2012 - China Automotive Systems,Inc.

advertisement

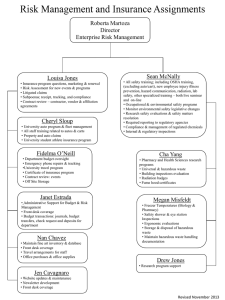

The Power to Steer Chinese Auto Industry INVESTOR PRESENTATION October 2013 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations or beliefs, including, but not limited to, statements concerning the company's operations and financial performance and condition. For this purpose, statements that are not statements of historical fact may be deemed to be forward-looking statements. The company cautions that these statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the impact of competitive products, pricing and new technology; changes in consumer preferences and tastes; and effectiveness of marketing; changes in laws and regulations; fluctuations in costs of production, and other factors as those discussed in the Company's reports filed with the Securities and Exchange Commission from time to time. 2 Introduction to CAAS Who We Are China Automotive Systems is the largest supplier of power steering components and systems in China. Its subsidiary groups offer a full range of auto parts incorporated into steering systems for both passenger automobiles and commercial vehicles. Investment Highlights Key Milestones 1993 – Established Jiulong to produce Integral Power Steering Gear in Heavy-duty vehicles 1997 – Established Henglong to produce Rack and Pinion Steering Gear in passenger vehicles 2001 – Signed licensing agreement with Bishop Steering for power steering valve technology 2002 – Established JV with Brilliance Auto 2004 – Listed on NASDAQ Small Cap – Selected as Exclusive Supplier for Steering Pumps for GM Wuling in China 2006 – Formed JV with Chery Auto #1 market share in China Key supplier to many top 10 auto makers Increasing number of supplier contracts with Sino-foreign JVs Strong R&D, high quality and low cost Majority sales to China domestic market Growing exports Ranked 23rd in FORTUNE'S "100 Fastest-Growing Companies“ in 2010 – Established JV to produce Electric Power Steering (EPS) 2007 – Launched Detroit office to develop NA business – Won supplier contract from FAW-Volkswagen 2008 – Won contracts with ChangAn Auto and Dongfeng Peugeot Citroen 2009 – Began shipments to Chrysler in N. America 2010 – Formed JV with Beijing Auto and designed new capacity of 500,000 units 2012 – Formed JV with SAIC-Iveco Hongyan and designed capacity of 200,000 units for CV – Established a Sino-foreign JV with two Brazilians 3 Organizational Chart CHINA AUTOMOTIVE SYSTEMS, INC. [NASDAQ:CAAS] 100% 100% HENGLONG USA CO. GREAT GENESIS HOLDINGS LIMITED 70% 100% Shenyang Jinbei Henglong Automotive Steering System Co., Ltd. (SHENYANG) Hubei Henglong Automotive System Group Co., Ltd. (Hubei Henglong) 80 % 81 % Jingzhou Henglong Automotive Parts Co., Ltd. Shashi Jiulong Power Steering Gears Co., Ltd. (HENGLONG) (JIULONG) 83.34 % 85 % 77.33 % 70 % 50 % Universal Sensor Application, Inc. Wuhan Jielong Electric Power Steering Co., Ltd. Wuhu Henglong Automotive Steering System Co., Ltd. Chongqing Henglong Hongyan Power Steering System Co. Beijing Hailong Automotive System Co., Ltd. (USAI) (JIELONG) (WUHU) (CHONGQING) (HAILONG) 80 % CAAS Brazil’s Imports And Trade In Automotive Parts Ltd. (Brazil ) 80 % Jingzhou Henglong Automotive Technology (Testing) Center (TESTING) 4 Our Products The company’s product offering encompasses a full range of auto parts which are incorporated into steering systems for both passenger automobiles and commercial vehicles. Steering Column Steering Pumps Steering Hoses Rack & Pinion Power Steering Gears The company currently offers four separate series of power steering sets and over 300 models of power steering and manual steering sets, steering columns, steering oil pumps, and steering hoses. 