Small Business Growth Funding

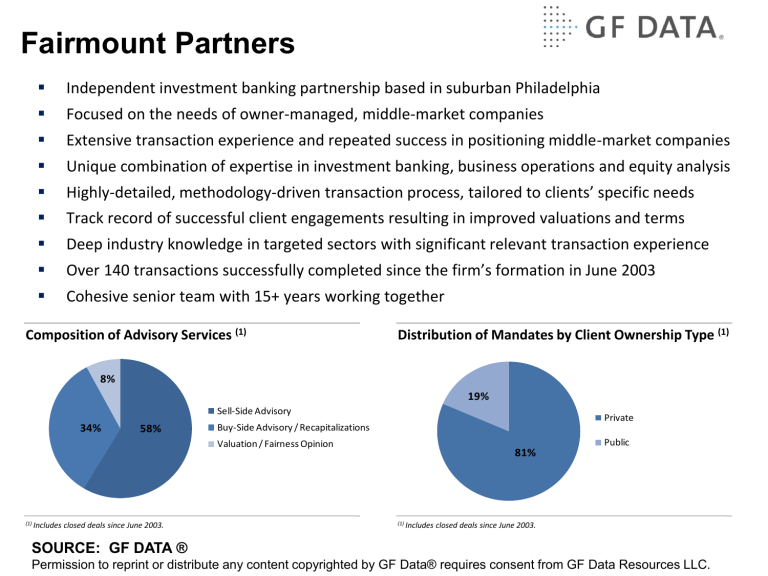

Fairmount Partners

Independent investment banking partnership based in suburban Philadelphia

Focused on the needs of owner-managed, middle-market companies

Extensive transaction experience and repeated success in positioning middle-market companies

Unique combination of expertise in investment banking, business operations and equity analysis

Highly-detailed, methodology-driven transaction process, tailored to clients’ specific needs

Track record of successful client engagements resulting in improved valuations and terms

Deep industry knowledge in targeted sectors with significant relevant transaction experience

Over 140 transactions successfully completed since the firm’s formation in June 2003

Cohesive senior team with 15+ years working together

Composition of Advisory Services (1) Distribution of Mandates by Client Ownership Type (1)

8%

19%

34% 58%

Sell-Side Advisory

Buy-Side Advisory / Recapitalizations

Valuation / Fairness Opinion

81%

Private

Public

(1) Includes closed deals since June 2003.

(1) Includes closed deals since June 2003.

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

Expertise in Selected Industry Sectors

Fairmount brings a broad base of operational, financial and transactional expertise across its key industry sectors, including:

Industrial & Consumer

Products

Information

Technology

Services

Healthcare

Technology and

Software

Food and Beverage

Consumer Products

Plastics and Packaging

Building and

Construction Products

Metals and Metals

Processing

Industrial Services

Distribution and

Logistics

Business Process

Outsourcing

Engineering Services

Hardware

Maintenance Services

IT Services –

Commercial and

Government

Legal Services

Management and

Applications

Consulting

Staffing / HR Services

Pharmaceutical

Services

Specialty

Pharmaceuticals

Generic

Pharmaceuticals

Life Sciences /

Biotechnology

Healthcare

Information

Technology

Healthcare Staffing

Medical Technology

Broadband

Technologies

Cloud Computing

Enterprise Software and Services

Internet Retail /

Consumer

Telecommunications

Equipment and

Semiconductors

Vertical Application

Software

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

GF Data®: Unique Data and Proprietary Relationships

GF Data® provides data on private equity-sponsored M&A transactions with enterprise values between $10 and $250 million. Since its inception in 2006, GF Data® has come to be recognized as the most reliable source of data on valuation, leverage and volume trends in the middle-market

GF Data® collects transaction information from private equity groups on a blind and confidential basis and provides periodic reports based on this data to contributing private equity firms and paid subscribers

More than 200 private equity firms have provided information on more than 2,000 transactions closed since January 1, 2003

Each deal is categorized by its six-digit NAICS code, enabling GF Data® to provide highly detailed benchmarks in this tier of the market

How GF Data® Works

Private equity groups provide transaction data through a proprietary on-line utility developed and operated by an independent technology application provider

Data delivery is encrypted to protect the data as it travels over the Internet from the private equity firm’s computer to the server

The data is released to GF Data® in batches large enough to prevent the identification of individual deals, or of individual firms based on their deal activity

GF Data® generates periodic reports based on this information and provides continuous access to detailed valuation data through an on-line, searchable database

The reports drill down to the greatest level of detail at which individual transactions remain disguised (e.g., there must be at least three deals in an industry subcategory for

GF Data® to report at that subcategory level)

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

Valuation Overview

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

The Size Premium

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

A Record for Quality

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

Leverage Overview

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

Leverage Drilldown

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.

Transaction Structure Trends

SOURCE: GF DATA ®

Permission to reprint or distribute any content copyrighted by GF Data® requires consent from GF Data Resources LLC.