

traders.

Husking mills should either be closed or modernized.

Profitable cases should be financed .

Labeling on the bag of rice should be mandatory.

22

Policy options contd.

Needs investigation of the nutritional aspects of milled

rice after extracting bran to ensure the quality of rice.

Ensure regular and undisrupted power supply to rice

mills

Vocational training programme helps to produce

qualified personnel for operating automatic rice mills.

Govt. should develop a complete and accurate data

base on rice mills and market intermediaries

23

24