5 Fast Growing Chinese Auto Market China Domestic Auto Market (million units) Beginning in 2009, China becomes the world’s largest auto nation Auto penetration in China is currently at 5% compared with the 60% penetration in US, Europe, and Japan Rising demand from low-to-mid income families whose purchasing power has increased with falling car prices 85 million vehicles on the road, 144 million driver licenses with 22 million new issuance every year • Source: CAAM China auto parts sales is expected to reach US$350 billion by 2015. All vehicle export reached 0.8 million units on 49% yoy increase. • (1)Source: China, Ministry of Public Security. (2) Investment Report of China Auto & Auto Parts Industry, 2000-2008 • (3) China auto Parts Industry Report 2007-2008, (4) AlixPartners Study Feb ’08; Analysis of China Auto Parts Market 2008-2009 (5) Sinomind, Roland Berger Analysis 6 Leading Competitive Position CAAS is China’s largest supplier of power steering components and systems China has 100 auto OEMs. Only 30 power steering system suppliers Safety related components = High barrier of entry OTHERS 16% CAAS 16% ZHEJIANG SHIBAO 4% SHANGHAI ZF, 11% ZHAOHE 4% Market Share of Steering Gear for Year 2012 HUBEI TRIRING 4% IMPORT 5% Major competitors, Shanghai ZF and FKS, are captive suppliers to specific JV automakers: Volkswagen, GM, Toyota, Honda etc. YUBEI (KOYO INCLUDED) 10% CHONGQING CHANGRON G, 7% ZHEJIANG WANDA, 7% FAW KOYO 8% MANDO 8% Source: Company estimates CAAS is able to innovate and introduce new products and manage costs much more nimbly than its state-owned or foreign JV competitors. 7 Competitive Strength CAAS is well positioned to take advantage of the fast growing Chinese auto market opportunity Strong Technology R&D Capabilities Rapid Product Introduction Top-Notch Management 225+ engineers; 3 technology and R&D centers 85+ Chinese patents; 4 trademarks Partner with Bishop Steering Technology, Namyang, Korea Delphi Automotive Systems and Tsinghua University Ongoing recruits from best auto engineering schools in China Independent supplier; Quick turnaround on new platform development CAAS 3 months vs Competitors 3-6 months Approximately 30 sedan makers in China have produced nearly 70 sedan models; Chinese OEMs are demanding fast product cycles Most senior management have been with CAAS for over 15years CEO 19 yrs, CFO 15yrs, CAO 16 yrs, VP Sales 19 yrs, VP R&D 19 yrs Strong auto background and proven track records with OEMs in China With 60% ownership in CAAS, Chairman is committed to create longterm shareholders’ value 8 Strong Cost Management Cost pressures will continue as the ASPs of autos decline in China Only suppliers with effective cost control measures can continue to maintain margins CAAS’ Cost Management Measurement • Continued technological innovations – Reduce overall manufacturing and processing cost developed through in-house R&D advancements – Retool and customize some of the production equipment • Reduce the cost of raw materials – Volume purchase of major raw materials through a bidding process – Optimize product design to reduce the raw material wastage in the process of production • Reduce manufacturing expenses – Improve productivity of current labor hours through more efficient use of the new equipment (Over USD 40M spent on high grade equipment in the past 4 years) – Set “targets” to control manufacturing overhead 9 Main Customers More than 60 OEM customers Revenue contribution from passenger vehicle was 85.2% in 2012 No customer accounts for more than 15% of total revenue Signature western brands: Chrysler, FAW-Volkswagen, Dongfeng Peugeot, GM Driving Force: passenger vehicle products Major Customers in 2012 Chrysler 3.7% 11.7% 5.7% 6.2% 9.4% 6.2% 6.9% 9.0% 7.1% 7.9% Geely Chery Dongfeng Great Wall Brilliance FAW BYD Foton SAIC GM 10 Road to Detroit First entry to US aftermarket with steering system for Volvo S40 First meeting with Chrysler Won Chrysler´s Excellent Supplier Award First meeting with Visteon Won multi-year contract from Chrysler Ram Won multi-year contract from Chrysler Wrangler Passed vehicle dynamic evaluation and received trial order from Chrysler Opened office in Troy, Michigan 11 Growing R & D Capability With state-of-art power steering gear inspection & test equipment, calibration room, physical & chemical inspection lab and vehicle test track, CAAS is building up a leading power steering inspection and test center. 