Chapter4-Global strategic alliances 1

advertisement

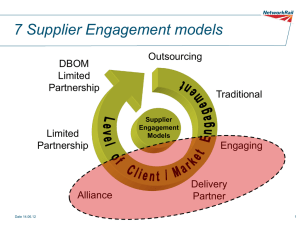

Chapter 4 Global strategic Alliances 1 Strategic alliances The combination of capabilities between 2 or more companies for: • Market entry • Resources acquisitions • Global competitiveness 2 Strategic alliances cont. COSPECIALIZATION COALITION Partners group together to gain global access or to establish a common standard. Example: Airlines Partners combine their respective unique capabilities that complement each other to create a business, to develop new products or technology or to reinforce their competitiveness through specialization. E.g. Renault-Nissan LEARNING Partners join together to a gain a mutual learning from each other and to co-develop new knowledge. E.g. Nummi 3 International strategic alliances Globally based Coalition Co-specialisation Consortia Learning E.g. Airlines Renault-Nissan E.g. GSM Scope of the alliance Joint venture for market entry Country based Typical in emerging countries Market Joint venture for resource exploitation E.g. Mining, agriculture based, oil and gas Purpose of the alliance 4 Resources Framework for strategic alliances Strategic value • Defining the scope • Strategic objectives • Value creation potential What are the benefits of the alliance? What do we get from it? Partners’ fit • Strategic fit • Capabilities fit • Cultural fit • Organizational fit How workable is the relationship? Negotiation and design • Operational scope • Interface • Governance How do we organize and manage? Implementation • Integration • Co-operation • Evolution How do we work? 5 Defining the scope of the alliance Coalition Strategic scope What is the alliance striving at? Economic scope Co-specialisation Complementing capabilities for new business or competitiveness Increasing reach to global market Enlarged revenues Cost sharing Specialisation leads to faster and cheaper development cost sharing Generally very limited to few elements of the value chain (e.g. code sharing) The alliance provides the interface for co-ordination or assembly of partners’ contribution What each partners contribute and get Operational scope What the alliance is doing E.g. Star alliance; Visa E.g. Fuji Xerox; Renault-Nissan 6 Learning Learning from and in the alliance Acquisition and/or transfer of know-how The alliance is a platform for transfer of knowledge and learning together E.g. Nummi ( GM-Toyota) Value creation in strategic alliances Value of the parent A DIRECT VALUE Value coming from the alliance Value of parent B Royalties Dividends Management fees Transfer pricing Learning from Learning fromB B Learning from Learning fromA A Cost saving due to combined operations SYNERGY VALUE Value coming from joint operations Increased revenues due to joint marketing and complementary products Increased profitability from joint innovation 7 Partner analysis 8 Strategic fit Determines the degree of commitment to the alliance CRITICALITY • How important and urgent is the business of the alliance for partners? - Restructuring - Competitiveness enhancing (cost, differentiation) - Global reach - New business development • To what extent do partners need to achieve their objectives? (Degree of capabilities autonomy)? - Can partners achieve objectives alone - Timing pressure - Resources and competencies DIFFERENCES IN EXPECTATIONS • How different are the expectations? • To what extent are any differences compatible? 9 Criticality and commitment in alliances Commitment is a function of… B Strategic importance of the project D Low AA = High commitment BB = No partnership CC = Low commitment DD = Very low commitment AB = Potential conflicts AC = Potential conflicts AD = High level of conflict High commitment Power battle High Low commitment Lack of support Low High Need of a partner 10 A C Differences in expectations B • Market development of existing products • New business • Product complements If no territorial Overlap • Market development of existing products • New business A • Product complements • Cost reduction • Learning Fit Possible fit Problematic fit 11 • Cost reduction • Learning Capabilities fit Who contributes to what ? TECHNOLOGY Partner A SOURCING Partner B Gaps PRODUCTION How to develop? Products Process Knowledge Resources Assets • What are the relative competitive strengths of partners ? • To what extent does the assembling of partners create a robust business model? 