12 2012 Highlights PV sales 15.5 mil. and +7.1% YoY CV sales 3.8 mil. and -5.49% YoY 2012 – the year OEMs overpromised and under-achieved “Favorable Environment” Recovery of the overall economy of China; Continued increase in the income of China’s urban and rural residents; Continuing development of the highway system will positively impact on the sale of automobiles in China. “Size Matters More” Small car (≤ 1.6 liter): sales grew 6.5% to 7.6m units and accounted for 71% total PV sales; Leading PV OEM Sales • Shanghai GM “National Brand” National PV brands sold 6.49 m units, up 6.1% YoY, • GM Wuling its market share down from 42.23% to 41.85% • Shanghai Volkswagen • FAW Volkswagen * Source: CAAM 13 Growth Strategy International Market Accelerate international expansion through direct sales and partnerships Continue to develop relationships with top tier international automotive OEMs Form joint venture in other emerging markets – JV in Brazil Build channel relationships to capture aftermarket opportunity Establish international office to pursue business development and R&D MAIN GOAL: DEVELOPING RELATIONSHIPS AND WINNING CONTRACTS IN US AND EUROPE Domestic Market Grow market share in China by partnering with fast growing OEMs – JV with OEMs Penetrate existing clients’ different lines of products Approach low-margin foreign brands who import parts Focus on continuous improvement in production efficiency and quality Introduce new products through R&D BENEFITS OF EPS: FUEL EFFICIENCY, ENVIRONMENTAL FRIENDLY AND HIGHER MARGIN 14 Robust Organic Revenue Growth Top line grew 889% over the last 8 years – all organic growth Despite the economic downturn, the revenue of the company remains flat USD millions USD millions 101 99 76 75 99 Q4 84 38 38 31 36 28 2007 37 73 Q3 Q2 65 85 82 80 47 63 41 45 84 91 84 2008 2009 2010 2011 2012 Q1 15 Positive Free Cash Flow Free Cash-Flow OP Cash Flow $ millions $millions 40 20 35 18 38.6 30 16 34.1 14 35 25 14.5 17.5 12 20 15 19.2 10 16.2 16.4 8 10.6 6 10 4 5 4.2 2 0 0 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 FCF= Op Cash Flow minus CapEx 16 2013 Q2 Summary Month Ended June 30 ($’000) 2013 2012 Net sales $97,889 $80,379 Gross profit $18,389 $15,632 Selling expenses $ 3,800 $ 2,088 G&A $3,217 $3,130 Income from operations $7,814 $8,574 (Loss) gain on change in fair value of derivative - Net income (loss) attrib to common shareholders $4,981 Diluted EPS $0.21 $3,411 $12,163 $0.03 17 Balance Sheet ($’000) 6/30/2013 6/30/2012 Cash and cash equivalents $75,270 $77,692 Accounts and Notes Receivable $25,941 $20,047 Inventories $48,251 $46,889 Property and Equipment, Net $83,361 $77,330 $526,234 $457,721 Accounts and Notes Payable $183,707 $157,617 Bank and Government Loans $47,175 $41,655 -- $691 $41,939 $35,984 Total Liabilities $276,459 $236,915 Total Shareholders Equity $249,775 $220,806 Total Assets Convertible Note Non-controlling interests 18 Investment Highlights China is the world’s largest automotive market Growing China auto parts industry High barrier of entry for safety-related components Leading market share Diversified customer base Key supplier to Chinese home-grown auto makers High-quality products, strong R&D and competitive pricing Well positioned for further potential export opportunities 19 The Power to Steer Chinese Auto Industry THANK YOU! www.caasauto.com