12 MARKETING Overlaps How to attribute? Views about business objectives: o o o o o o Growth Profitability Risks Long/short term Shareholder value Stakeholders Cultural fit PARTNER A PARTNER B How to deal with it? Views about competitive approaches: o o o o o Customer orientation Pricing Importance of quality Importance of technology Ethics Ways to manage: o o o What to anticipate? Leadership style Trust/control Motivating factors Communication: o Openness/secrecy o Formal/informal o Importance of personal relationships 13 Organisational fit PARTNER A PARTNER B What to anticipate? Structural differences: o Centralisation/decentralization o Form of organisation How to deal with it? Systems and processes: o Importance of formal systems o Sophistication of financial controls o Quality of IT o Importance of team work/ committees Performance: o o o Performance based rewards Career mobility Quality of Management 14 Organisational fit cont. BIGGER, MORE BUREAUCRATIC PARTNER (A) SMALLER, MORE ENTREPRENEURIAL PARTNER (B) Formal, explicit decisions Periodic, scheduled plans Low contextual embeddedness Slow, sequential inputs to decisions Analytical choices Aggregation, consolidation of data BIGGER, MORE BUREAUCRATIC PARTNER AS SEEN BY THE SMALLER ENTREPRENEURIAL Informal, tacit, shared decisions Continuous, unscheduled planning High contextual embeddedness Fast, simultaneous inputs to decisions Intuitive judgments Real-time immersion in data 15 Ponderous, slow, and stupid Preoccupied with reviewing everything to death Awash in mindless procedures Risk averse, procrastinating Characterized by paralysis through analysis Divided, fragmented SMALLER, MORE ENTREPRENEAURIAL PARTNER AS SEEN BY THE LARGER FIRM A bunch of cowboys Shooting from the hip Disorganized, slippery Going off in all directions, unfocused Characterized by sloppy work Exclusive, clannish, hostile Overall assessment 16 17 Design STRUCTURE Role of the alliance structure: broker/operator INTERFACE How value is distributed among partners Degree of task integration People appointment (alliance management) GOVERNANCE Legal structure Executive authority/ supervisory authority Communication/information/reporting Conflict resolution 18 Four structural designs in alliances 19 The alliance designed Project Management: the GE/SNECMA design 20 The alliance designed as a self-contained JV: the Fuji Xerox case 21 The alliance designed as a joint committee: the AlZA-Cibe Geigy case CIBA 53% shareholding 80% voting right Right to produce Right to market Exclusive right to ADDS Board 5 Audit committee Joint research conference Joint research board ALZA Scientific liaison Scientific liaison Information 22 The alliance designed as a transfer JV: the case of NUMMI GM TOYOTA Management Joint venture GM engineers (25) 50% 50% FREEMONT PLANT Lean manufacturing Know-how 2500 GM unionized workers 23 How to solve valuation issues • Clearly define alliance scope and trade terms between partners • Create separate economic entity • Seek external benchmarks • Plan for renegotiation 24 Distribution of value • Profit sharing vs revenue sharing • Transfer pricing •Tasks definition and costs allocation 25 Profit sharing vs revenue sharing Revenue sharing Cost sharing Partner A Alliance revenues Alliance direct costs Net revenues 1000 (100) 900 Partner A allocated costs (Ca) Partner B allocated costs (Cb) Net profit Partner A (900-Ca-Cb)/2 900-Ca-Cb Partner B (900-Ca-Cb)/2 26 450 Partner B 450 Task integration Limited interactions Limited integration PLUG-IN E.g. GE/SNECMA High integration Requires a lot of operational interactions E.g.Fuji and Xerox 27 The 8 criteria for successful alliances (the 8 I’s) • INDIVIDUAL EXCELLENCE • IMPORTANCE • INTERDEPENDENCE • INVESTMENT • INFORMATION - Both partners are strong - Have something to contribute - Positive intent - Fits strategy of both partners - Long term view - Partners need each other - Complementing capabilities - Nobody can do it alone - Partner shows commitment - Investment/re-investment - Reasonable open communication - Sharing of operational information • INTEGRATION - Shared operating procedures - Numerous connections - Teachers/learners • INSTITUTIONALIZATION - Clear responsibilities - Clear decision processes INTEGRITY - No abuse - Willingness to enhance trust • 28 GE/SNECMA: the ingredients of success • Strong mutual trust at the top • Near perfect complementarity - little overlap (the possibility to isolate each partner’s contribution from other partner’s interference) • Revenue sharing eliminates issues of transfer pricing • Willingness of partners to learn and adapt - cooperation over time • A small structure is in charge of the whole project (ownership) and manages the relationships between partners • Mutual respect • Successful products 29 Firm orders: 100+ passenger aircraft 30 Advantages of the CFM partnership • The two parent companies had a common goal and no competing products • By limiting the agreement to two partners, the operational structure maintained a simplicity required for efficient decision making • GE and Snecma participate equally in all operational activities 31 • A clear definition of responsibilities encompasses all management, manufacturing, marketing and support functions • Environment-friendly technology • Manufacturer position in the industry • Committed, worldwide product support